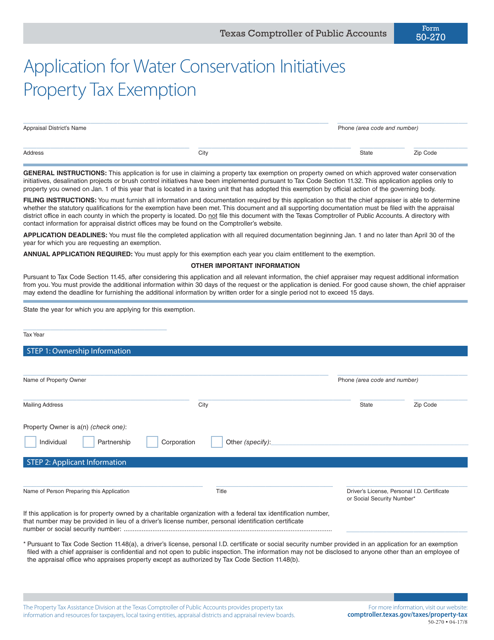

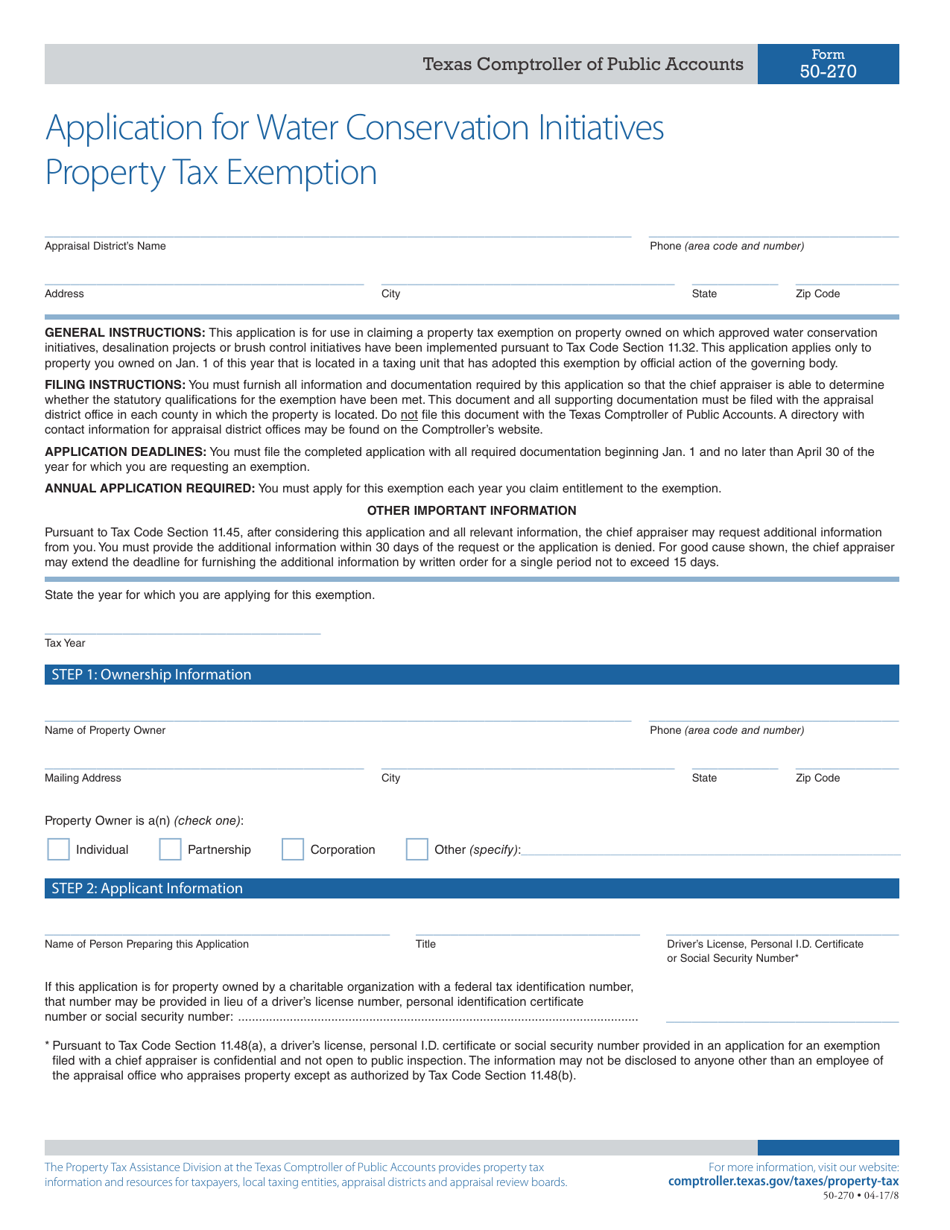

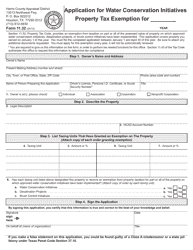

Form 50-270 Application for Water Conservation Initiatives Property Tax Exemption - Texas

What Is Form 50-270?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-270?

