This version of the form is not currently in use and is provided for reference only. Download this version of

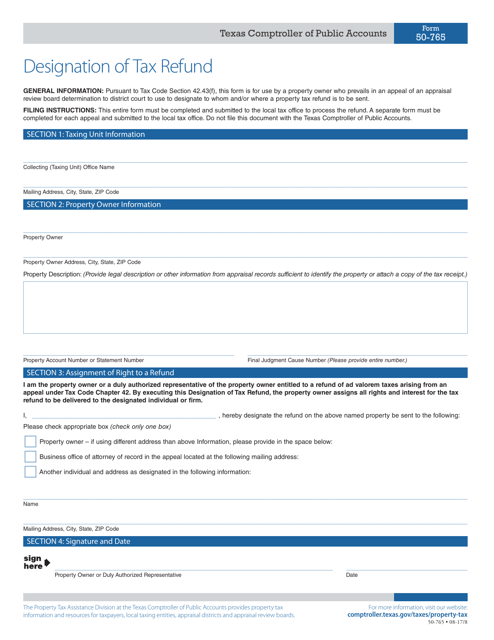

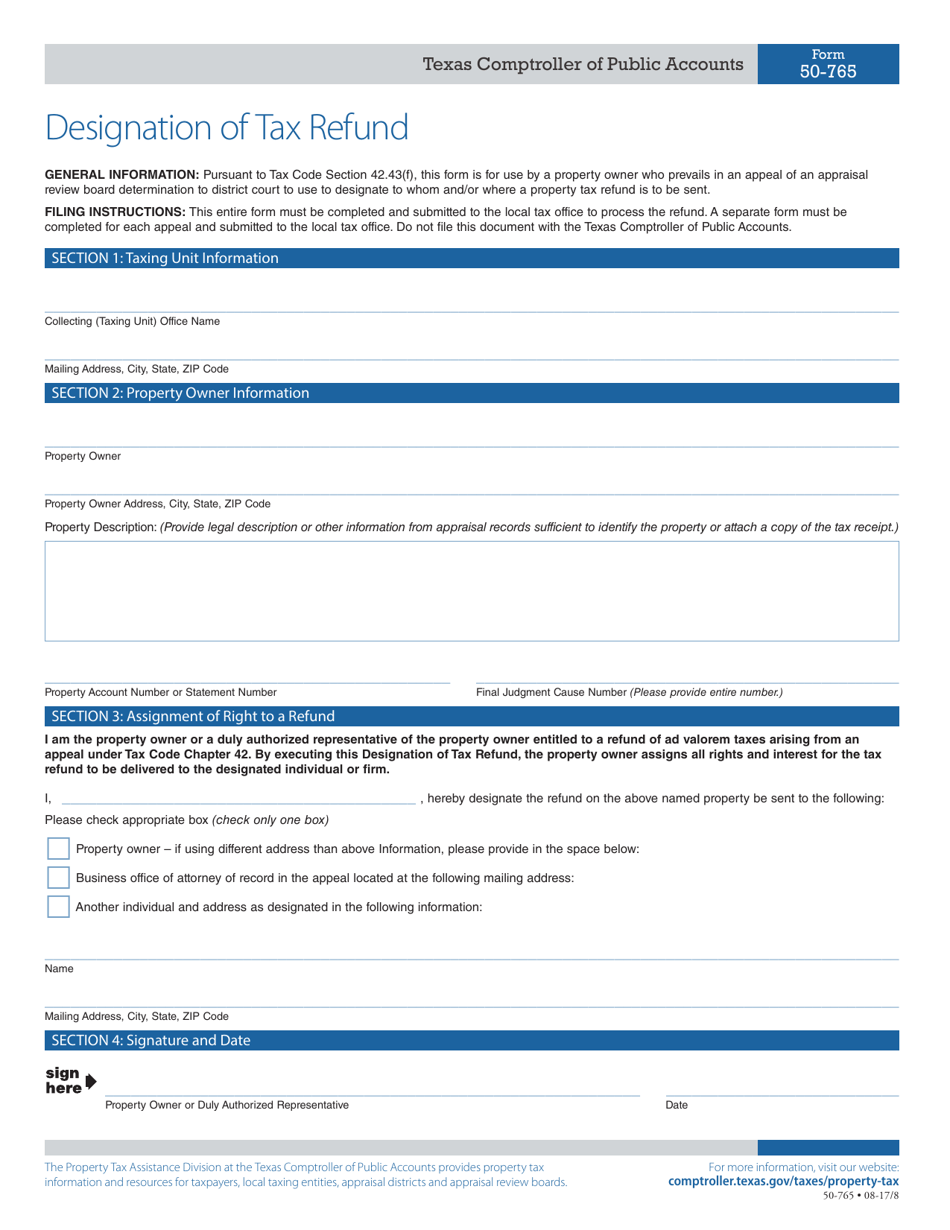

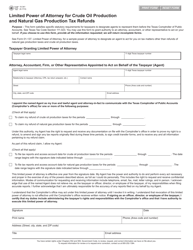

Form 50-765

for the current year.

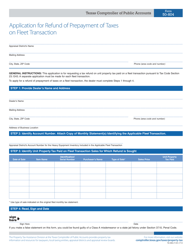

Form 50-765 Designation of Tax Refund - Texas

What Is Form 50-765?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-765?

A: Form 50-765 is the Designation of Tax Refund form in Texas.

Q: What is the purpose of Form 50-765?

A: The purpose of Form 50-765 is to designate how you want your tax refund to be applied.

Q: Do I need to fill out Form 50-765?

A: Filling out Form 50-765 is optional. If you don't designate a refund, it will be automatically applied as a credit towards future taxes.

Q: What information do I need to provide on Form 50-765?

A: You will need to provide your name, address, Social Security Number or taxpayer ID, and the amount of the refund you are designating.

Q: Can I change my refund designation after submitting Form 50-765?

A: Yes, you can change your refund designation by submitting a new Form 50-765 with the updated information.

Q: Are there any deadlines for submitting Form 50-765?

A: There is no specific deadline for submitting Form 50-765. However, it is recommended to submit it as soon as possible to ensure your refund is processed correctly.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-765 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.