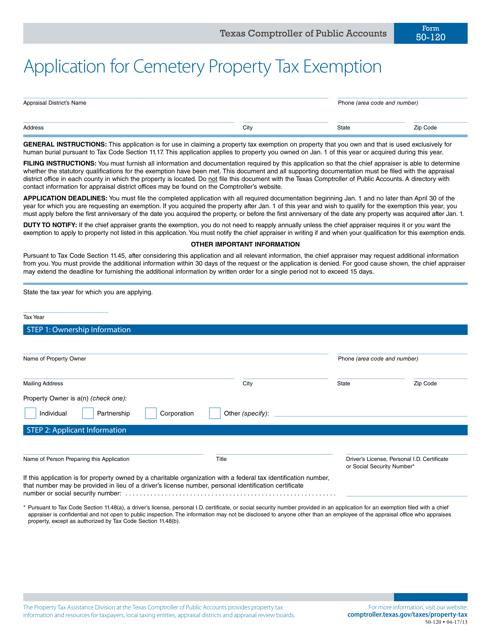

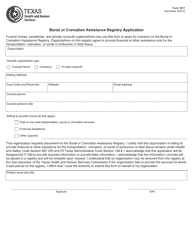

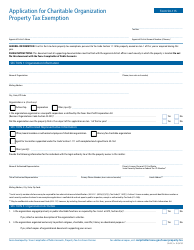

Form 50-120 Application for Cemetery Property Tax Exemption - Texas

What Is Form 50-120?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-120?

A: Form 50-120 is an application for cemetery property tax exemption in Texas.

Q: Who should use Form 50-120?

A: Cemeteries in Texas should use Form 50-120 to apply for property tax exemption.

Q: What is the purpose of the cemetery property tax exemption?

A: The purpose of the cemetery property tax exemption is to provide financial relief for cemeteries.

