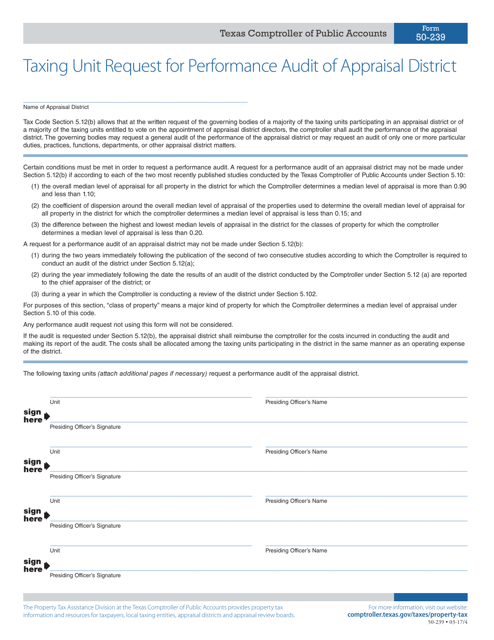

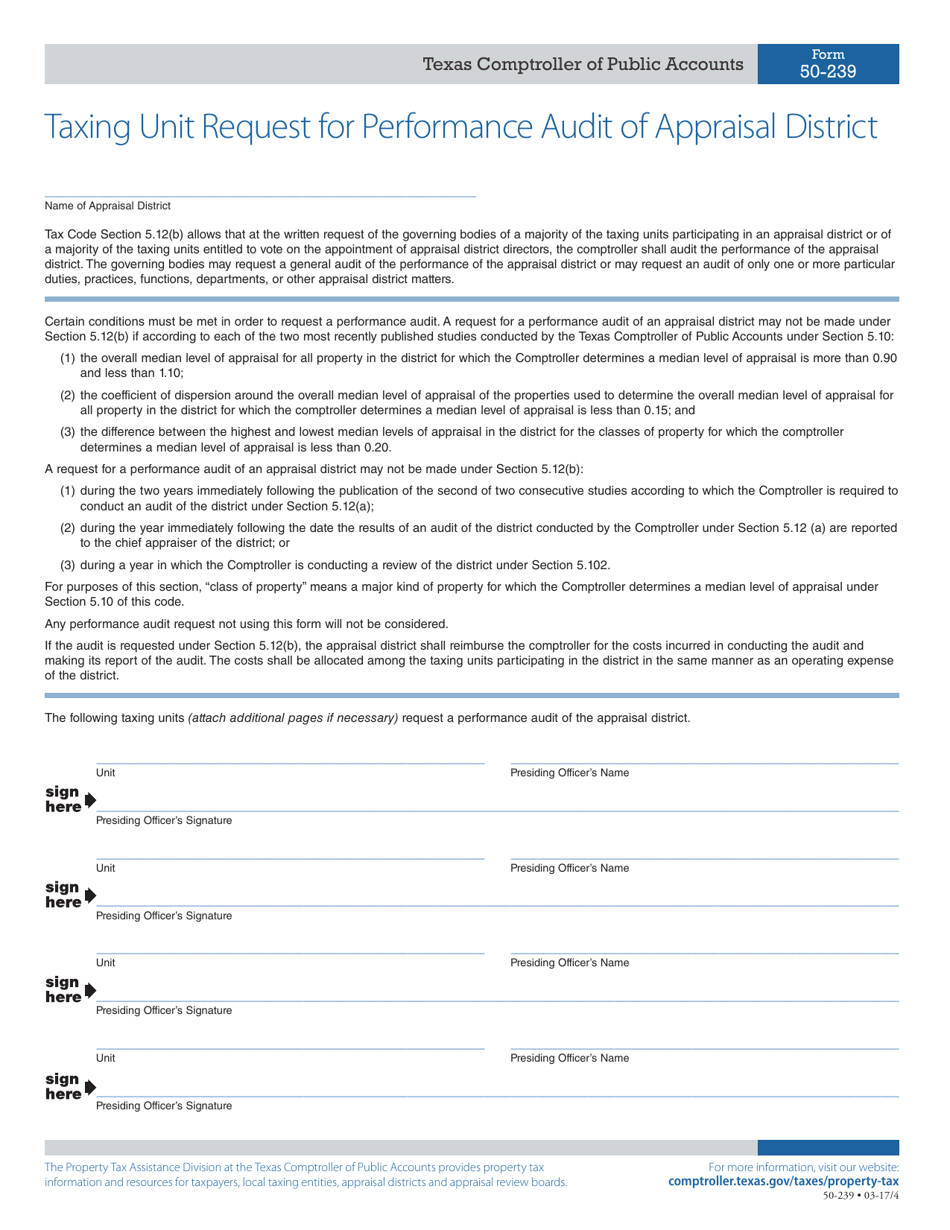

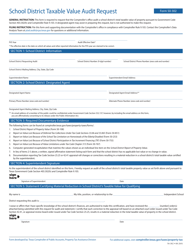

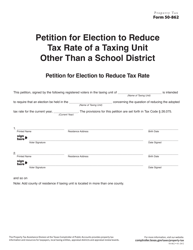

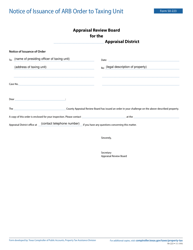

Form 50-239 Taxing Unit Request for Performance Audit of Appraisal District - Texas

What Is Form 50-239?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-239?

