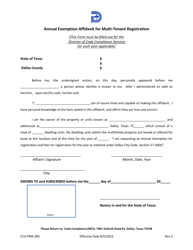

This version of the form is not currently in use and is provided for reference only. Download this version of

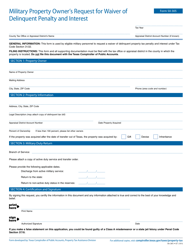

Form 50-283

for the current year.

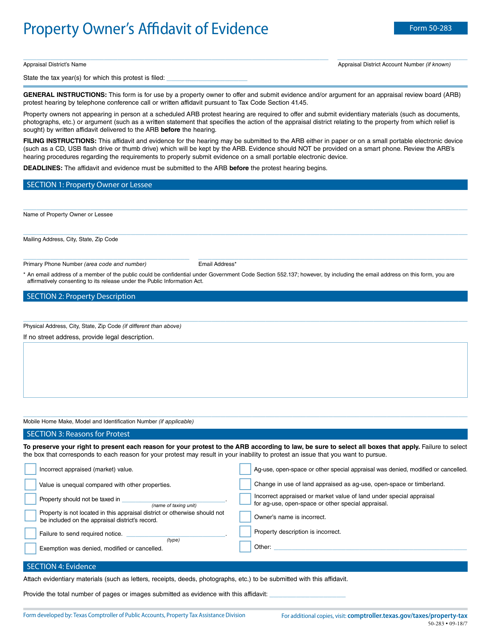

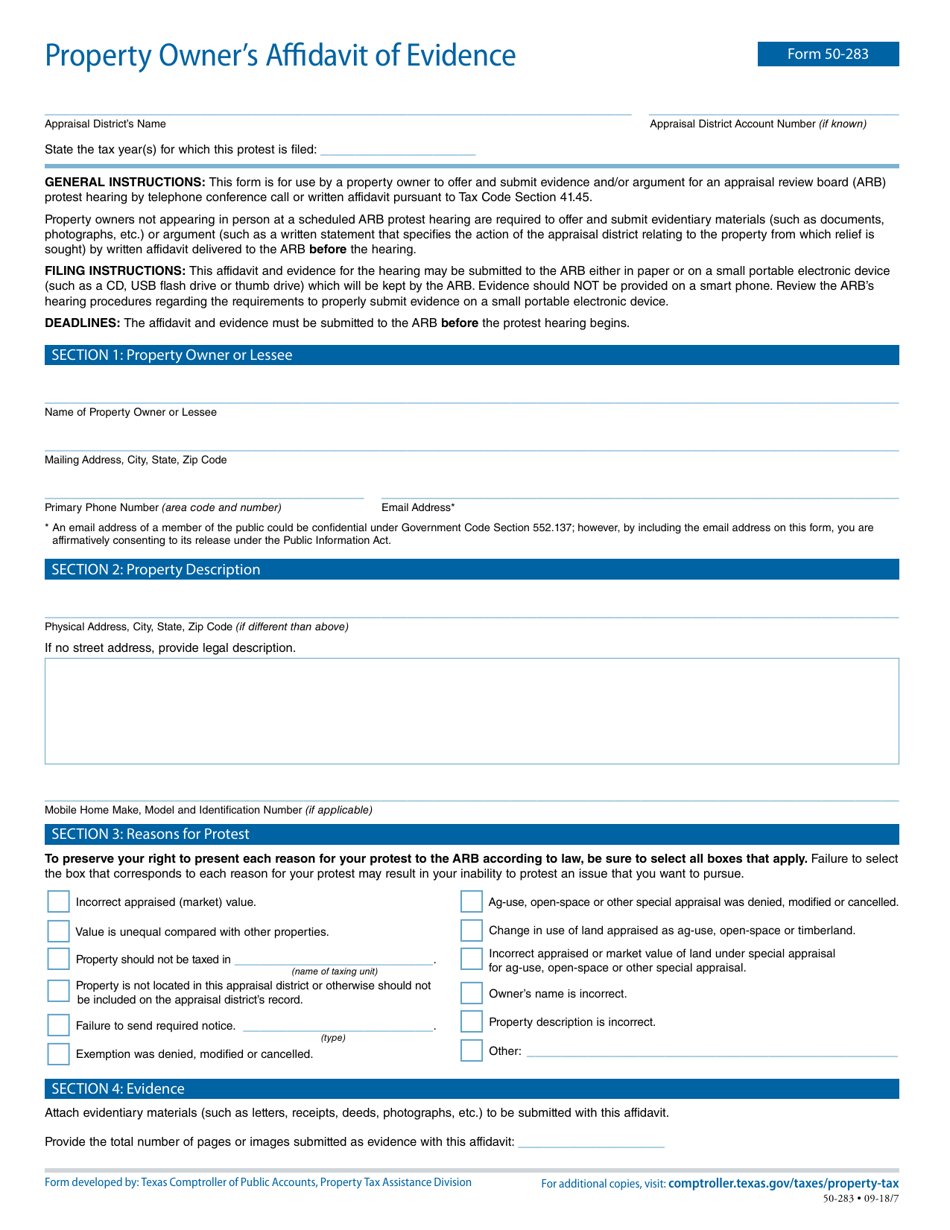

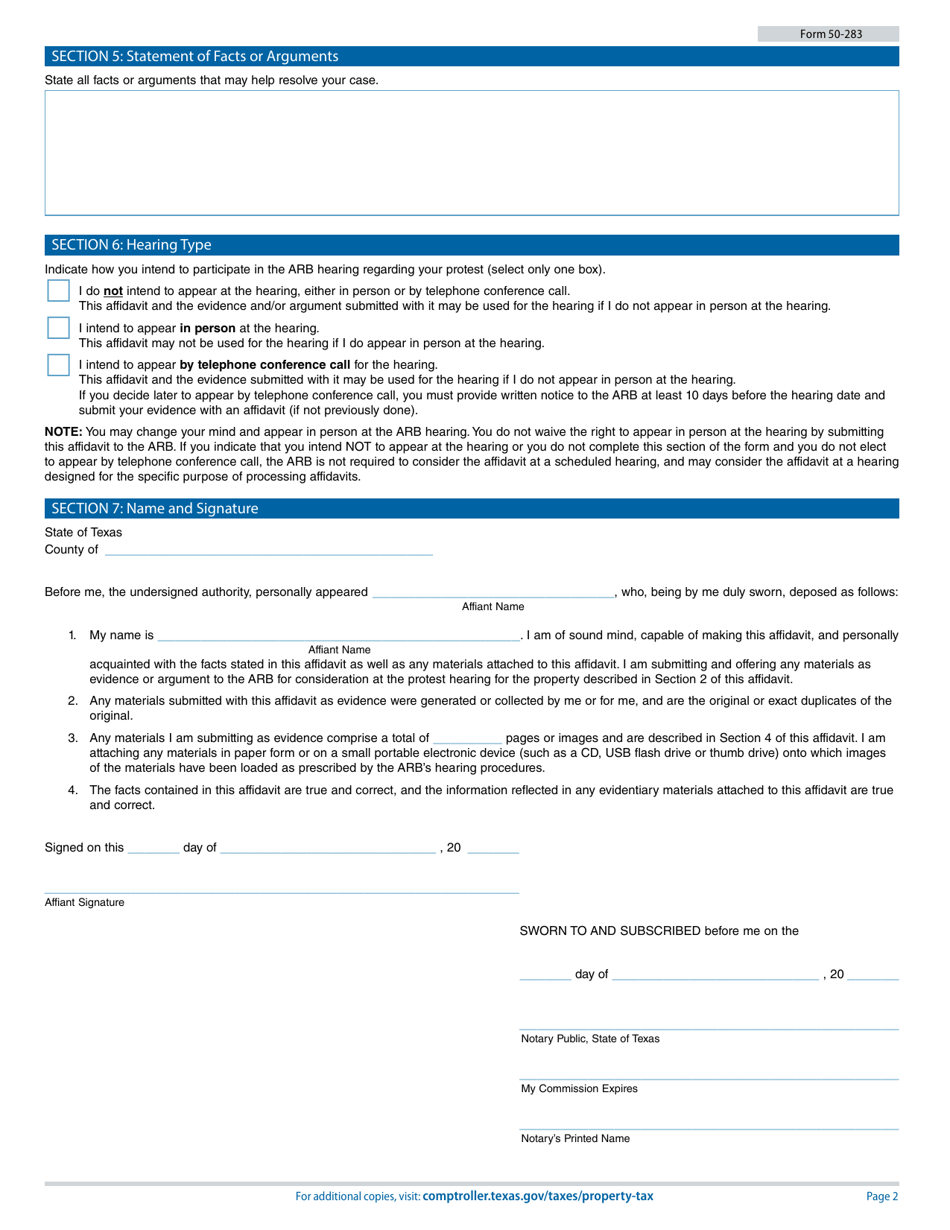

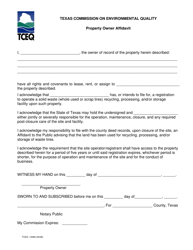

Form 50-283 Property Owner's Affidavit of Evidence - Texas

What Is Form 50-283?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-283?

A: Form 50-283 is the Property Owner's Affidavit of Evidence used in Texas.

Q: Who needs to fill out Form 50-283?

A: Property owners in Texas need to fill out Form 50-283.

Q: What is the purpose of Form 50-283?

A: The purpose of Form 50-283 is to provide evidence of the ownership of a property.

Q: What information is required on Form 50-283?

A: Form 50-283 requires information such as the property owner's name, address, and legal description of the property.

Q: Are there any fees associated with filing Form 50-283?

A: There are no fees associated with filing Form 50-283.

Q: When should Form 50-283 be filed?

A: Form 50-283 should be filed when requested by the taxing authority or as part of the property tax assessment process.

Q: Is Form 50-283 specific to Texas?

A: Yes, Form 50-283 is specific to Texas and is used for property tax purposes in the state.

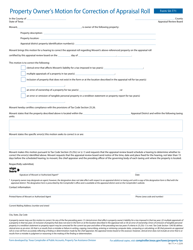

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-283 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.