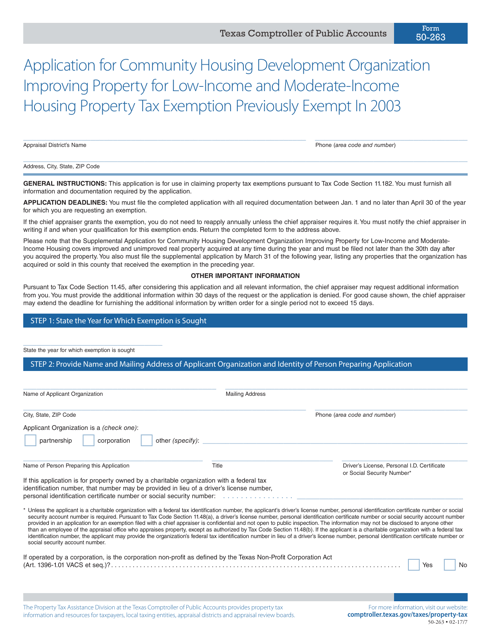

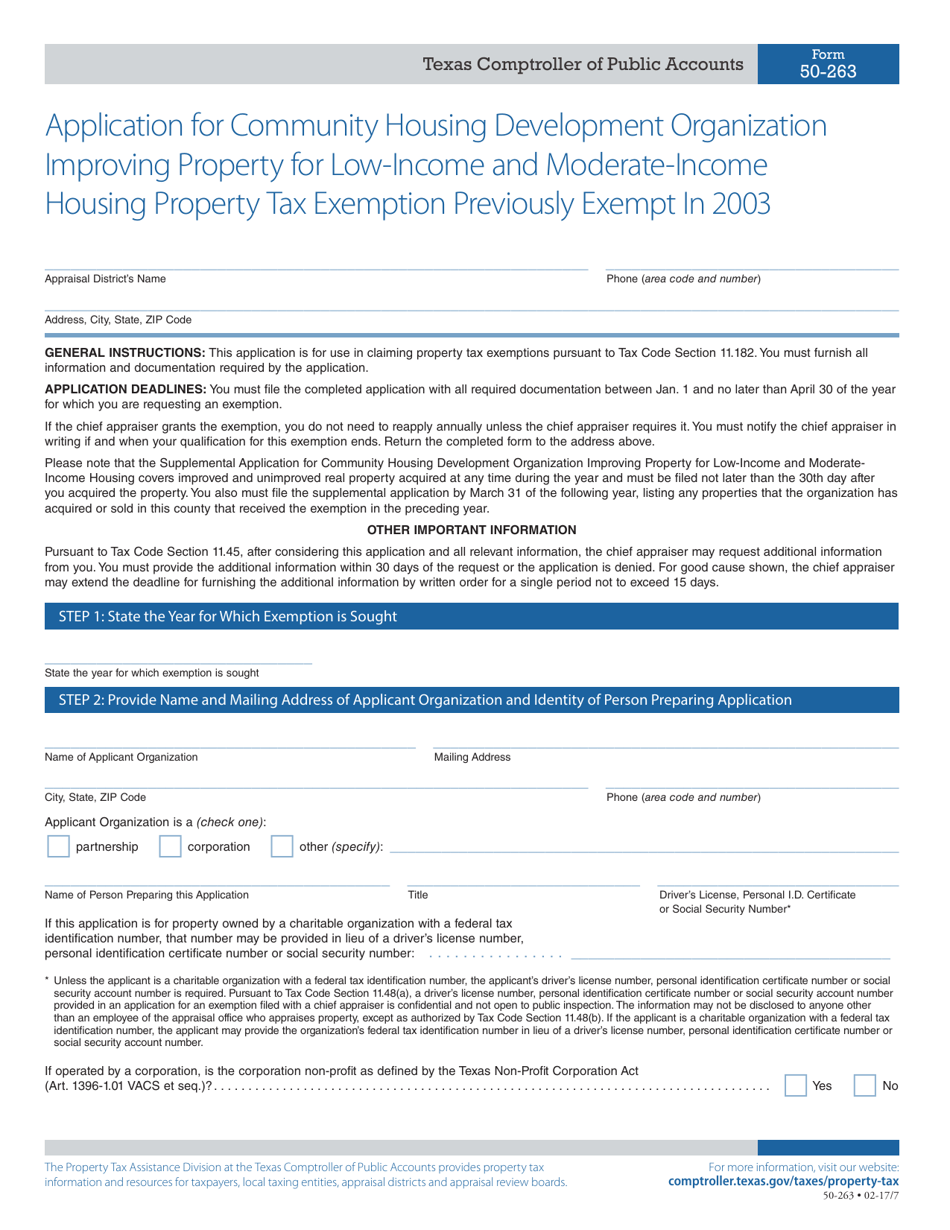

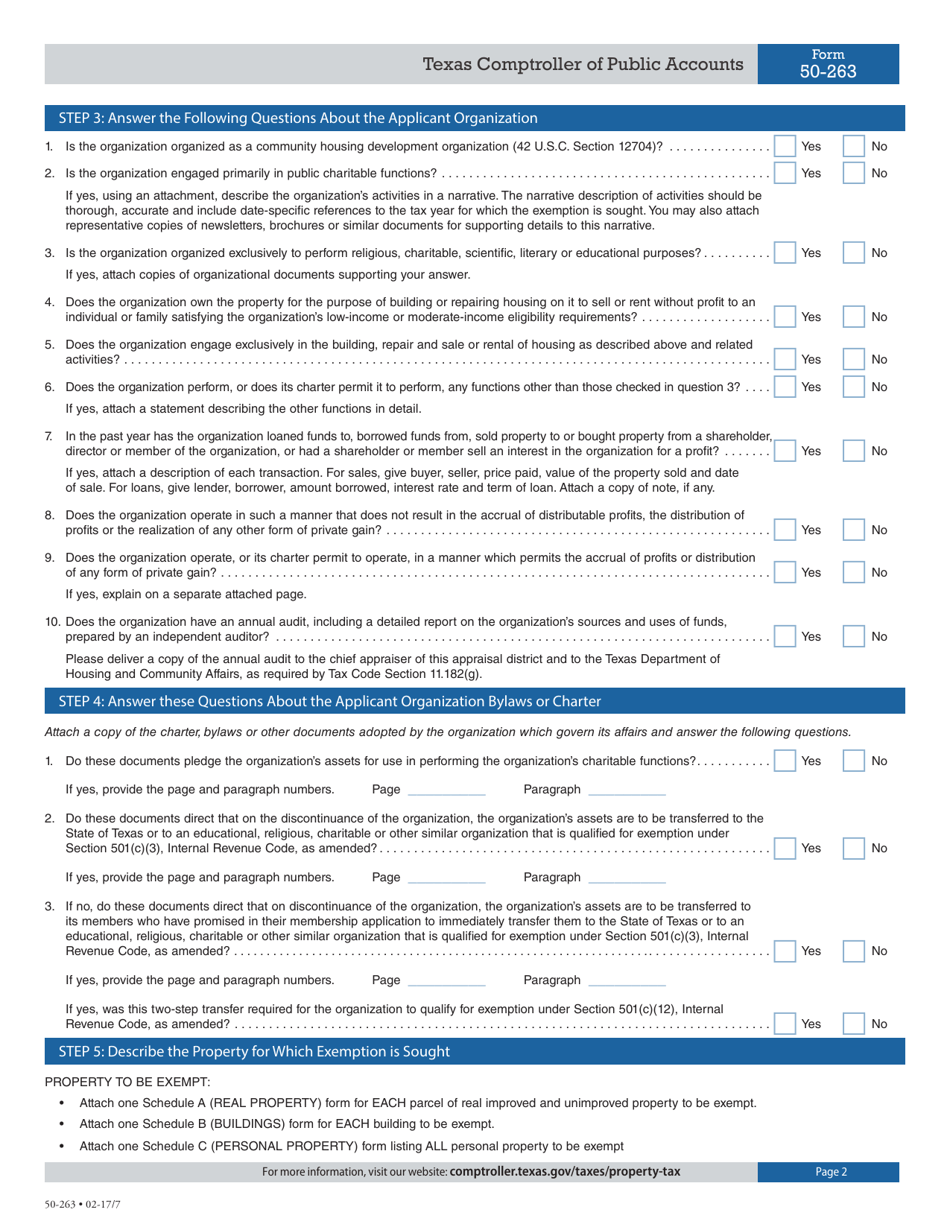

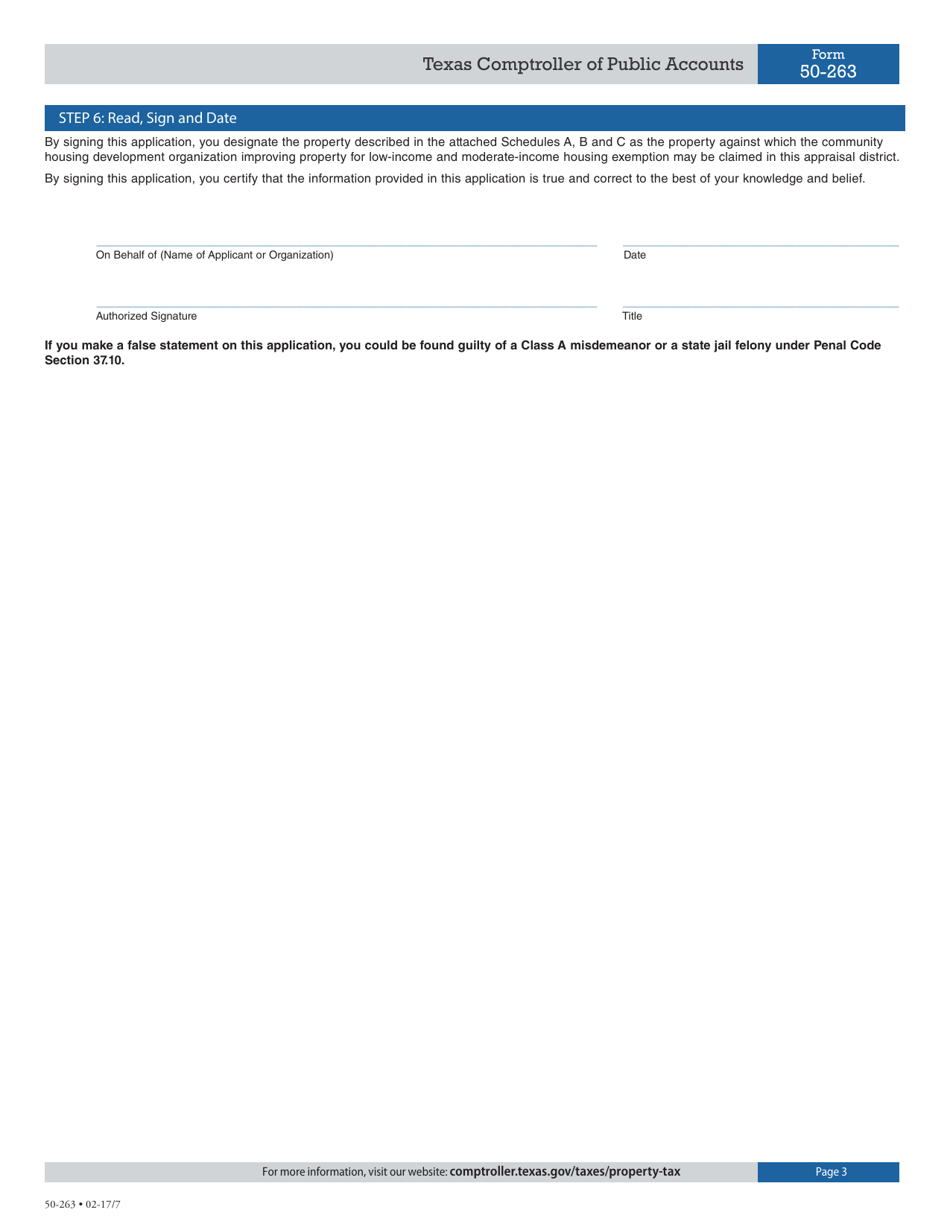

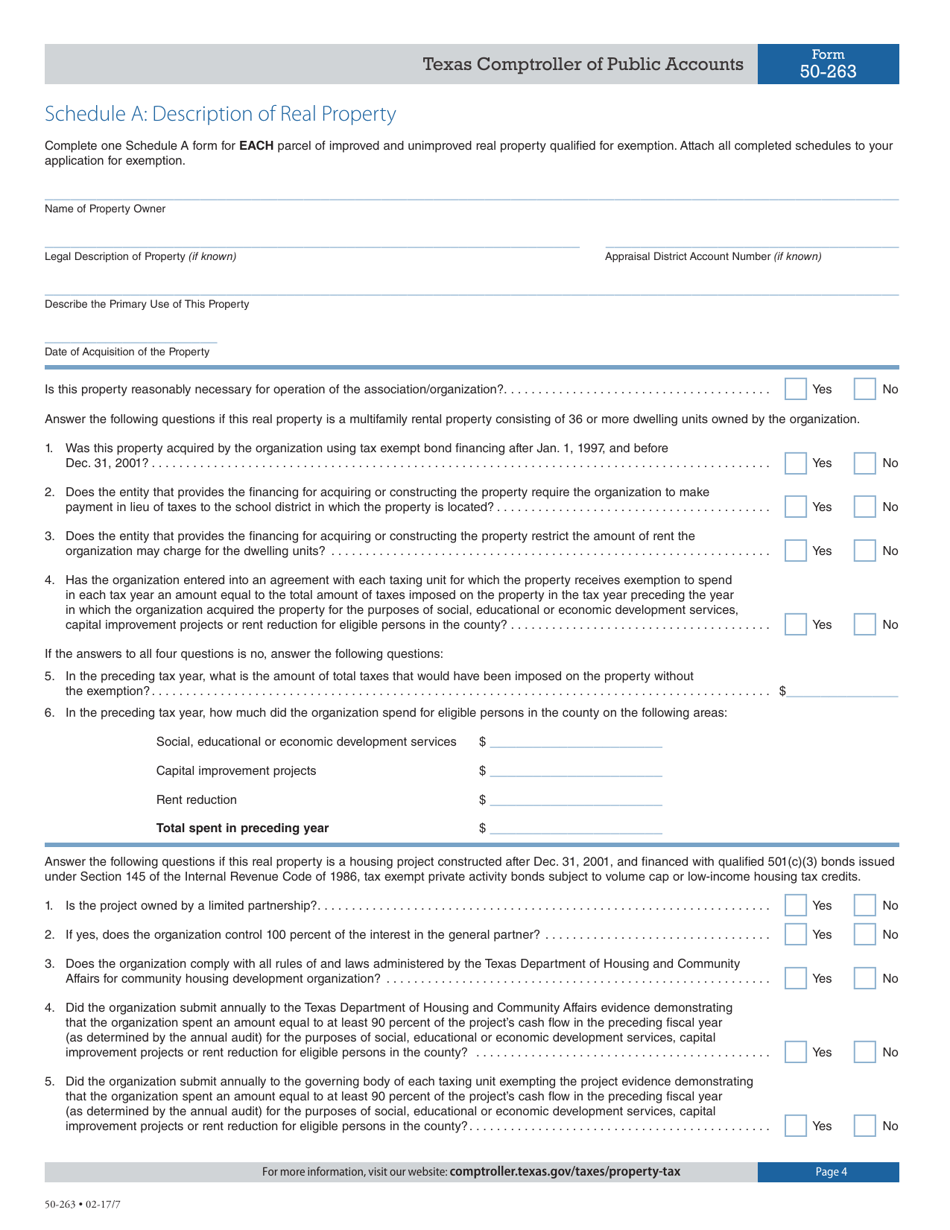

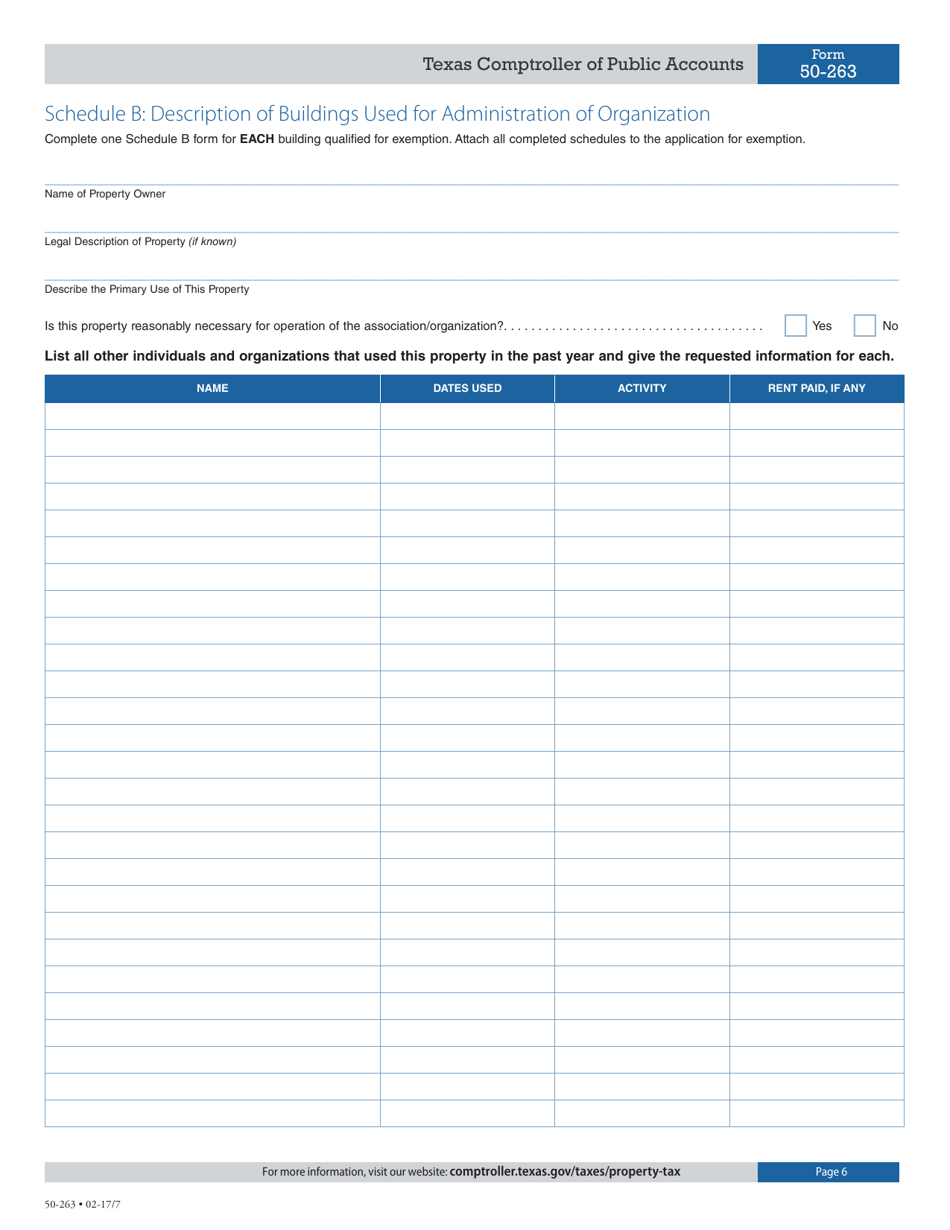

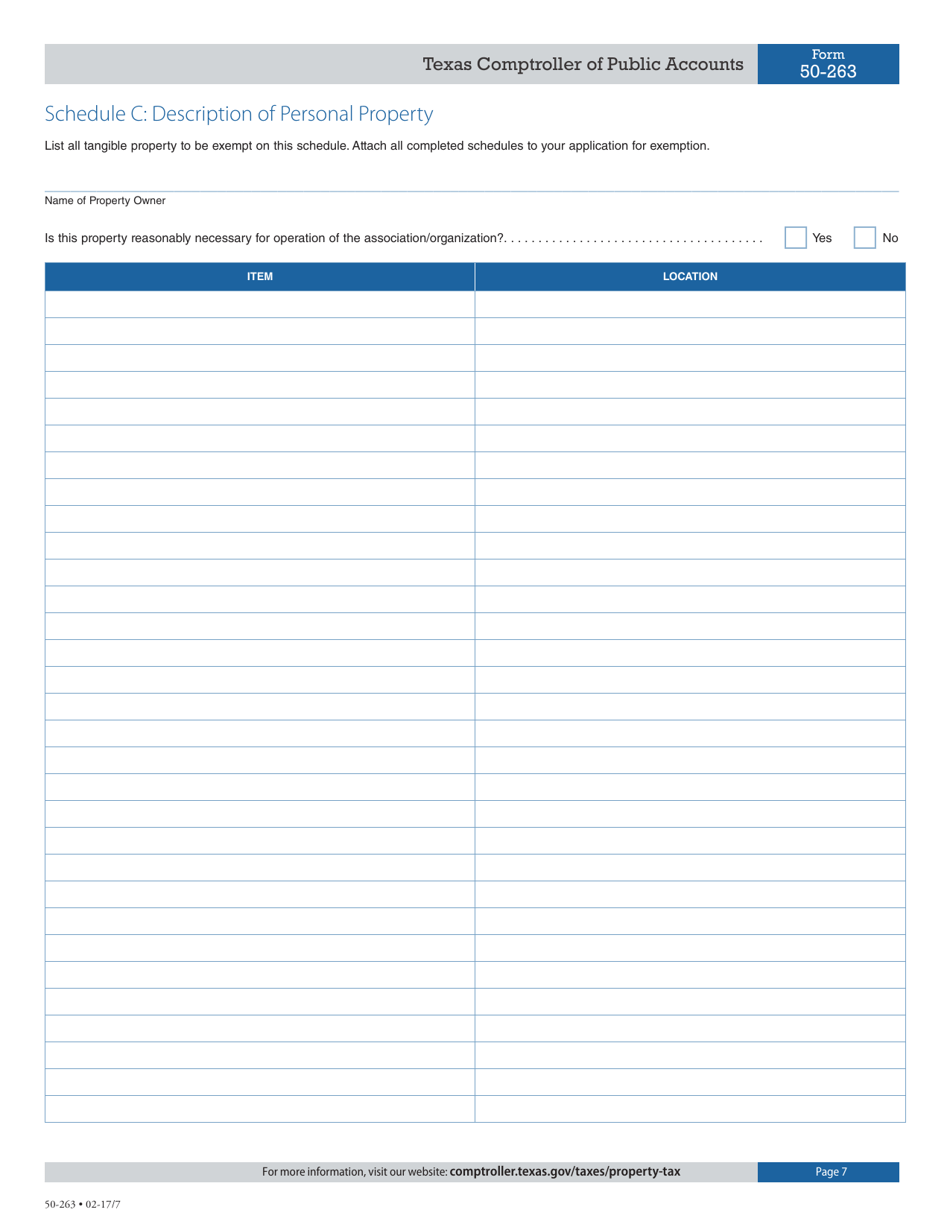

