This version of the form is not currently in use and is provided for reference only. Download this version of

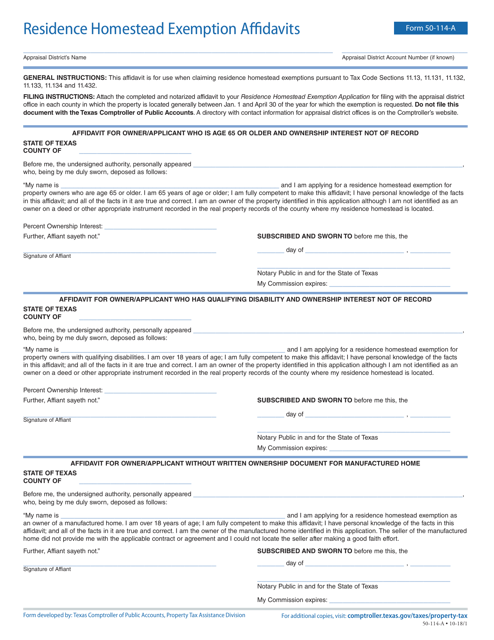

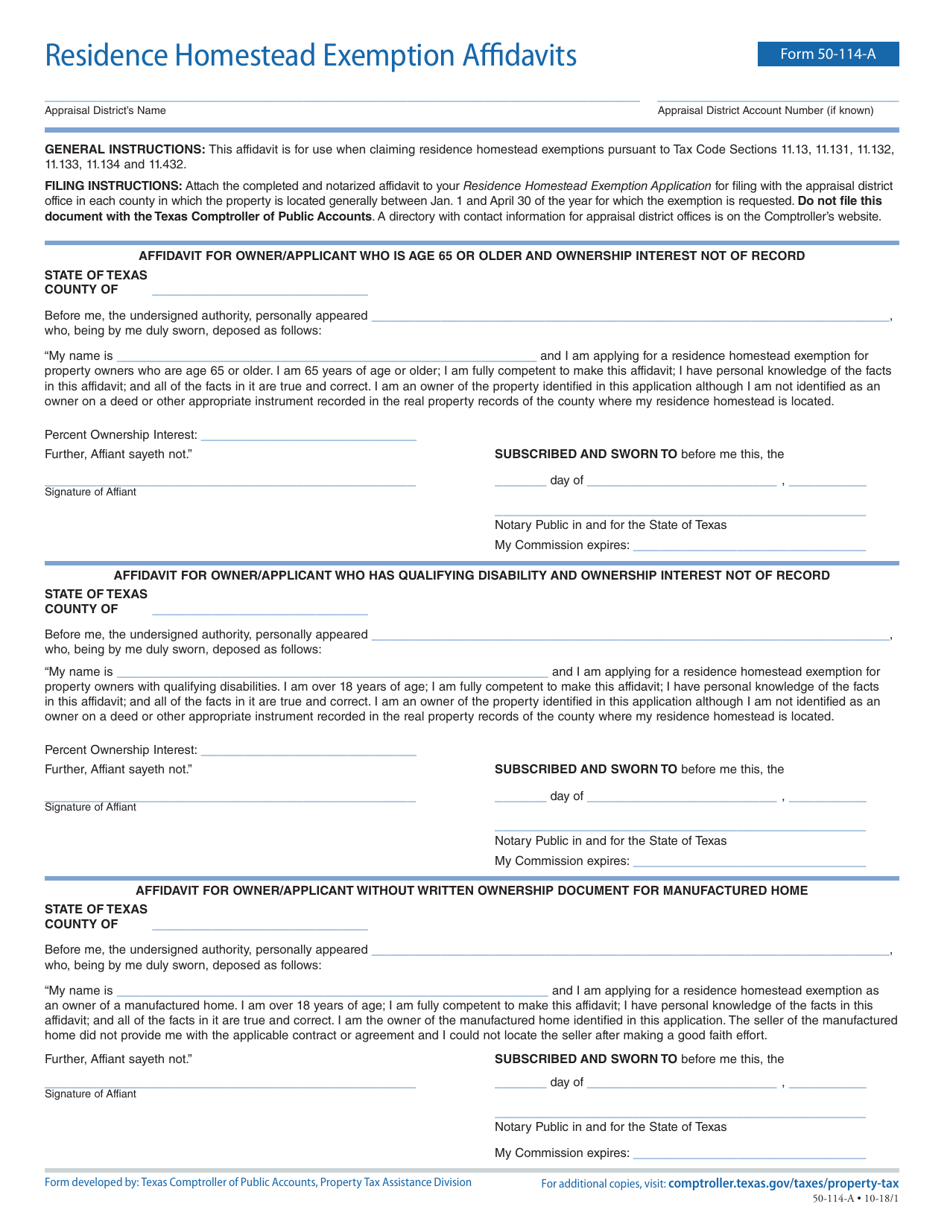

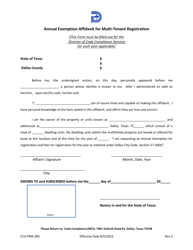

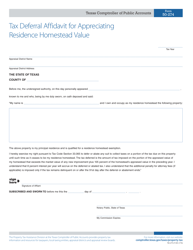

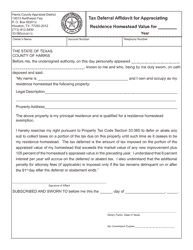

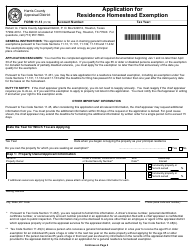

Form 50-114-A

for the current year.

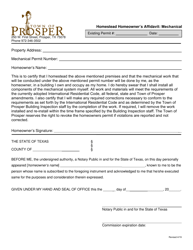

Form 50-114-A Residence Homestead Exemption Affidavits - Texas

What Is Form 50-114-A?

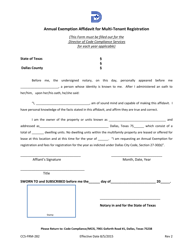

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-114-A?

A: Form 50-114-A is the Residence Homestead Exemption Affidavit in Texas.

Q: What does the form do?

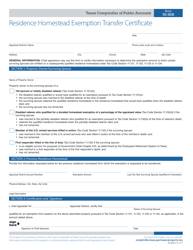

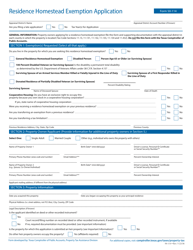

A: This form is used to apply for a residential homestead exemption in Texas.

Q: Who is eligible for the homestead exemption?

A: Property owners who use their property as their primary residence may be eligible for the homestead exemption.

Q: What are the benefits of the homestead exemption?

A: The homestead exemption can provide property tax relief by reducing the taxable value of the property.

Q: When should I file the form?

A: The form must be filed with the county appraisal district between January 1 and April 30 of the tax year.

Q: Are there any fees associated with filing the form?

A: There are no fees for filing the Residence Homestead Exemption Affidavit.

Q: What documents do I need to include with the form?

A: You may need to provide proof of residence, such as a driver's license or utility bills, along with the completed form.

Q: How long does the exemption last?

A: Once approved, the homestead exemption generally remains in effect as long as you continuously qualify for it.

Q: Can I use the homestead exemption for multiple properties?

A: No, the homestead exemption can only be claimed on your primary residence.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-114-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.