This version of the form is not currently in use and is provided for reference only. Download this version of

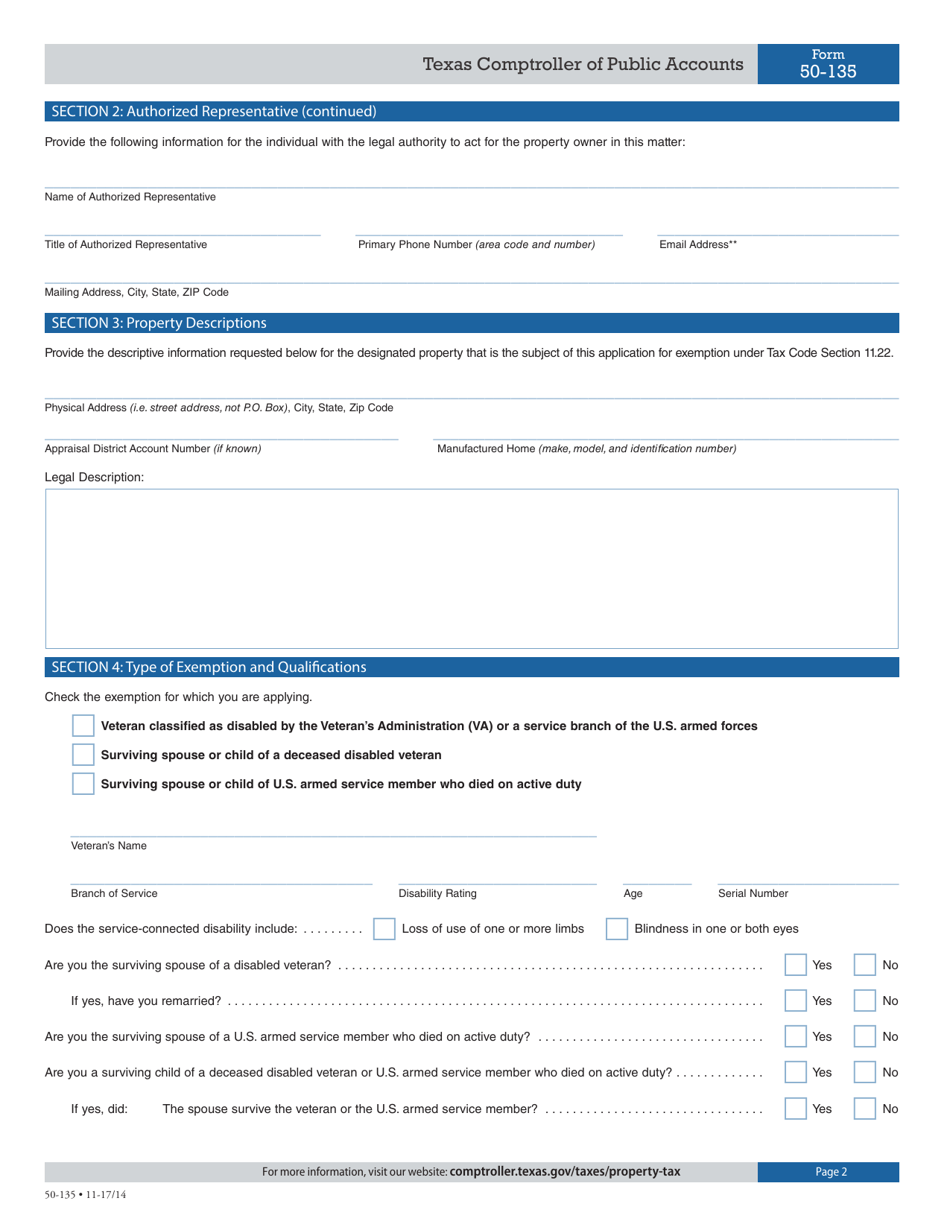

