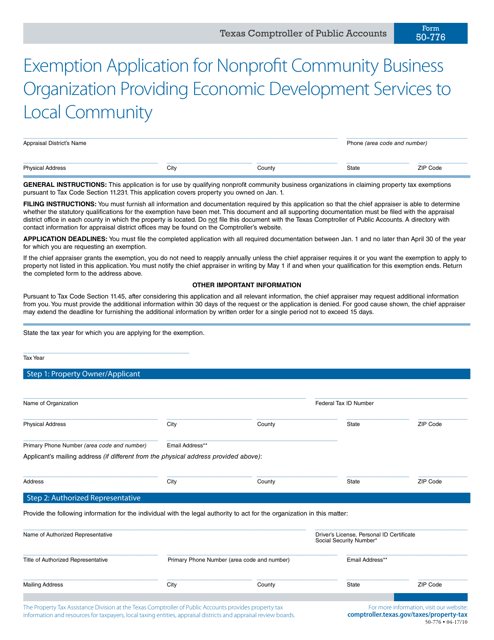

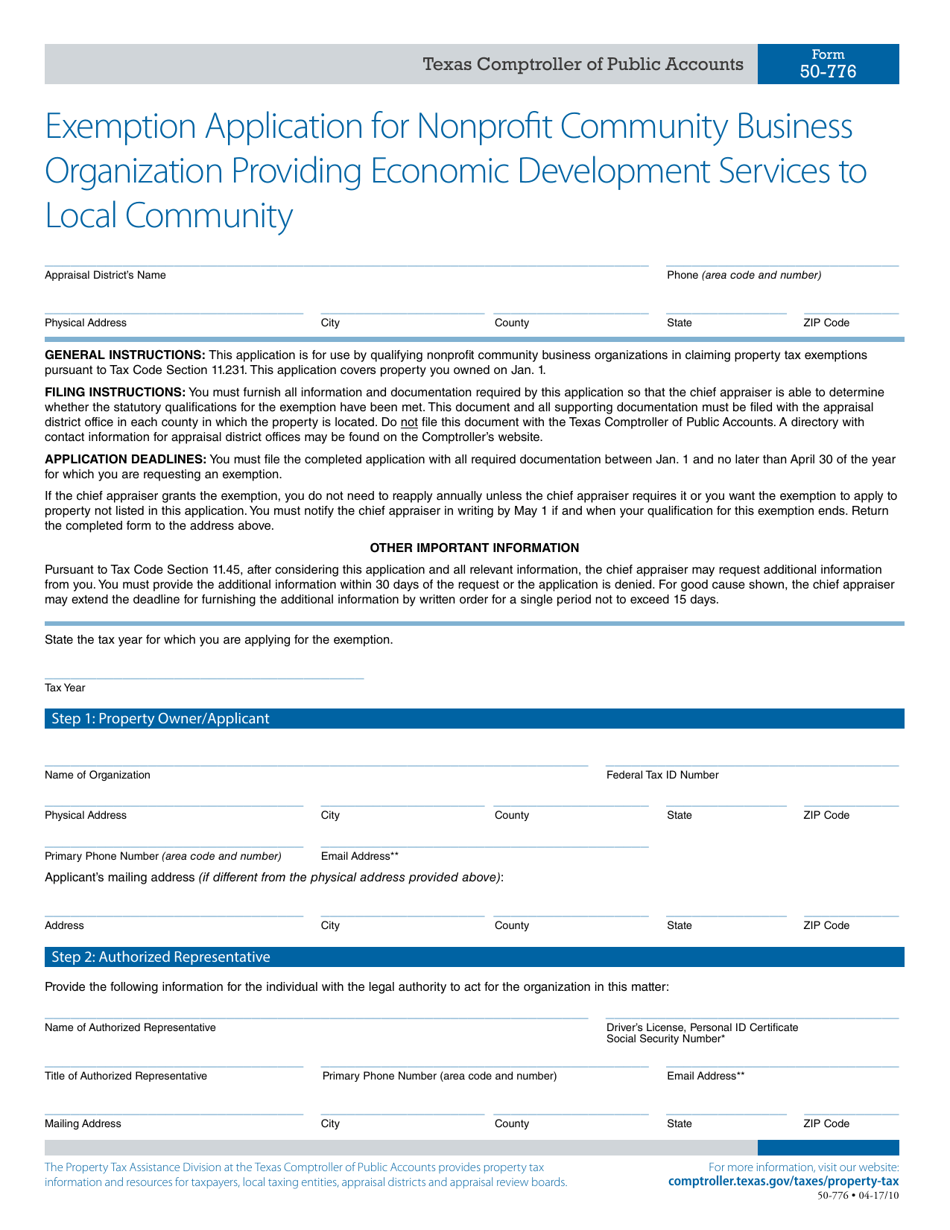

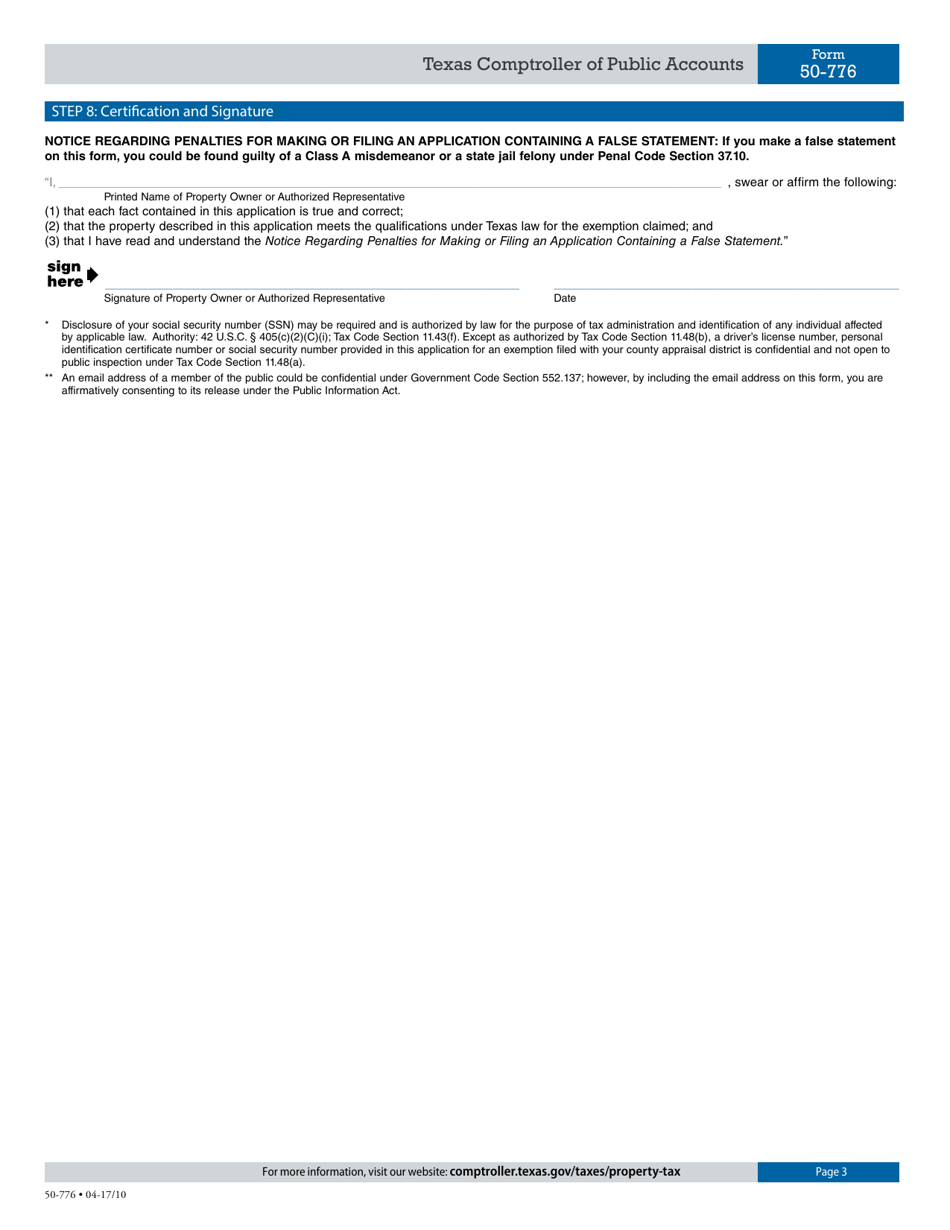

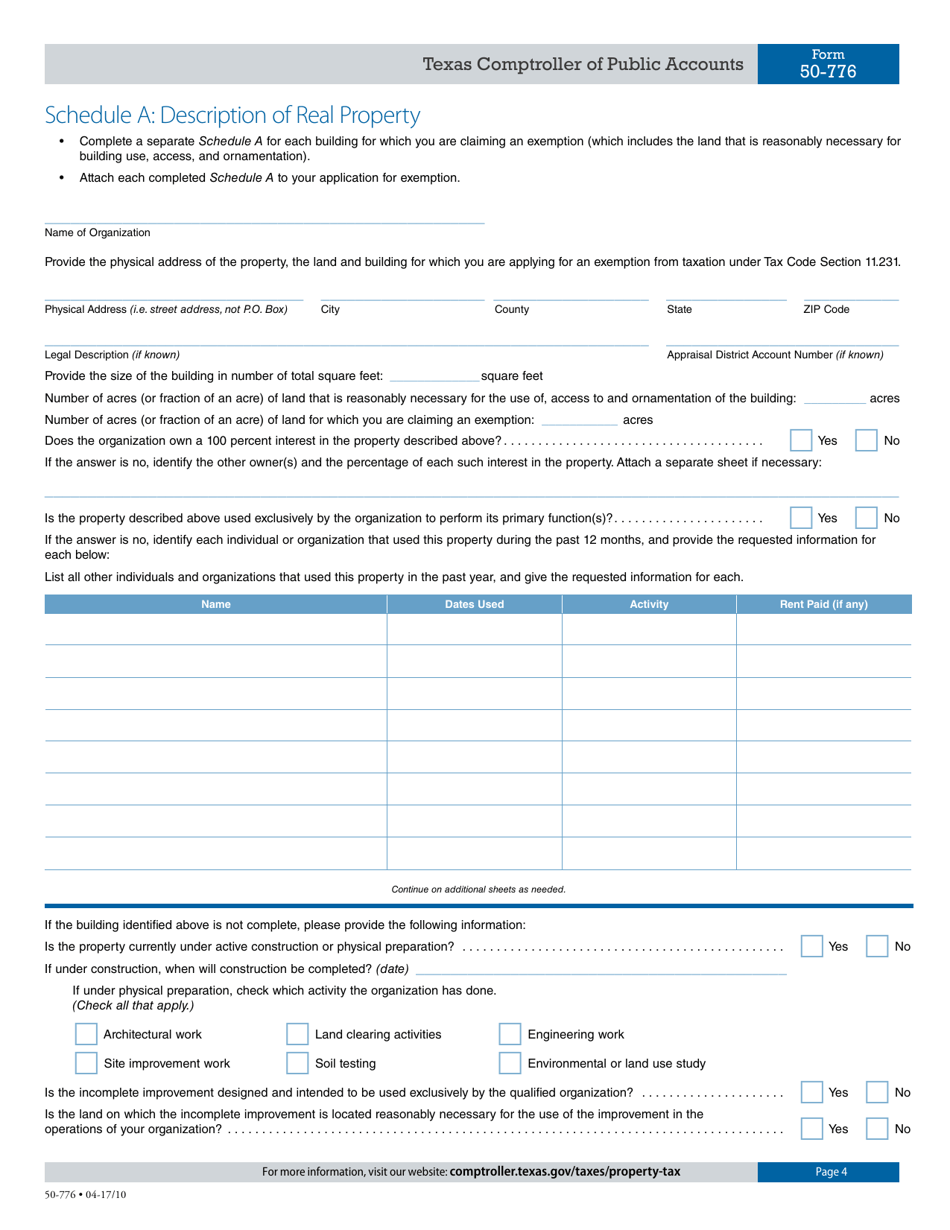

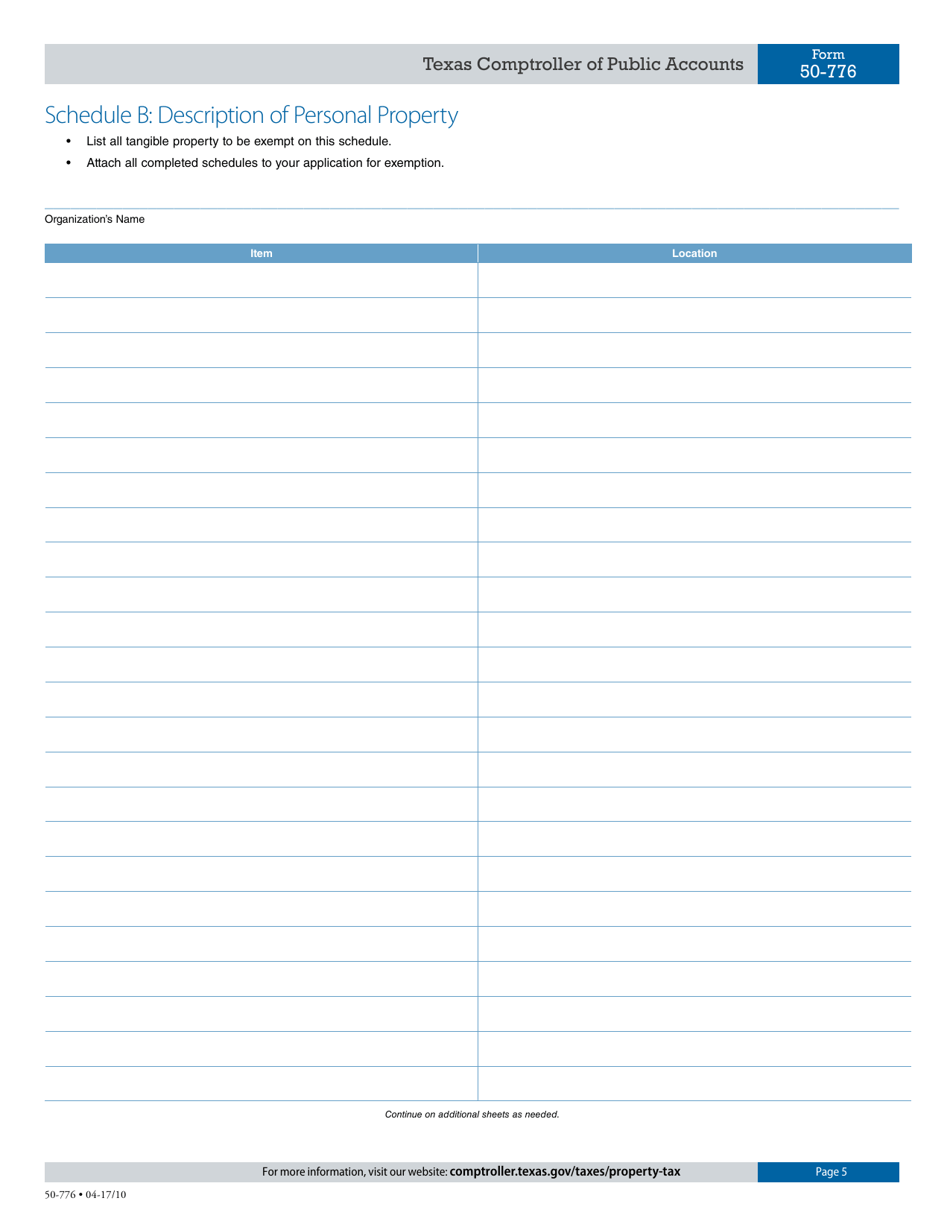

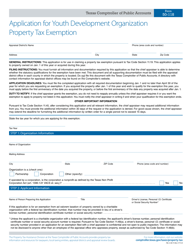

Form 50-776 Exemption Application for Nonprofit Community Business Organization Providing Economic Development Services to Local Community - Texas

What Is Form 50-776?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-776?

A: Form 50-776 is an Exemption Application for Nonprofit Community Business Organization Providing Economic Development Services to Local Community in Texas.

Q: Who can use form 50-776?

A: Nonprofit community business organizations providing economic development services to the local community in Texas can use form 50-776.

Q: What is the purpose of form 50-776?

A: The purpose of form 50-776 is to apply for exemption from certain Texas taxes for nonprofit community business organizations.

Q: What taxes are exempted with form 50-776?

A: Form 50-776 can be used to apply for exemption from sales and use tax, franchise tax, and hotel occupancy tax.

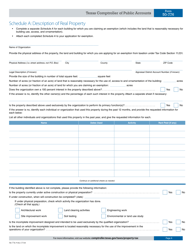

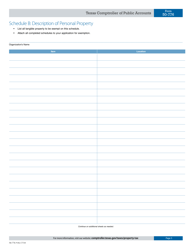

Q: What documents are required to be submitted with form 50-776?

A: The specific documents required may vary, but generally, you will need to include the organization's articles of incorporation, bylaws, financial statements, and a completed form 50-776.

Q: Is there a fee for applying with form 50-776?

A: No, there is no fee for submitting form 50-776.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-776 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.