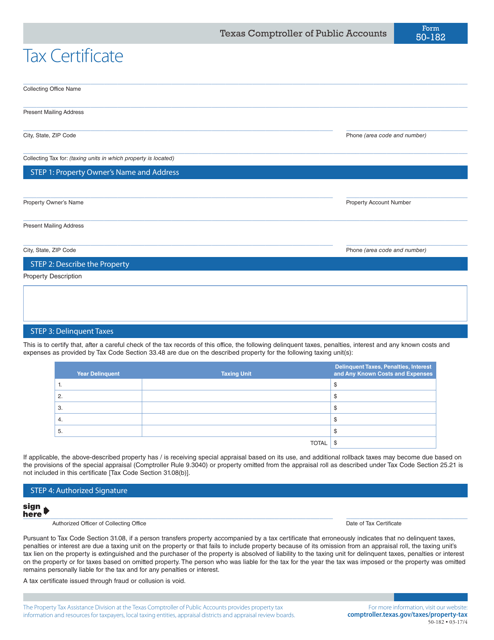

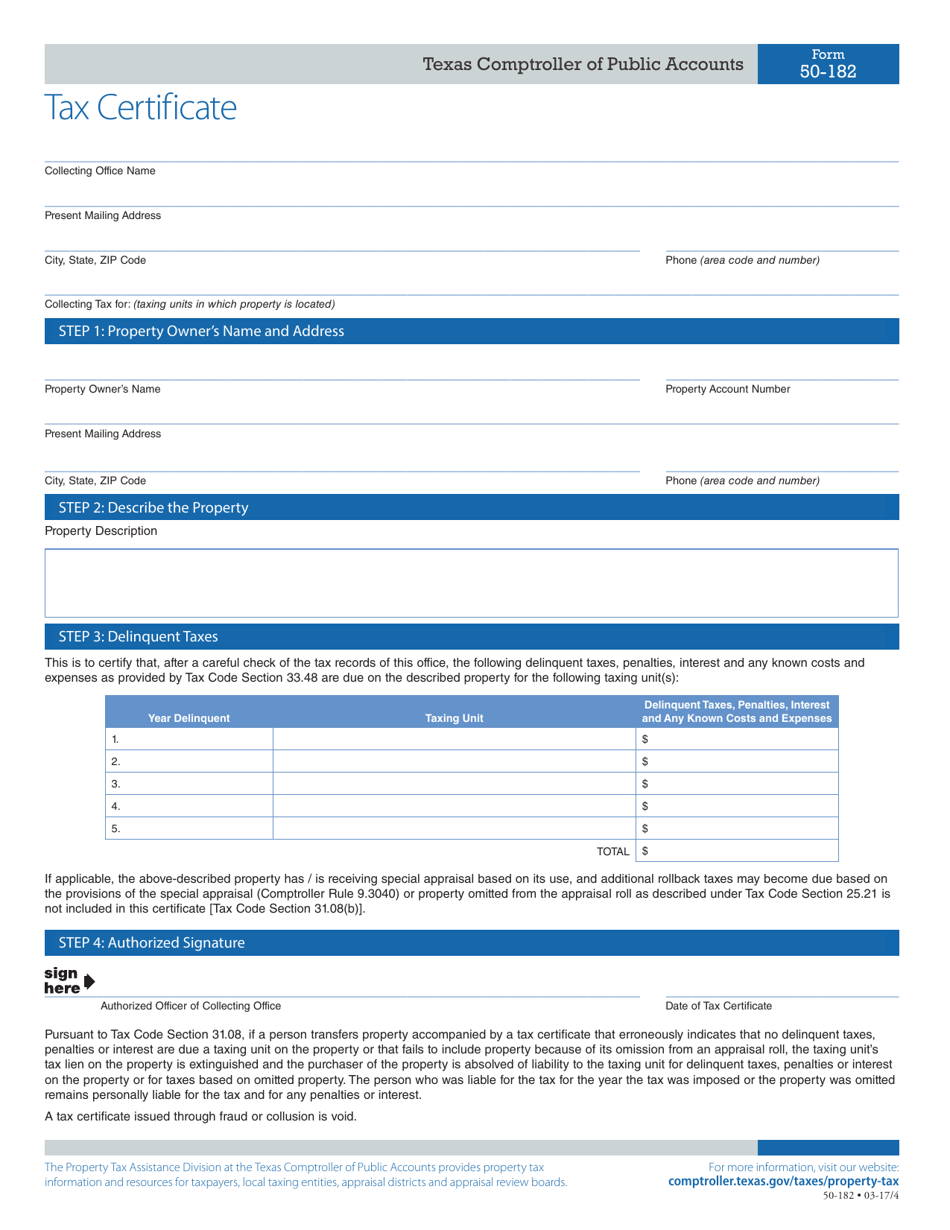

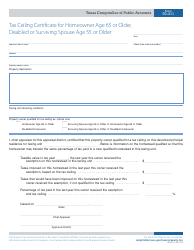

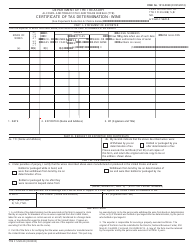

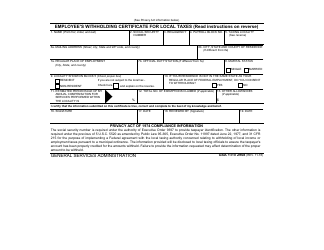

Form 50-182 Tax Certificate - Texas

What Is Form 50-182?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-182 Tax Certificate?

A: Form 50-182 is a Tax Certificate used in Texas.

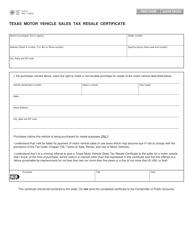

Q: Who needs to file Form 50-182 Tax Certificate?

A: Property owners or their agents are required to file Form 50-182 to receive a tax certificate.

Q: What is the purpose of Form 50-182 Tax Certificate?

A: The purpose of Form 50-182 Tax Certificate is to provide proof that all taxes on a property have been paid.

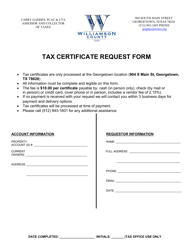

Q: Are there any fees associated with filing Form 50-182 Tax Certificate?

A: Yes, there are fees associated with filing Form 50-182 Tax Certificate. The fees vary depending on the county.

Q: When is the deadline to file Form 50-182 Tax Certificate?

A: The deadline to file Form 50-182 Tax Certificate is on or before July 24th of each year.

Q: What happens if I don't file Form 50-182 Tax Certificate?

A: Failure to file Form 50-182 Tax Certificate may result in penalties or being unable to sell the property.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-182 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.