A: Form 50-270 is an application for the Water Conservation Initiatives Property Tax Exemption in Texas.

Q: What is the purpose of Form 50-270?

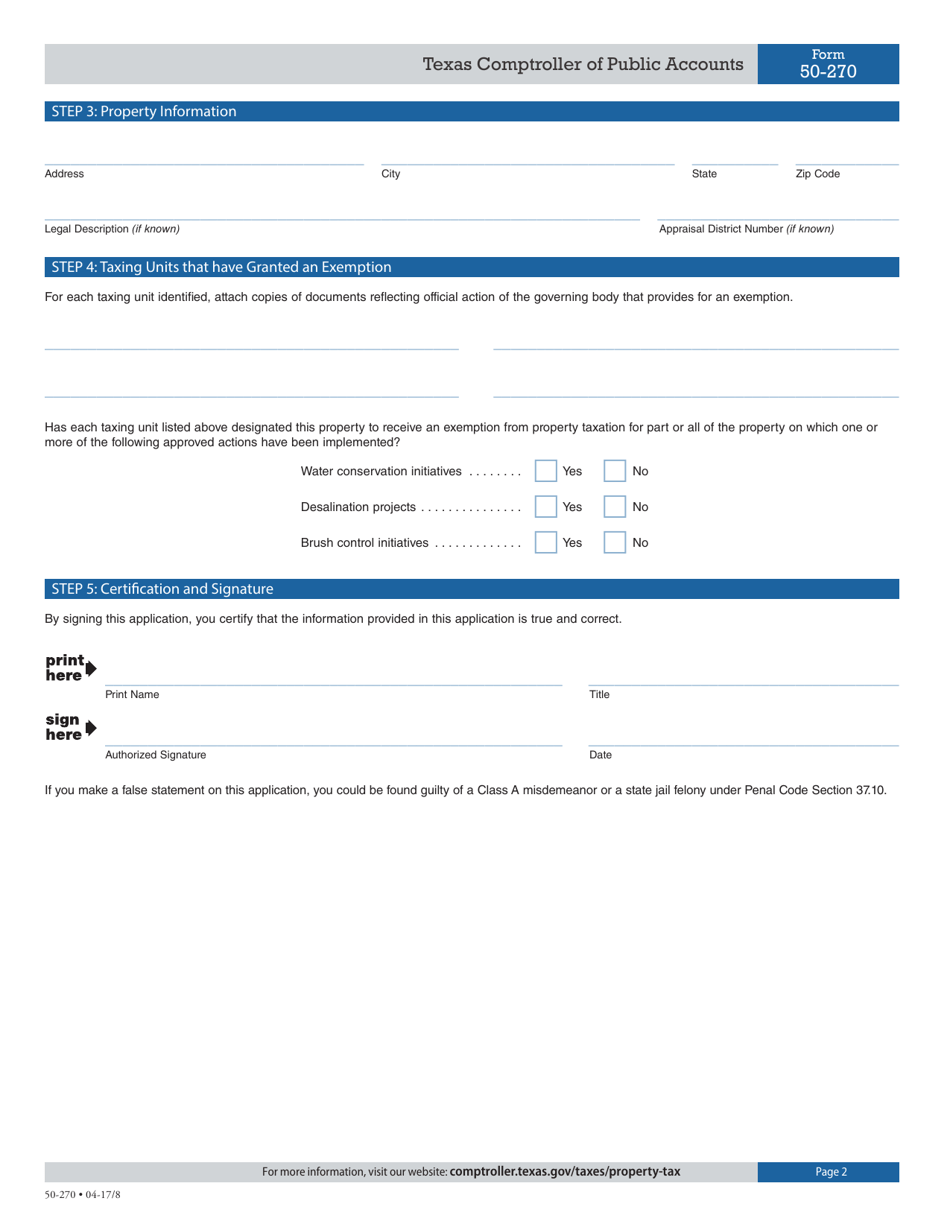

A: The purpose of Form 50-270 is to apply for a property tax exemption for water conservation initiatives in Texas.

Q: Who can use Form 50-270?

A: Property owners in Texas who have implemented water conservation initiatives on their property can use Form 50-270.

Q: What are water conservation initiatives?

A: Water conservation initiatives include measures or technologies that reduce water consumption or promote water conservation, such as rainwater harvesting systems or low-flow toilets.

Q: What is the benefit of the property tax exemption?

A: The property tax exemption reduces or eliminates the property taxes associated with the value that was added to the property by the water conservation initiatives.

Q: What documents do I need to submit with Form 50-270?

A: You may need to provide documentation such as receipts, engineering reports, or other evidence of the water conservation initiatives on your property.

Q: Is there a deadline for submitting Form 50-270?

A: Yes, Form 50-270 should be submitted to the county appraisal district office no later than April 30th of the year following the year in which the water conservation initiatives were implemented.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-270 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.