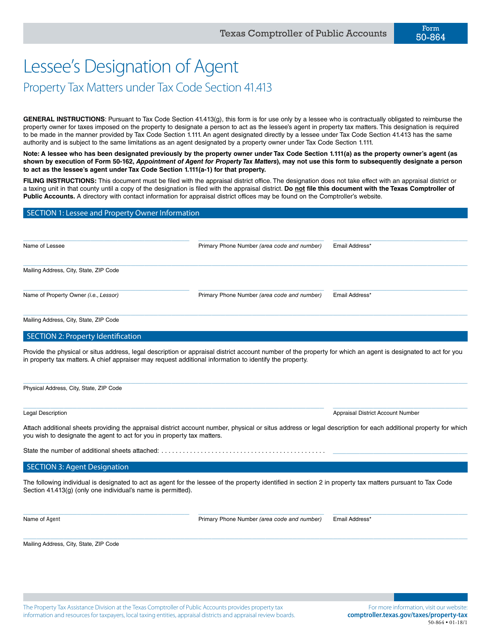

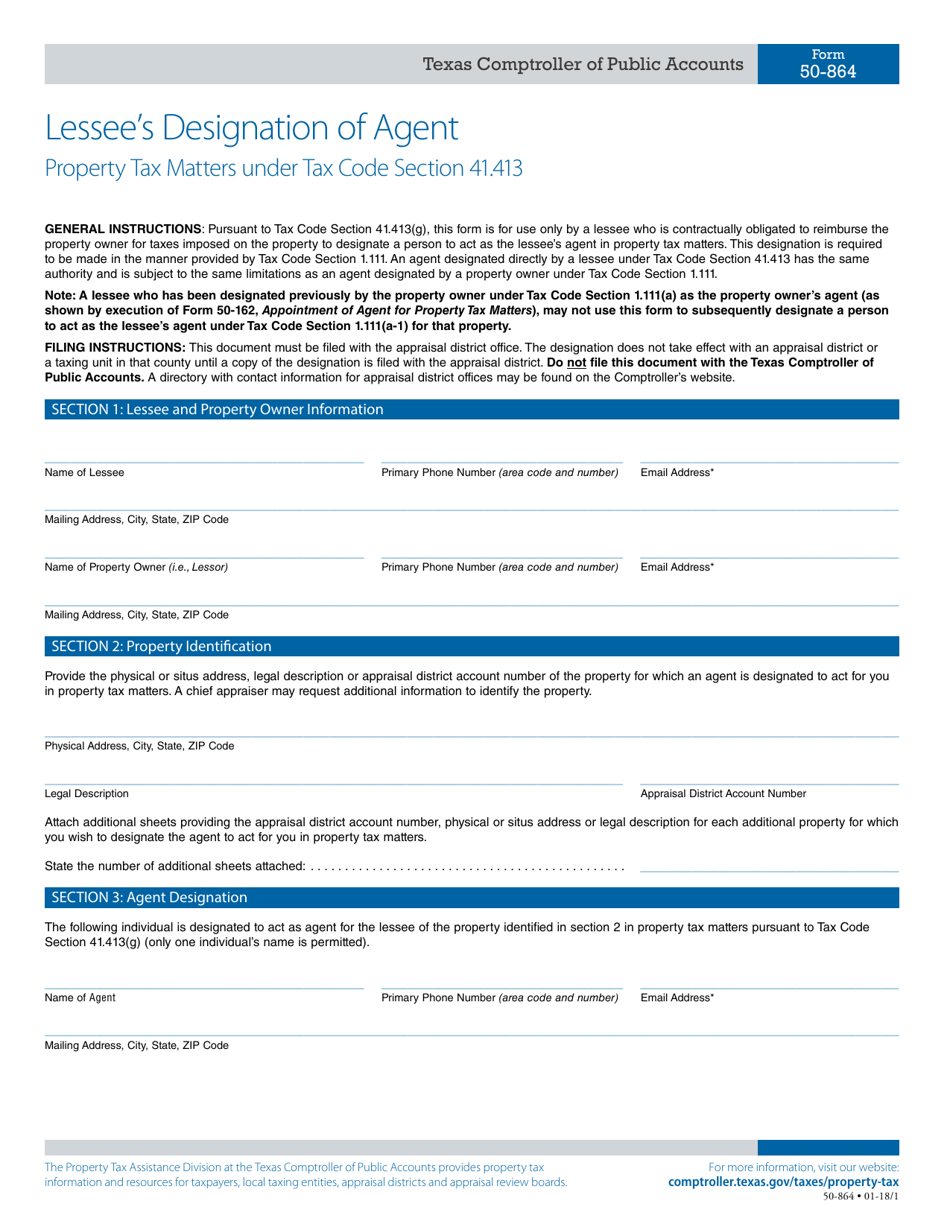

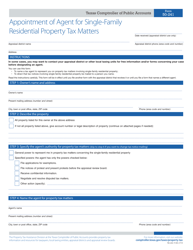

Form 50-864 Lessee's Designation of Agent - Property Tax Matters Under Tax Code Section 41.413 - Texas

What Is Form 50-864?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-864?

