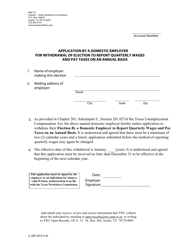

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-181

for the current year.

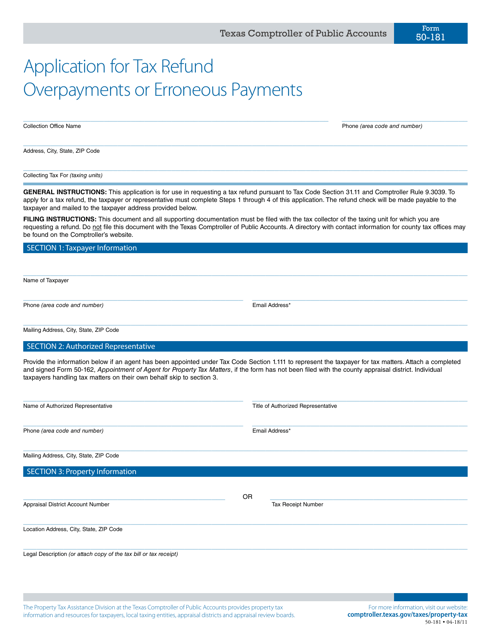

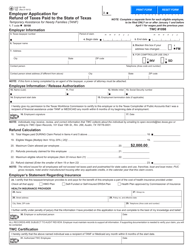

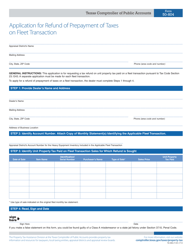

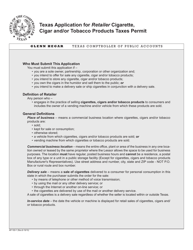

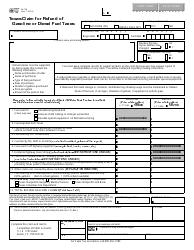

Form 50-181 Application for Tax Refund Overpayments or Erroneous Payments - Texas

What Is Form 50-181?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-181?

A: Form 50-181 is an application for tax refund overpayments or erroneous payments in Texas.

Q: What is the purpose of Form 50-181?

A: The purpose of Form 50-181 is to request a refund for overpayments or erroneous tax payments.

Q: Who can use Form 50-181?

A: Any individual or business in Texas that has made overpayments or erroneous tax payments can use Form 50-181.

