This version of the form is not currently in use and is provided for reference only. Download this version of

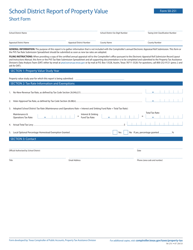

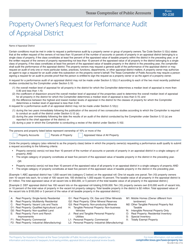

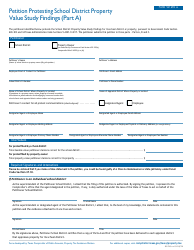

Form 50-302

for the current year.

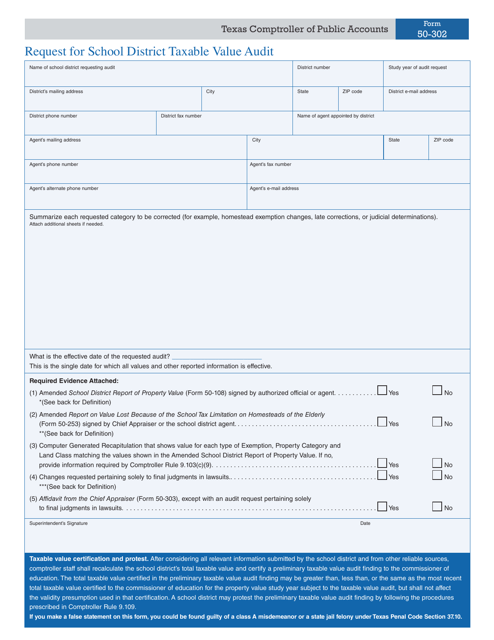

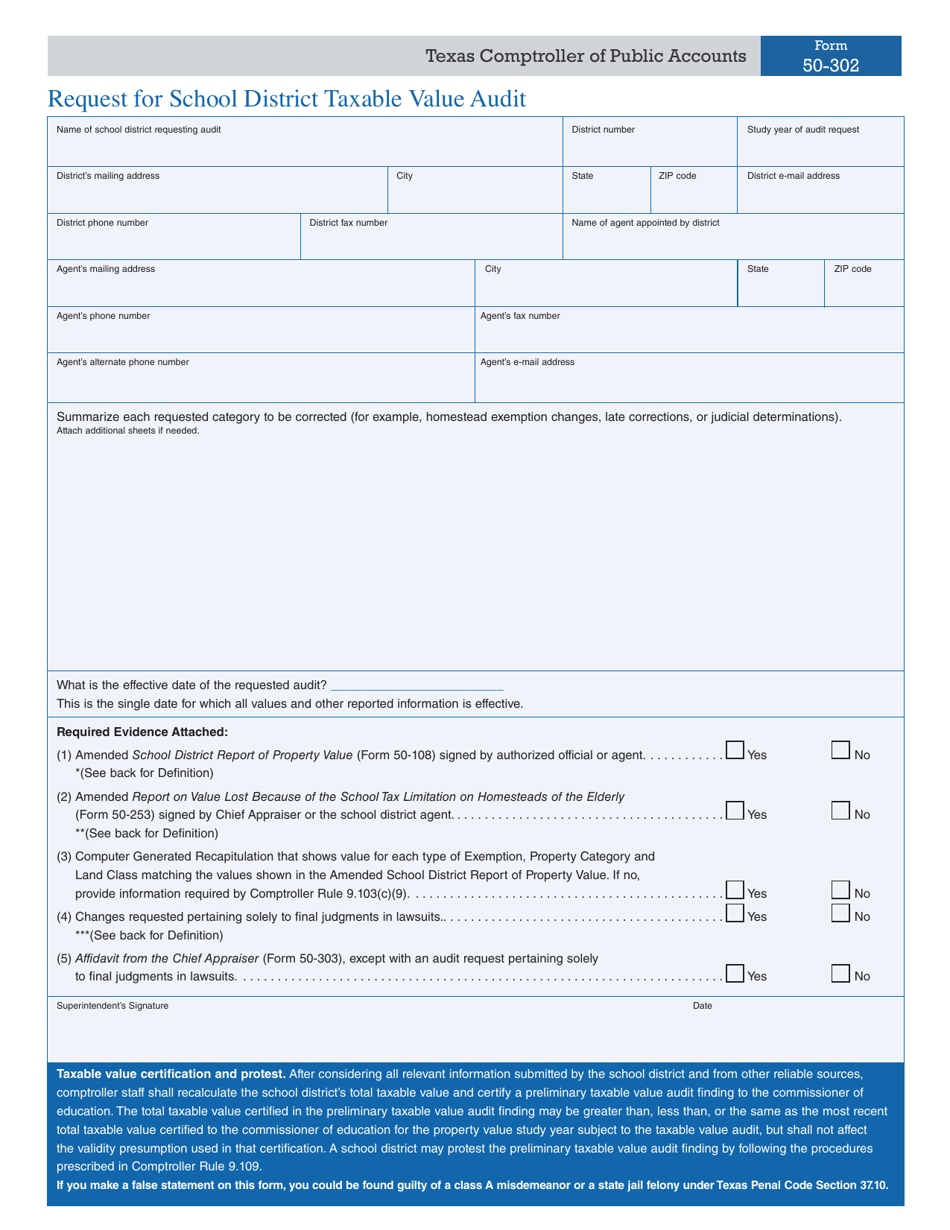

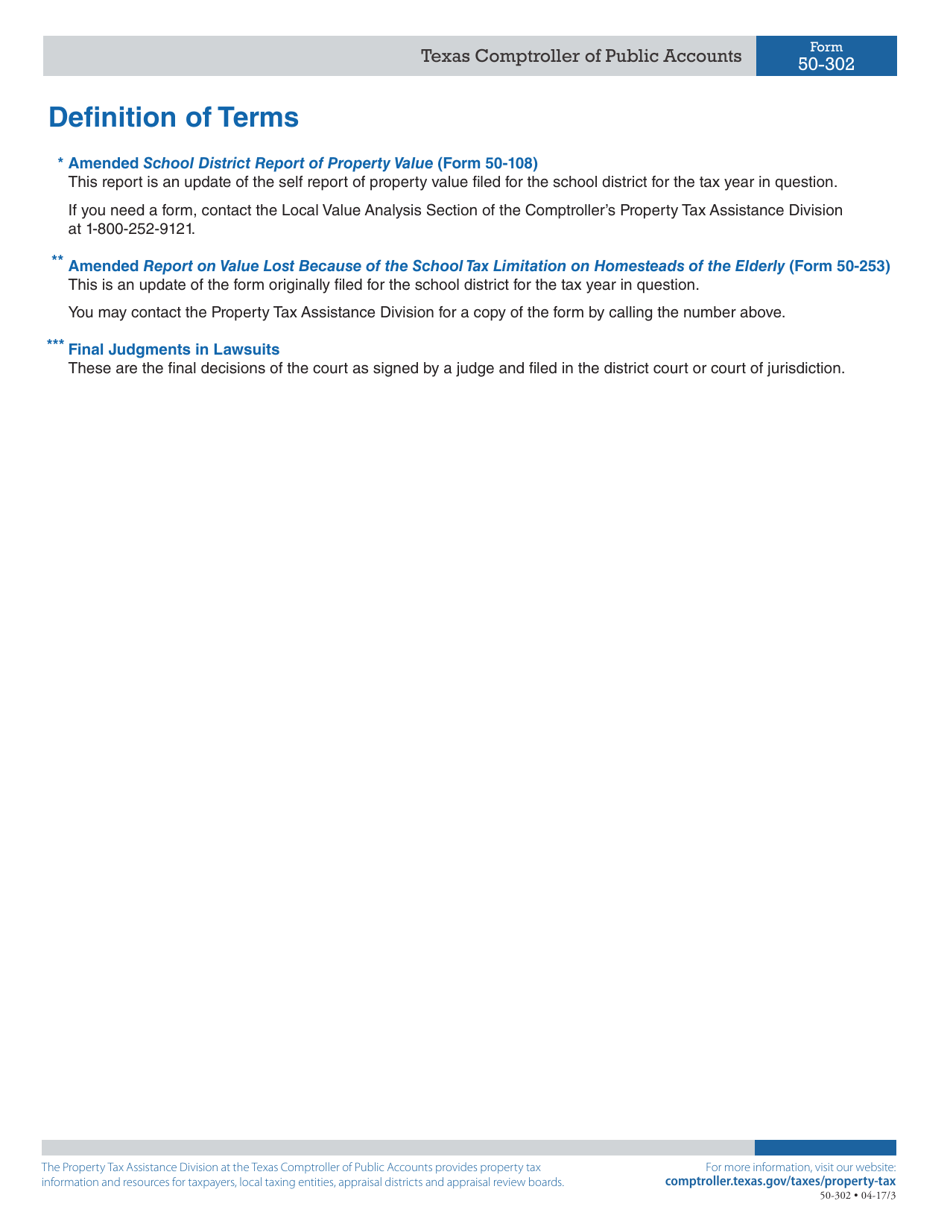

Form 50-302 Request for School District Taxable Value Audit - Texas

What Is Form 50-302?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-302?

A: Form 50-302 is the request form for a School DistrictTaxable Value Audit in Texas.

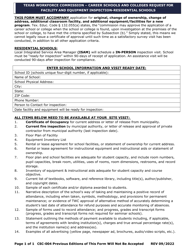

Q: Who needs to fill out Form 50-302?

A: Property owners or their authorized representatives, such as tax consultants or agents, may need to fill out Form 50-302.

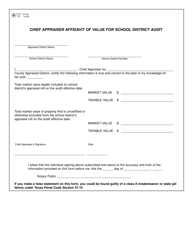

Q: What is a School District Taxable Value Audit?

A: A School District Taxable Value Audit is an examination of a property's taxable value by the school district to ensure accurate taxation.

Q: Why would someone need a School District Taxable Value Audit?

A: Someone may need a School District Taxable Value Audit if they believe there are errors in the taxable value assigned to their property, which could affect their property tax liability.

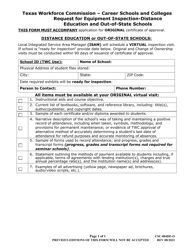

Q: Are there any fees associated with submitting Form 50-302?

A: It is advisable to check with the specific school district or appraisal district for any fees associated with submitting Form 50-302, as these may vary.

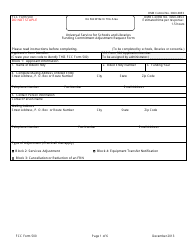

Q: What information is required on Form 50-302?

A: Form 50-302 typically requires information such as property owner's name, property address, account number, and a detailed explanation of the requested audit.

Q: What happens after submitting Form 50-302?

A: After submitting Form 50-302, the school district will review the request and determine whether an audit is necessary.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-302 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.