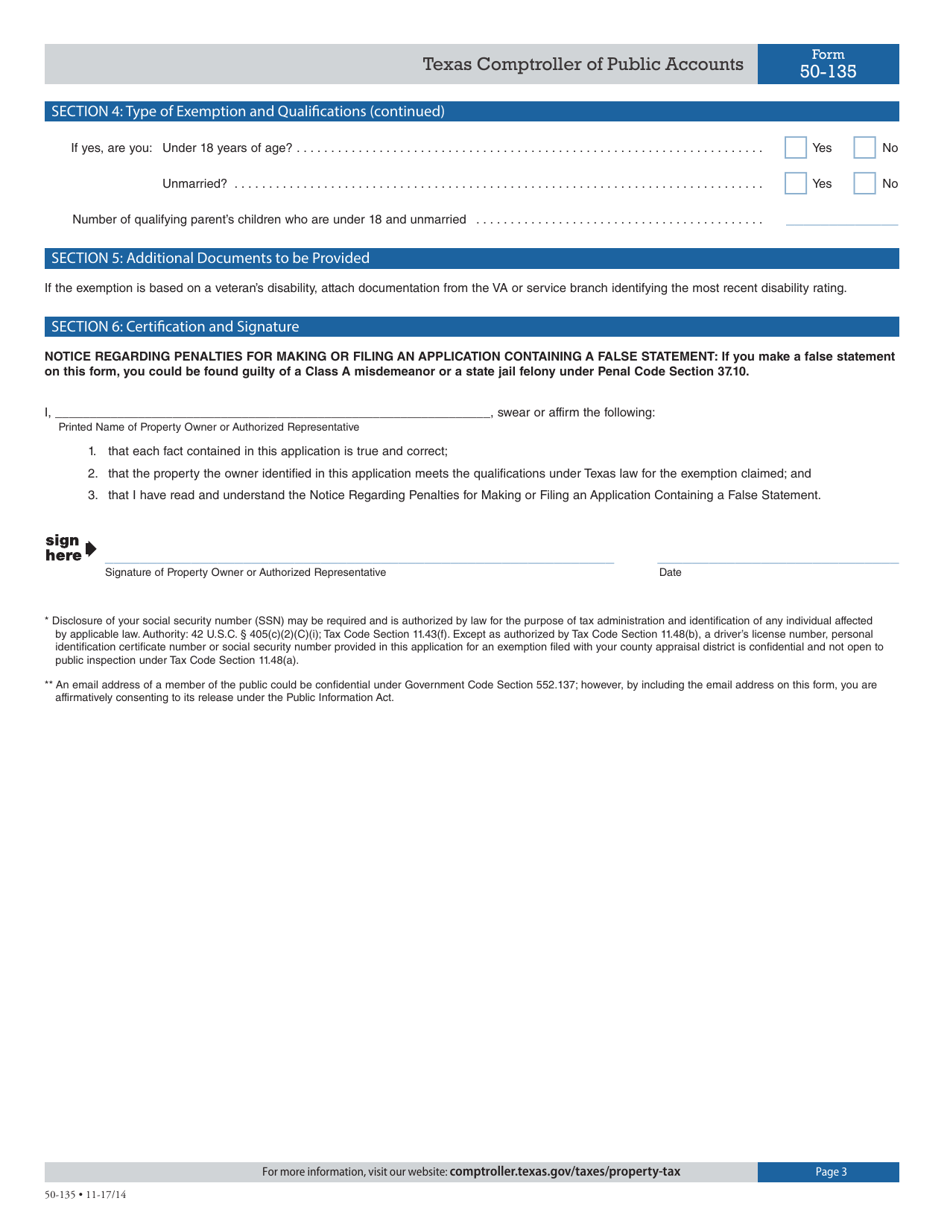

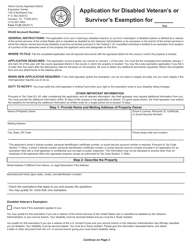

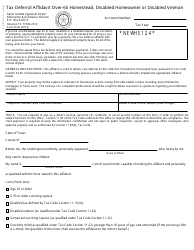

Form 50-135

for the current year.