A: Form 50-864 is Lessee's Designation of Agent - Property Tax Matters Under Tax Code Section 41.413 in Texas.

Q: What is the purpose of Form 50-864?

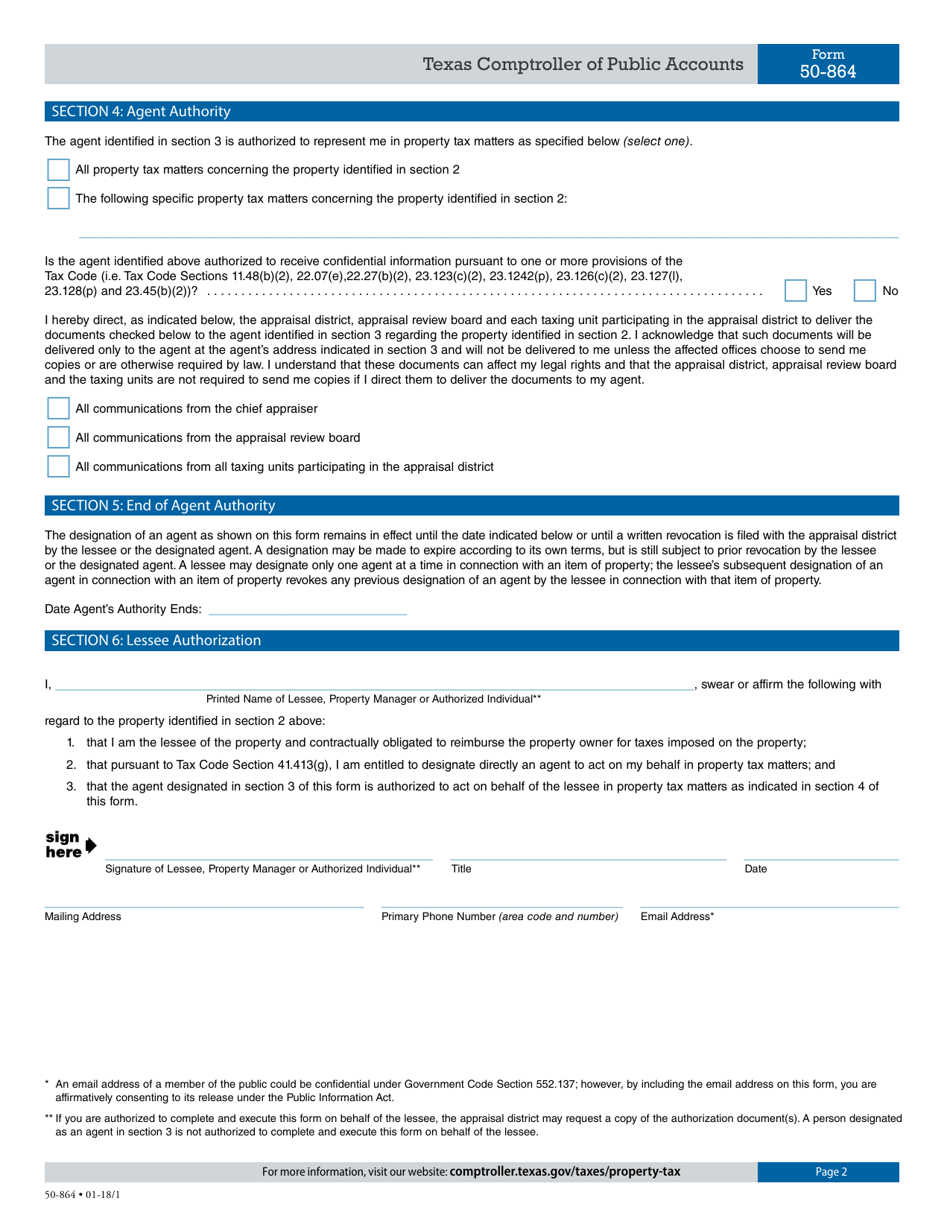

A: The purpose of Form 50-864 is to designate an agent for property tax matters.

Q: Who needs to fill out Form 50-864?

A: Lessees in Texas who want to designate an agent for property tax matters need to fill out Form 50-864.

Q: Is there a deadline for submitting Form 50-864?

A: Yes, Form 50-864 must be submitted by April 15th each year.

Q: What happens after submitting Form 50-864?

A: After submitting Form 50-864, the designated agent will receive property tax notifications on behalf of the lessee.

Q: Are there any fees associated with Form 50-864?

A: No, there are no fees associated with filing Form 50-864.

Q: Can the designated agent be changed?

A: Yes, the designated agent can be changed by submitting a new Form 50-864.

Q: What if I have more questions about Form 50-864?

A: For more information or assistance, you can contact the Texas Comptroller of Public Accounts.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-864 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.