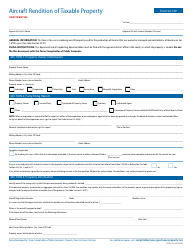

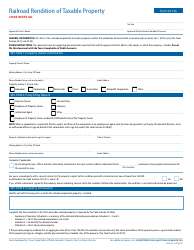

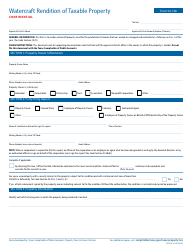

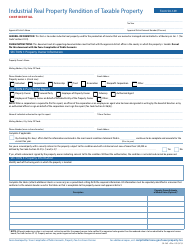

This version of the form is not currently in use and is provided for reference only. Download this version of

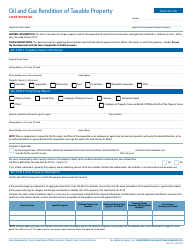

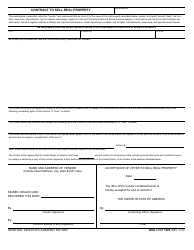

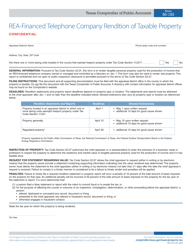

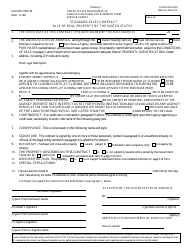

Form 50-141

for the current year.

