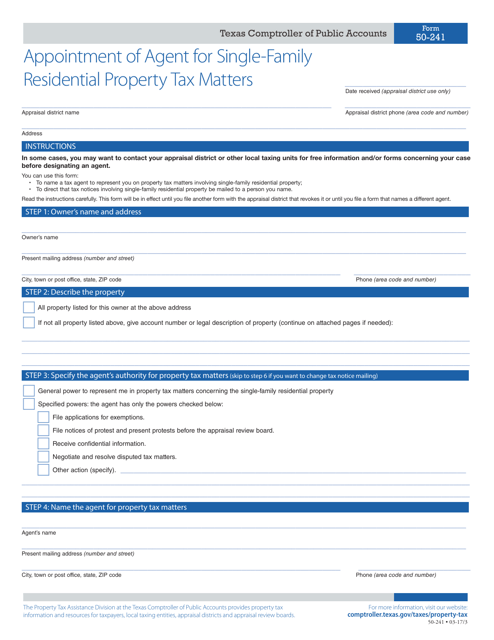

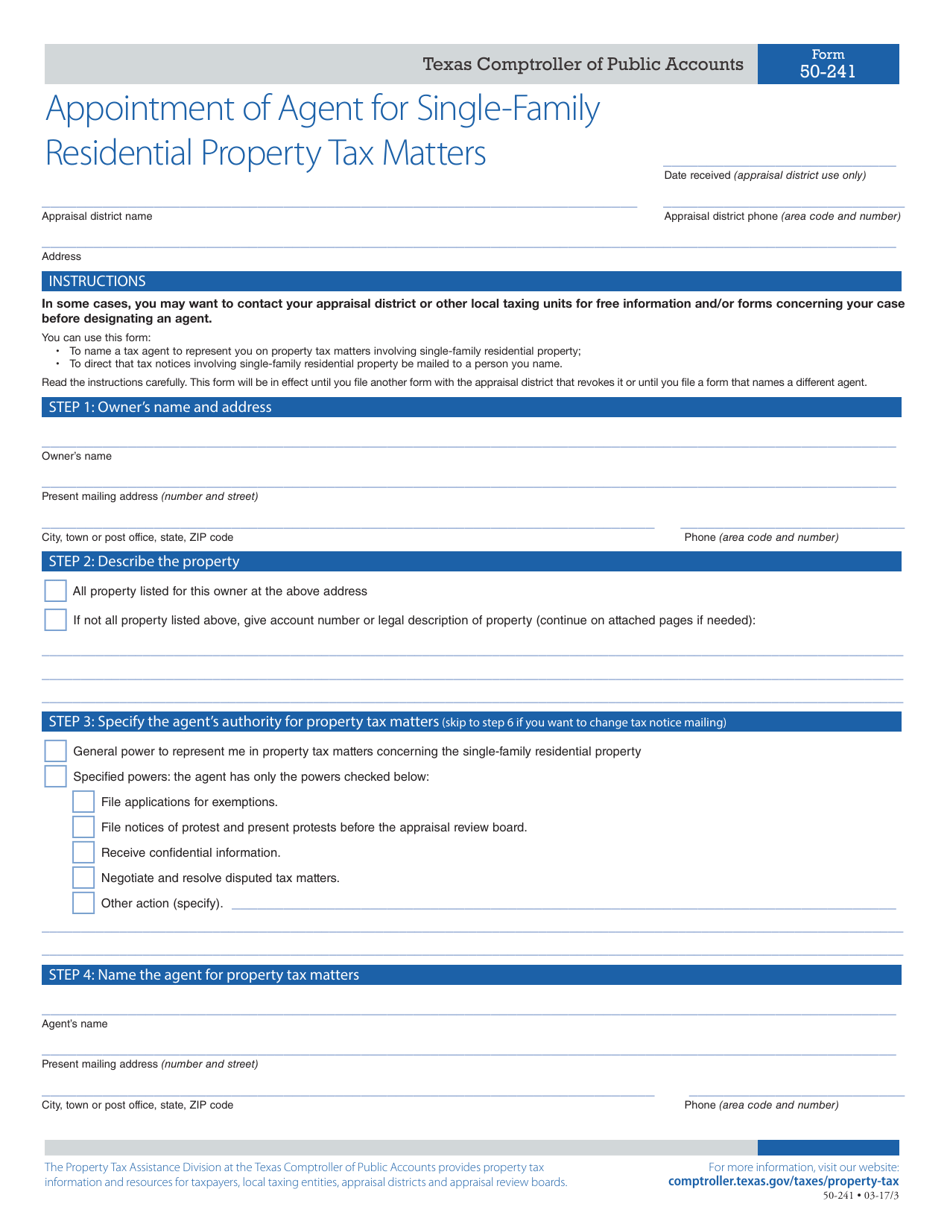

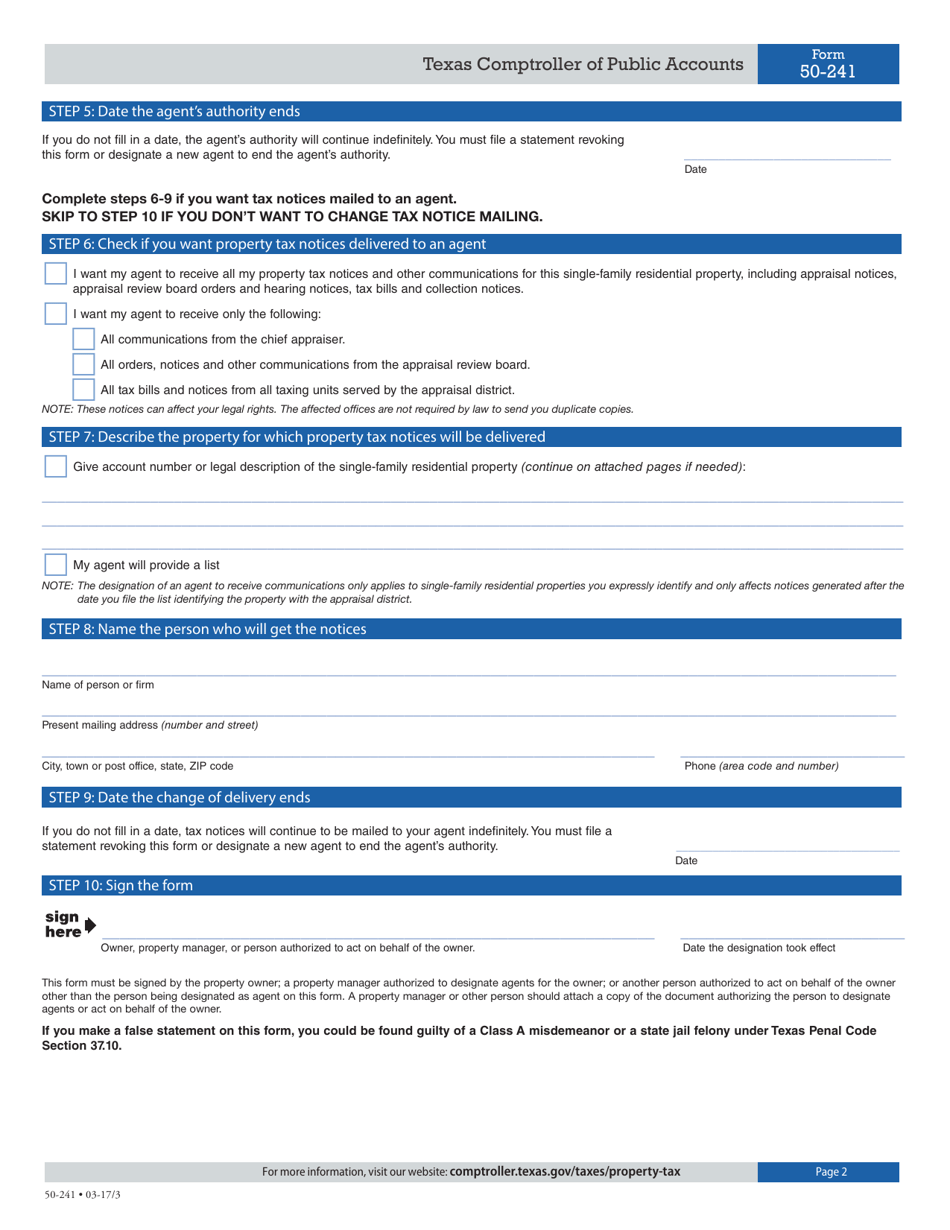

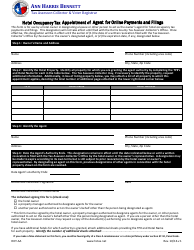

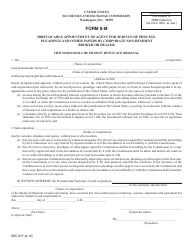

Form 50-241 Appointment of Agent for Single-Family Residential Property Tax Matters - Texas

What Is Form 50-241?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-241?

A: Form 50-241 is the Appointment of Agent for Single-Family Residential Property Tax Matters in Texas.

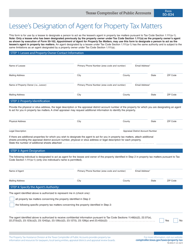

Q: Who needs to fill out Form 50-241?

A: Property owners who wish to appoint an agent to handle their single-family residential property tax matters in Texas.

Q: What is the purpose of Form 50-241?

A: The purpose of Form 50-241 is to designate an agent to act on behalf of the property owner in matters related to property taxes.

Q: Is there a fee for submitting Form 50-241?

A: No, there is no fee for submitting Form 50-241.

Q: What information is required to fill out Form 50-241?

A: Form 50-241 requires information such as the property owner's name and contact information, as well as the agent's name and contact information.

Q: Can multiple agents be appointed using Form 50-241?

A: Yes, multiple agents can be appointed using Form 50-241.

Q: Can I revoke the appointment of an agent made using Form 50-241?

A: Yes, the property owner can revoke the appointment of an agent by submitting a written notice to the agent and to the local county appraisal district.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-241 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.