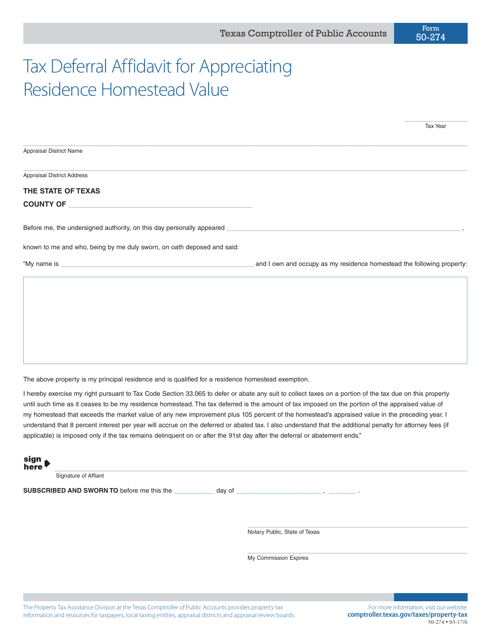

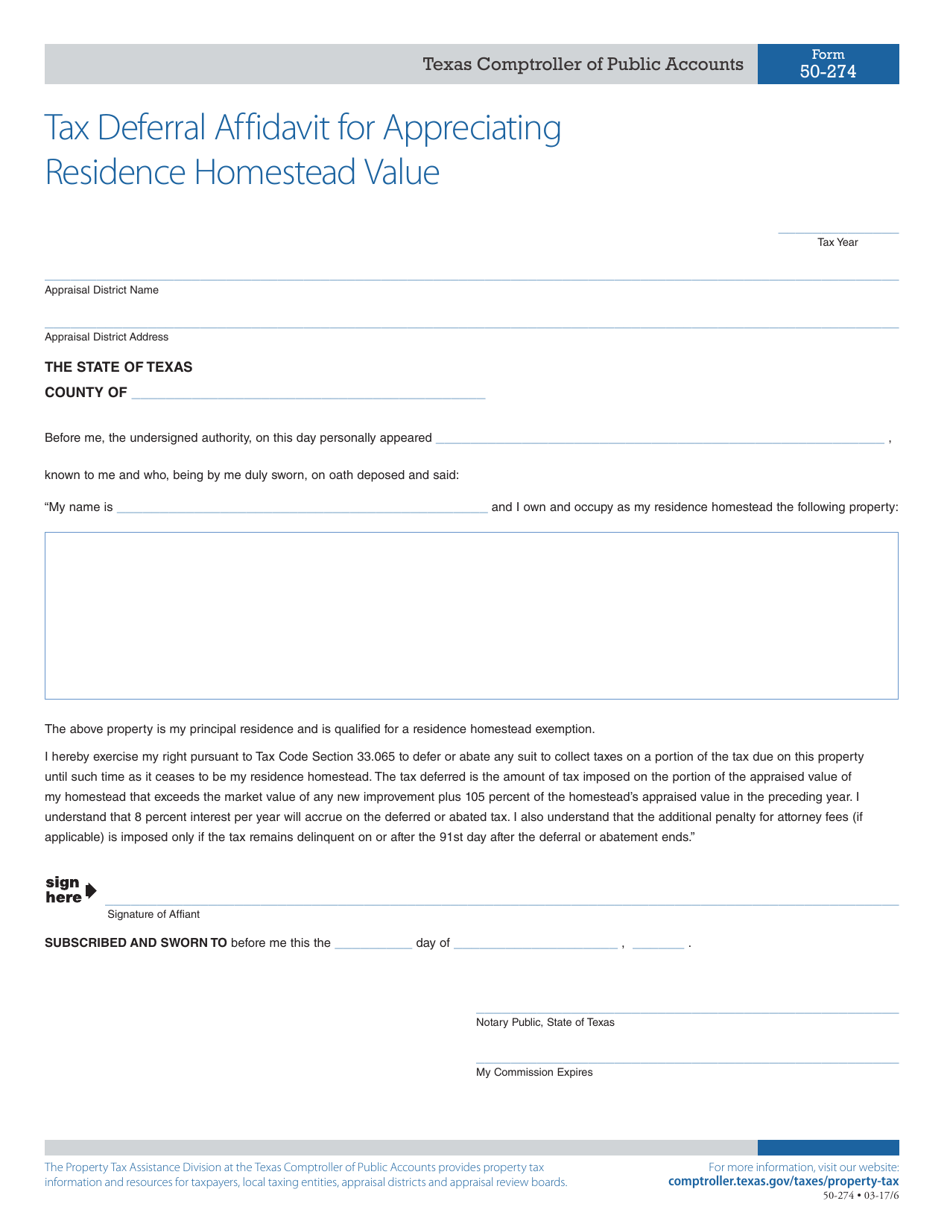

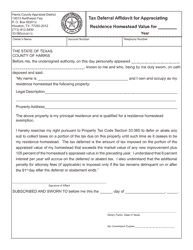

Form 50-274 Tax Deferral Affidavit for Appreciating Residence Homestead Value - Texas

What Is Form 50-274?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-274?

A: Form 50-274 is the Tax Deferral Affidavit for Appreciating Residence Homestead Value in Texas.

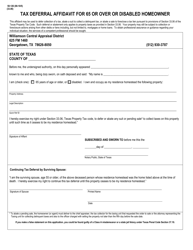

Q: Who is required to file Form 50-274?

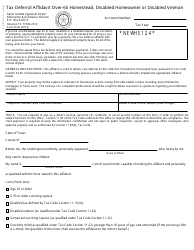

A: Homeowners in Texas whose residence homestead value is appreciating are required to file Form 50-274.

Q: What is the purpose of Form 50-274?

A: The purpose of Form 50-274 is to defer the payment of property taxes on the appreciating value of a residence homestead.

Q: How does the tax deferral work?

A: By filing Form 50-274, homeowners can defer the payment of property taxes on the increase in the value of their residence homestead until they sell the property or it is no longer their primary residence.

Q: What are the eligibility requirements for the tax deferral?

A: To be eligible for the tax deferral, homeowners must meet certain age and income requirements, and the property must be their primary residence.

Q: What is the deadline for filing Form 50-274?

A: Form 50-274 must be filed by April 30th of the year following the year in which the tax deferral is first requested.

Q: Is there a fee for filing Form 50-274?

A: No, there is no fee for filing Form 50-274.

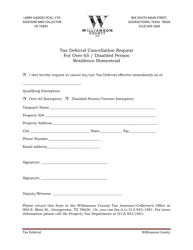

Q: Can the tax deferral be canceled?

A: Yes, the tax deferral can be canceled at any time by filing a cancellation of tax deferral form with the county appraisal district.

Q: What happens to the deferred taxes when the property is sold?

A: When the property is sold, the deferred taxes, including any interest that has accrued, must be paid.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-274 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.