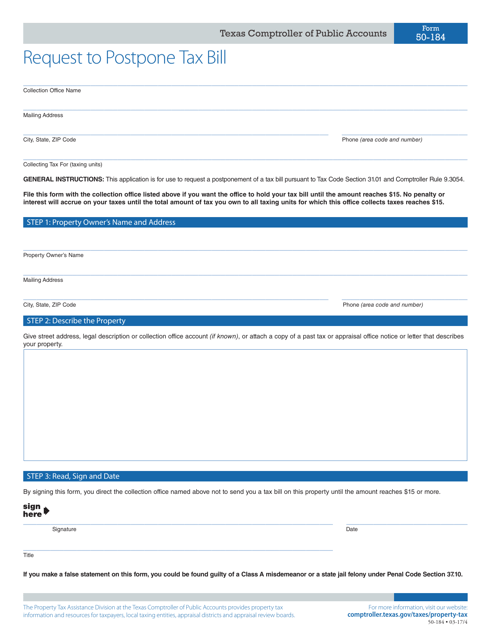

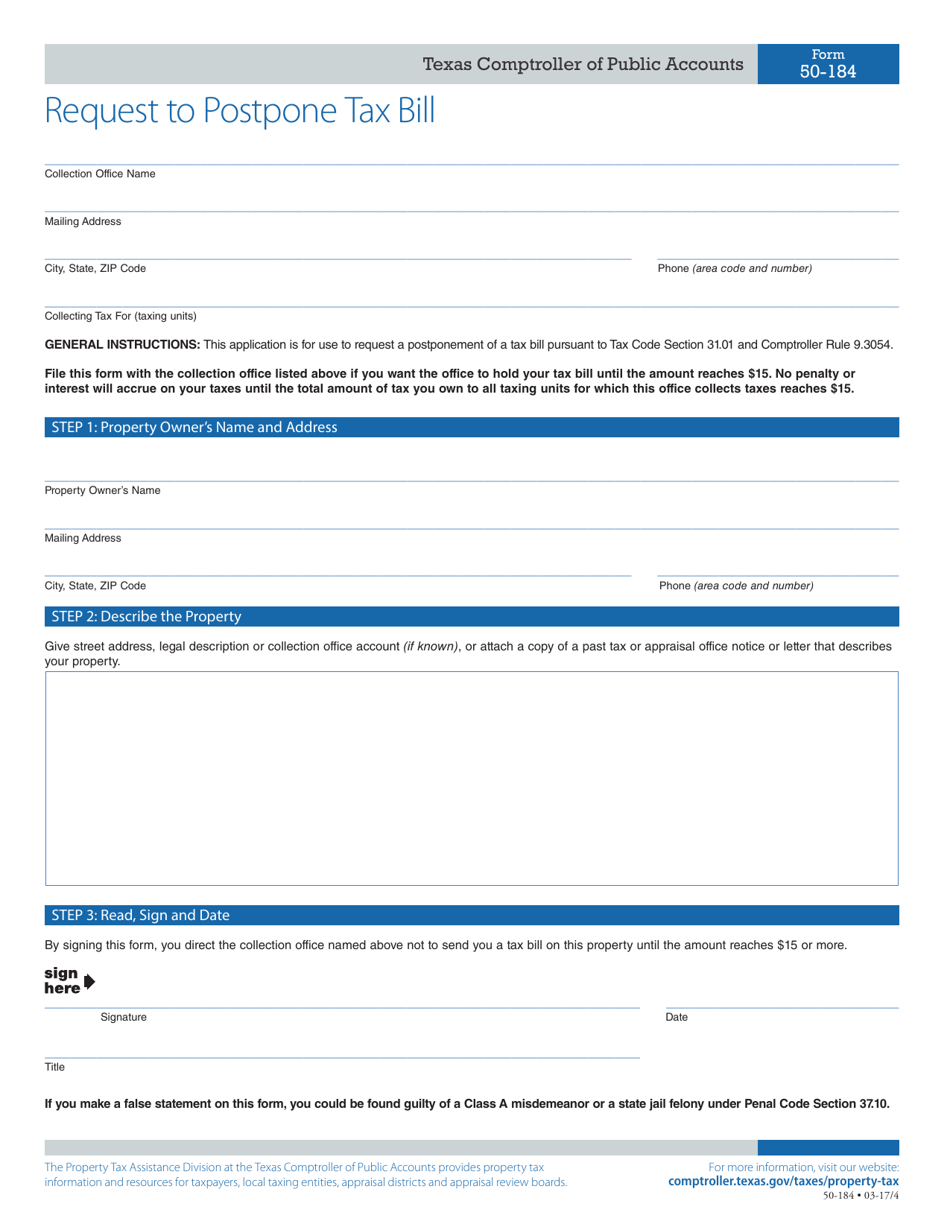

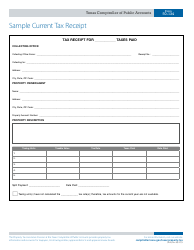

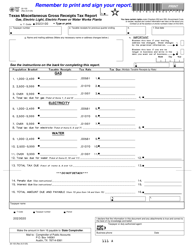

Form 50-184 Request to Postpone Tax Bill - Texas

What Is Form 50-184?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-184?

A: Form 50-184 is a request to postpone a tax bill in Texas.

Q: How do I use Form 50-184?

A: You can use Form 50-184 to request a postponement of your tax bill in Texas.

Q: When should I submit Form 50-184?

A: You should submit Form 50-184 as soon as possible, preferably before the due date of your tax bill.

Q: Is there a fee to submit Form 50-184?

A: There is no fee to submit Form 50-184.

Q: Can I request multiple postponements with Form 50-184?

A: Yes, you can request multiple postponements with Form 50-184, but each request will be evaluated separately.

Q: What happens after I submit Form 50-184?

A: After you submit Form 50-184, the Texas Comptroller's office will review your request and notify you of their decision.

Q: Can anyone use Form 50-184?

A: Form 50-184 is specifically for taxpayers in Texas who need to request a postponement of their tax bill.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-184 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.