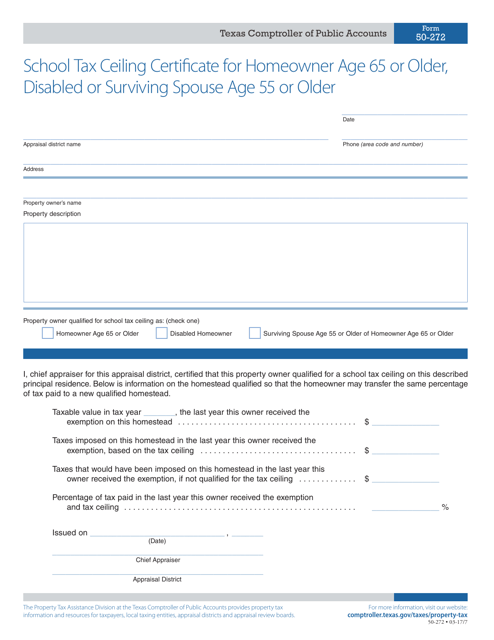

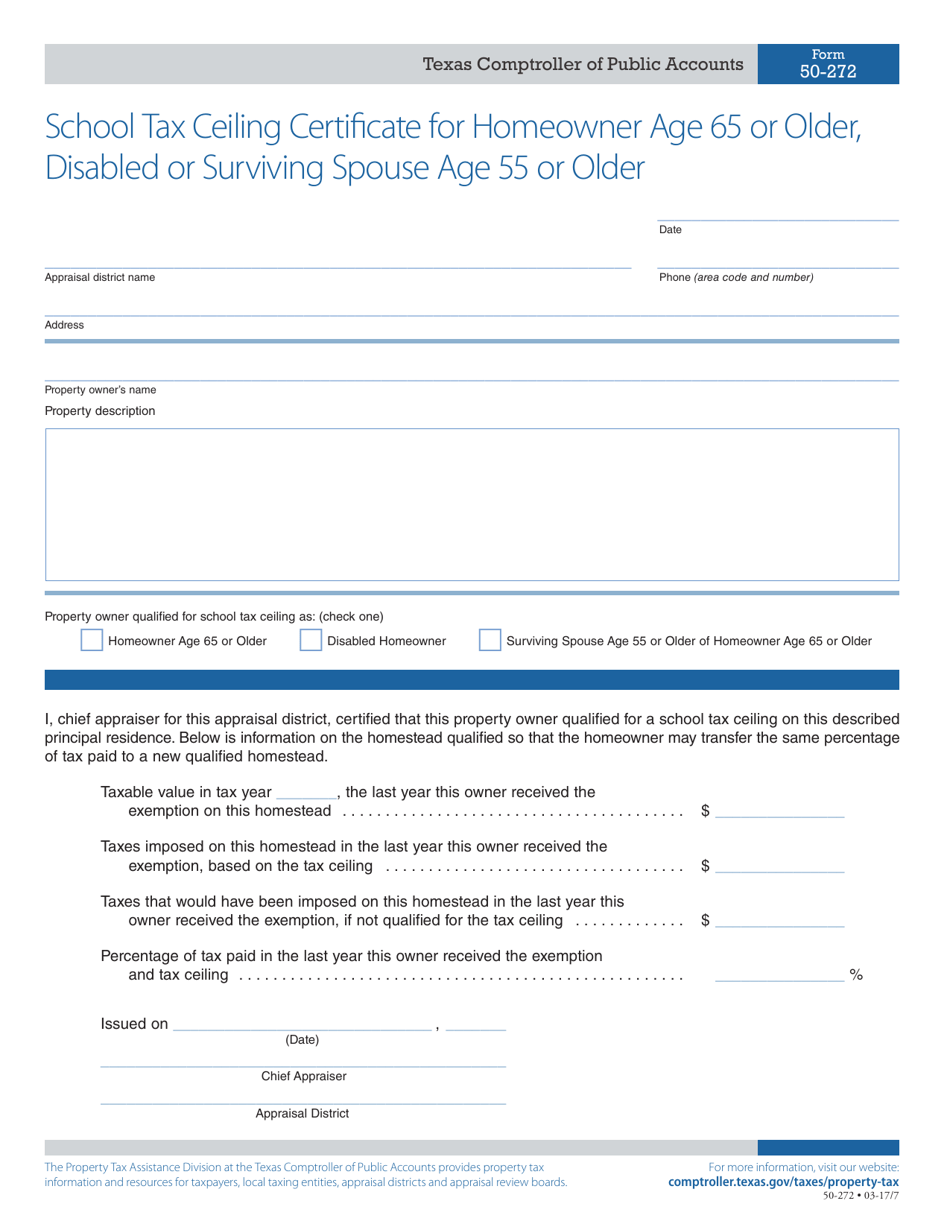

Form 50-272 School Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older - Texas

What Is Form 50-272?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-272?

A: Form 50-272 is the School Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled, or Surviving Spouse Age 55 or Older in Texas.

Q: Who is eligible to use Form 50-272?

A: Homeowners age 65 or older, disabled individuals, or surviving spouses age 55 or older in Texas are eligible to use Form 50-272.

Q: What does the Form 50-272 do?

A: The Form 50-272 allows eligible homeowners to establish a tax ceiling and limit increases in the school district portion of their property taxes.

Q: How do I apply for the tax ceiling?

A: To apply for the tax ceiling, you need to complete and submit Form 50-272 to your local appraisal district.

Q: What are the benefits of the tax ceiling?

A: The tax ceiling helps eligible homeowners by limiting the increases in the school district portion of their property taxes, providing more stability and predictability in their tax liabilities.

Q: Is there an application deadline for Form 50-272?

A: Yes, the application deadline for Form 50-272 is generally April 30th of the tax year for which the tax ceiling is sought.

Q: Do I need to reapply for the tax ceiling every year?

A: No, once you have applied and qualified for the tax ceiling, you do not need to reapply each year. However, you are required to notify the appraisal district if you move or if your qualifications change.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-272 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.