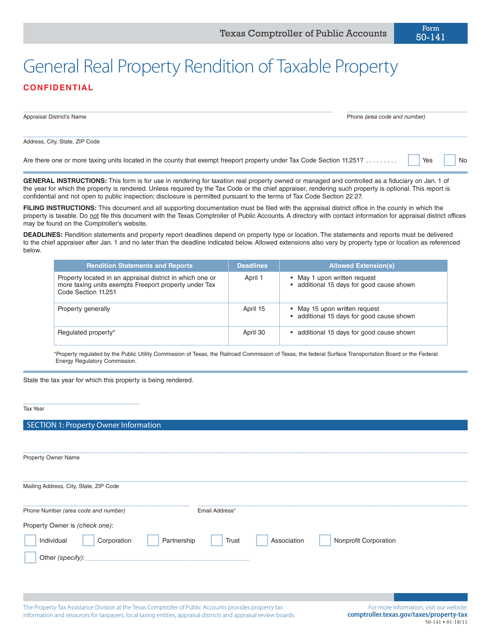

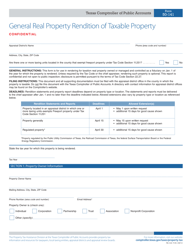

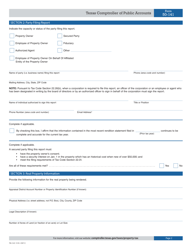

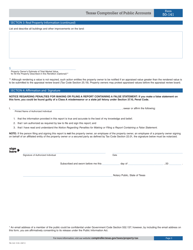

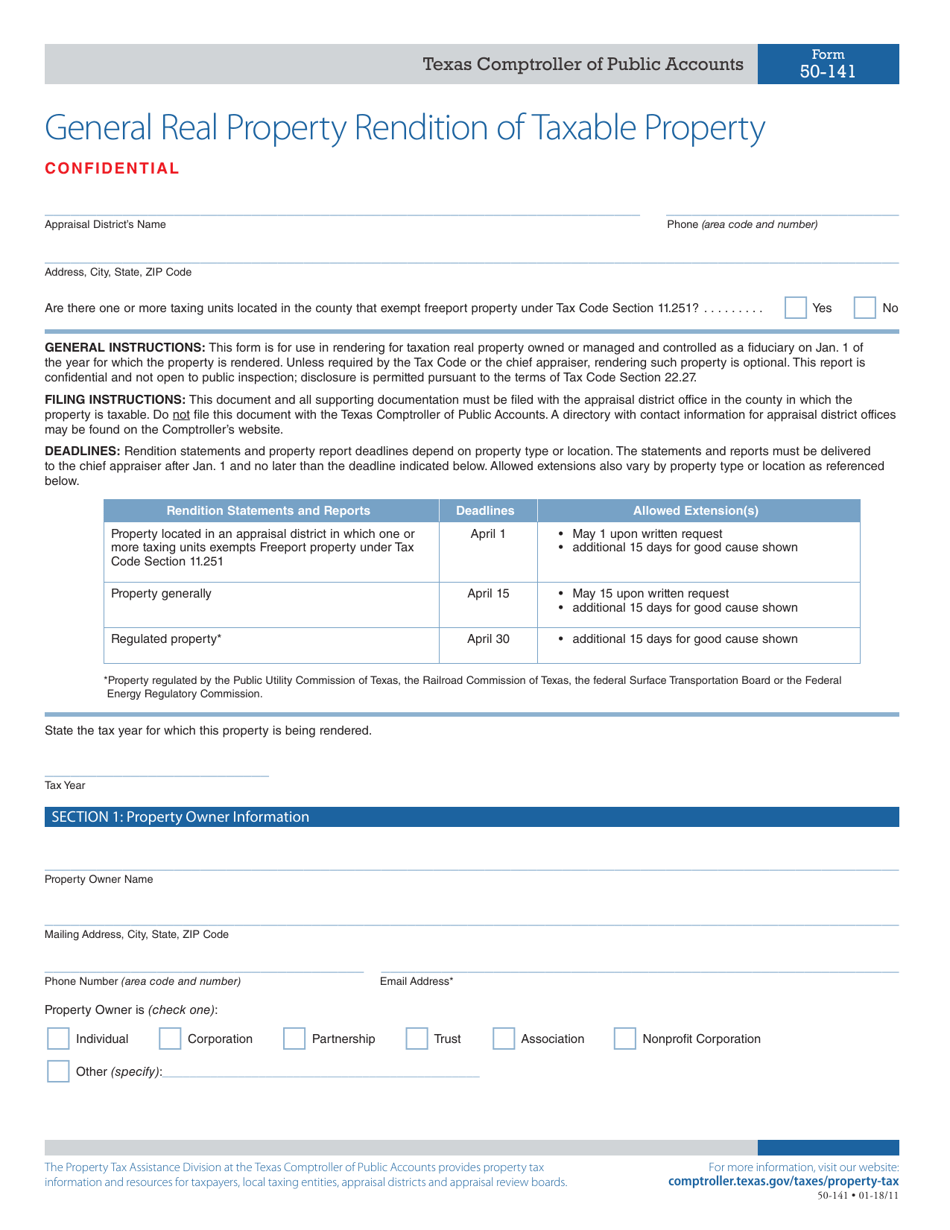

Form 50-141 General Real Property Rendition of Taxable Property - Texas

What Is Form 50-141?

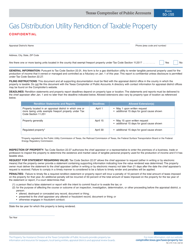

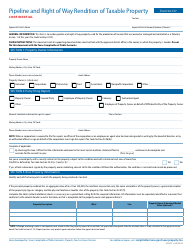

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-141?

A: Form 50-141 is a document used in Texas for the general real property rendition of taxable property.

Q: Who uses Form 50-141?

A: Property owners in Texas use Form 50-141 to report their taxable real property.

Q: What is the purpose of Form 50-141?

A: The purpose of Form 50-141 is to provide information on the value and ownership of taxable real property for property tax assessment.

Q: When is Form 50-141 due?

A: Form 50-141 is due on April 15th of each year in Texas.

