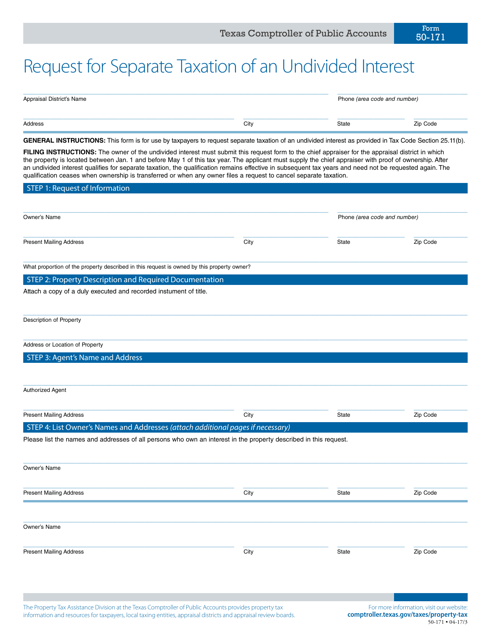

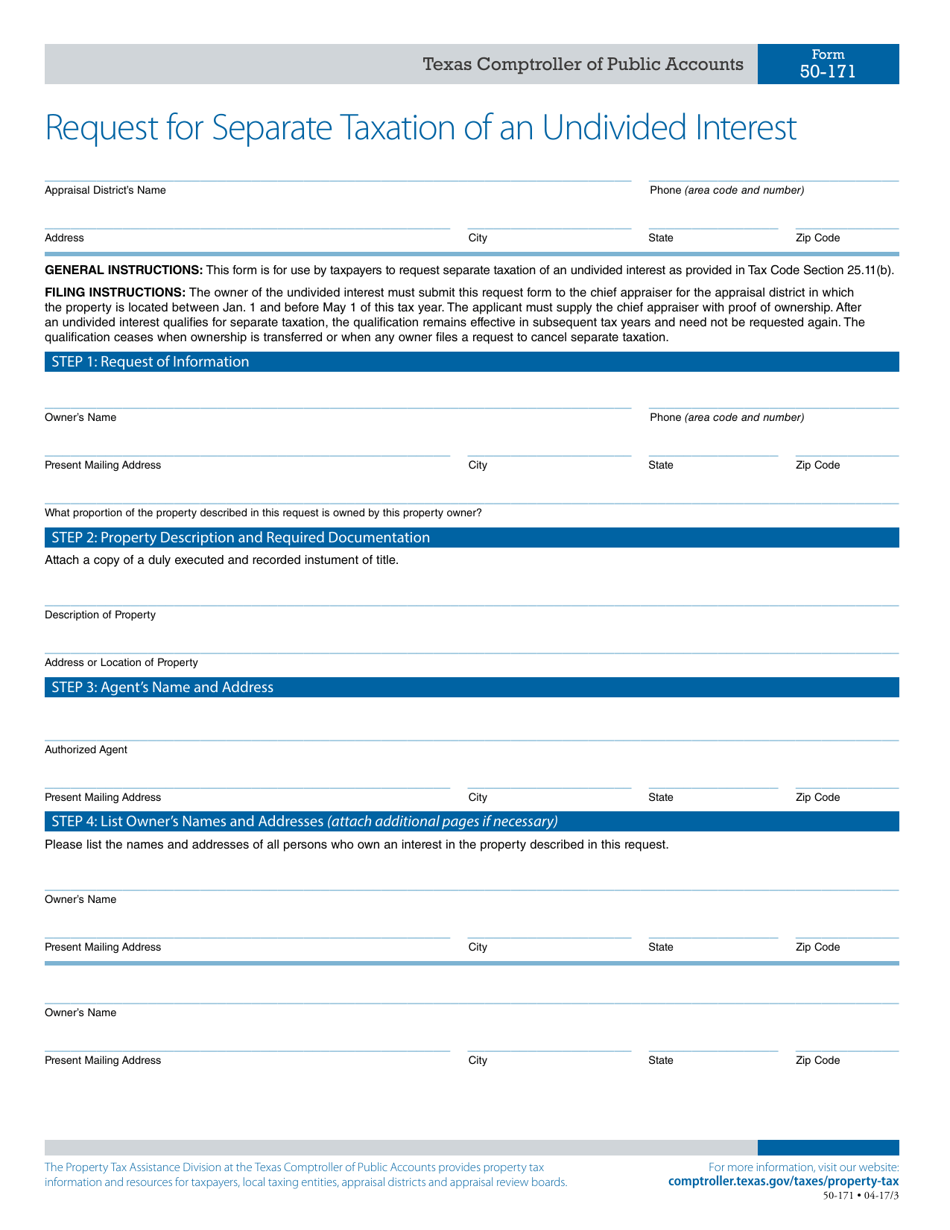

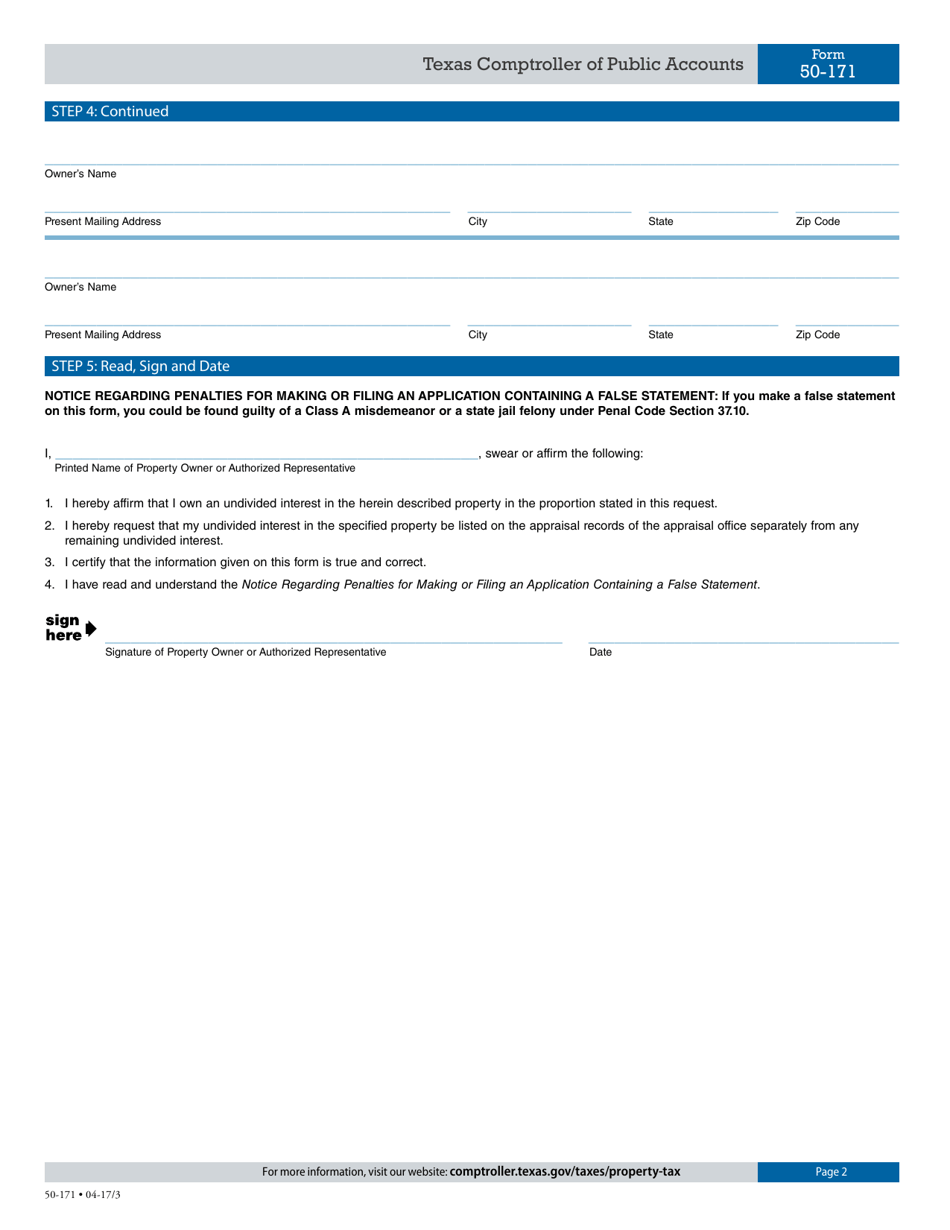

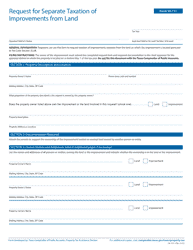

Form 50-171 Request for Separate Taxation of an Undivided Interest - Texas

What Is Form 50-171?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-171?

A: Form 50-171 is a request for separate taxation of an undivided interest in Texas.

Q: What is the purpose of Form 50-171?

A: The purpose of Form 50-171 is to request separate taxation of an undivided interest, which means that each co-owner will be taxed on their share of the property.

Q: Who should use Form 50-171?

A: Form 50-171 should be used by co-owners of property in Texas who want to be taxed separately on their respective shares of the property.

Q: Is there a fee for filing Form 50-171?

A: No, there is no fee for filing Form 50-171.

Q: When should Form 50-171 be filed?

A: Form 50-171 should be filed as soon as possible after acquiring an undivided interest in the property, but no later than May 1st of the year for which separate taxation is requested.

Q: What supporting documents are required with Form 50-171?

A: No supporting documents are required with Form 50-171, but the property address and other relevant information should be provided.

Q: What happens after filing Form 50-171?

A: After filing Form 50-171, each co-owner will be taxed separately on their share of the property, based on the information provided on the form.

Q: Can I amend or revoke a previously filed Form 50-171?

A: Yes, a previously filed Form 50-171 can be amended or revoked by submitting a new form to the chief appraiser in the county where the property is located.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-171 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.