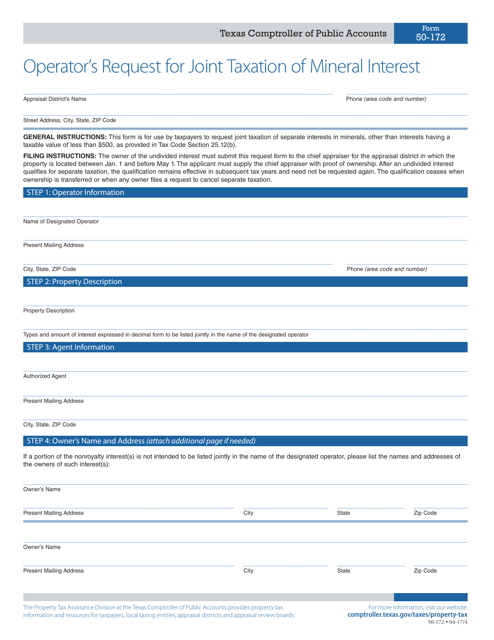

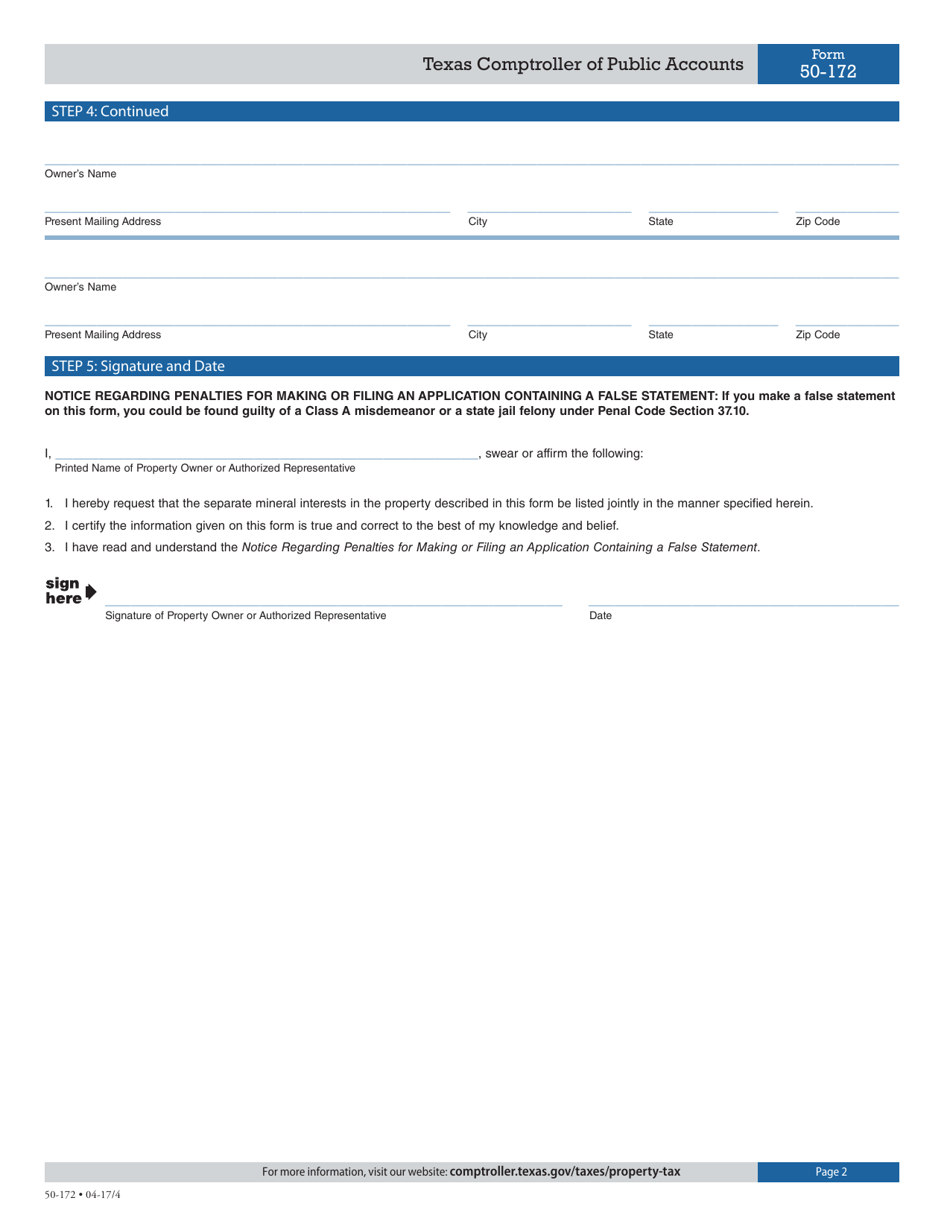

Form 50-172 Operator's Request for Joint Taxation of Mineral Interest - Texas

What Is Form 50-172?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-172?

