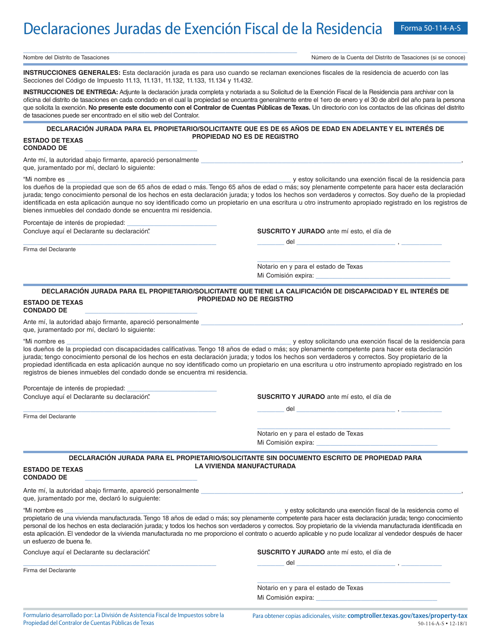

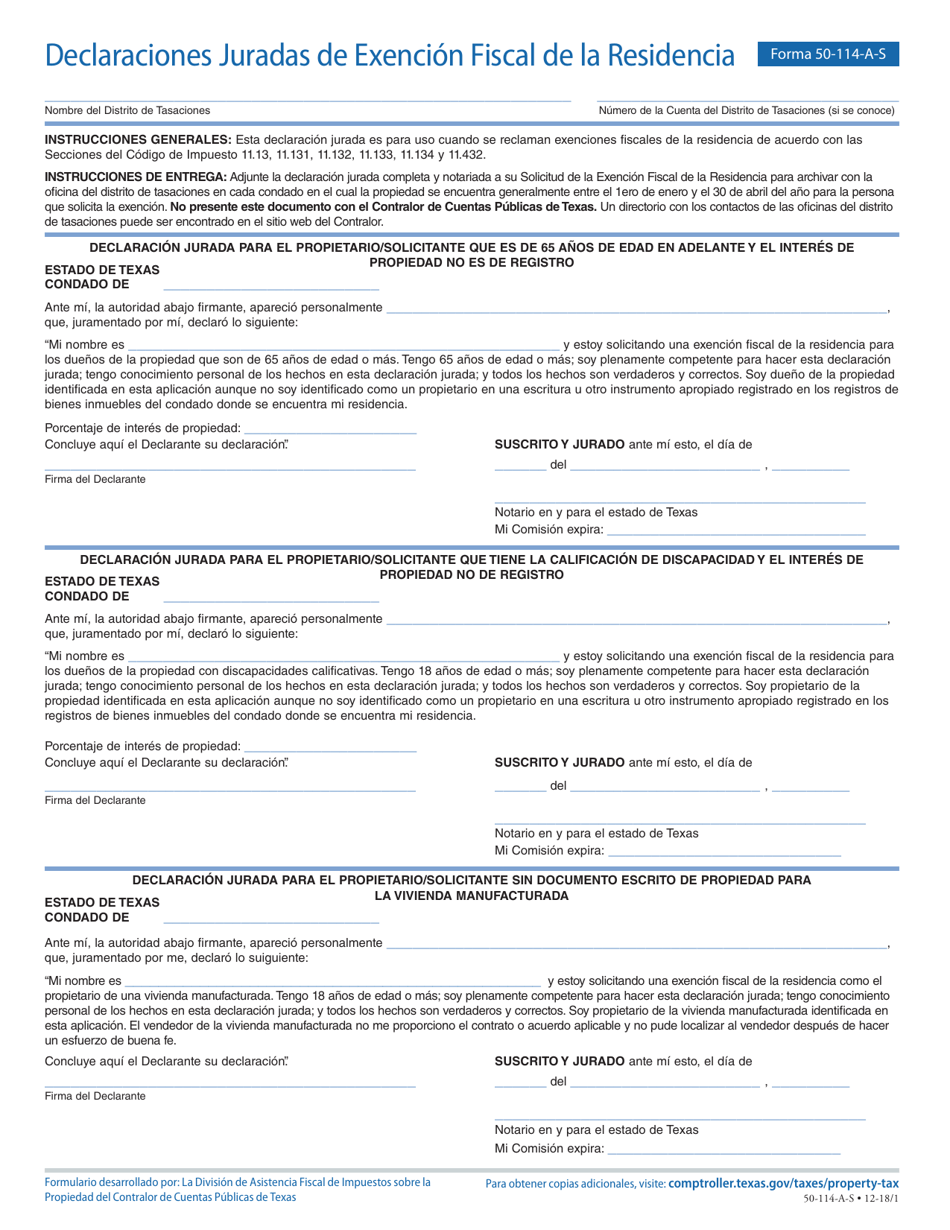

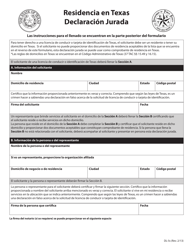

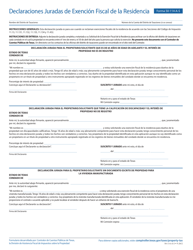

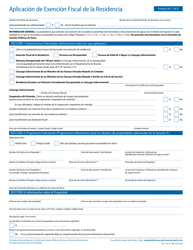

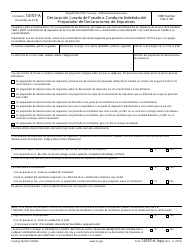

Formulario 50-114-A-S Declaraciones Juradas De Exencion Fiscal De La Residencia - Texas (Spanish)

Qué es Formulario 50-114-A-S?

Este es un formulario legal que fue publicado por el Texas Comptroller of Public Accounts, una autoridad gubernamental que opera dentro de Texas. A partir de hoy, el departamento emisor no proporciona en separado pautas de presentación para el formulario.

Detalles del formulario:

- Publicado el 1 de diciembre de 2018;

- La última versión proporcionada por el Texas Comptroller of Public Accounts;

- Lista para utilizar e imprimir;

- Fácil de personalizar;

- Compatible con la mayoría de las aplicaciones para visualizar PDF;

- Complete este formulario en línea.

Descargue una versión del Formulario 50-114-A-S haciendo clic en el enlace debajo o busque más documentos y plantillas proporcionados por el Texas Comptroller of Public Accounts.

FAQ

Q: What is Form 50-114-A-S?

A: Form 50-114-A-S is a Spanish language form used for filing a tax exemption for residence in Texas.

Q: What is the purpose of Form 50-114-A-S?

A: The purpose of Form 50-114-A-S is to declare tax exemption for residence in Texas.

Q: Who should use Form 50-114-A-S?

A: Form 50-114-A-S should be used by individuals who are seeking tax exemption for their residence in Texas.

Q: Is Form 50-114-A-S available in English?

A: No, Form 50-114-A-S is only available in Spanish.

Q: What information is required on Form 50-114-A-S?

A: Form 50-114-A-S requires personal information, such as name, address, and social security number, as well as details about the property and the reason for tax exemption.

Q: When should I file Form 50-114-A-S?

A: Form 50-114-A-S should be filed before the property tax assessment date, which is usually January 1st of the tax year.

Q: What are the benefits of filing Form 50-114-A-S?

A: Filing Form 50-114-A-S can result in tax exemption for the residence, reducing the amount of property tax owed.

Q: Are there any fees associated with filing Form 50-114-A-S?

A: No, there are no fees for filing Form 50-114-A-S.