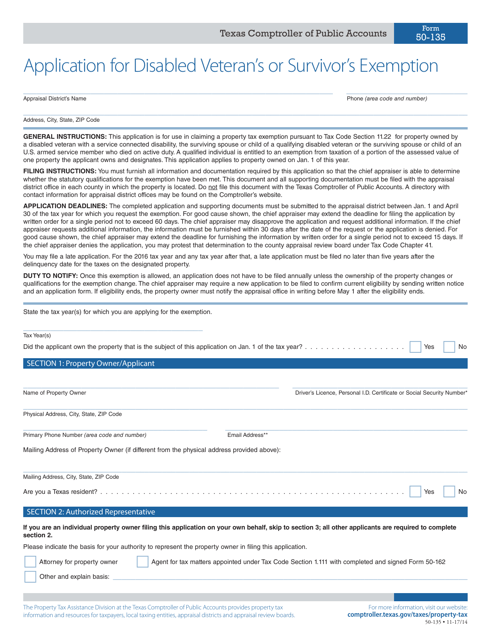

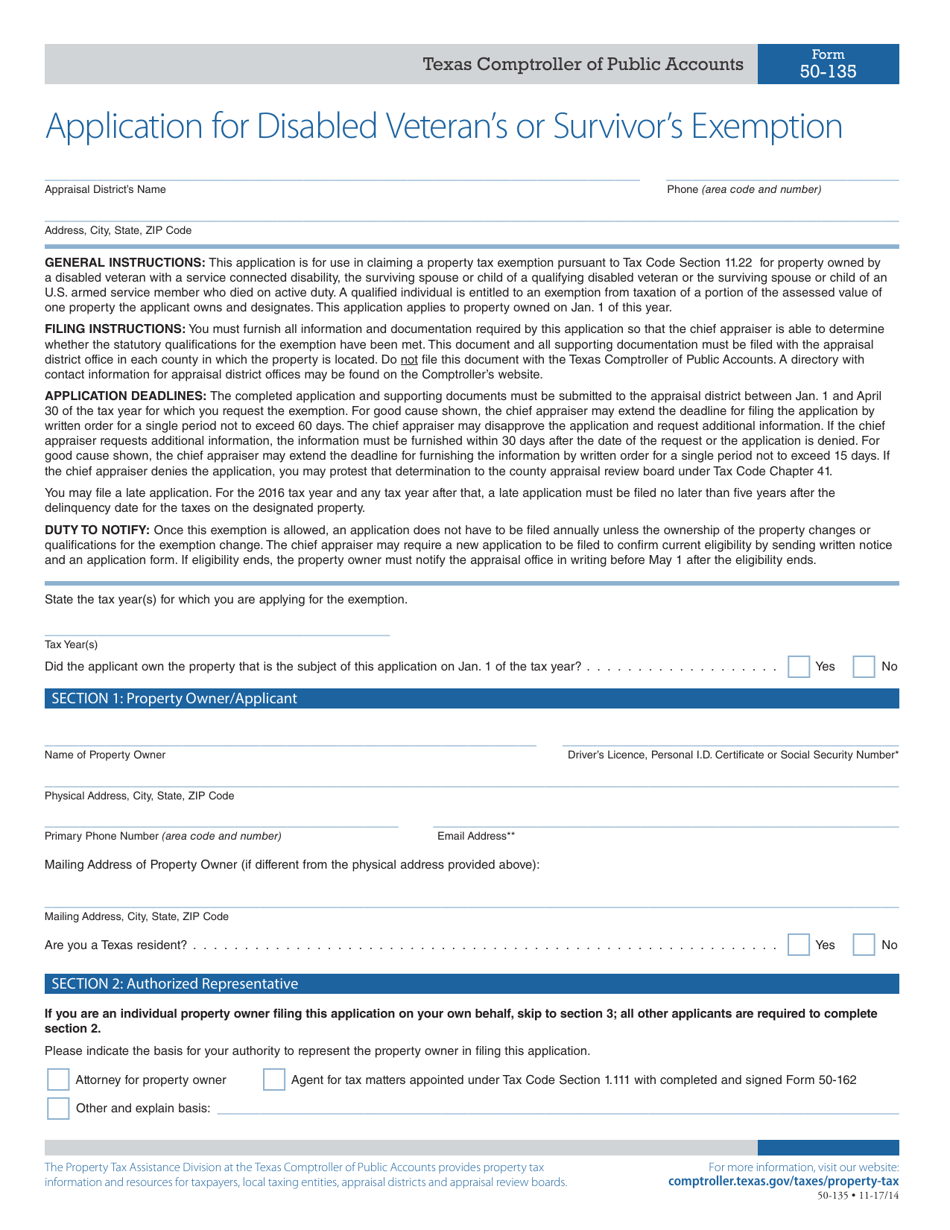

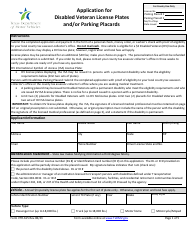

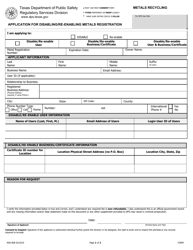

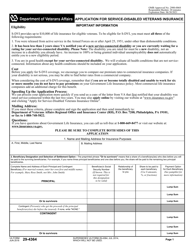

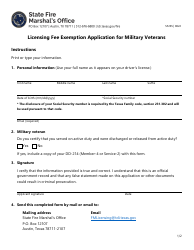

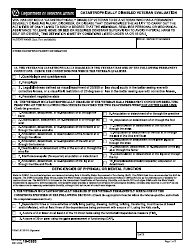

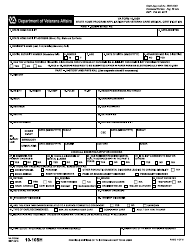

Form 50-135 Application for Disabled Veteran's or Survivor's Exemption - Texas

What Is Form 50-135?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-135?

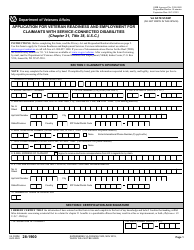

A: Form 50-135 is the application for Disabled Veteran's or Survivor's Exemption in Texas.

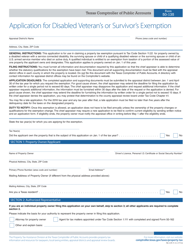

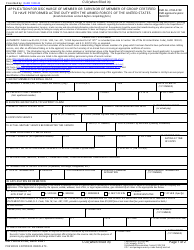

Q: Who is eligible to apply for the exemption?

A: Disabled veterans or their survivors are eligible to apply for the exemption.

Q: What does the exemption provide?

A: The exemption provides property tax relief for qualified disabled veterans or their survivors.

Q: What documents do I need to include with the application?

A: You will need to include proof of eligibility, such as a certificate of disability or proof of survivorship.

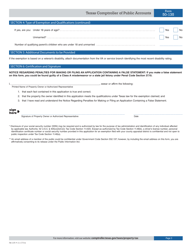

Q: Is there a deadline to submit the application?

A: The application must be submitted to the appraisal district by April 30th of the tax year.

Q: How long does the exemption last?

A: The exemption lasts as long as the person remains eligible.

Q: What if I have questions or need assistance with the application?

A: You can contact your local appraisal district for assistance with the application or any questions you may have.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-135 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.