A: Form 50-172 is the Operator's Request for Joint Taxation of Mineral Interest in Texas.

Q: Who can use Form 50-172?

A: Form 50-172 is used by operators in Texas who want to request joint taxation of mineral interests.

Q: What is joint taxation of mineral interest?

A: Joint taxation of mineral interest allows operators to combine multiple mineral interests into a single tax account.

Q: Why would an operator request joint taxation?

A: Operators may request joint taxation to simplify their tax reporting and administration processes.

Q: Are there any fees associated with filing Form 50-172?

A: No, there are no fees for filing Form 50-172.

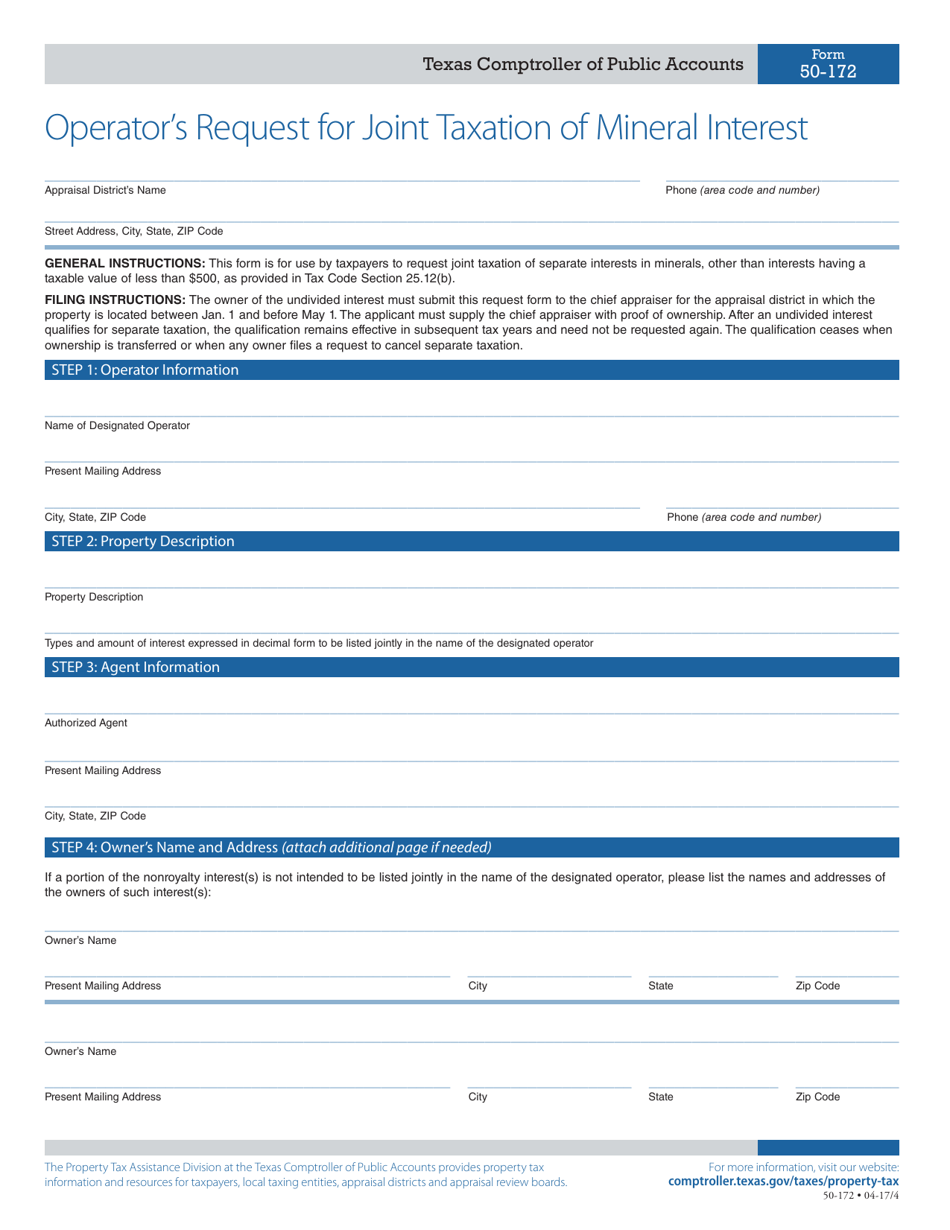

Q: What information is required on Form 50-172?

A: Form 50-172 requires information about the operator's name, tax identification number, contact information, and details of the mineral interests to be jointly taxed.

Q: Can Form 50-172 be filed electronically?

A: Yes, Form 50-172 can be filed electronically through the Texas Comptroller's Electronic Reporting System (ERS).

Q: Are there any deadlines for filing Form 50-172?

A: Form 50-172 should be filed by April 15th of each year for the previous calendar year.

Q: What should I do if I need assistance with Form 50-172?

A: If you need assistance with Form 50-172, you can contact the Texas Comptroller's office for help.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-172 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.