This version of the form is not currently in use and is provided for reference only. Download this version of

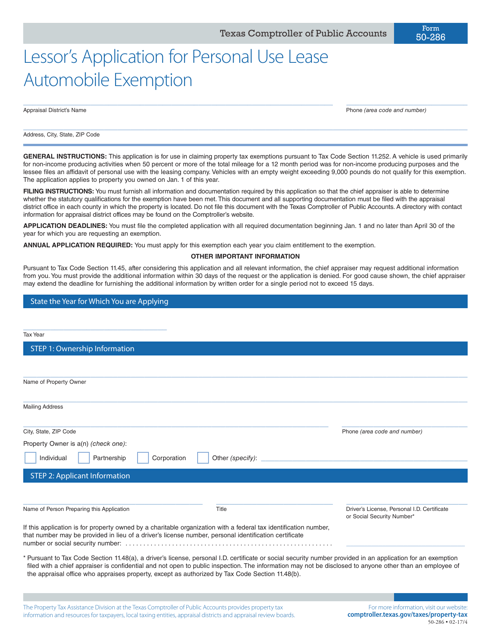

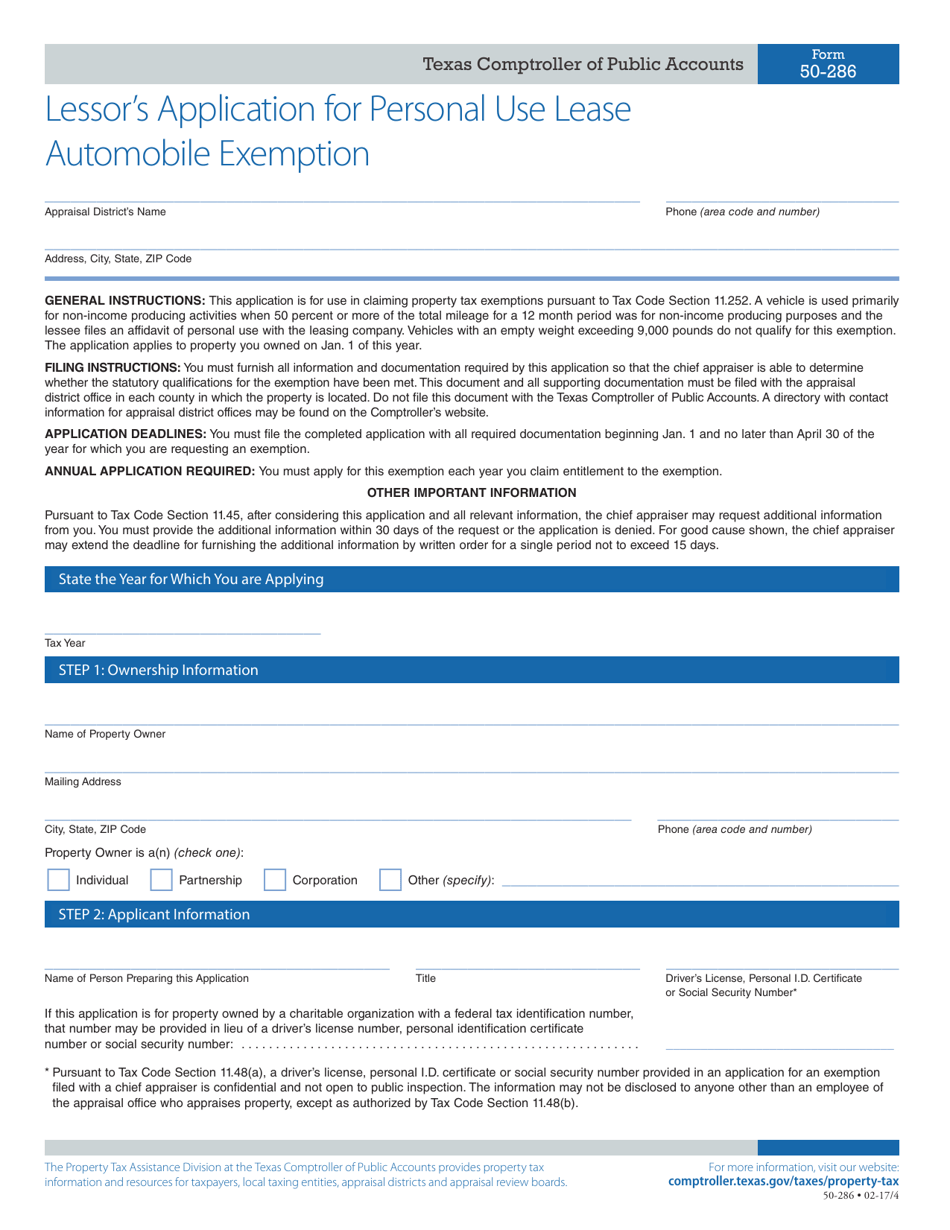

Form 50-286

for the current year.

