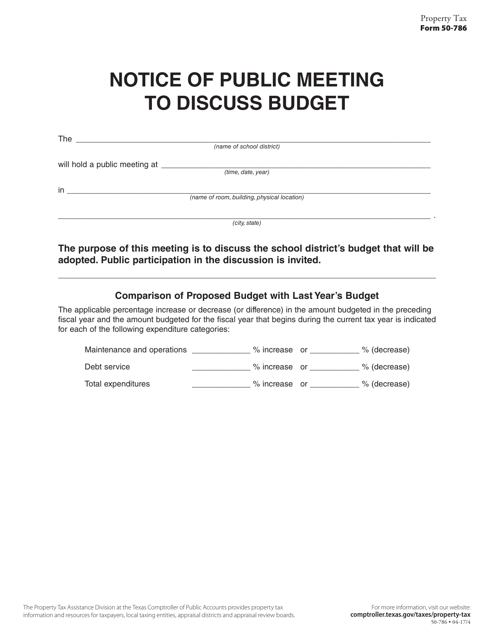

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-786

for the current year.

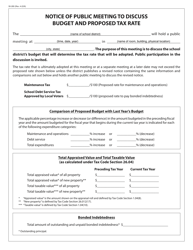

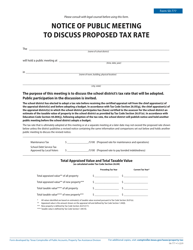

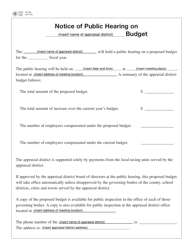

Form 50-786 Notice of Public Meeting to Discuss Budget - Texas

What Is Form 50-786?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

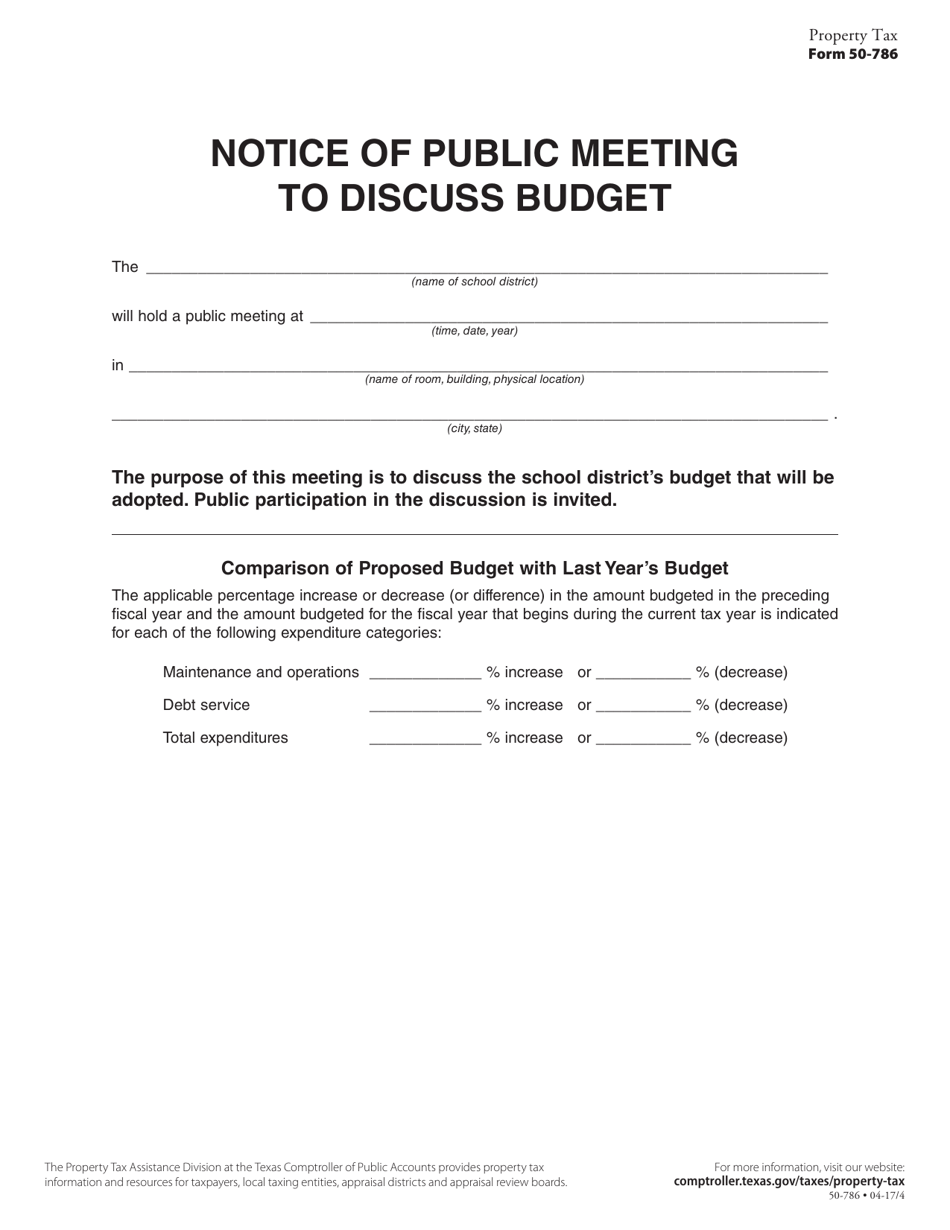

Q: What is Form 50-786?

A: Form 50-786 is a Notice of Public Meeting to Discuss Budget.

Q: Who is required to file Form 50-786?

A: Public entities in Texas, such as counties, cities, school districts, and other political subdivisions, are required to file Form 50-786.

Q: What is the purpose of Form 50-786?

A: The purpose of Form 50-786 is to provide public notice of a meeting to discuss the budget of a public entity.

Q: When should Form 50-786 be filed?

A: Form 50-786 should be filed at least 10 days before the scheduled meeting to allow for public notice.

Q: Are there any penalties for not filing Form 50-786?

A: Failure to file Form 50-786 may result in penalties or legal consequences.

Q: Can the public attend the meeting mentioned in Form 50-786?

A: Yes, the purpose of the notice is to inform the public of the meeting and invite them to attend.

Q: Is Form 50-786 specific to Texas?

A: Yes, Form 50-786 is specific to public entities in Texas.

Q: Is Form 50-786 required for all public entities in Texas?

A: Yes, all public entities in Texas are required to file Form 50-786.

Q: Is there a fee for filing Form 50-786?

A: The filing fee for Form 50-786 may vary depending on the specific requirements of the public entity.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-786 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.