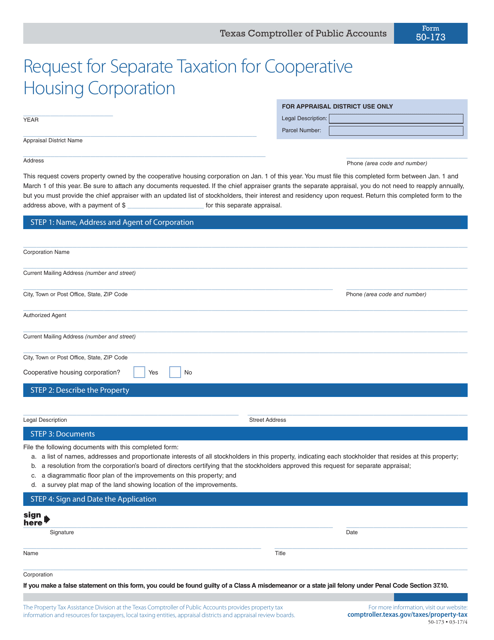

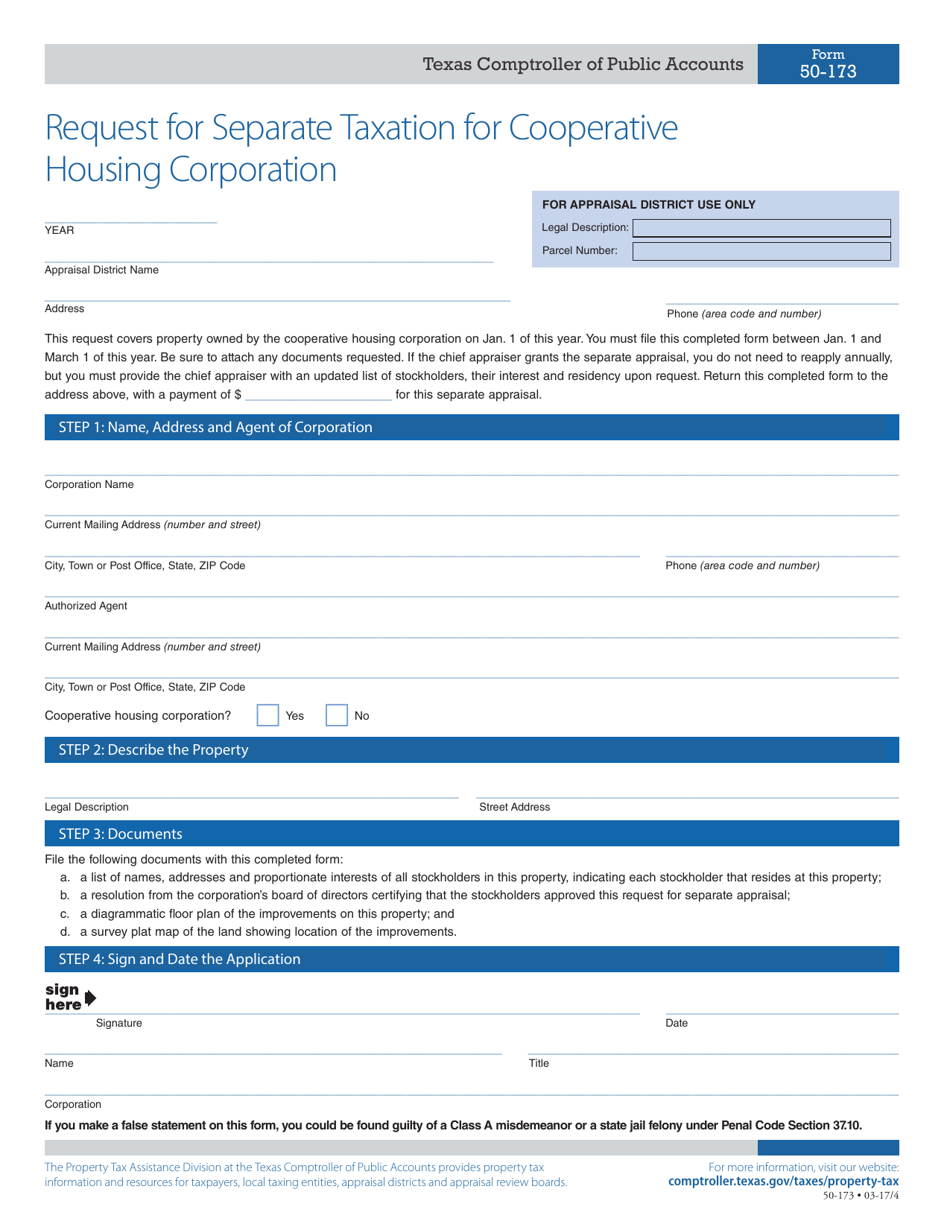

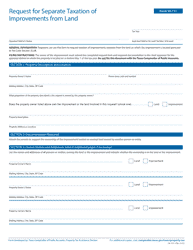

Form 50-173 Request for Separate Taxation for Cooperative Housing Corporation - Texas

What Is Form 50-173?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-173?

A: Form 50-173 is a request for separate taxation for a cooperative housing corporation in Texas.

Q: What is a cooperative housing corporation?

A: A cooperative housing corporation is a form of housing where residents own shares in the corporation and have the right to occupy a particular unit.

Q: Why would a cooperative housing corporation want separate taxation?

A: Separate taxation allows the corporation to be taxed separately from its individual shareholders, which can have certain financial benefits.

Q: Who should use form 50-173?

A: Form 50-173 should be used by cooperative housing corporations in Texas that want to request separate taxation.

Q: Are there any fees associated with filing form 50-173?

A: There are no fees associated with filing form 50-173.

Q: Are there any deadlines for filing form 50-173?

A: The deadline for filing form 50-173 is the 15th day of the third month after the end of the corporation's taxable year.

Q: What information is required on form 50-173?

A: Form 50-173 requires information such as the corporation's name, address, federal employer identification number, and details about its shareholders and income.

Q: What should I do after filing form 50-173?

A: After filing form 50-173, you should keep a copy for your records and ensure that any required taxes are paid on time.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-173 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.