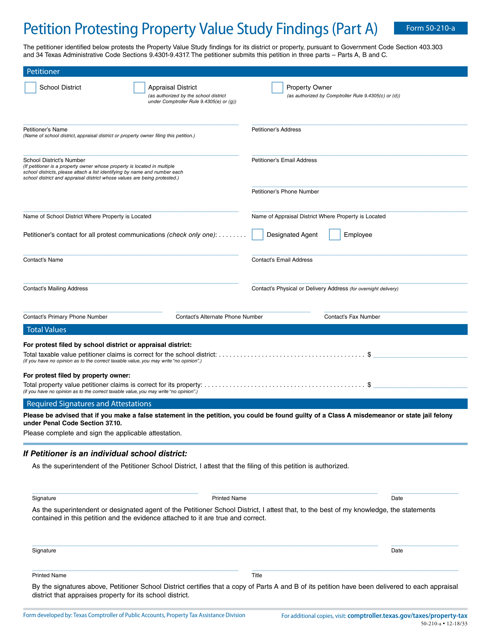

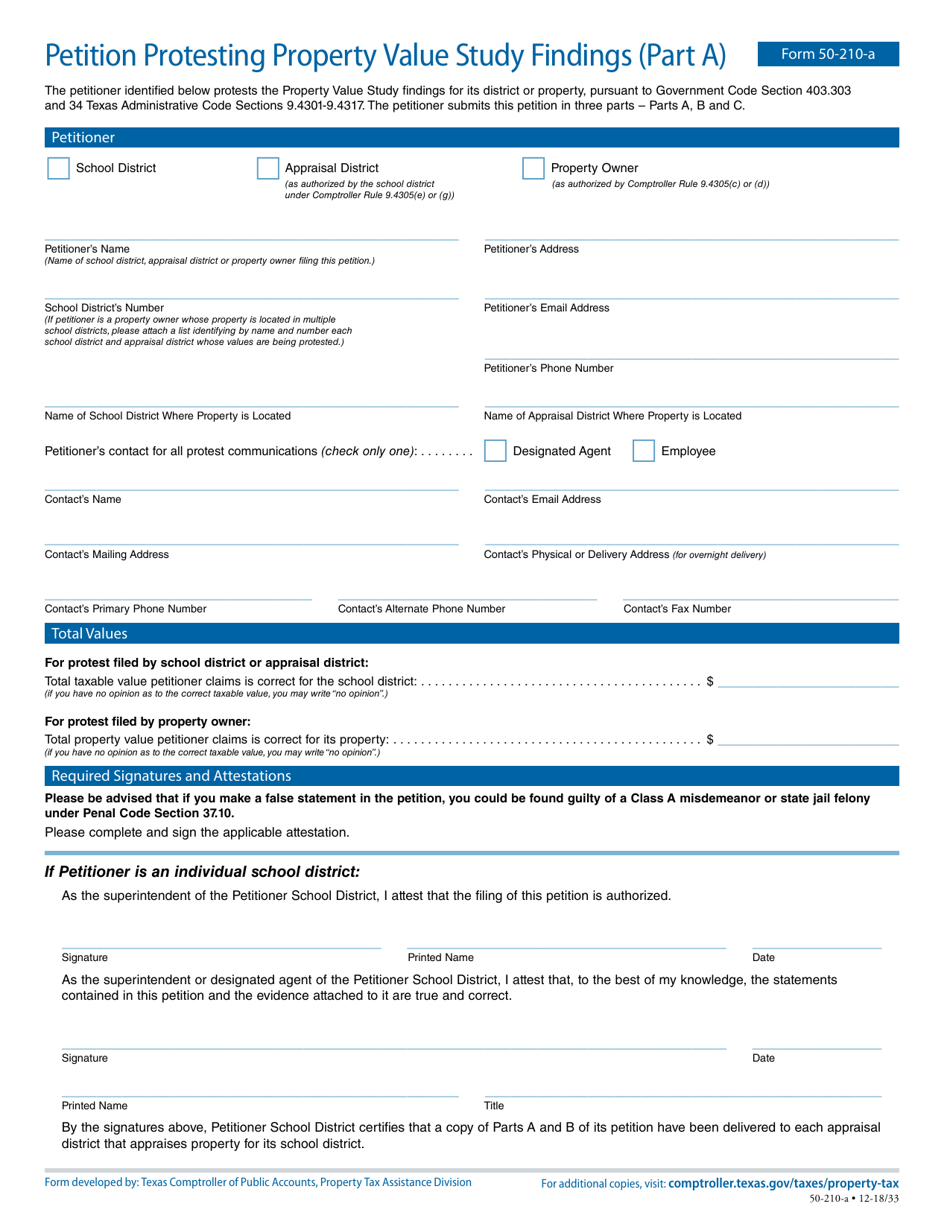

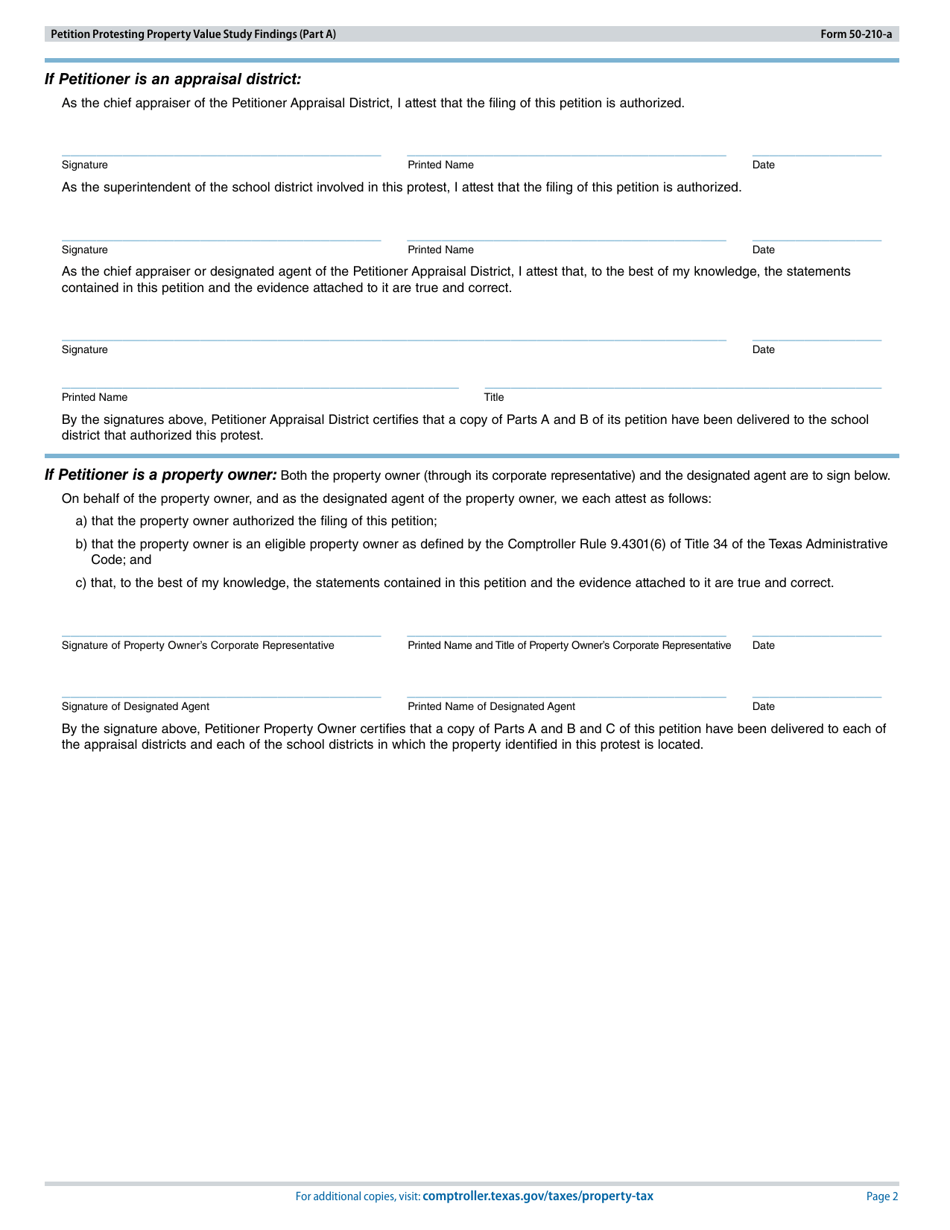

Form 50-210-A Petition Protesting Property Value Study Findings (Part a) - Texas

What Is Form 50-210-A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-210-A?

A: Form 50-210-A is a petition used to protest property value study findings in Texas.

Q: What is the purpose of Form 50-210-A?

A: The purpose of Form 50-210-A is to allow property owners to protest the findings of a property value study.

Q: Who can use Form 50-210-A?

A: Any property owner in Texas who disagrees with the findings of a property value study can use Form 50-210-A to lodge a protest.

Q: How do I fill out Form 50-210-A?

A: Form 50-210-A requires information such as the property owner's name, property ID number, appraisal district, and reasons for the protest. Detailed instructions are provided on the form.

Q: What is the deadline to submit Form 50-210-A?

A: The deadline to submit Form 50-210-A is usually May 15th or 30 days after the appraisal district mails the notice of appraised value, whichever is later.

Q: What happens after I submit Form 50-210-A?

A: After you submit Form 50-210-A, the appraisal review board will schedule a hearing where you can present your case. They will then make a determination regarding the property value.

Q: Can I appeal the decision made by the appraisal review board?

A: Yes, if you disagree with the decision made by the appraisal review board, you can appeal it to the district court.

Q: Are there any fees associated with filing Form 50-210-A?

A: There may be fees associated with filing Form 50-210-A, such as a filing fee or an administrative fee. The specific fees will depend on your local appraisal district.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-210-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.