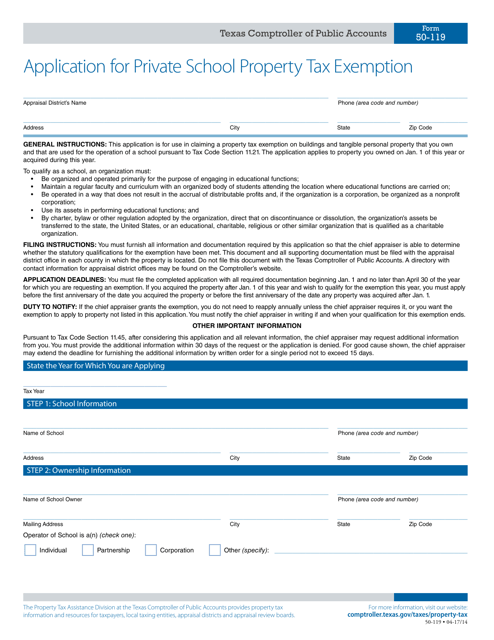

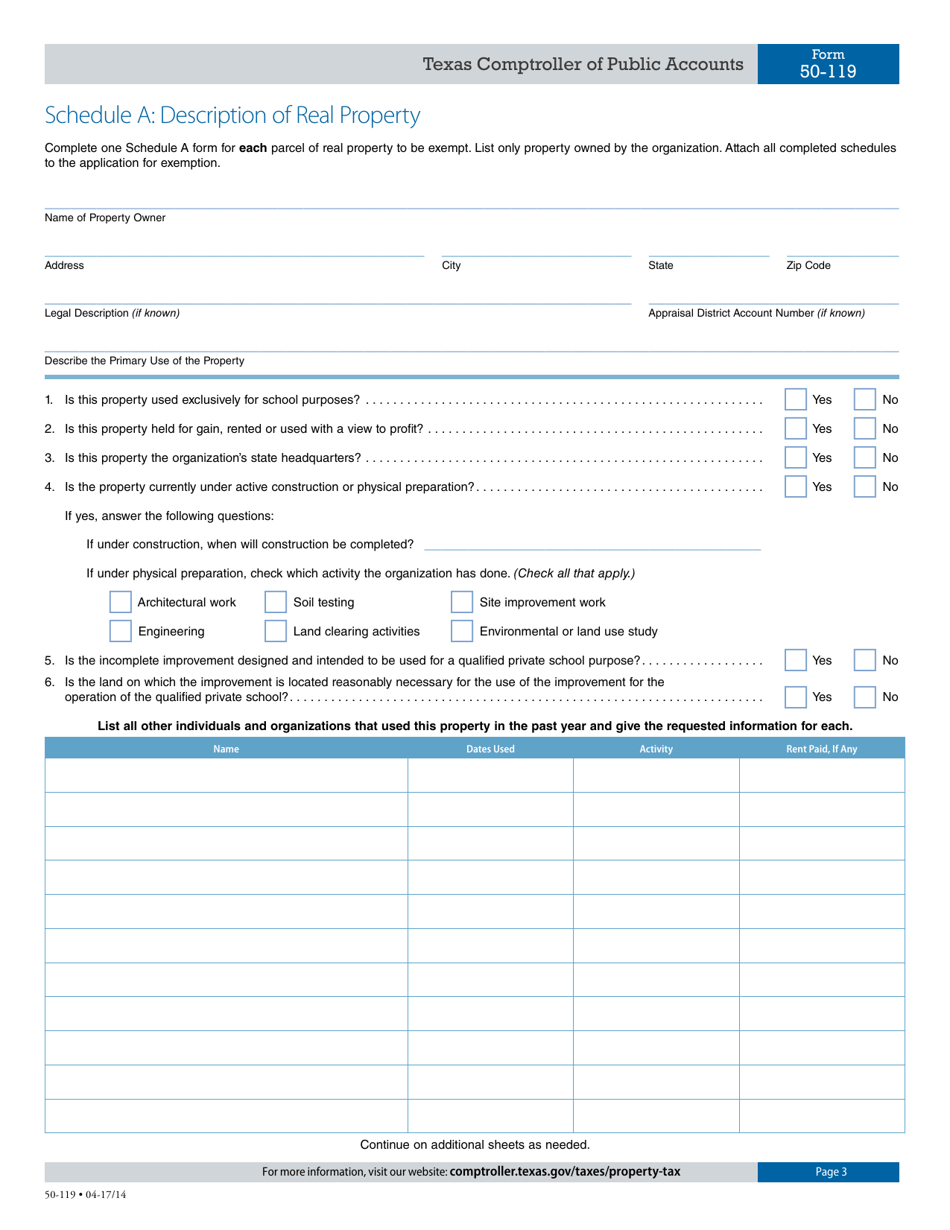

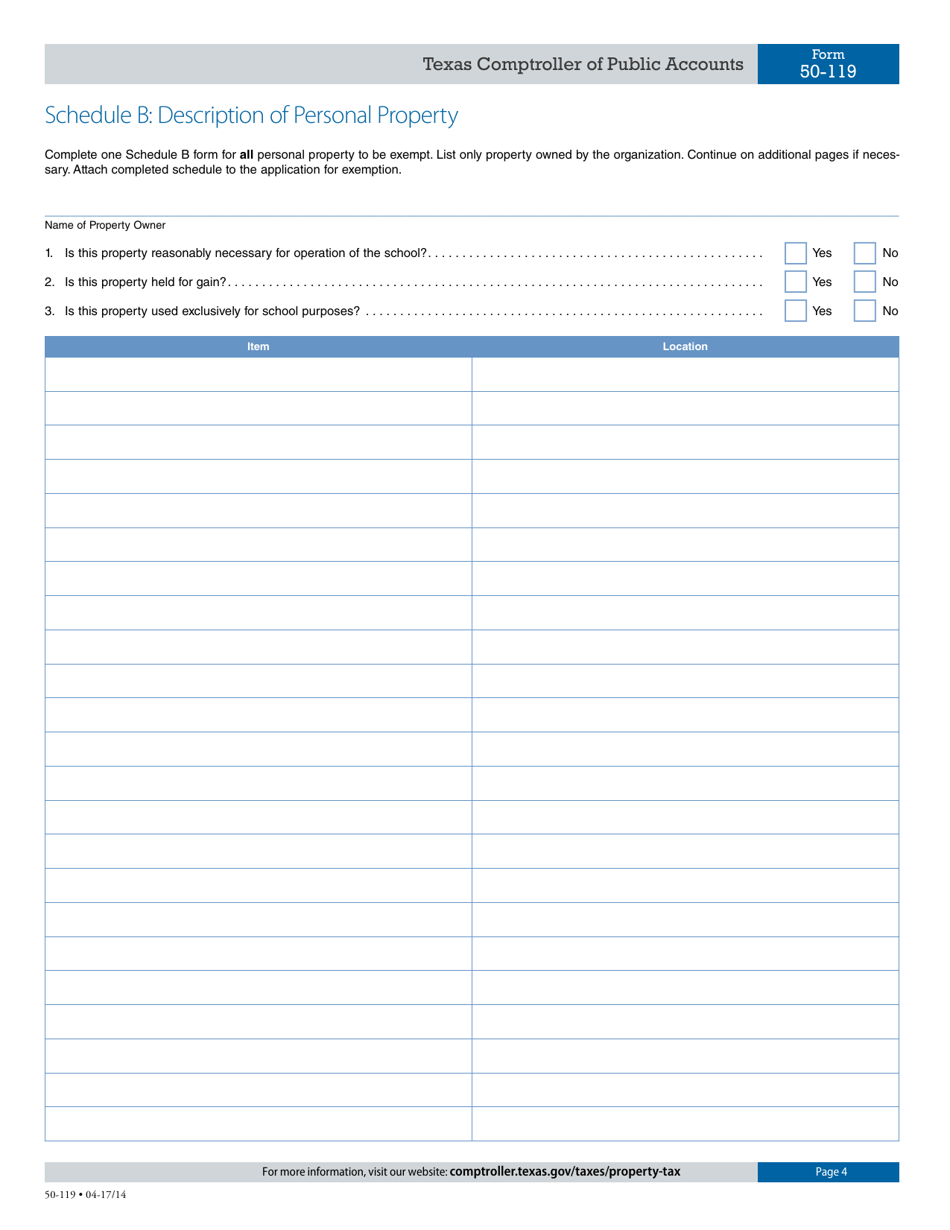

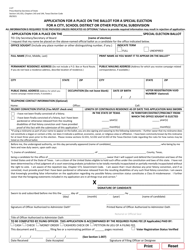

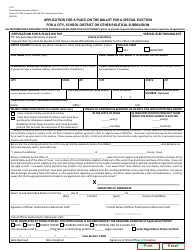

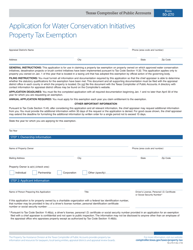

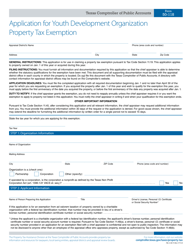

Form 50-119 Application for Private School Property Tax Exemption - Texas

What Is Form 50-119?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-119?

