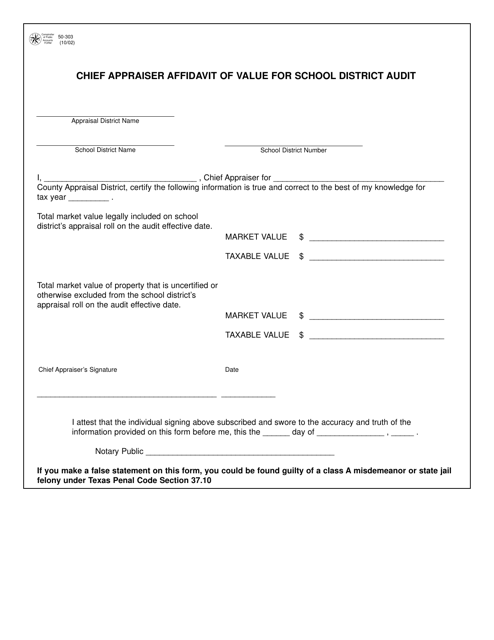

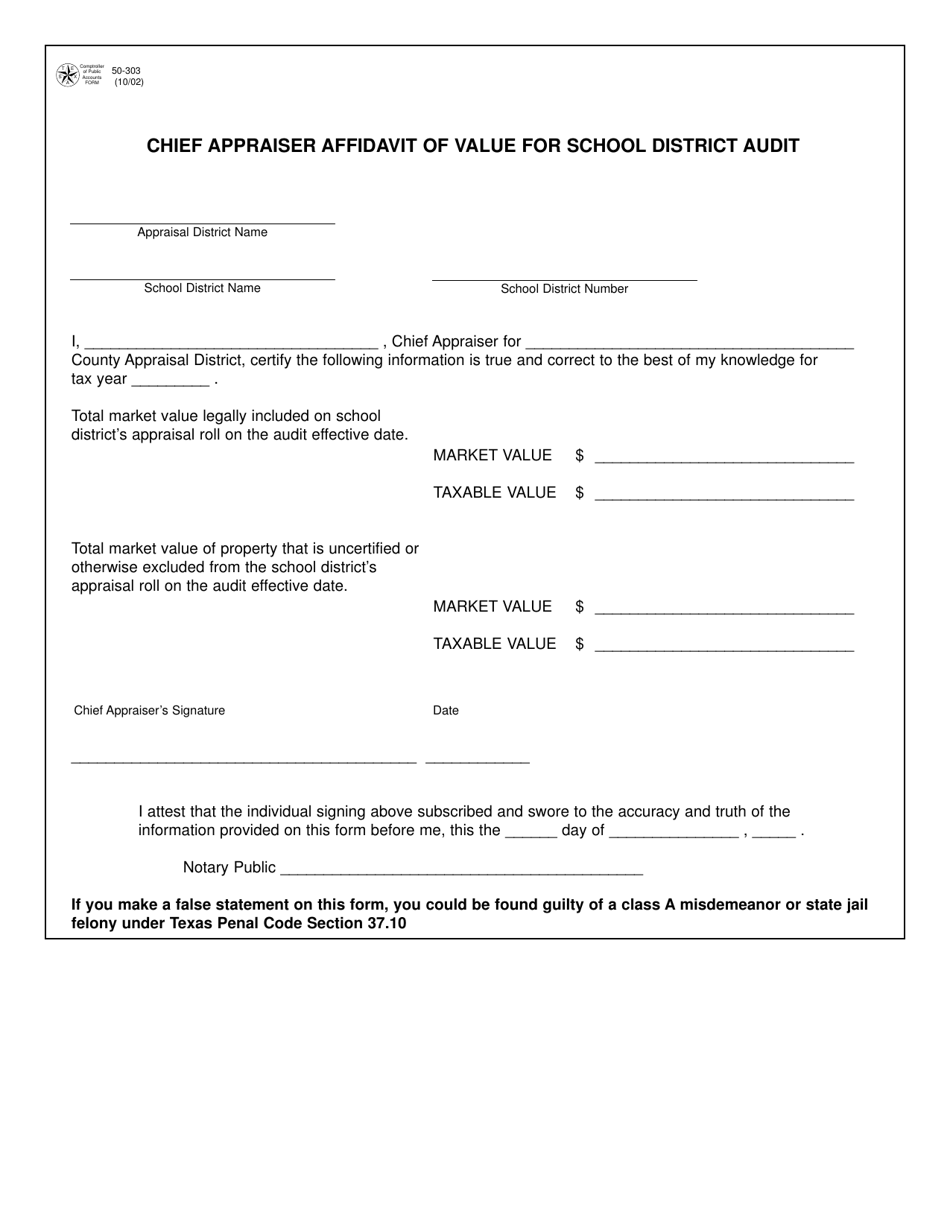

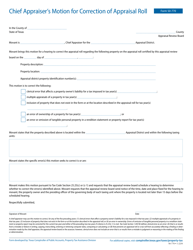

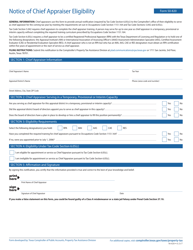

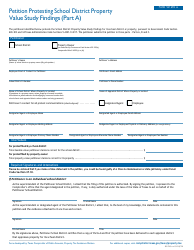

Form 50-303 Chief Appraiser Affidavit of Value for School District Audit - Texas

What Is Form 50-303?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-303?

A: Form 50-303 is the Chief Appraiser Affidavit of Value for School District Audit in Texas.

Q: Who is required to fill out Form 50-303?

A: The Chief Appraiser is required to fill out Form 50-303.

Q: What is the purpose of Form 50-303?

A: The purpose of Form 50-303 is to provide the value of taxable property within a school district for audit purposes.

Q: When should Form 50-303 be filed?

A: Form 50-303 should be filed on or before the 120th day after the end of the school district's fiscal year.

Form Details:

- Released on October 1, 2002;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-303 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.