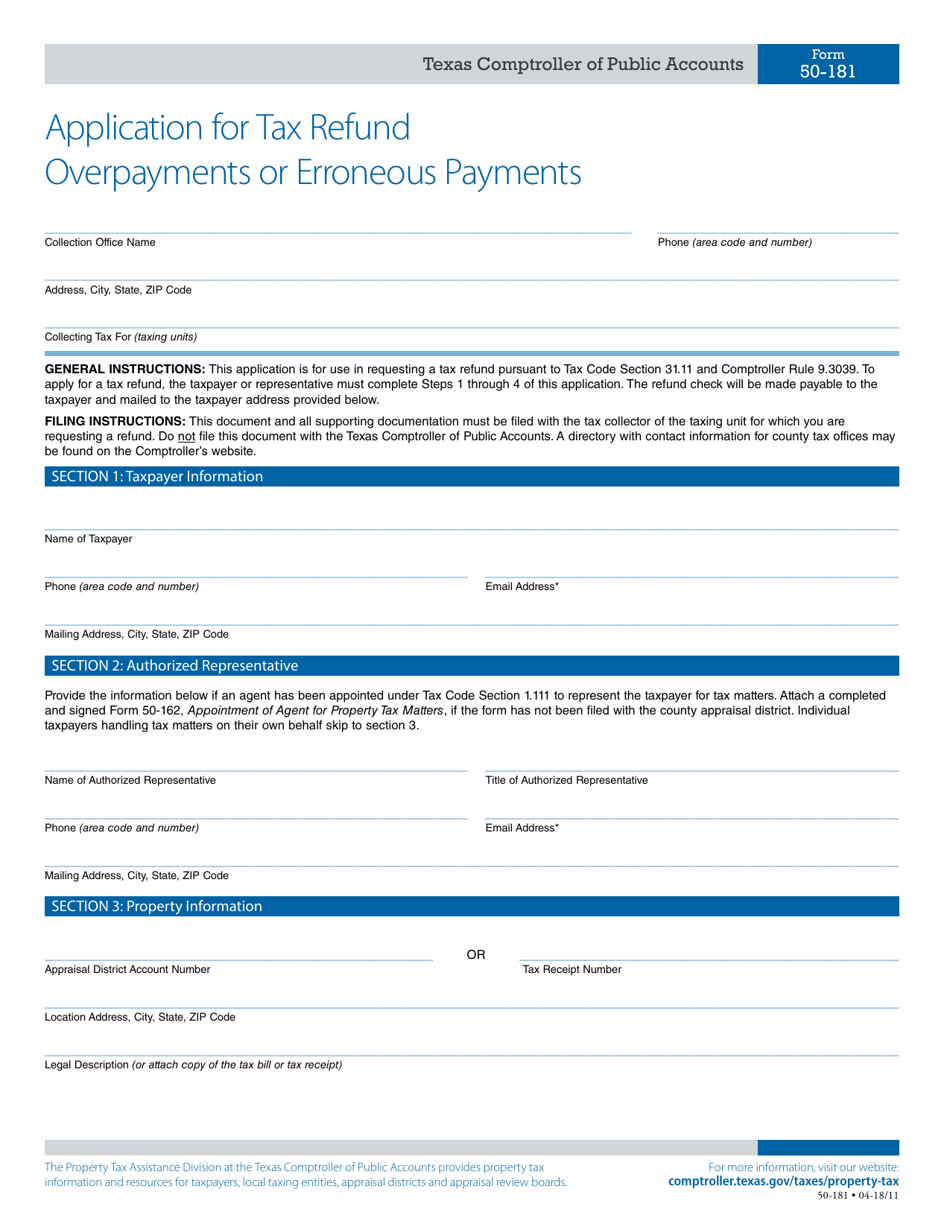

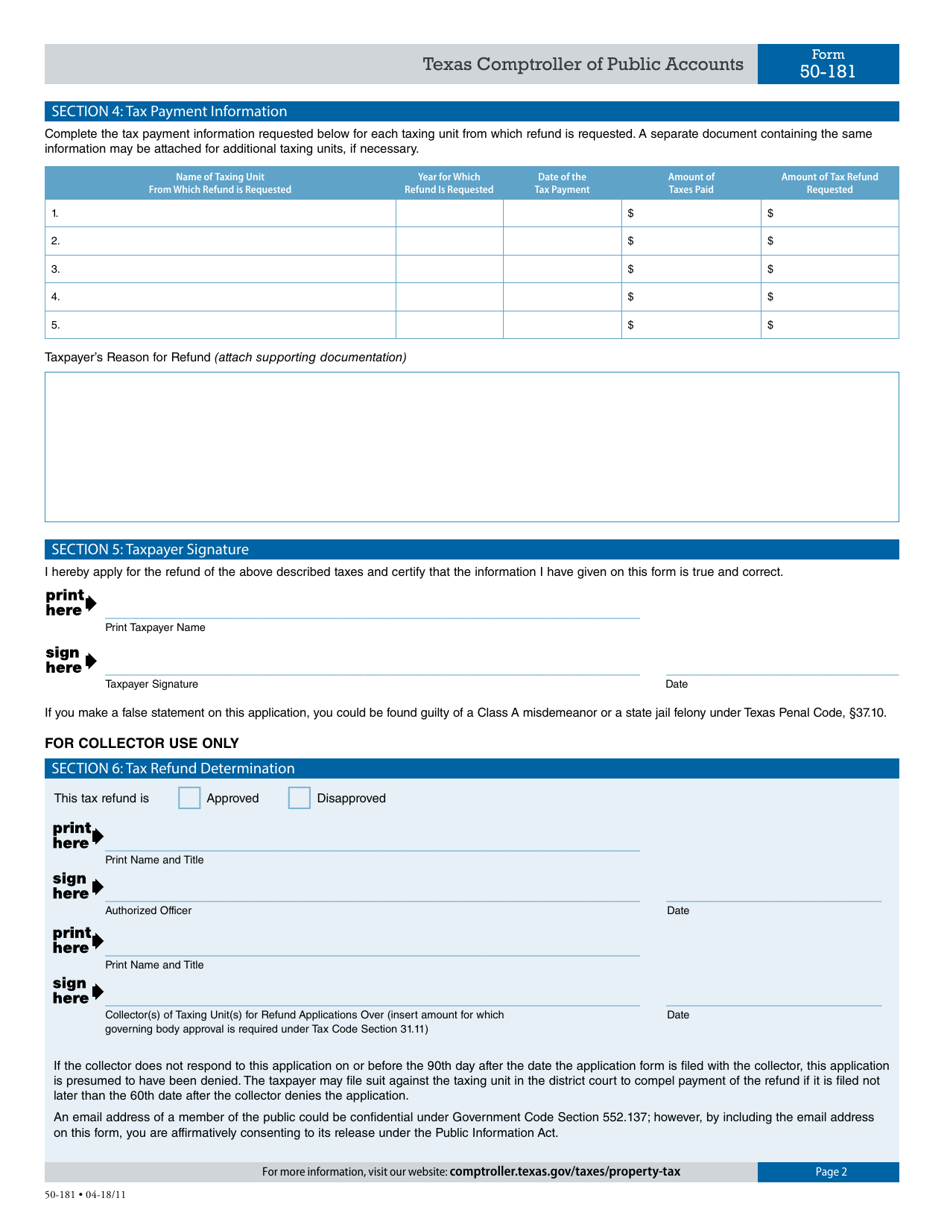

Q: What information is required on Form 50-181?

A: Form 50-181 requires information such as the taxpayer's name, address, tax identification number, payment details, and reasons for the refund.

Q: Is there a deadline to submit Form 50-181?

A: Yes, Form 50-181 must be submitted within four years from the date the overpayment or erroneous payment was made.

Q: How long does it take to process Form 50-181?

A: The processing time for Form 50-181 may vary, but it typically takes about 30-45 days for the refund to be issued.

Q: What should I do if I have additional questions about Form 50-181?

A: If you have additional questions, you can contact the Texas Comptroller's office directly for assistance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-181 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.