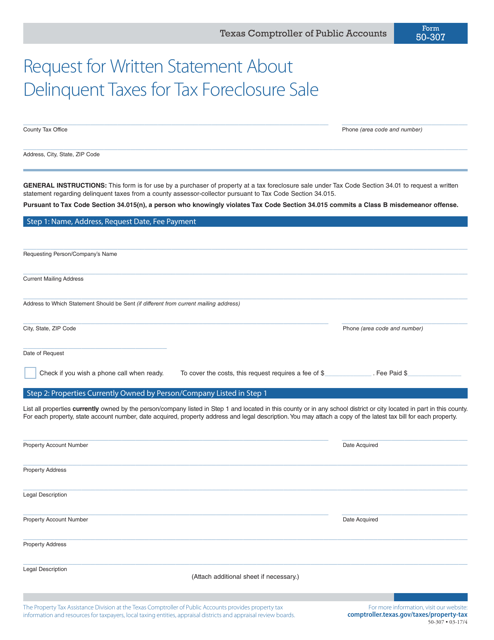

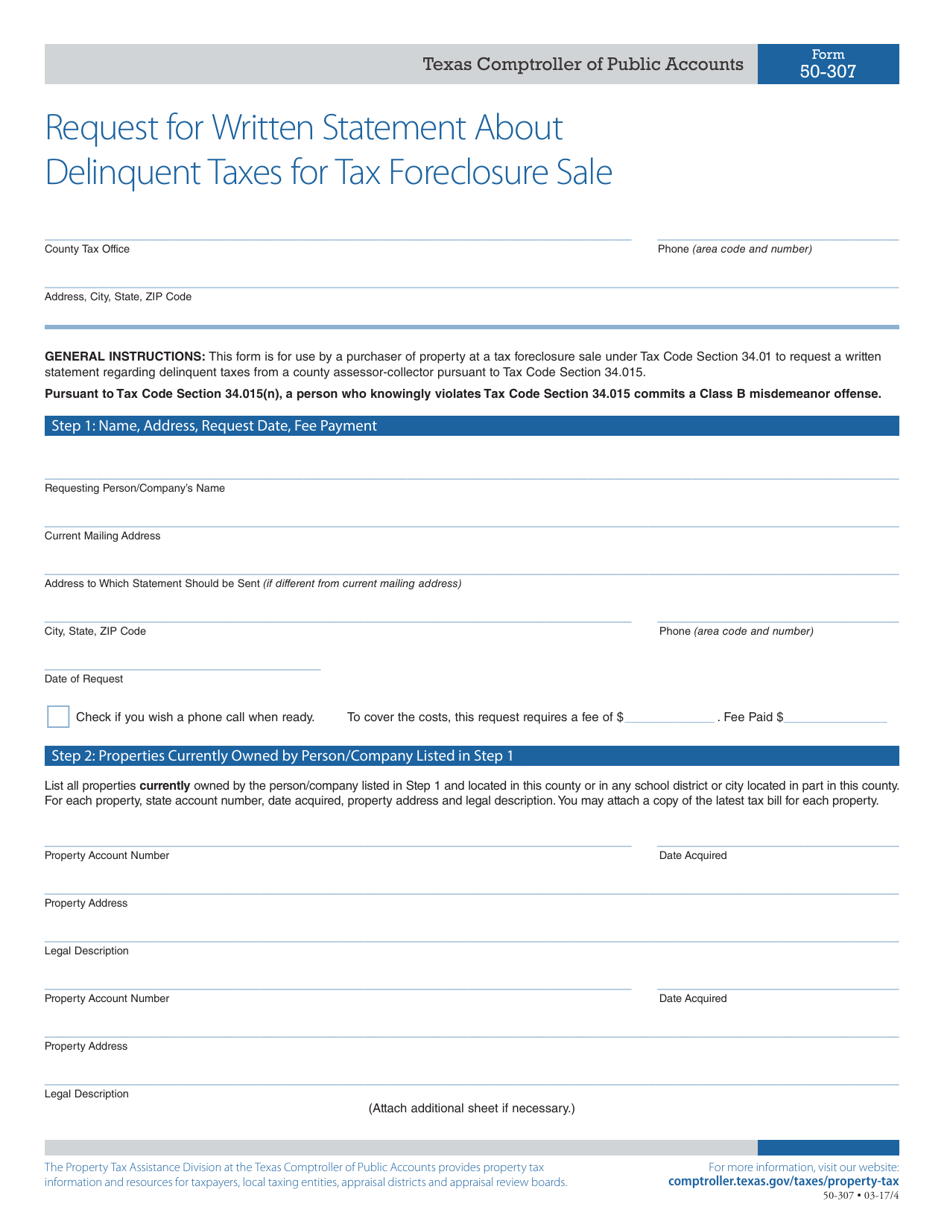

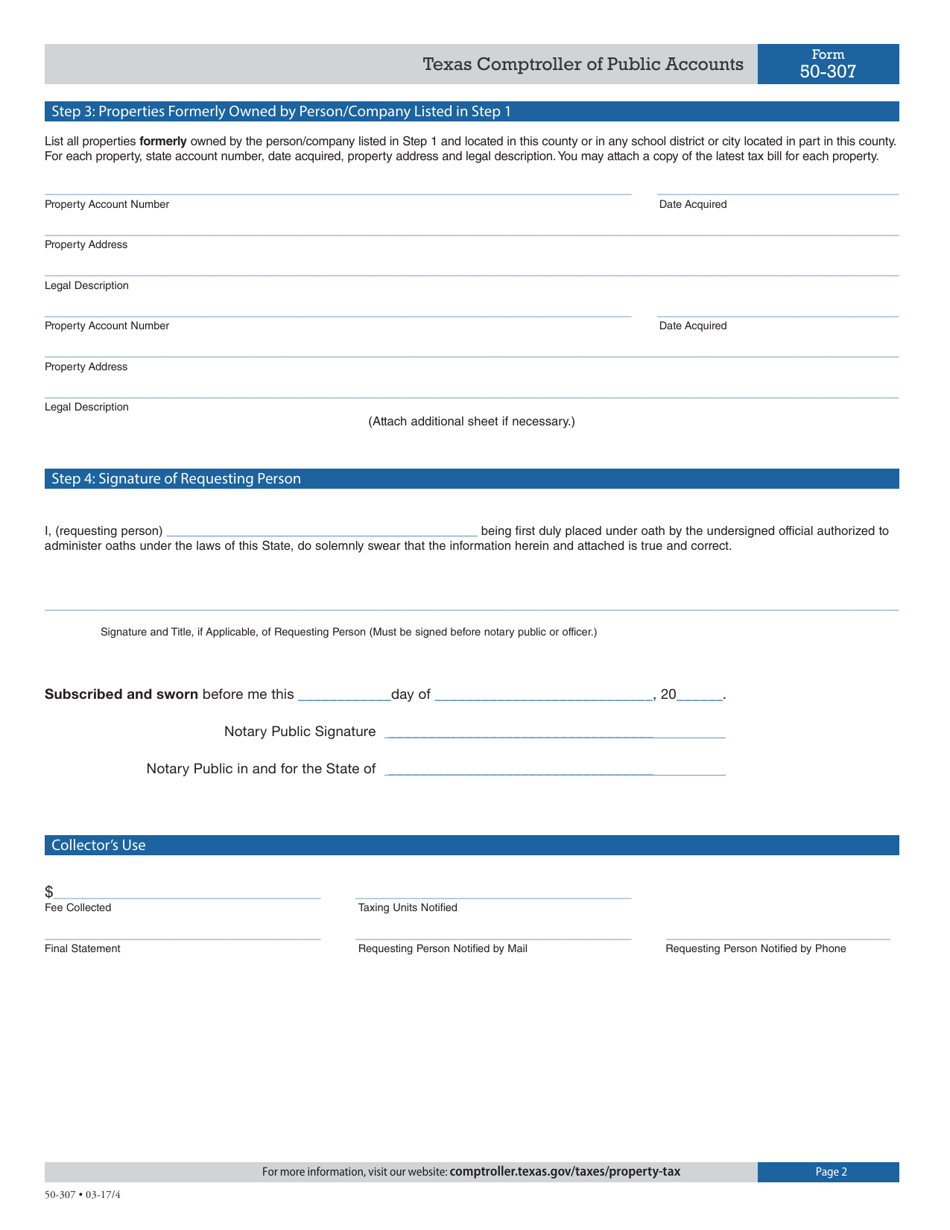

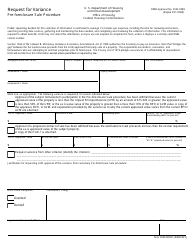

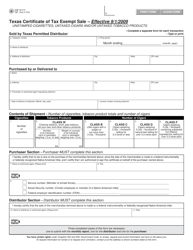

Form 50-307 Request for Written Statement About Delinquent Taxes for Tax Foreclosure Sale - Texas

What Is Form 50-307?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-307?

A: Form 50-307 is a Texas-specific form used to request a written statement about delinquent taxes for a tax foreclosure sale.

Q: How do I use Form 50-307?

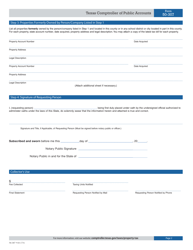

A: You can use Form 50-307 to request a written statement about delinquent taxes by filling out the required information and submitting it to the appropriate tax office.

Q: What is the purpose of Form 50-307?

A: The purpose of Form 50-307 is to gather information about delinquent taxes for a tax foreclosure sale in Texas.

Q: Who needs to fill out Form 50-307?

A: Anyone who wants to request a written statement about delinquent taxes for a tax foreclosure sale in Texas needs to fill out Form 50-307.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-307 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.