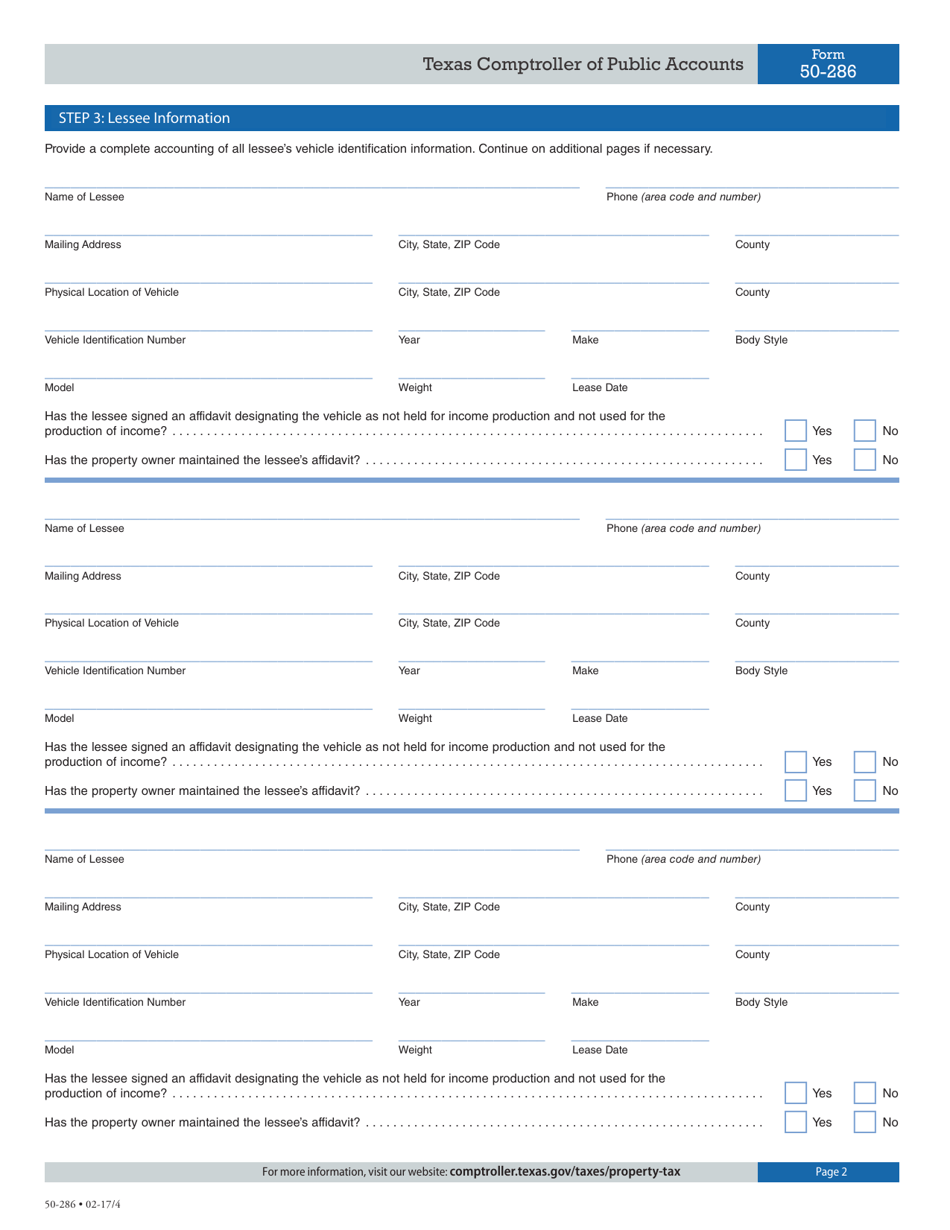

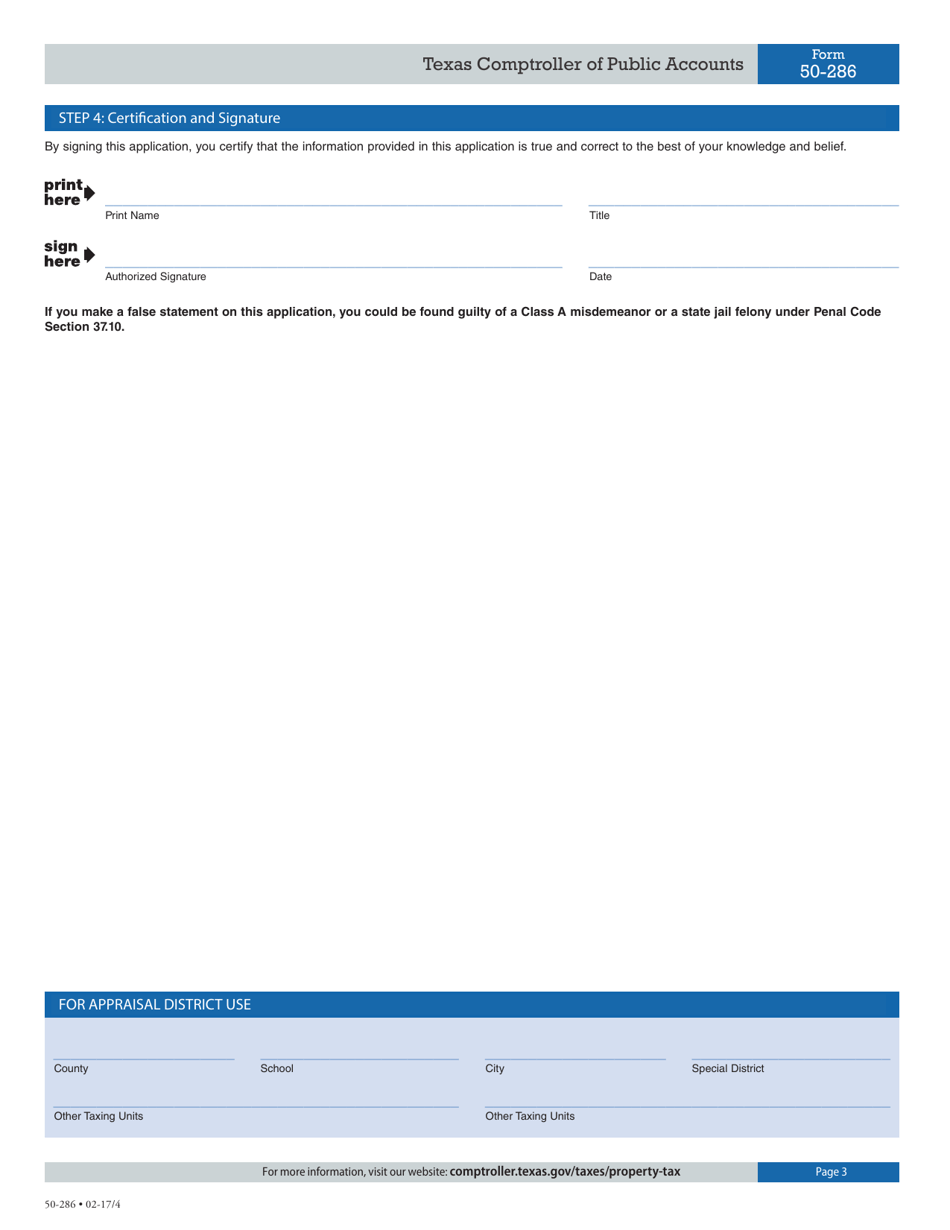

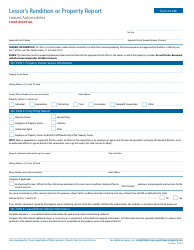

Form 50-286 Lessor's Application for Personal Use Lease Automobile Exemption - Texas

What Is Form 50-286?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-286?

A: Form 50-286 is the Lessor's Application for Personal Use Lease Automobile Exemption in Texas.

Q: What is the purpose of Form 50-286?

A: The purpose of Form 50-286 is to apply for a personal use lease automobile exemption in Texas.

Q: Who should use Form 50-286?

A: Lessees who want to apply for a personal use lease automobile exemption in Texas should use Form 50-286.

Q: Is there a fee for filing Form 50-286?

A: No, there is no fee for filing Form 50-286.

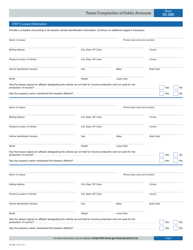

Q: What information is required on Form 50-286?

A: Form 50-286 requires information about the lessor, lessee, and the automobile being leased.

Q: When should Form 50-286 be filed?

A: Form 50-286 should be filed within 30 days of the commencement of the lease.

Q: Are there any penalties for late filing of Form 50-286?

A: Yes, there are penalties for late filing of Form 50-286. It is best to file the form on time to avoid penalties.

Q: What is the duration of the personal use lease automobile exemption?

A: The personal use lease automobile exemption is valid for one year.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-286 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.