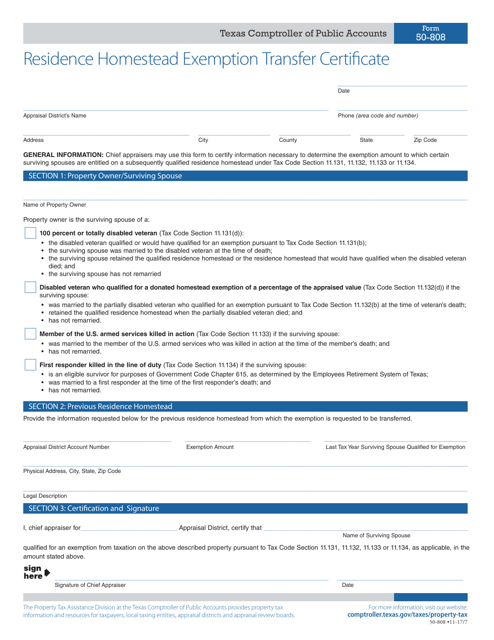

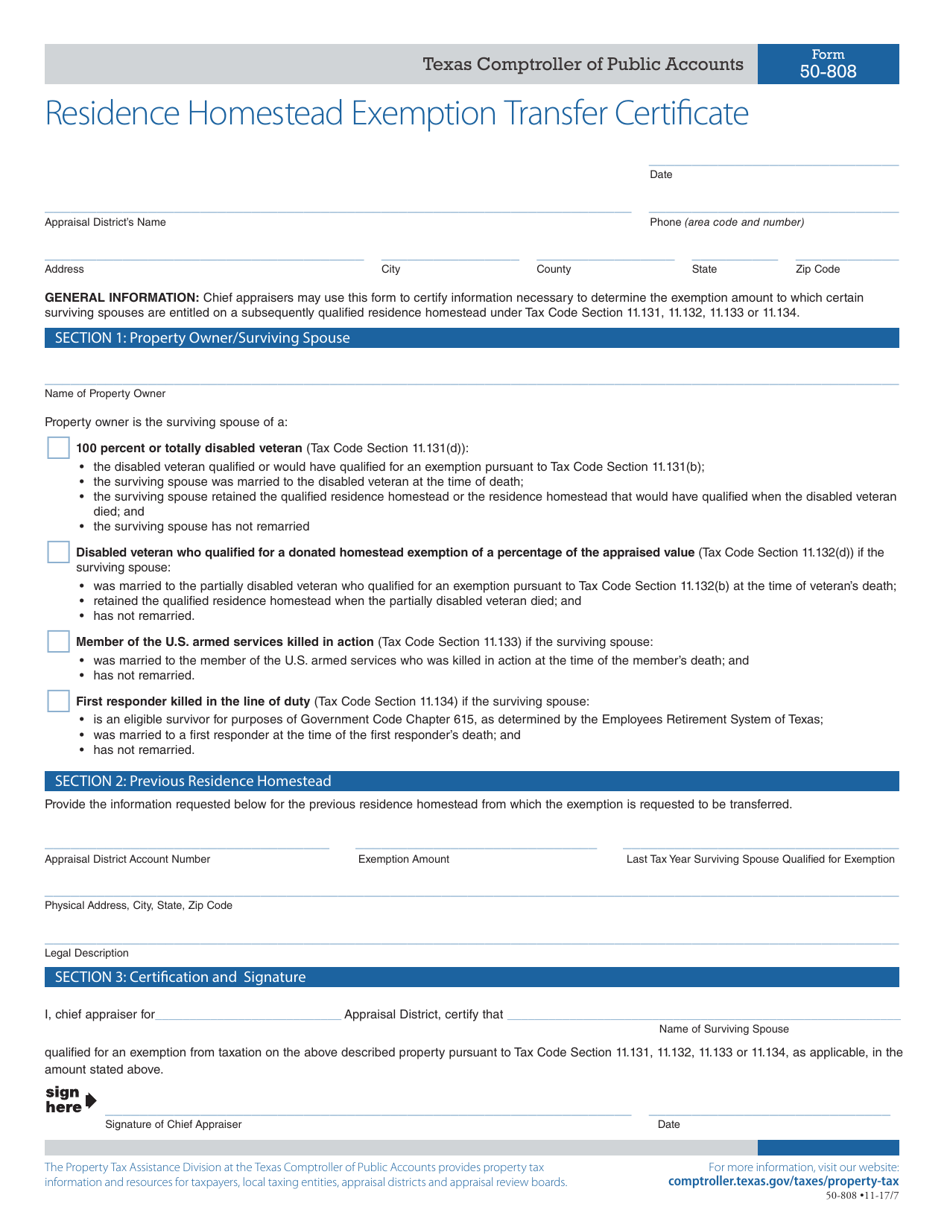

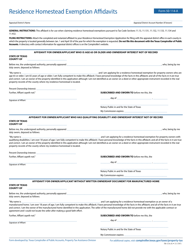

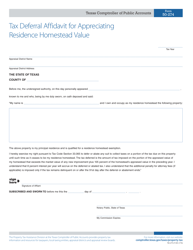

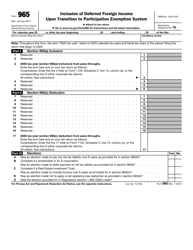

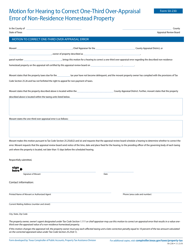

Form 50-808 Residence Homestead Exemption Transfer Certificate - Texas

What Is Form 50-808?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

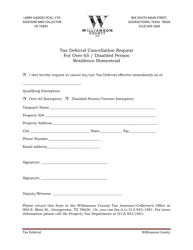

Q: What is Form 50-808?

A: Form 50-808 is the Residence Homestead Exemption Transfer Certificate in Texas.

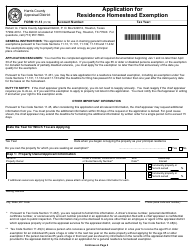

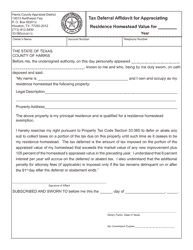

Q: What is the purpose of Form 50-808?

A: The purpose of Form 50-808 is to transfer a residence homestead exemption from one property to another in Texas.

Q: Who should use Form 50-808?

A: Form 50-808 should be used by individuals who want to transfer their residence homestead exemption to a new property in Texas.

Q: Is there a deadline to file Form 50-808?

A: Yes, Form 50-808 must be filed before the deadline set by the local appraisal district in Texas.

Q: Are there any fees associated with filing Form 50-808?

A: There may be fees associated with filing Form 50-808, depending on the local appraisal district in Texas.

Q: What supporting documents are required with Form 50-808?

A: Supporting documents, such as a copy of the deed or contract for the new property, may be required with Form 50-808 in Texas.

Q: Is Form 50-808 applicable for commercial properties?

A: No, Form 50-808 is specifically for the transfer of residence homestead exemptions and not applicable for commercial properties in Texas.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-808 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.