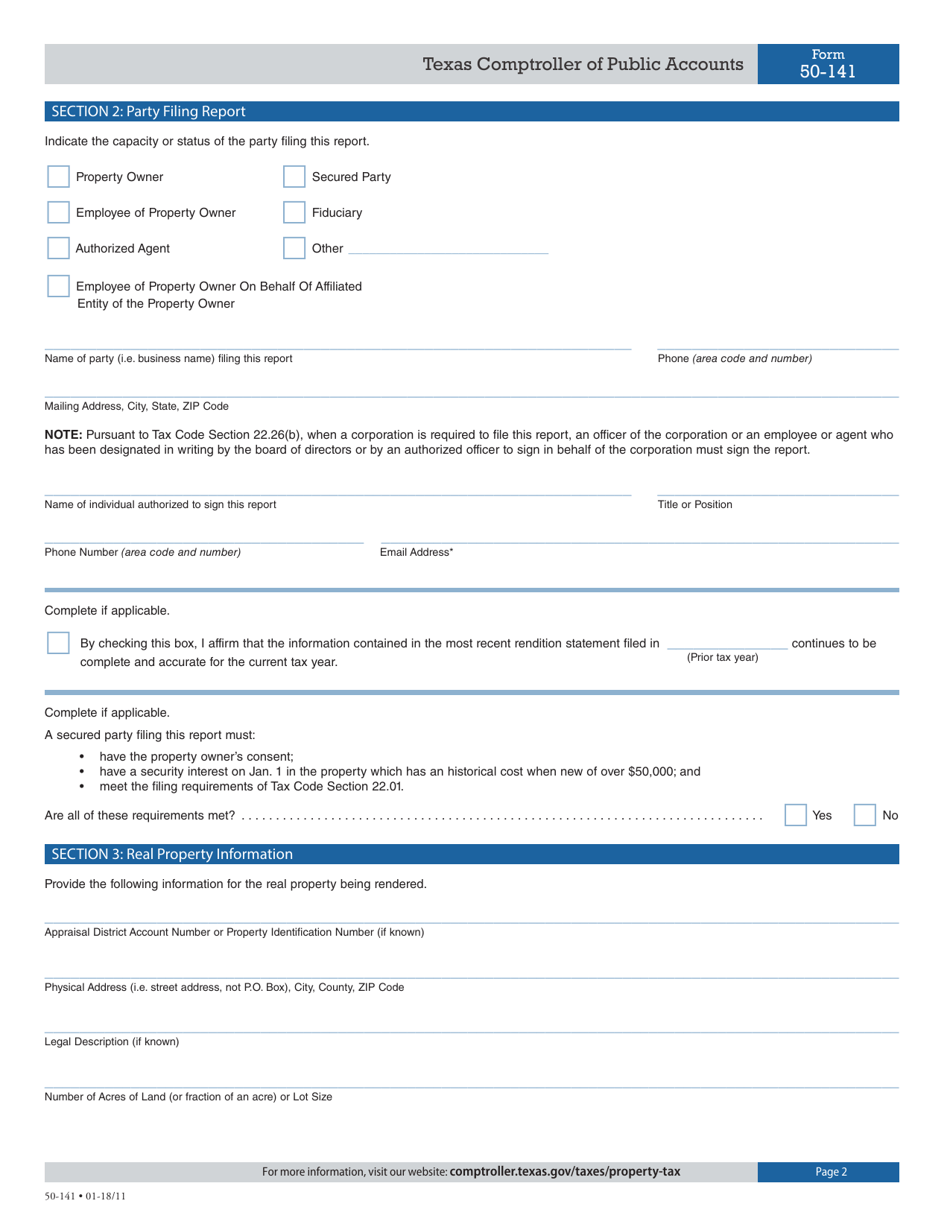

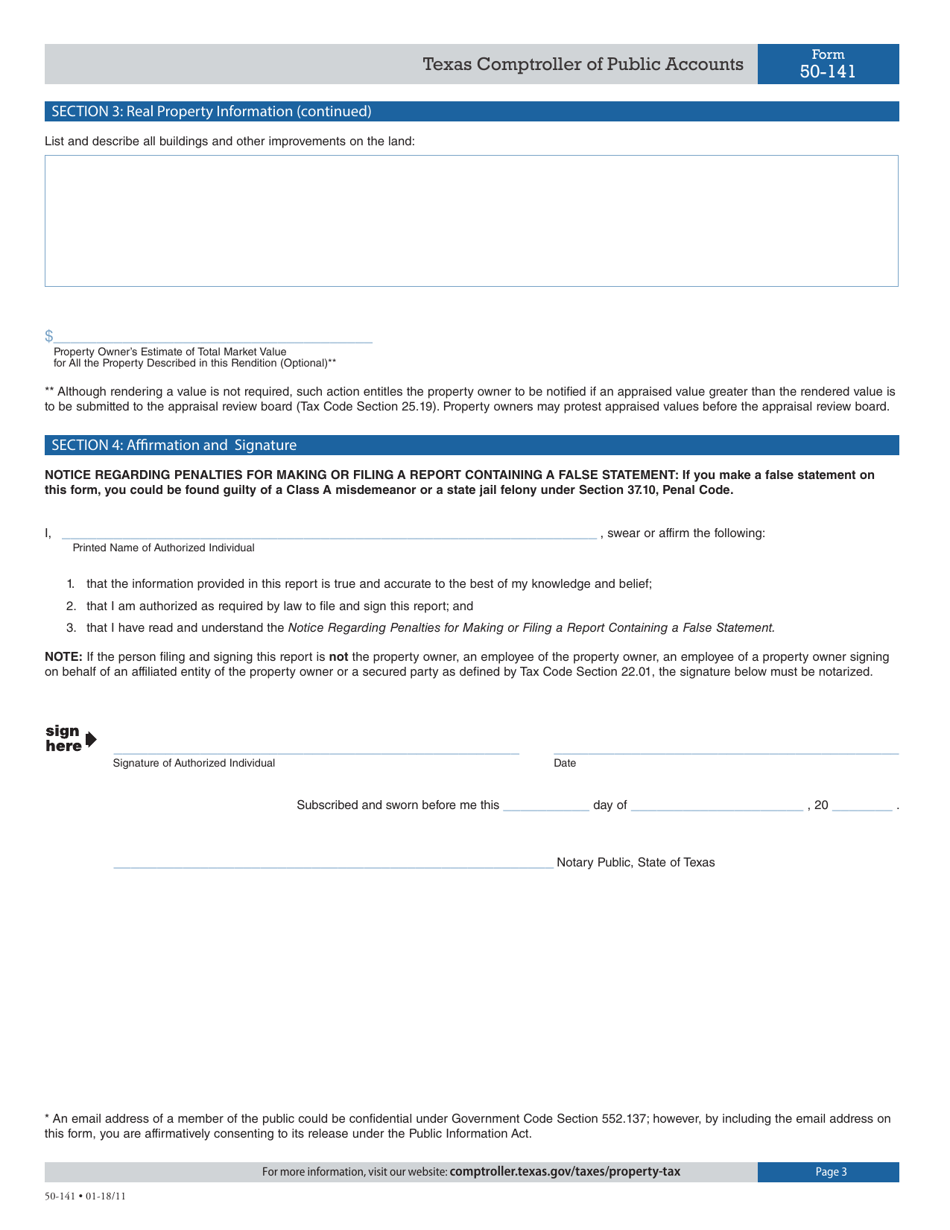

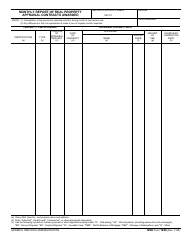

Q: How should I complete Form 50-141?

A: You should provide accurate and detailed information about your taxable real property, including its value, location, and ownership details.

Q: Are there any penalties for not filing Form 50-141?

A: Yes, failure to file Form 50-141 or providing false information may result in penalties and interest on the property taxes owed.

Q: Can I e-file Form 50-141?

A: In most cases, electronic filing of Form 50-141 is not allowed. You should file a paper copy with the local county appraisal district.

Q: What if I need an extension to file Form 50-141?

A: If you need an extension to file Form 50-141, you should contact the local county appraisal district to inquire about the process for obtaining an extension.

Q: What other documents may be required with Form 50-141?

A: Depending on your specific situation, you may need to provide additional documents such as property appraisals, lease agreements, or other relevant information when filing Form 50-141.

Form Details:

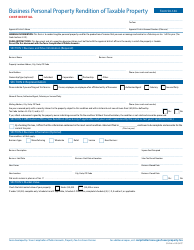

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-141 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.