This version of the form is not currently in use and is provided for reference only. Download this version of

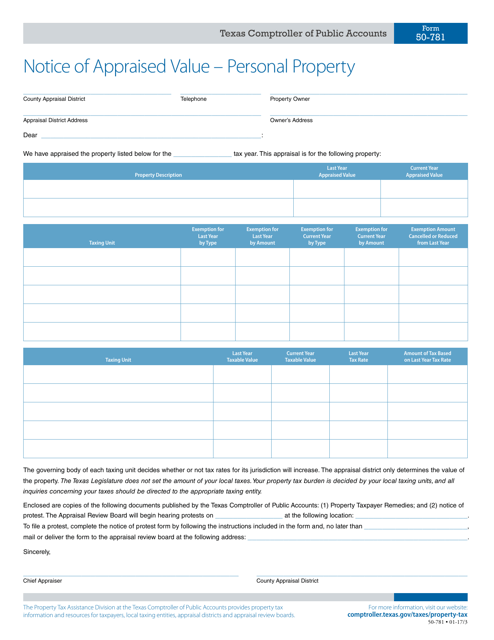

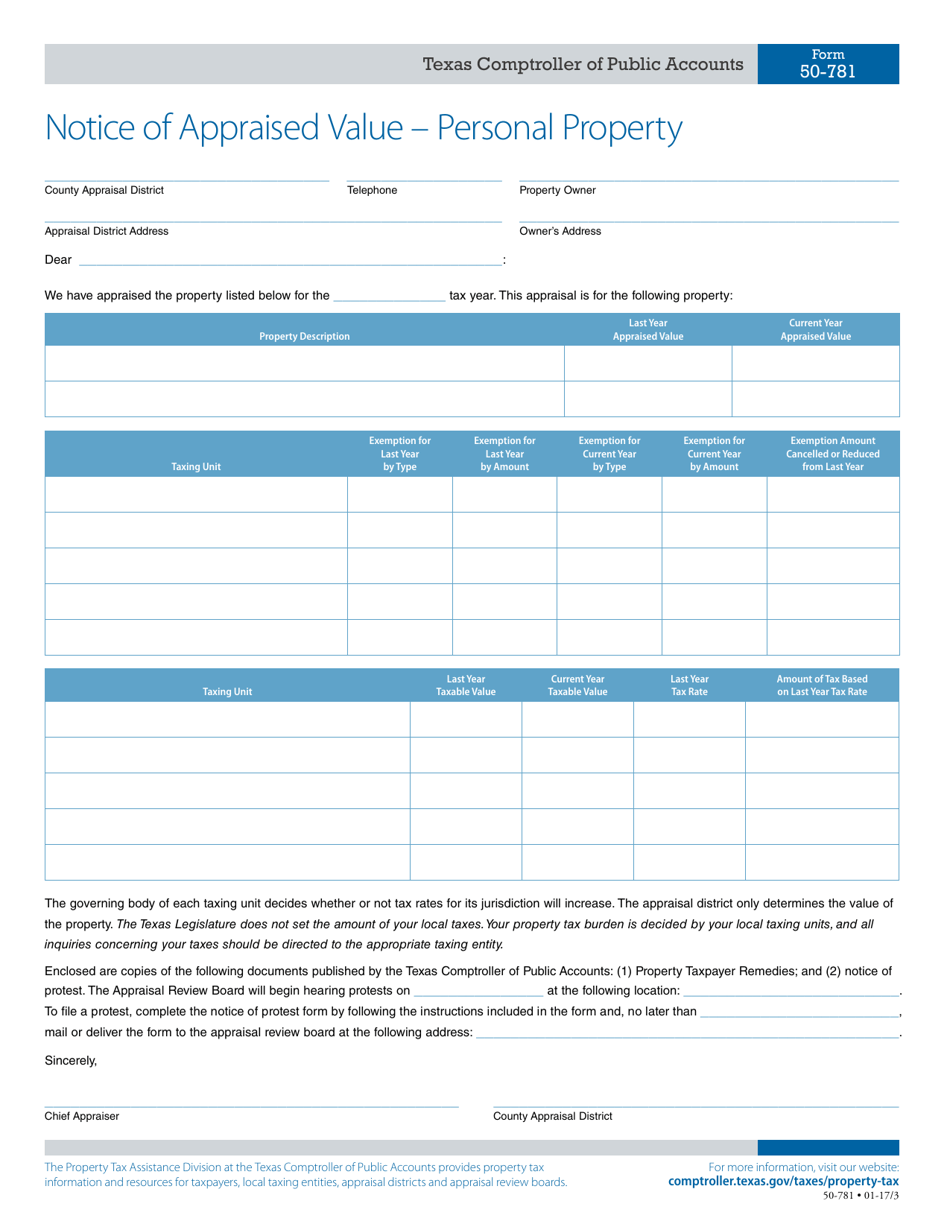

Form 50-781

for the current year.

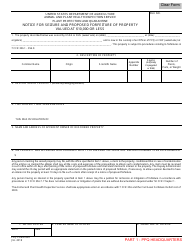

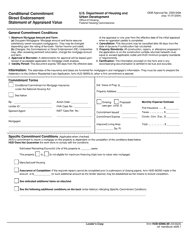

Form 50-781 Notice of Appraised Value - Personal Property - Texas

What Is Form 50-781?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-781?

A: Form 50-781 is the Notice of Appraised Value for Personal Property in Texas.

Q: What is the purpose of Form 50-781?

A: Form 50-781 is used to inform property owners in Texas of the appraised value of their personal property.

Q: Who needs to fill out Form 50-781?

A: Form 50-781 is filled out by the county appraisal district in Texas and sent to property owners.

Q: When is Form 50-781 due?

A: The due date for Form 50-781 varies depending on the county. Property owners should refer to the instructions on the form or contact their county appraisal district for the specific due date.

Q: What happens after I receive Form 50-781?

A: After receiving Form 50-781, property owners have the opportunity to review the appraised value and make any necessary corrections or protests with the county appraisal district.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-781 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.