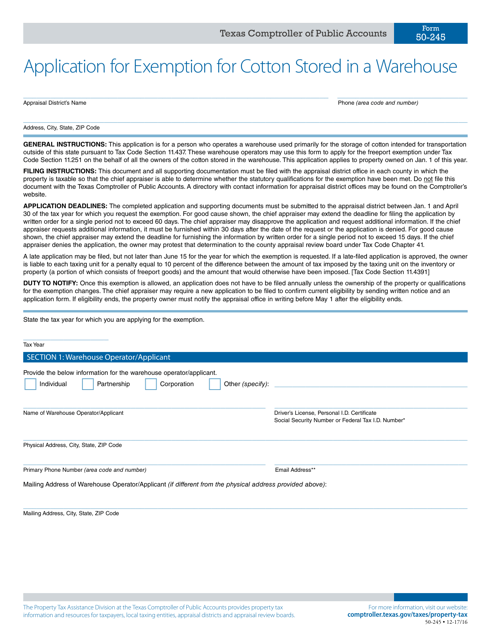

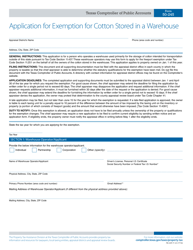

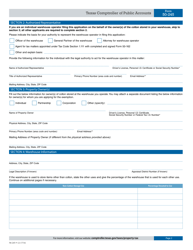

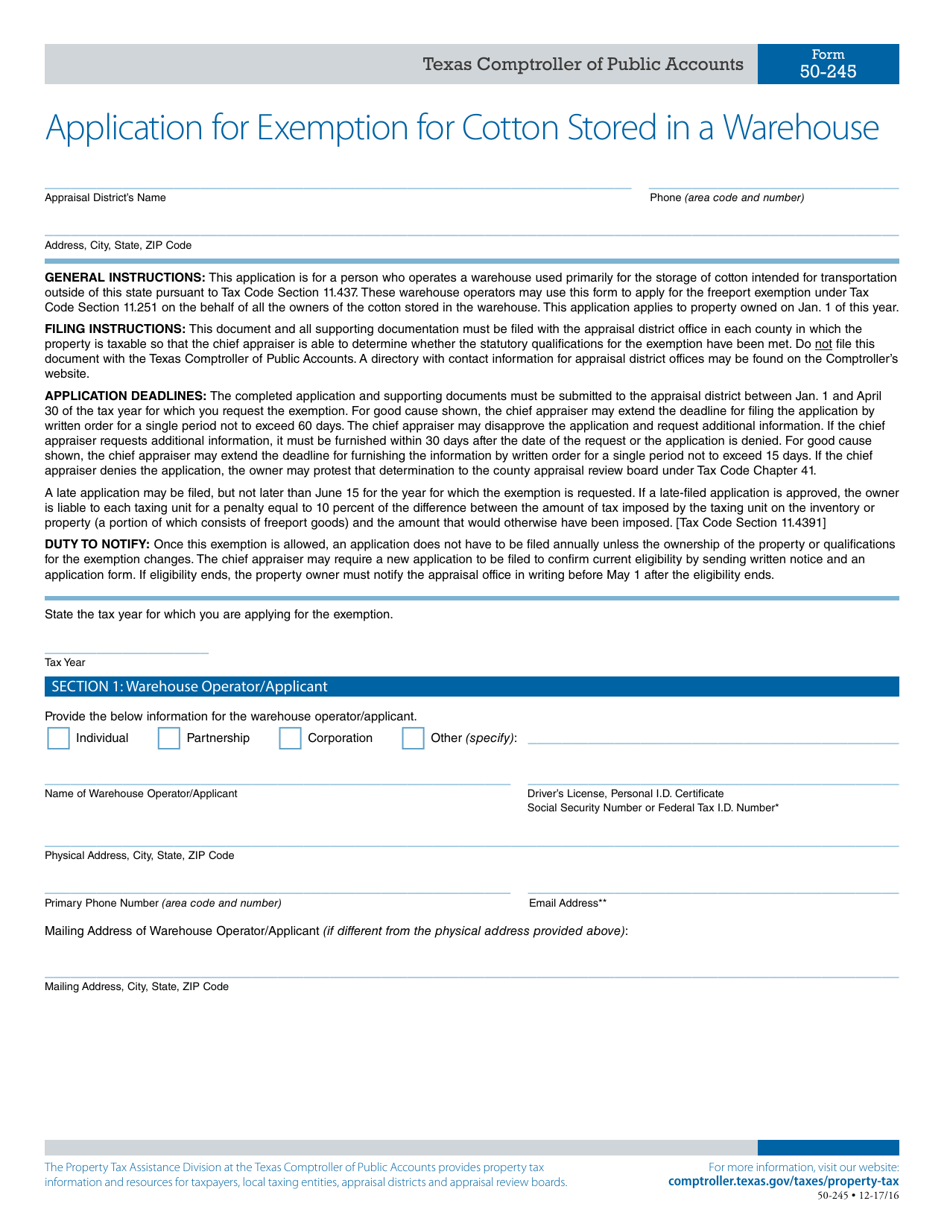

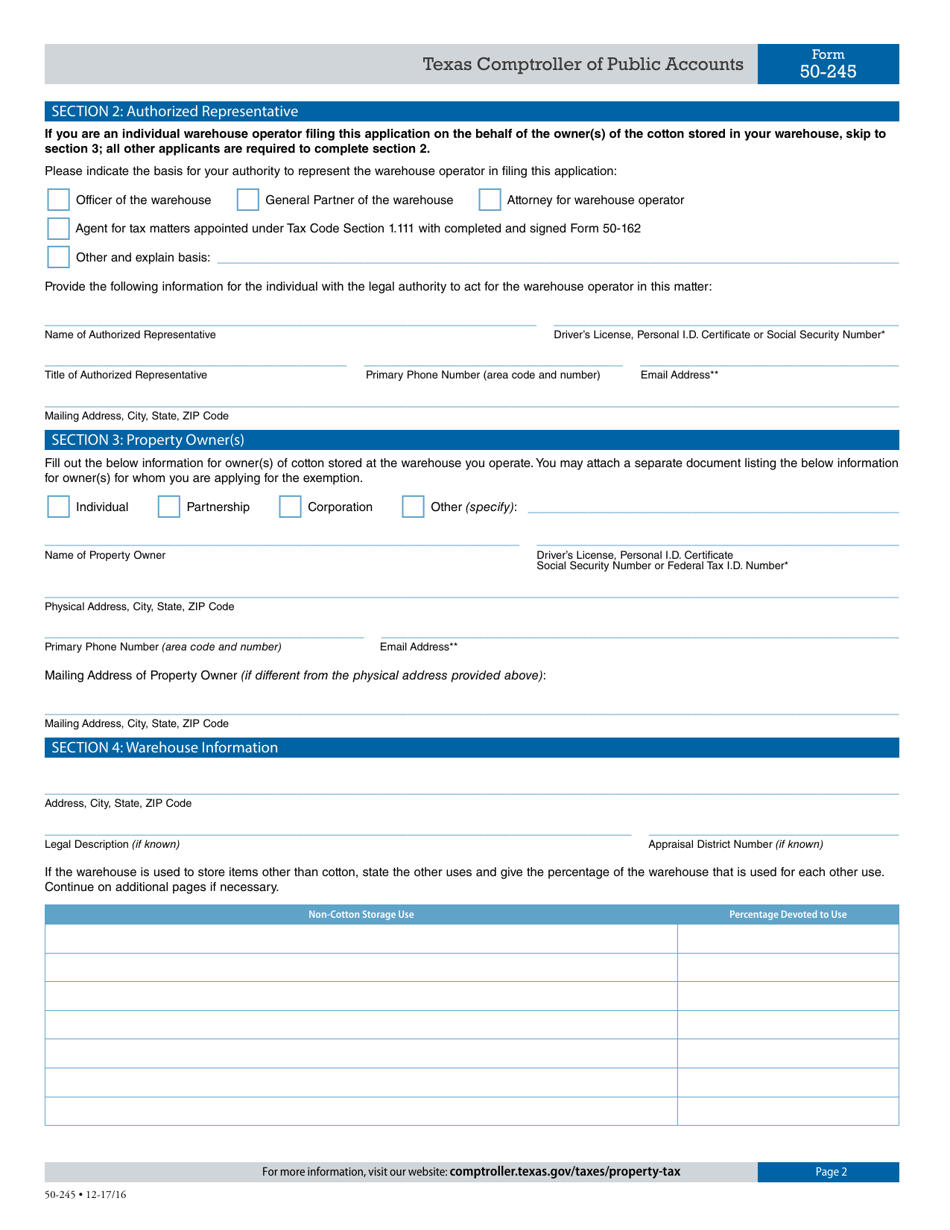

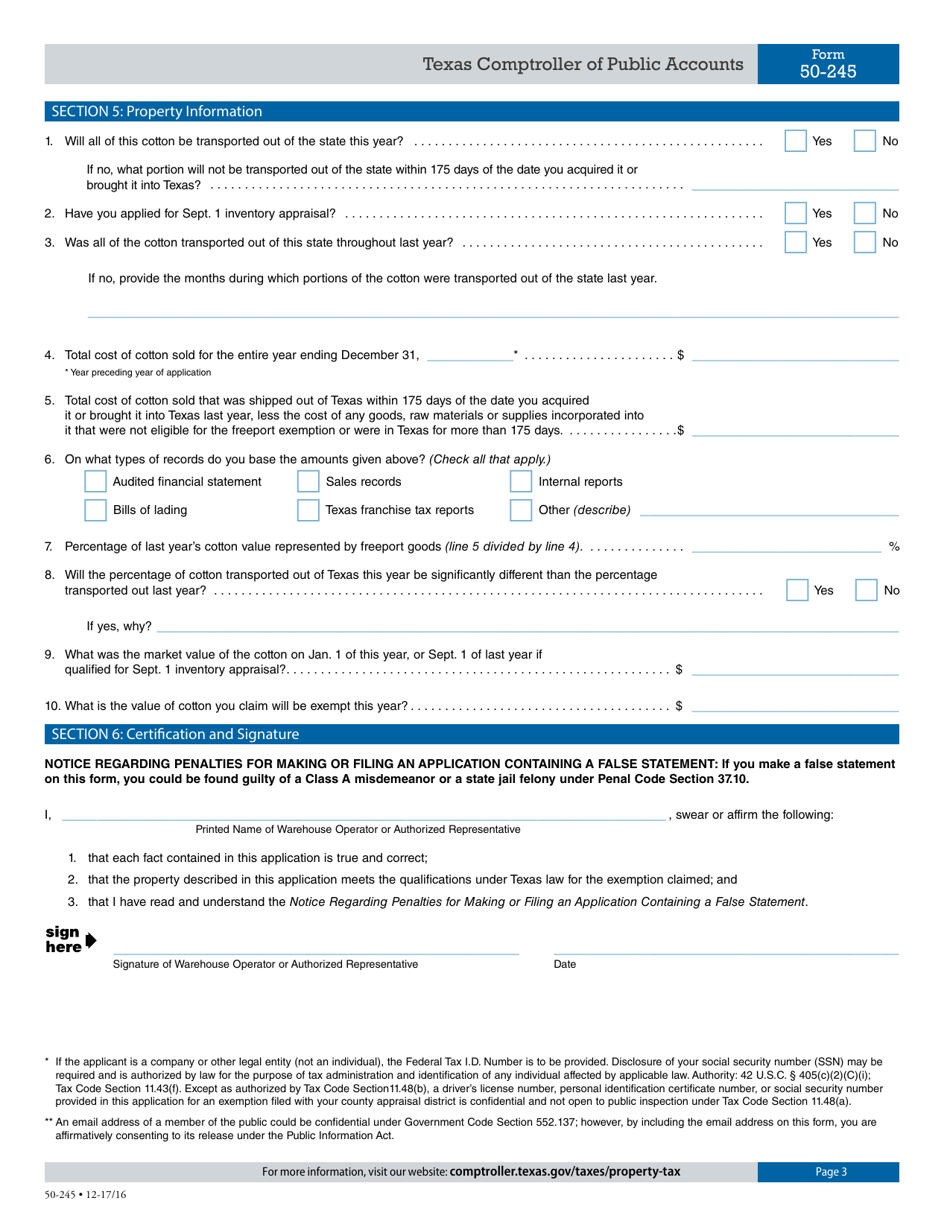

Form 50-245 Application for Exemption for Cotton Stored in a Warehouse - Texas

What Is Form 50-245?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 50-245?

A: The Form 50-245 is an application for exemption for cotton stored in a warehouse in Texas.

Q: Who can use the Form 50-245?

A: The Form 50-245 can be used by individuals or entities who have cotton stored in a warehouse in Texas.

Q: What is the purpose of the Form 50-245?

A: The Form 50-245 is used to apply for an exemption from certain taxes on cotton stored in a warehouse in Texas.

Q: What taxes does the Form 50-245 provide exemption from?

A: The Form 50-245 provides exemption from the Texas sales tax and the Texas use tax.

Q: Is there a fee to submit the Form 50-245?

A: No, there is no fee to submit the Form 50-245.

Q: What supporting documentation is required with the Form 50-245?

A: You need to provide a copy of the warehouse receipt or other proof of cotton storage with the Form 50-245.

Q: How long does it take to process the Form 50-245?

A: The processing time for the Form 50-245 can vary, but it generally takes a few weeks.

Q: What happens after I submit the Form 50-245?

A: After you submit the Form 50-245, it will be reviewed by the Texas Comptroller of Public Accounts and you will receive a determination letter regarding your exemption status.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-245 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.