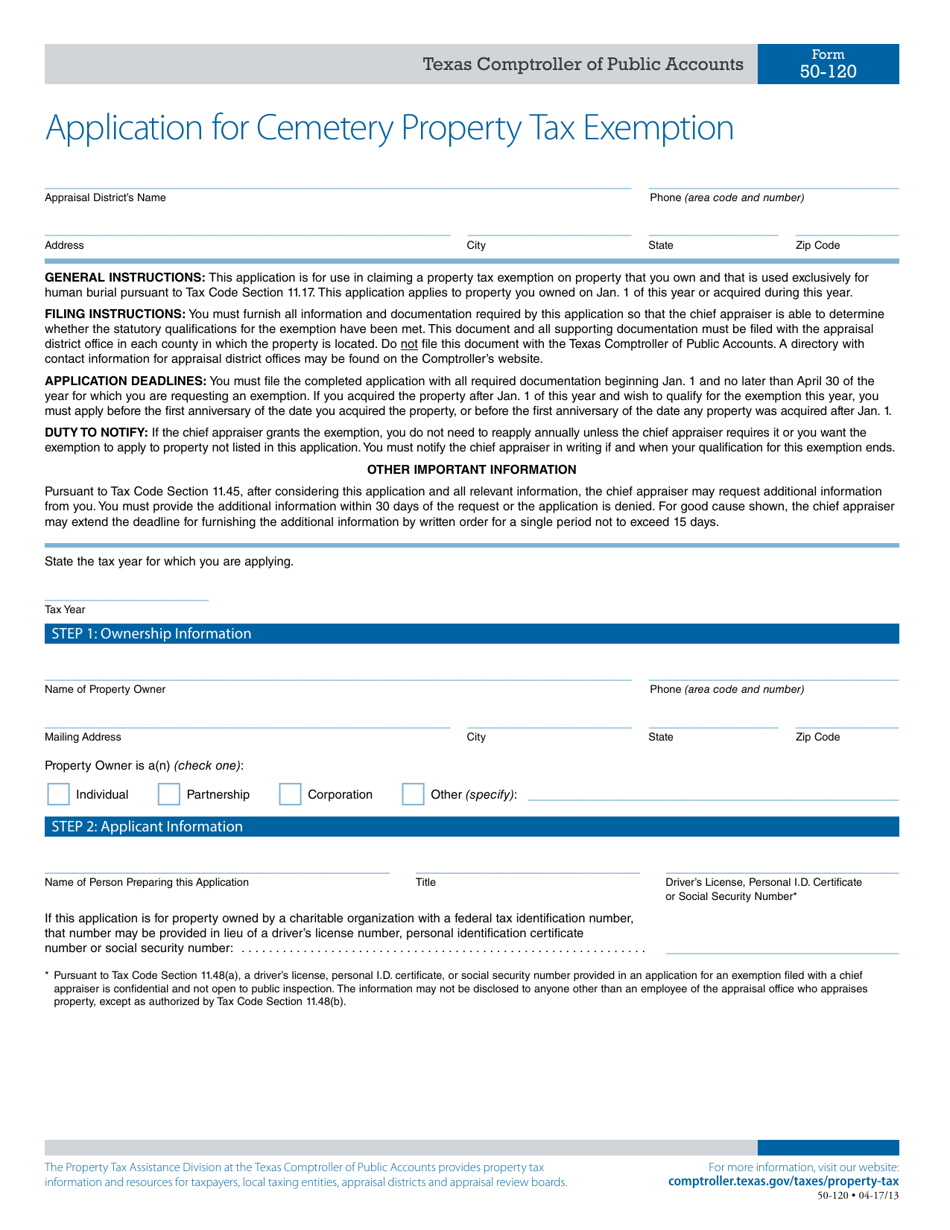

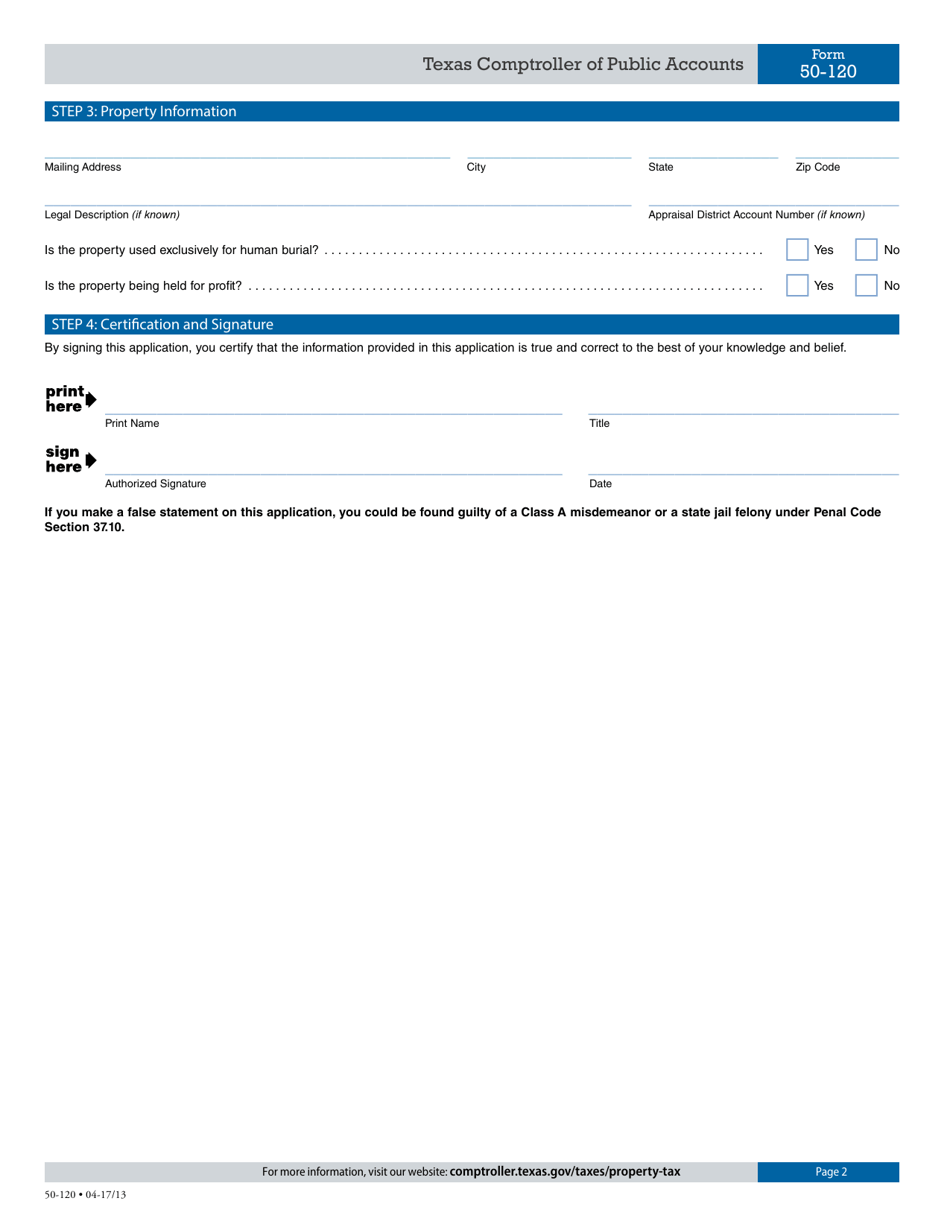

Q: What information is required on Form 50-120?

A: Form 50-120 requires information such as the cemetery's contact information, property description, and details about the organization operating the cemetery.

Q: Is there a deadline for submitting Form 50-120?

A: Yes, Form 50-120 should be submitted to the county appraisal district no later than April 30th of the year for which the exemption is requested.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-120 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.