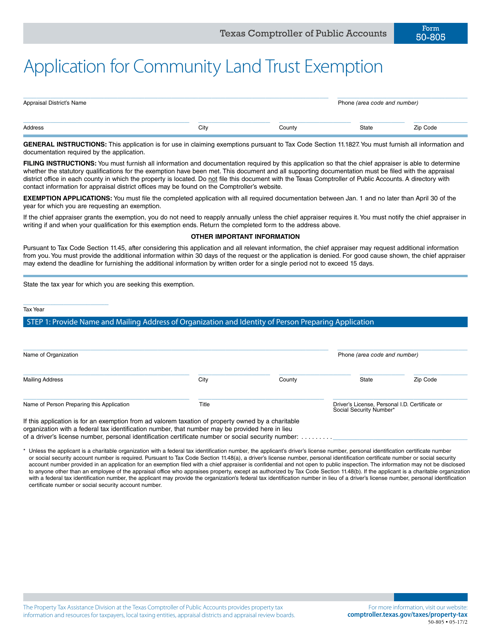

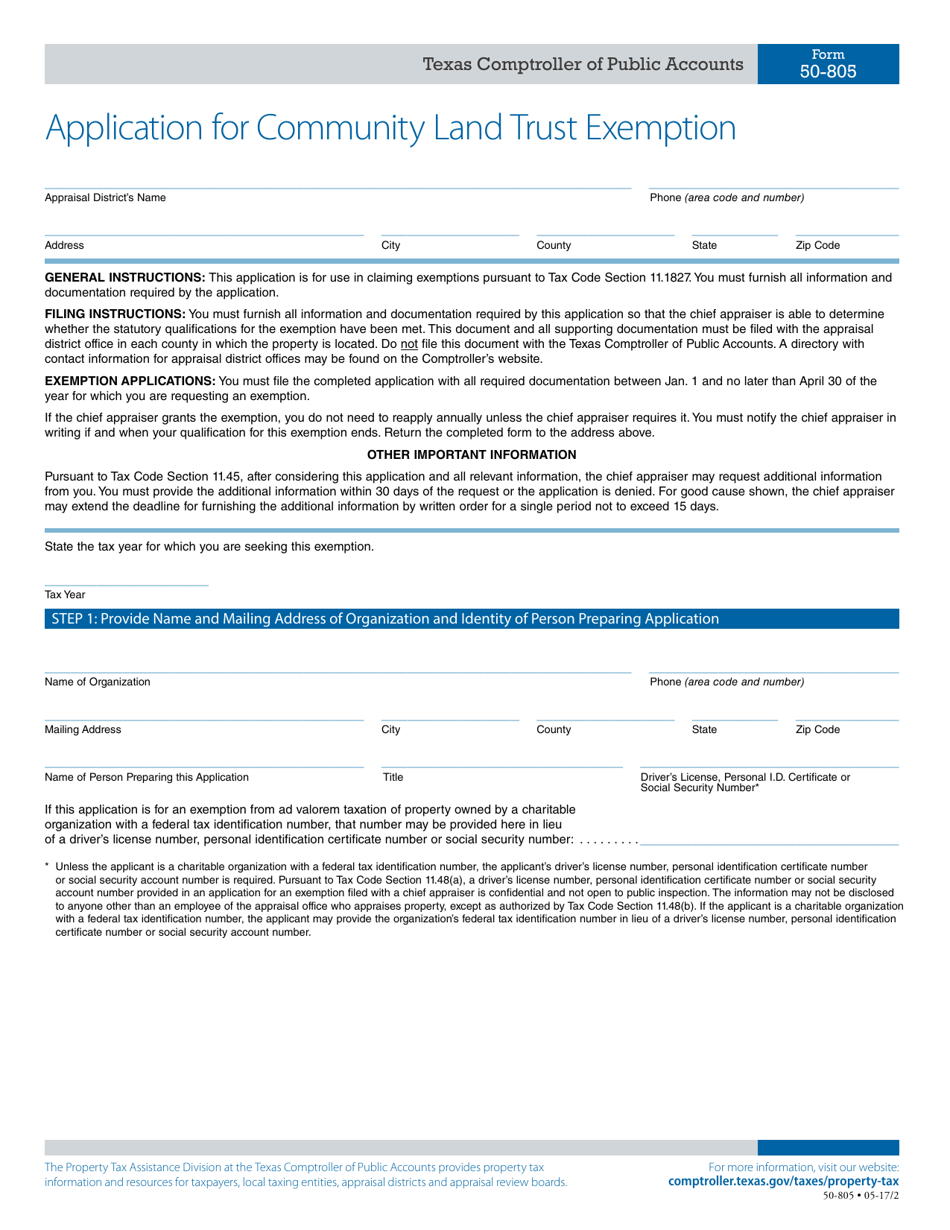

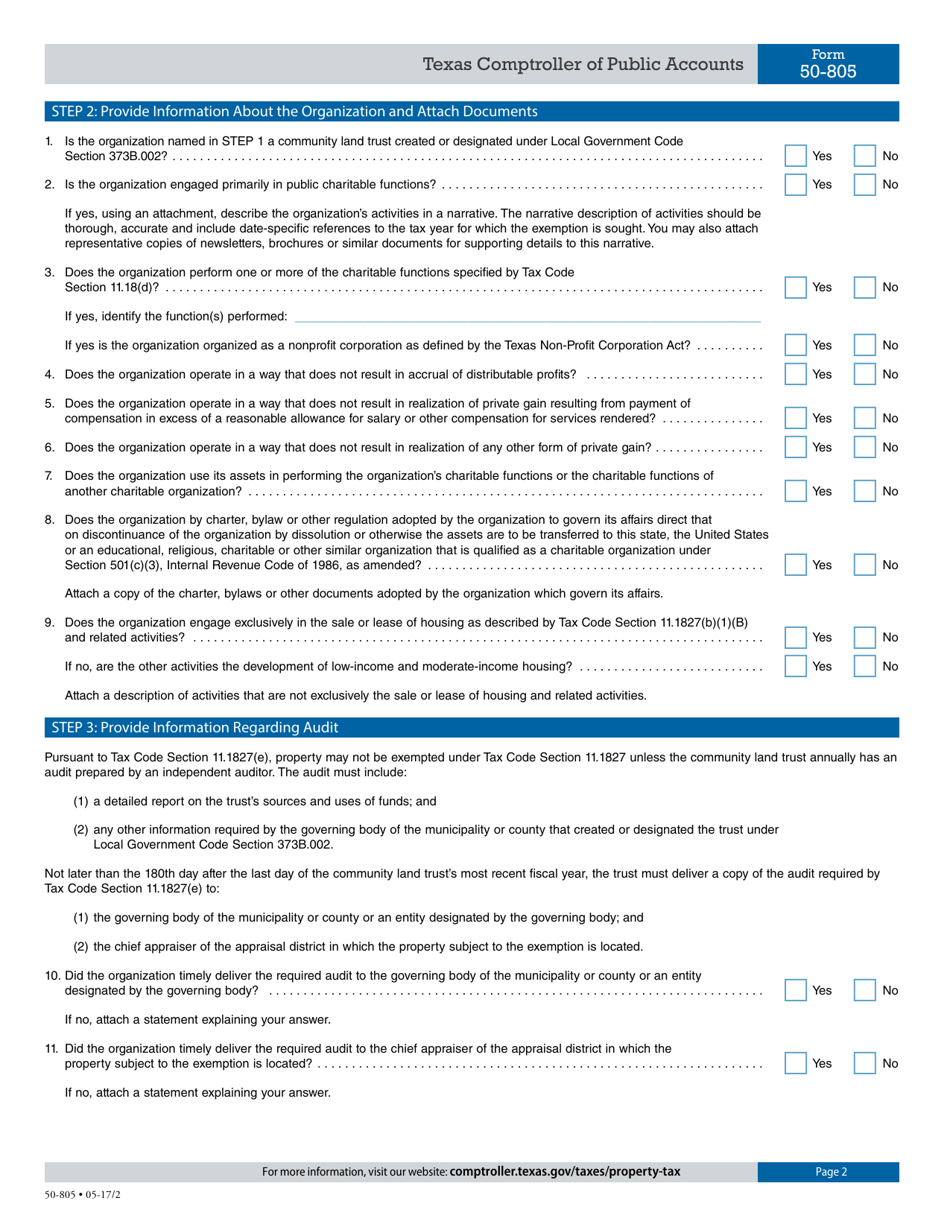

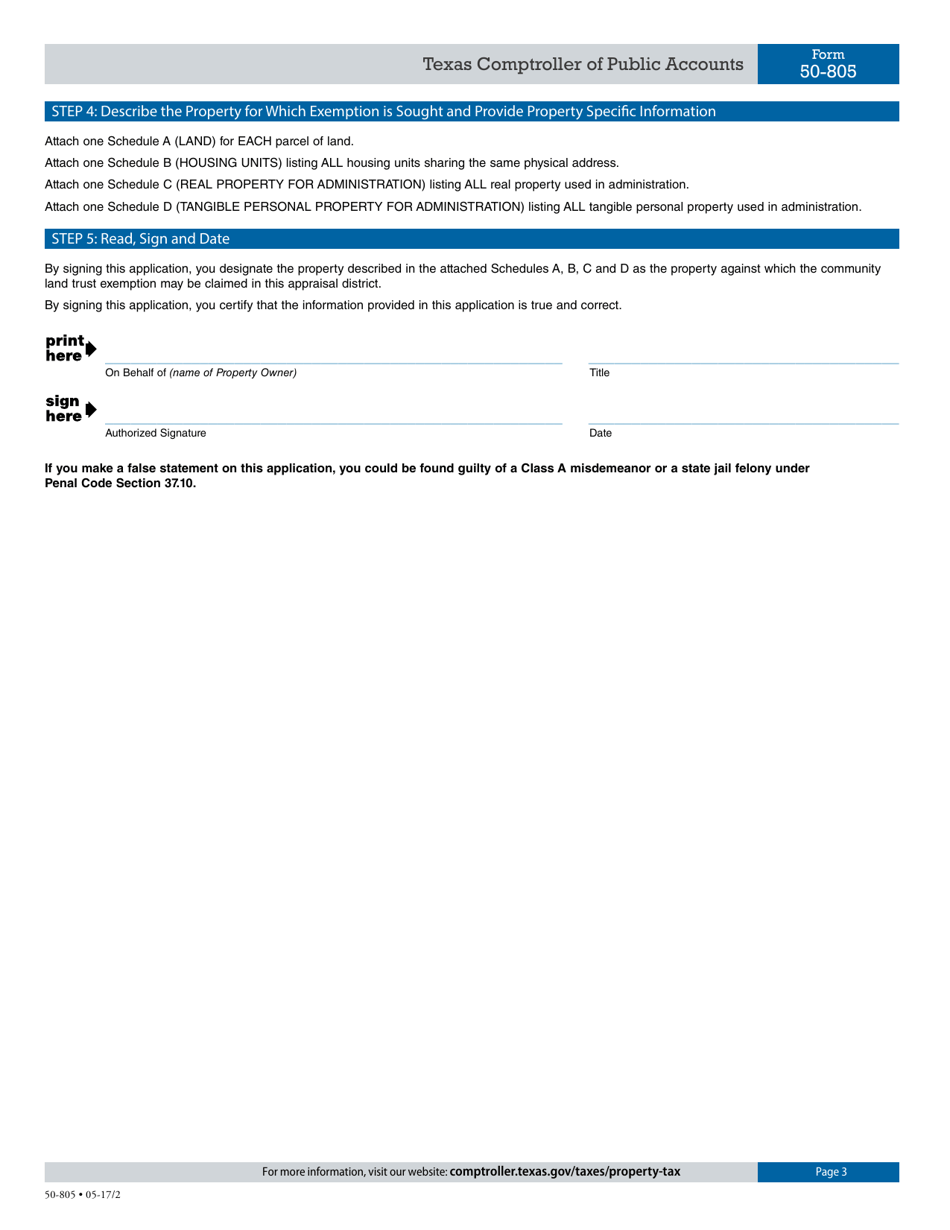