A: Form 50-239 is the Taxing Unit Request for Performance Audit of Appraisal District in Texas.

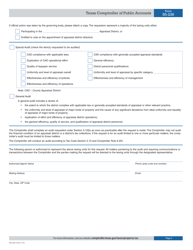

Q: Who can submit Form 50-239?

A: Taxing units can submit Form 50-239.

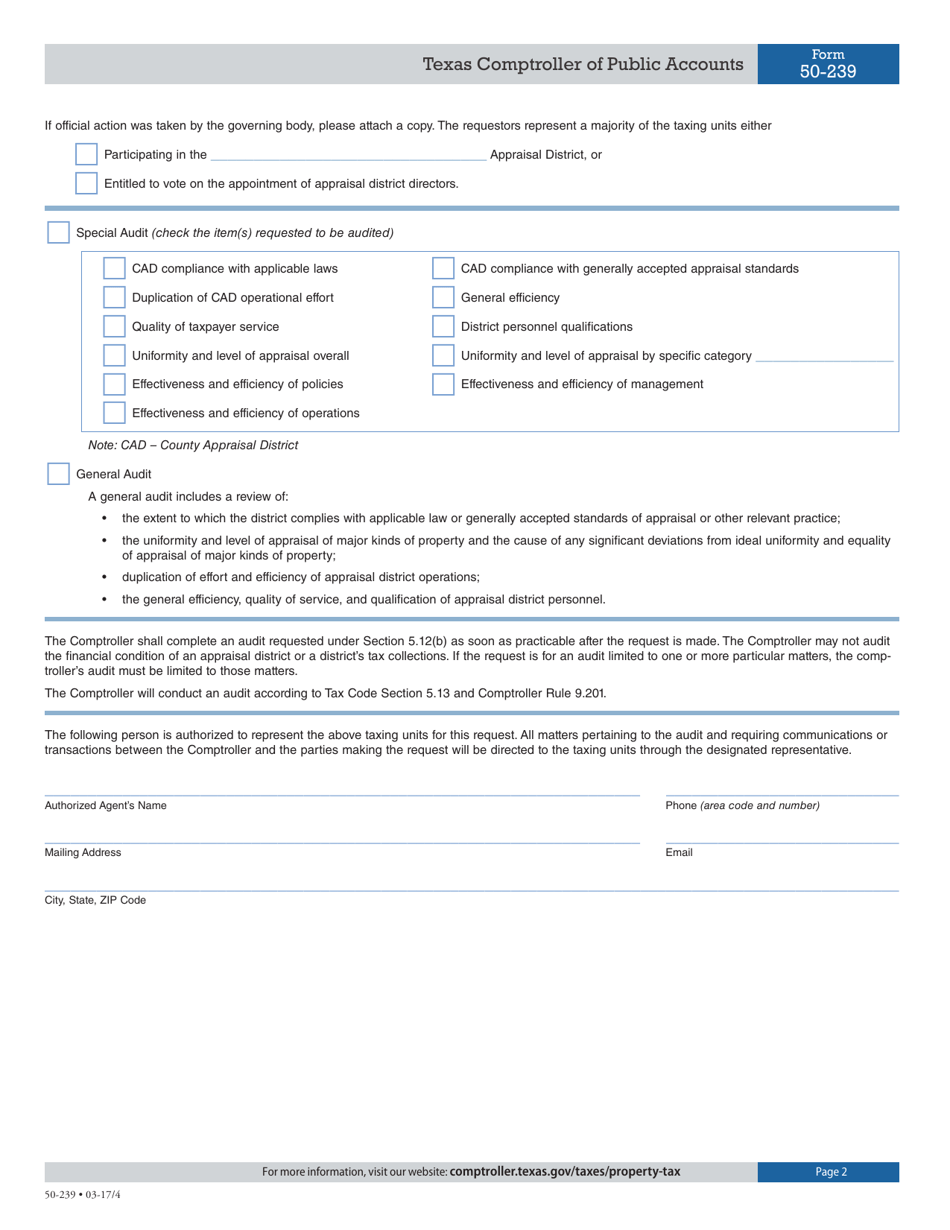

Q: What is the purpose of Form 50-239?

A: The purpose of Form 50-239 is to request a performance audit of an appraisal district.

Q: What is a performance audit?

A: A performance audit is an examination of an organization's activities to assess if it is achieving its objectives efficiently and effectively.

Q: Why would a taxing unit request a performance audit of an appraisal district?

A: A taxing unit may request a performance audit to ensure that the appraisal district is operating efficiently and effectively.

Q: Is there a deadline for submitting Form 50-239?

A: Yes, the deadline for submitting Form 50-239 is typically September 30th of each year.

Q: Are there any fees associated with submitting Form 50-239?

A: Yes, there is a fee associated with submitting Form 50-239. The fee amount is specified on the form.

Q: Can an individual taxpayer submit Form 50-239?

A: No, only taxing units are eligible to submit Form 50-239.

Q: What happens after Form 50-239 is submitted?

A: After Form 50-239 is submitted, the Texas Comptroller's office will review the request and determine whether a performance audit will be conducted.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-239 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.