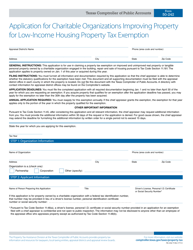

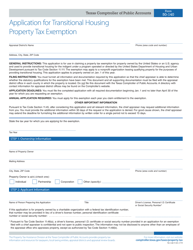

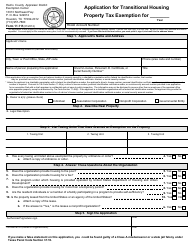

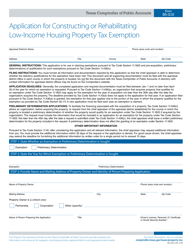

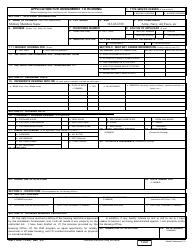

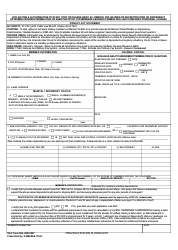

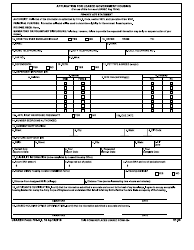

Form 50-263 Application for Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Tax Exemption Previously Exempt in 2003 - Texas

What Is Form 50-263?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-263?

A: Form 50-263 is an application for Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Tax Exemption Previously Exempt in 2003 in Texas.

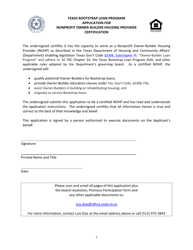

Q: Who can use form 50-263?

A: Community Housing Development Organizations can use form 50-263 to apply for property tax exemption.

Q: What is the purpose of form 50-263?

A: The purpose of form 50-263 is to enable Community Housing Development Organizations to apply for property tax exemption for low-income and moderate-income housing.

Q: When was this property tax exemption previously exempted?

A: This property tax exemption was previously exempted in 2003.

Q: Is this property tax exemption available only in Texas?

A: Yes, this property tax exemption is available only in Texas.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-263 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.