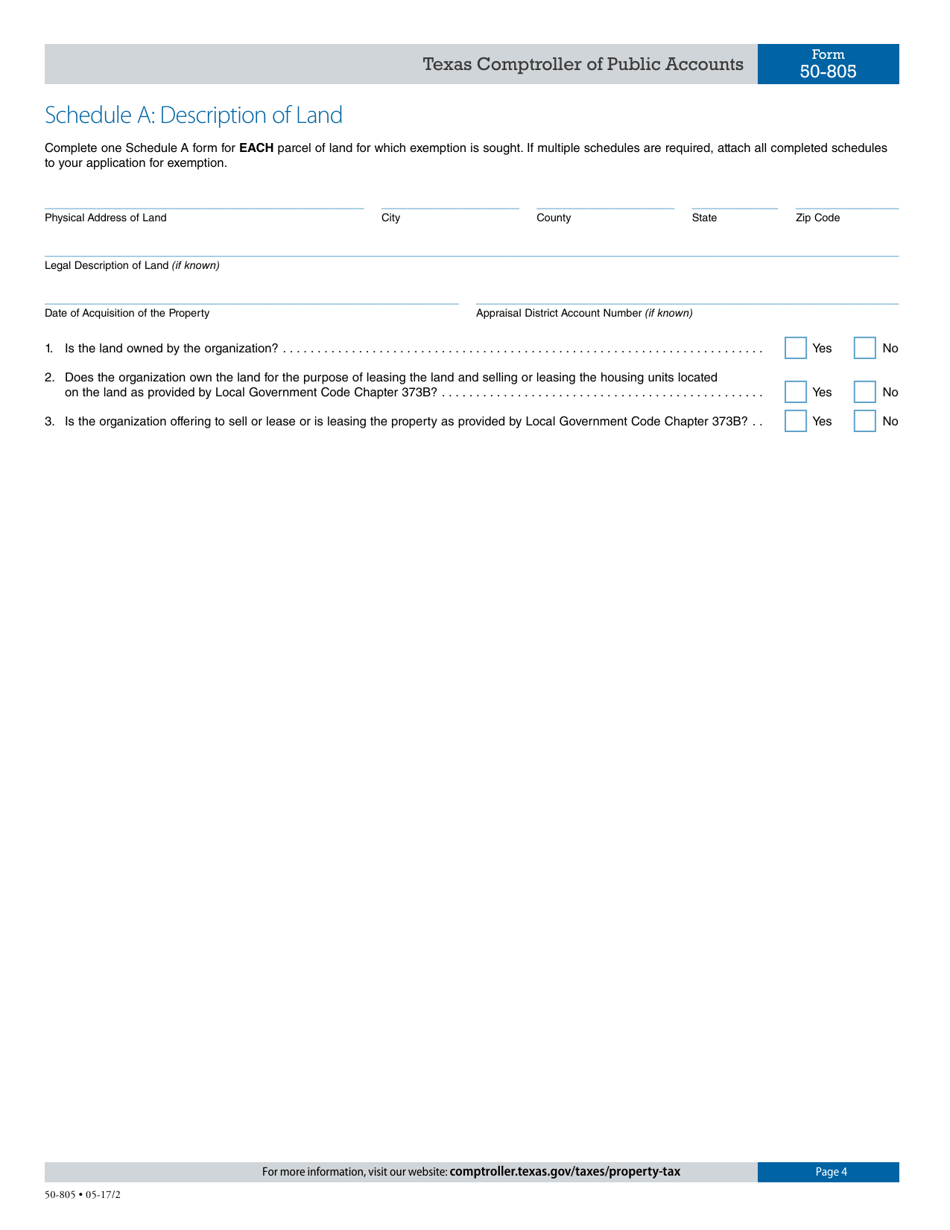

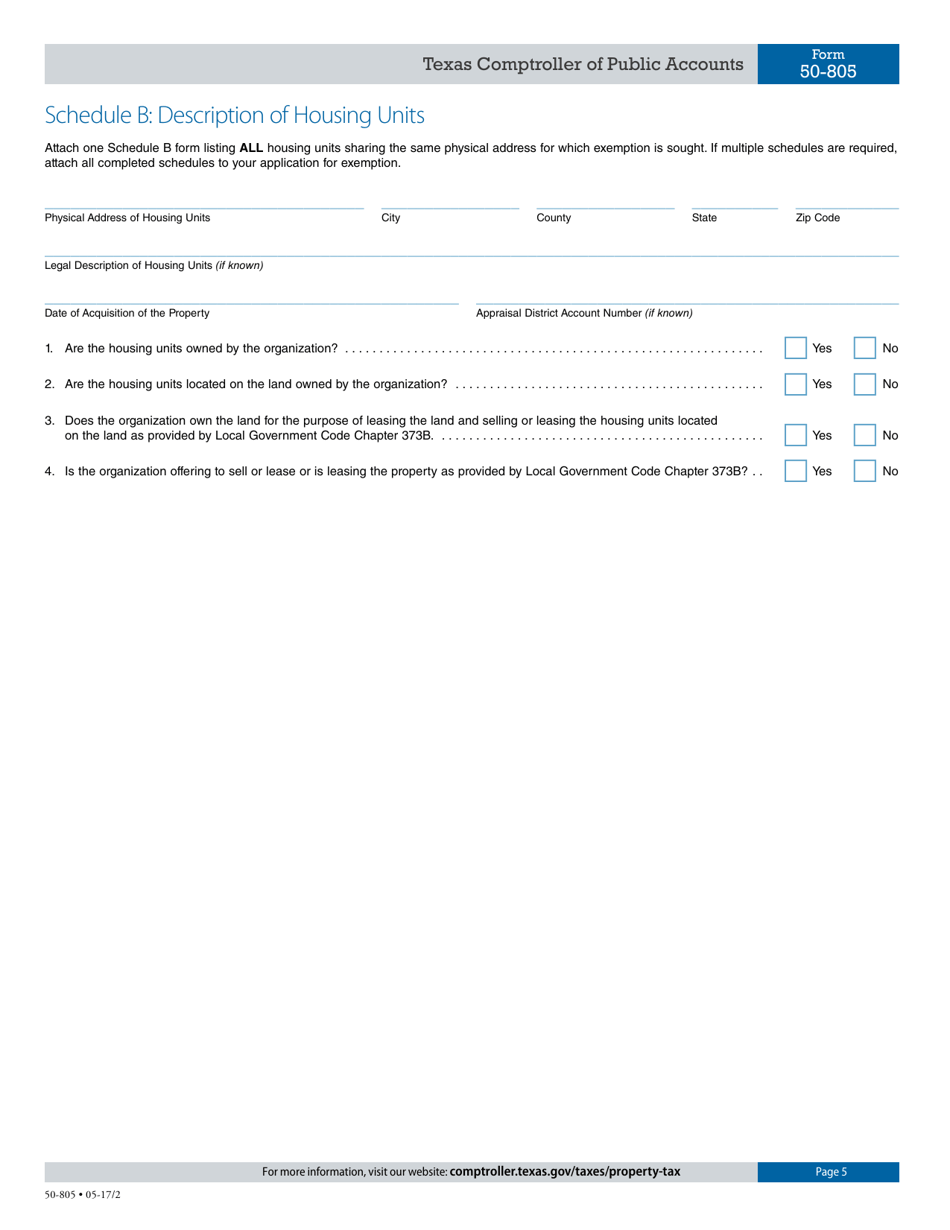

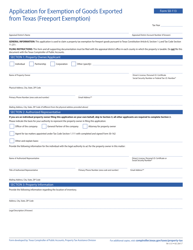

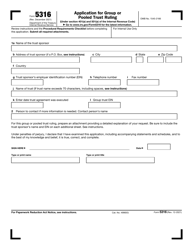

Form 50-805 Application for Community Land Trust Exemption - Texas

What Is Form 50-805?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-805?

A: Form 50-805 is the Application for Community Land Trust Exemption in Texas.

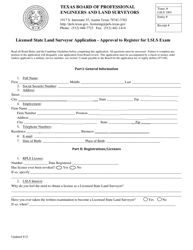

Q: Who needs to fill out Form 50-805?

A: Anyone who wishes to apply for a community land trust exemption in Texas needs to fill out this form.

Q: What is a community land trust exemption?

