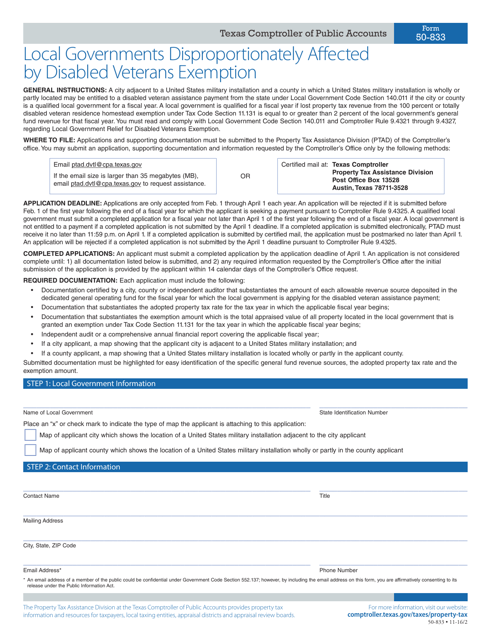

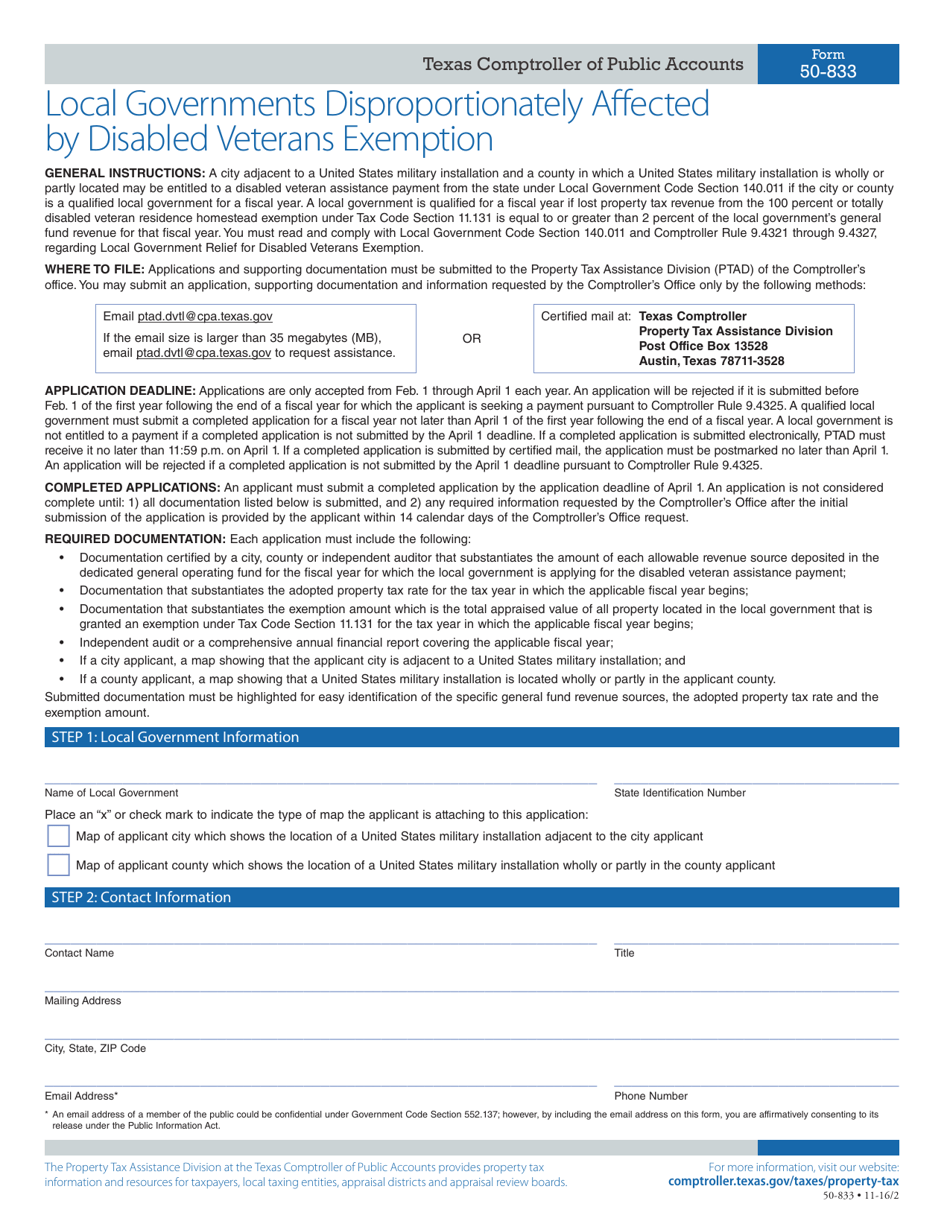

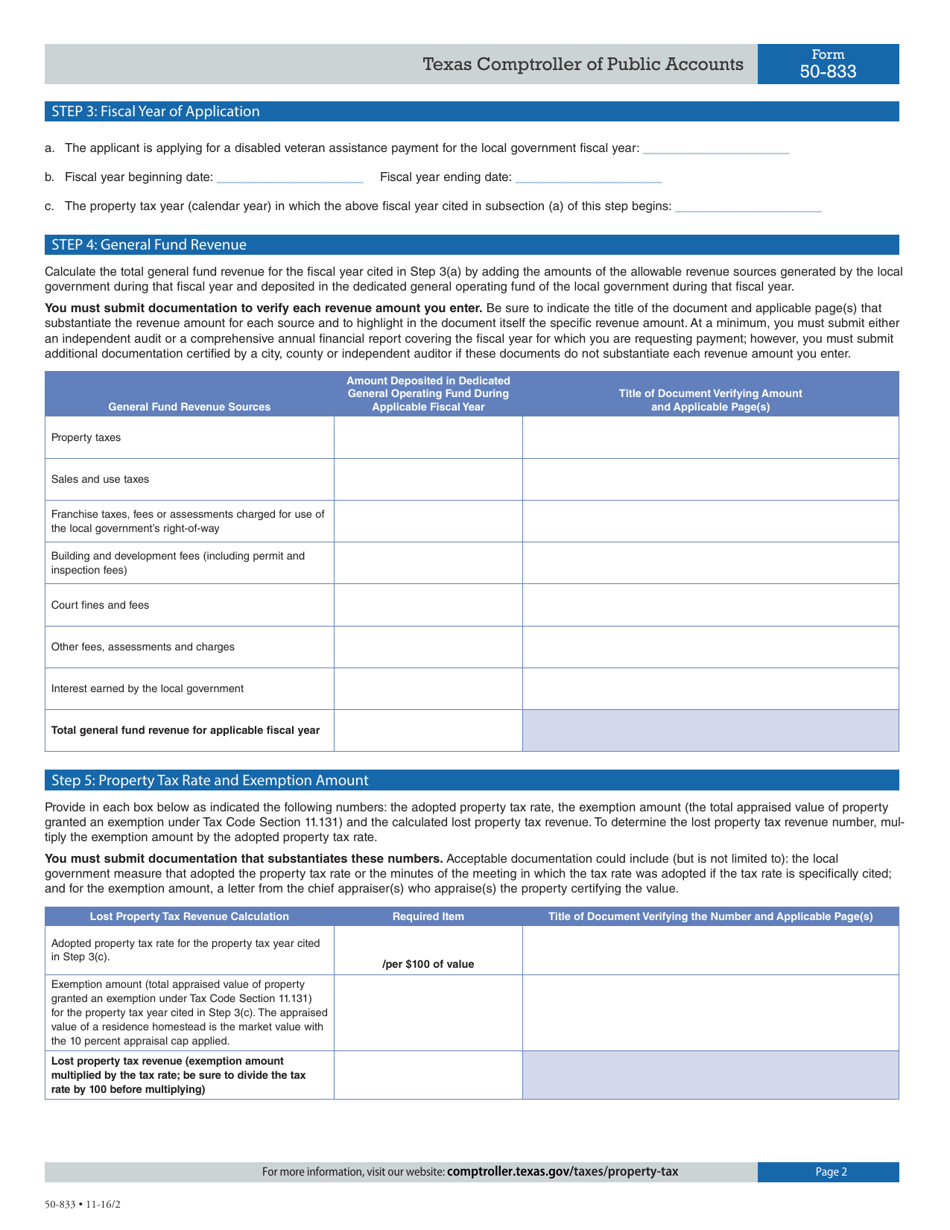

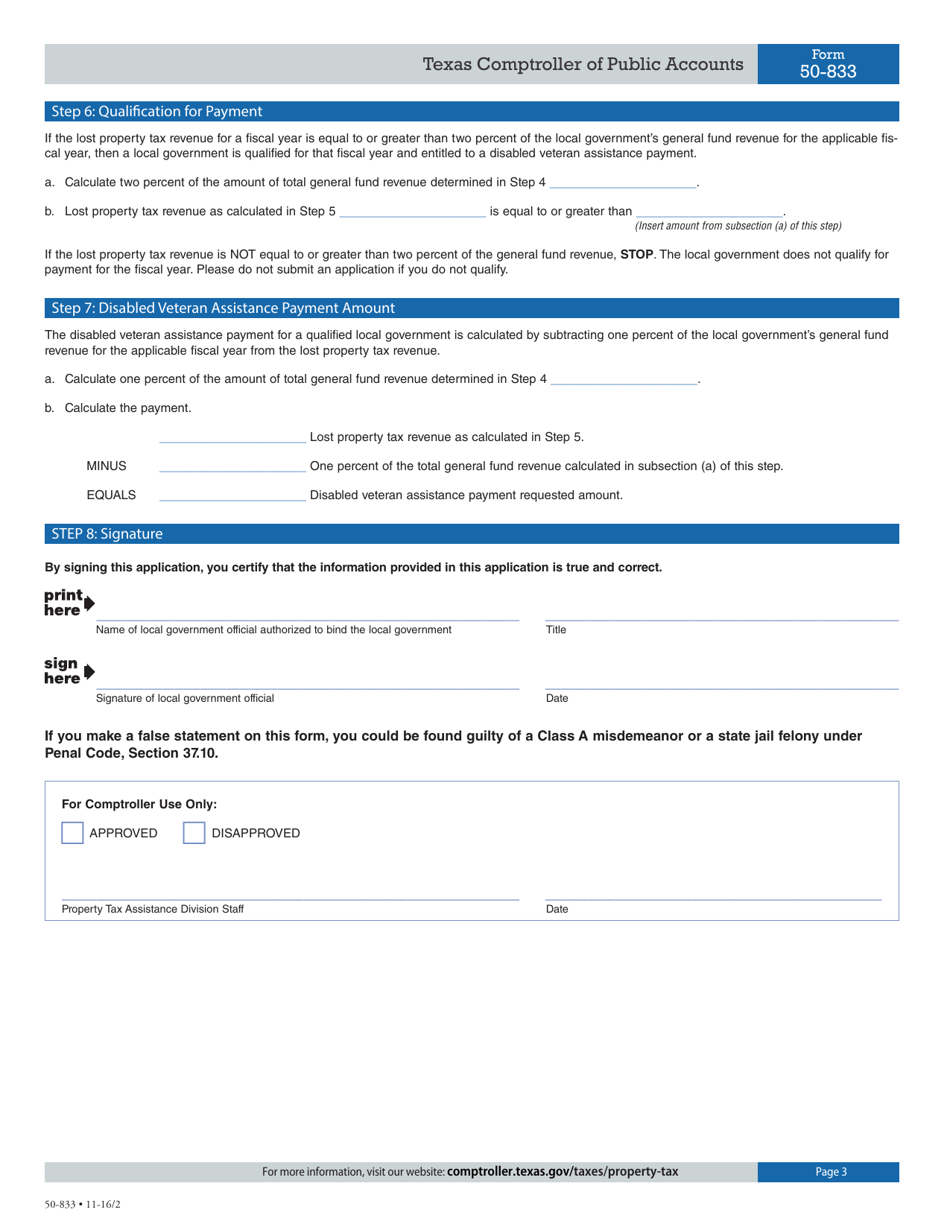

Form 50-833 Local Governments Disproportionately Affected by Disabled Veterans Exemption - Texas

What Is Form 50-833?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-833?

A: Form 50-833 is a form used in Texas for Local Governments Disproportionately Affected by Disabled Veterans Exemption.

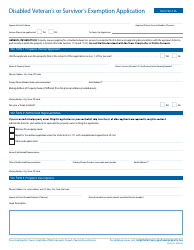

Q: Who is eligible for the Disabled Veterans Exemption?

A: Disabled veterans who meet certain criteria are eligible for the exemption.

Q: What is the purpose of Form 50-833?

A: Form 50-833 is used to determine the financial impact on local governments due to the Disabled Veterans Exemption.

Q: How does the exemption affect local governments?

A: The exemption reduces property tax revenue for local governments, which may require adjustments to their budgets.

Q: Are all disabled veterans eligible for the exemption?

A: Not all disabled veterans are eligible. They must meet specific criteria set by the state of Texas.

Q: What other exemptions are available for disabled veterans in Texas?

A: In addition to the Local Governments Disproportionately Affected by Disabled Veterans Exemption, there is also a Homestead Exemption for Disabled Veterans.

Q: How can local governments mitigate the financial impact of the exemption?

A: Local governments can adjust their budgets and seek alternative sources of revenue to mitigate the financial impact of the exemption.

Q: Is the Disabled Veterans Exemption available in other states?

A: The exemption may be available in other states, but the eligibility criteria and application process may vary.

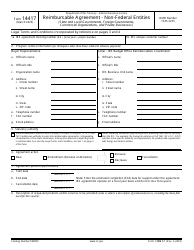

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-833 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.