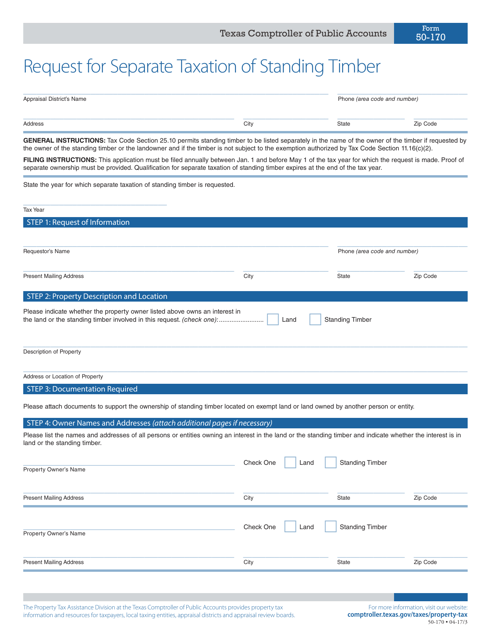

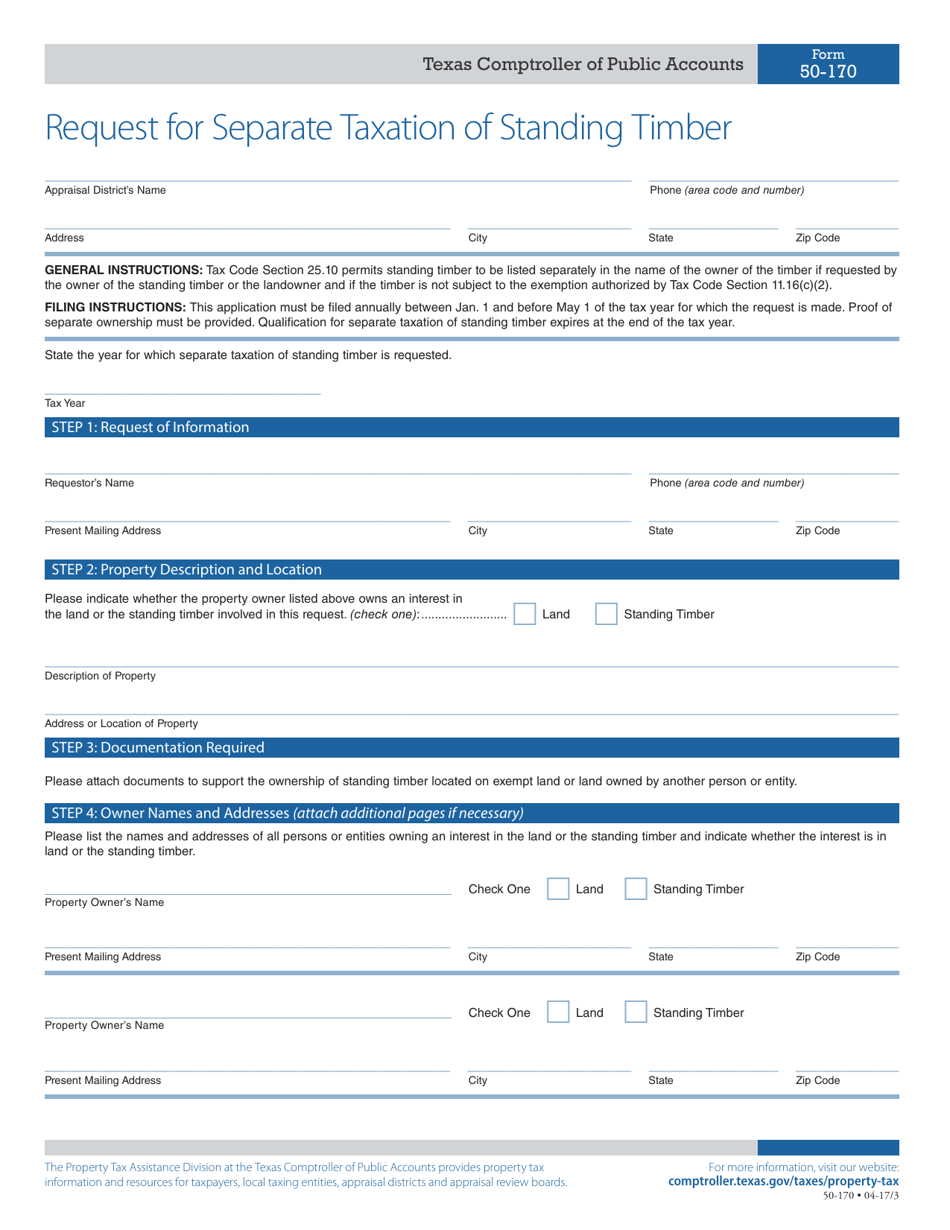

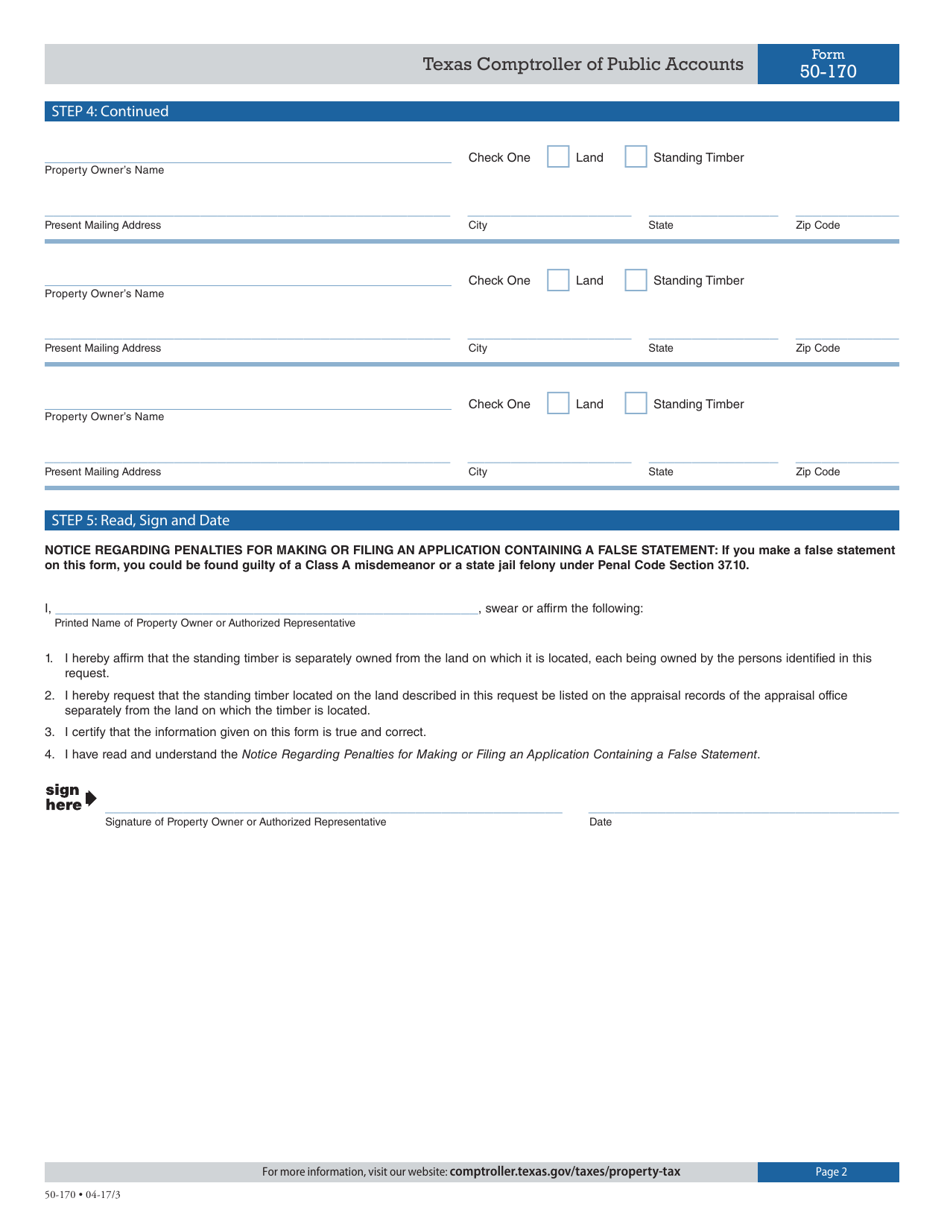

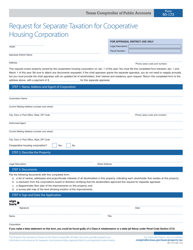

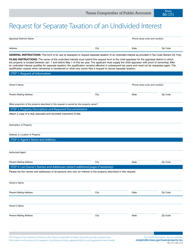

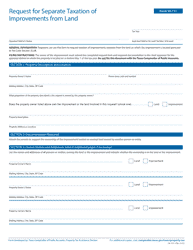

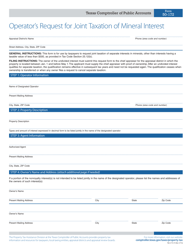

Form 50-170 Request for Separate Taxation of Standing Timber - Texas

What Is Form 50-170?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-170?

A: Form 50-170 is a tax form used in Texas to request separate taxation of standing timber.

Q: Who can use Form 50-170?

A: Any owner of standing timber in Texas can use Form 50-170.

Q: Why would I need to request separate taxation of standing timber?

A: Separate taxation allows the timber to be assessed and taxed separately from the land it is on.

Q: How do I fill out Form 50-170?

A: You need to provide information about the timber, such as the location, type, and estimated value.

Q: Is there a deadline to submit Form 50-170?

A: Yes, Form 50-170 must be filed with the county appraisal district between January 1st and April 30th of the tax year it applies to.

Q: Are there any fees associated with Form 50-170?

A: There is no fee to file Form 50-170.

Q: What happens after I submit Form 50-170?

A: The county appraisal district will review the request and determine the separate value of the timber for taxation purposes.

Q: Can I appeal the appraisal decision for my timber?

A: Yes, if you disagree with the appraisal decision, you have the right to file an appeal with the Appraisal Review Board.

Q: Do I need to submit Form 50-170 every year?

A: No, once you have established separate taxation for your standing timber, you do not need to submit the form again unless there are significant changes to the timber.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-170 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.