A: A community land trust exemption is a tax exemption granted to qualifying community land trusts in Texas.

Q: What are the requirements for a community land trust exemption?

A: To qualify for a community land trust exemption, the land trust must meet certain criteria set by the Texas Property Tax Code.

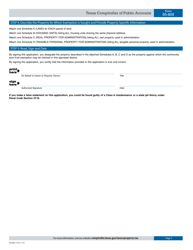

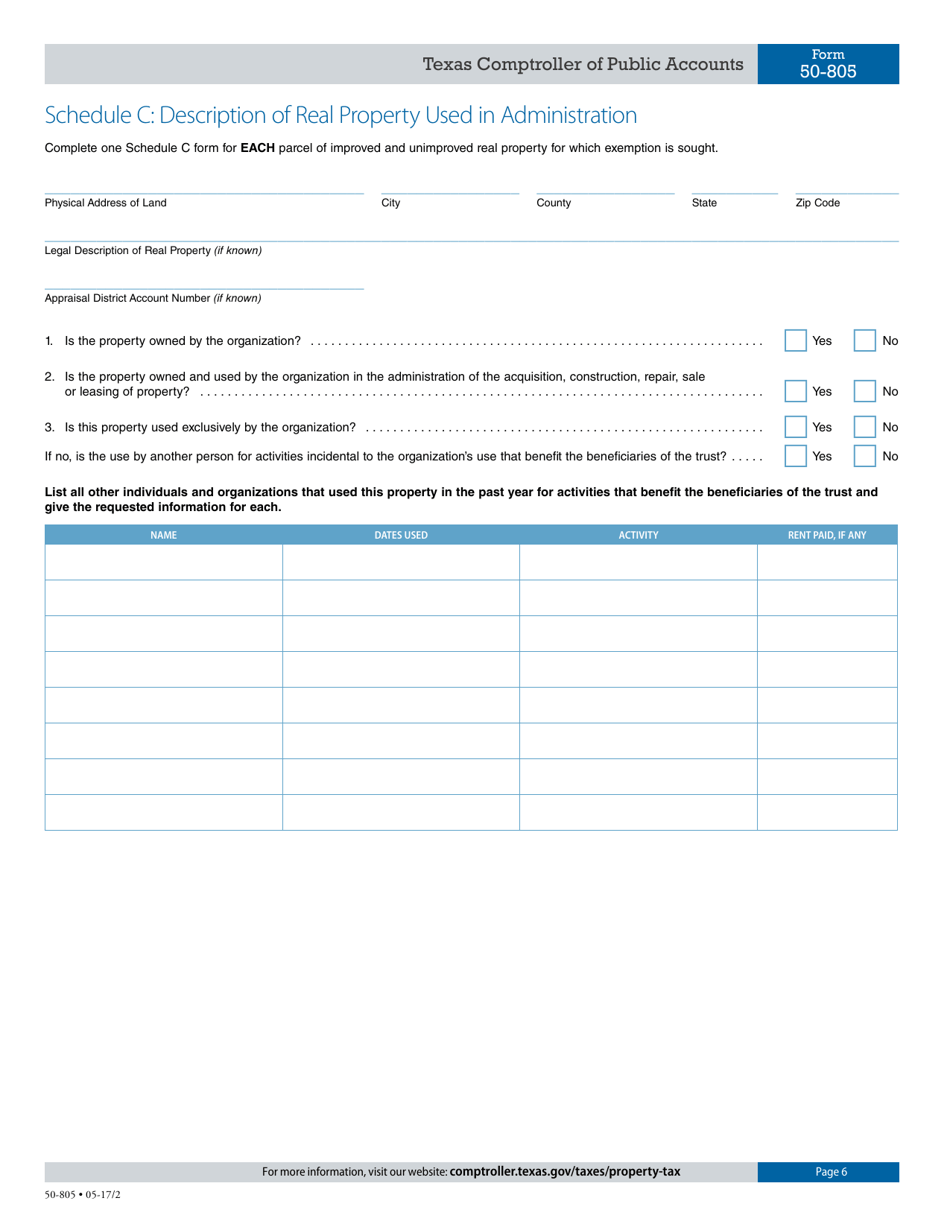

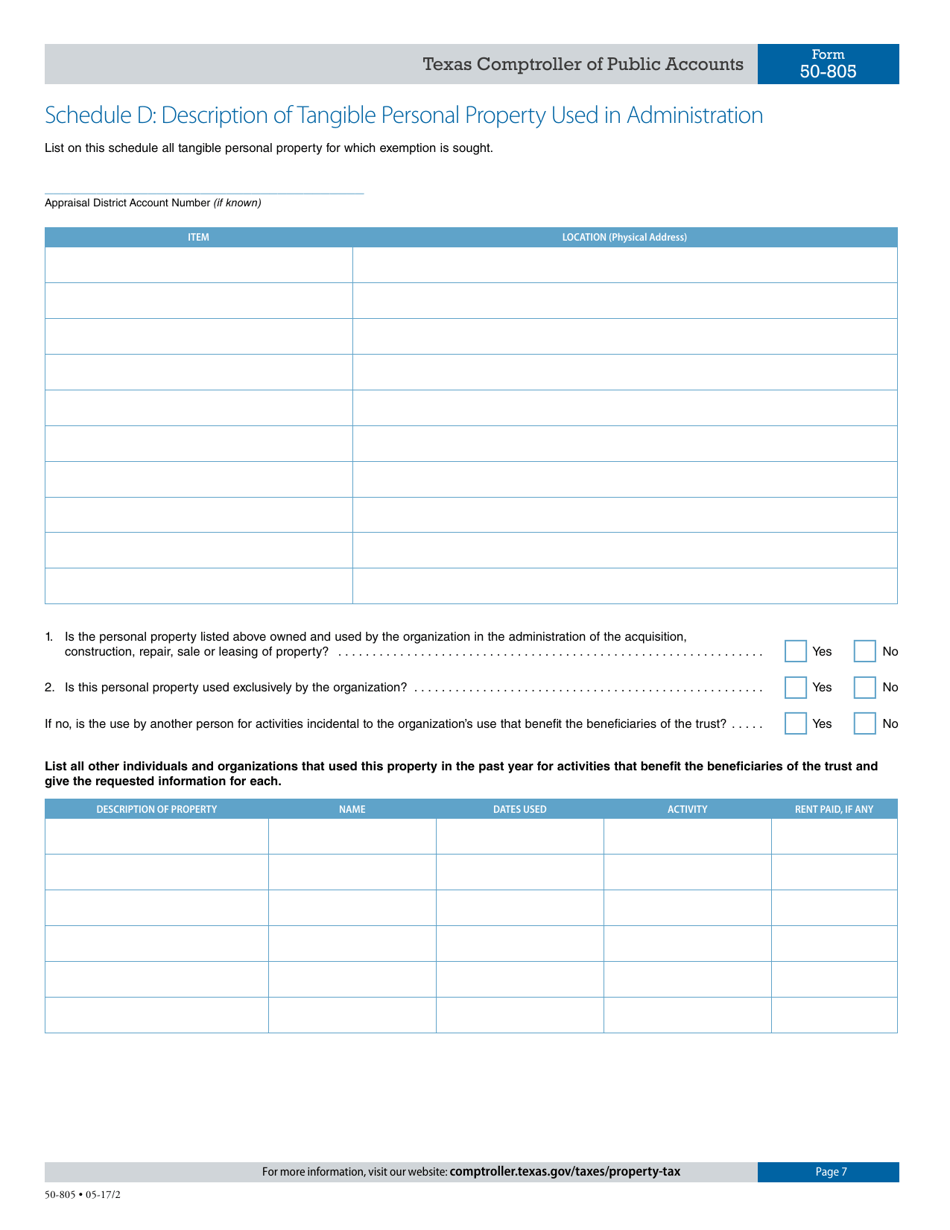

Q: What information do I need to provide on Form 50-805?

A: You will need to provide information about the community land trust, its purpose, activities, and any applicable financial documentation.

Q: Is there a deadline for submitting Form 50-805?

A: Yes, Form 50-805 must be submitted to the Comptroller no later than April 30th of the year for which the exemption is sought.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-805 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.