A: Form 50-119 is the Application for Private School Property Tax Exemption in Texas.

Q: Who can use Form 50-119?

A: Private schools in Texas can use Form 50-119 to apply for property tax exemption.

Q: What is the purpose of the property tax exemption?

A: The property tax exemption is designed to provide financial relief to private schools by exempting them from paying property taxes.

Q: Are all private schools eligible for property tax exemption?

A: Not all private schools are eligible for property tax exemption. They must meet certain criteria set by the state of Texas.

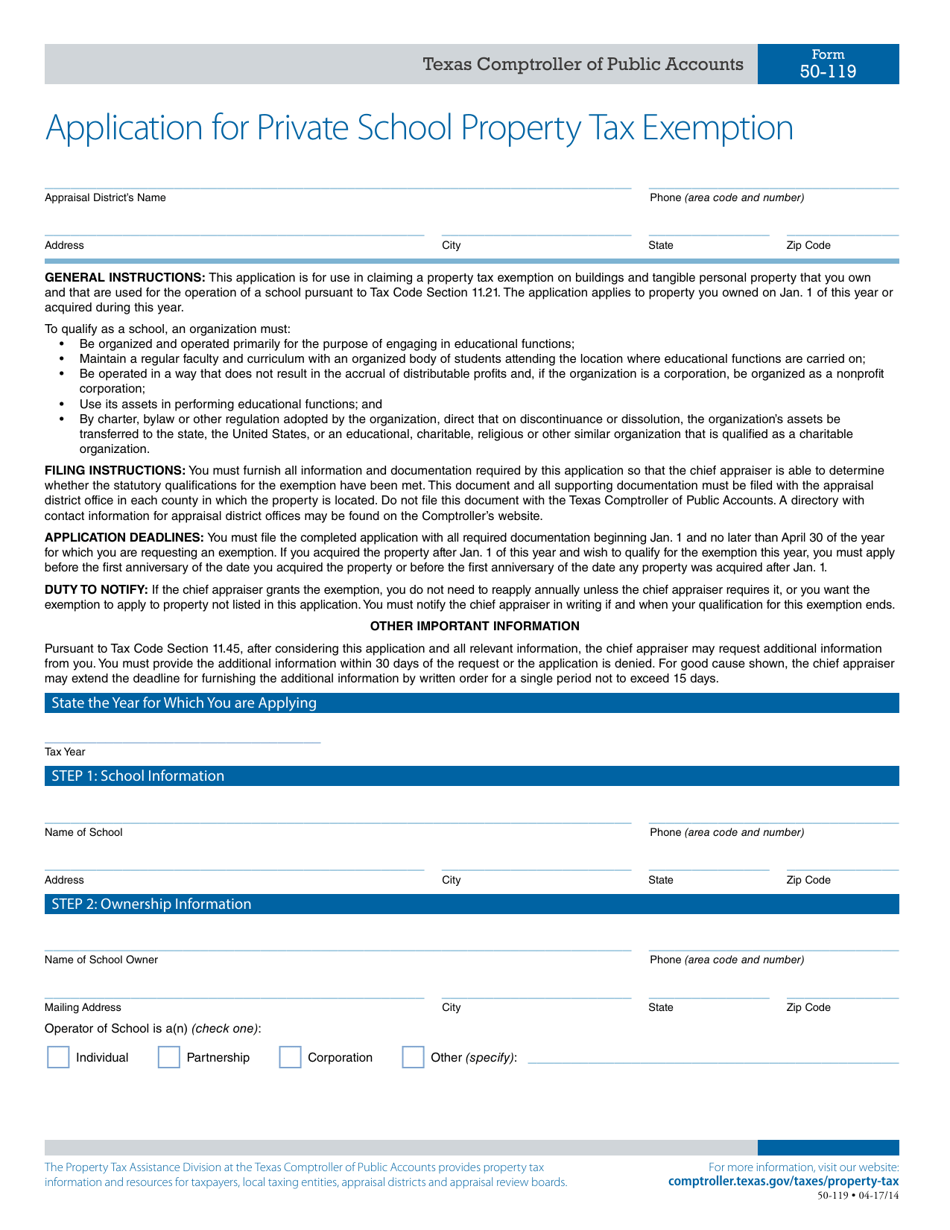

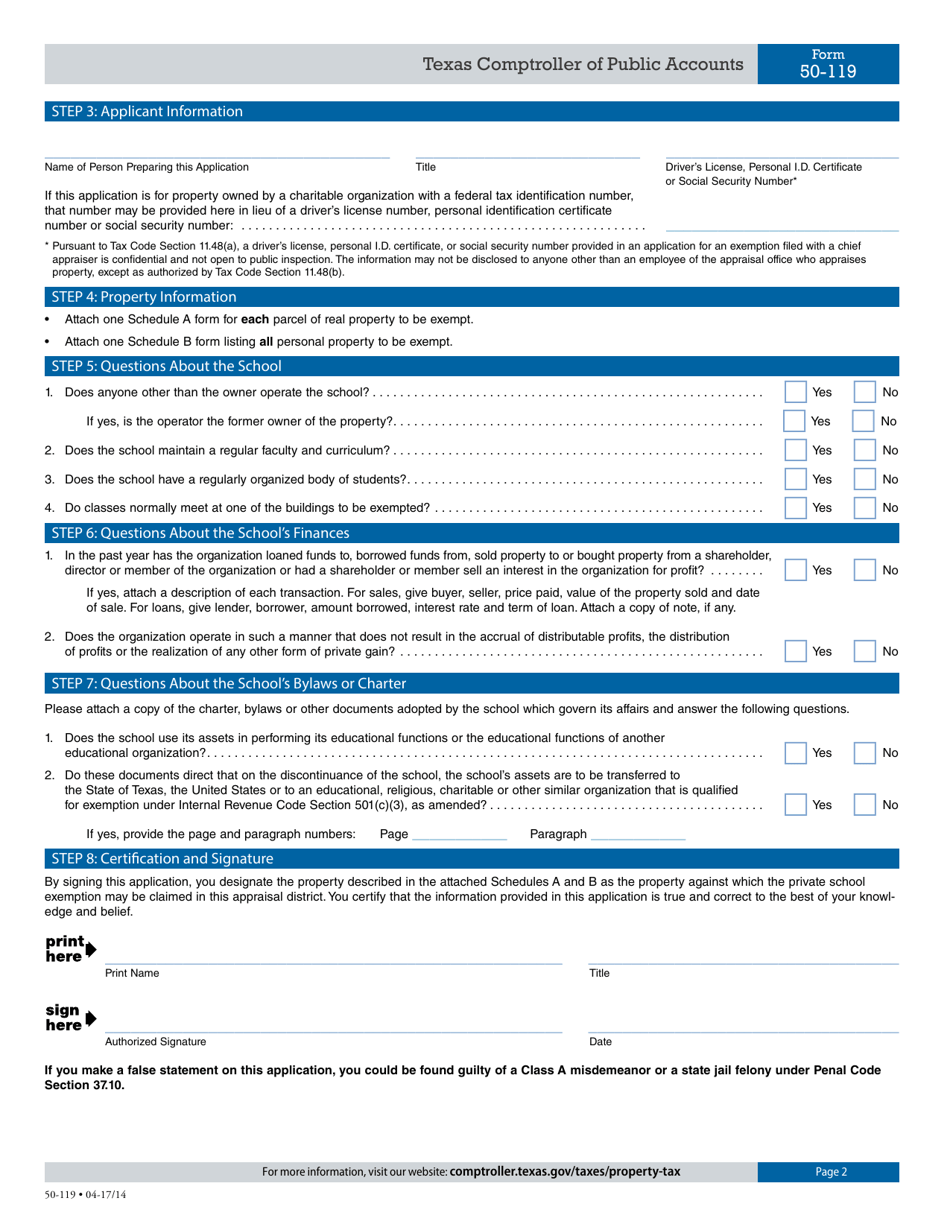

Q: What information is required on Form 50-119?

A: Form 50-119 requires information about the private school's ownership, operations, and financial status.

Q: Is there a deadline for submitting Form 50-119?

A: Yes, Form 50-119 must be submitted to the appropriate taxing authority by May 1st of the tax year for which the exemption is sought.

Q: What documents need to be submitted along with Form 50-119?

A: Along with Form 50-119, private schools need to submit supporting documents such as financial statements, enrollment information, and property ownership documents.

Q: How long does it take to process the application for property tax exemption?

A: The processing time can vary, but it usually takes several weeks to a few months to process the application and make a determination on the exemption.

Q: What happens if the application for property tax exemption is approved?

A: If the application is approved, the private school will be exempt from paying property taxes on eligible properties for the specified tax year.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-119 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.