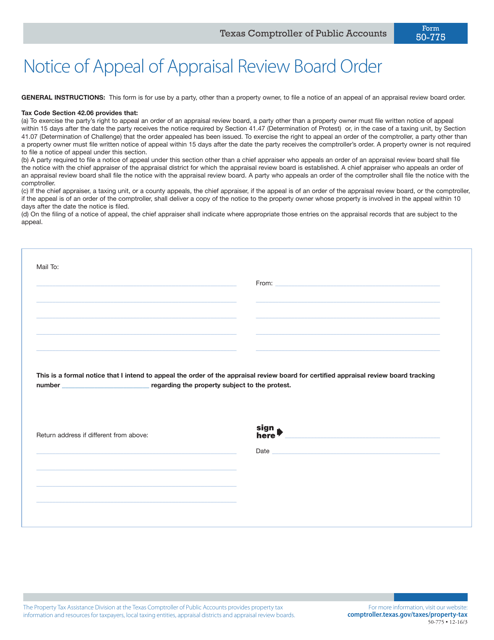

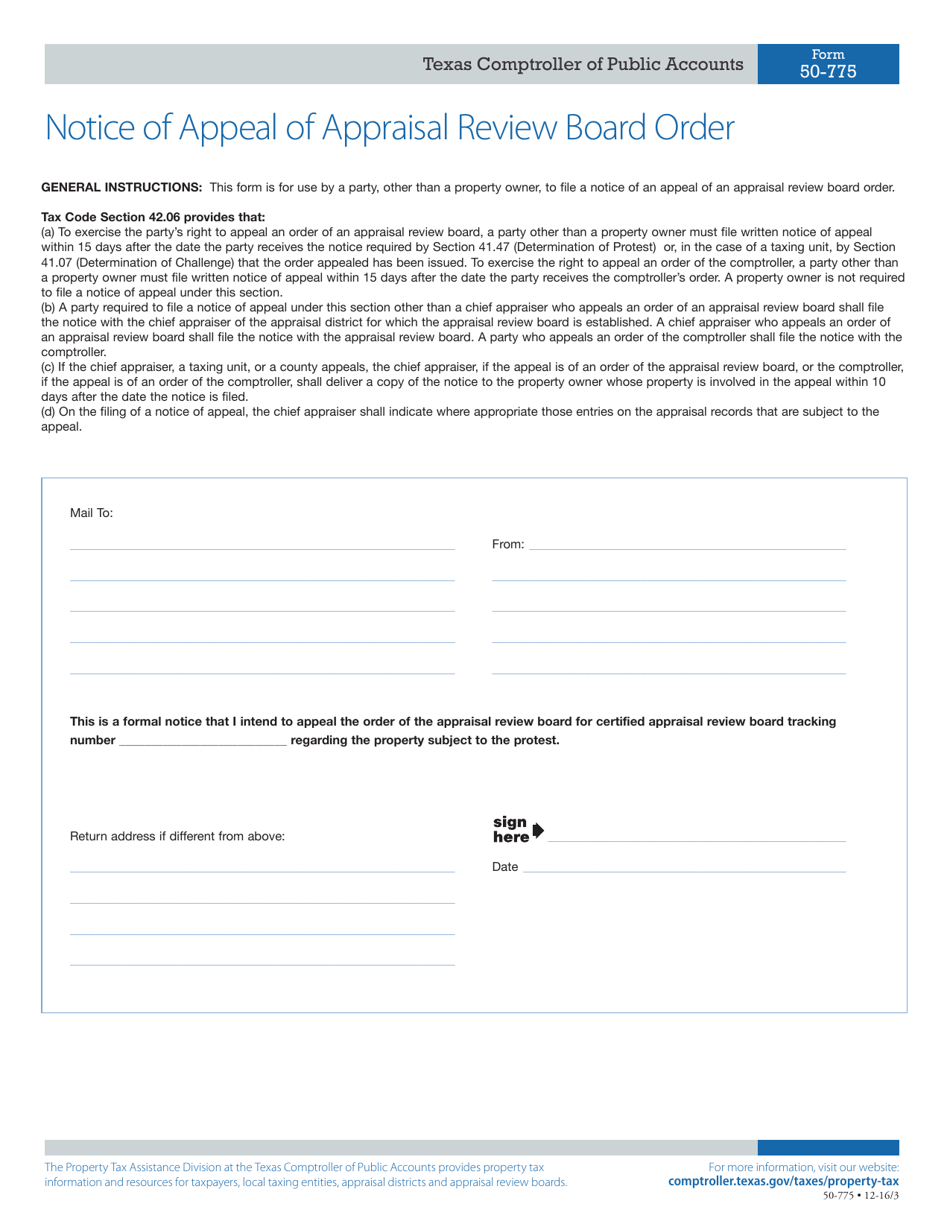

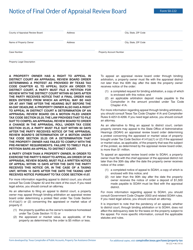

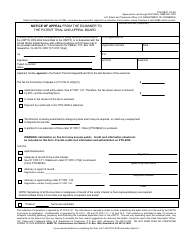

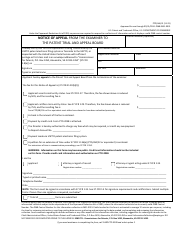

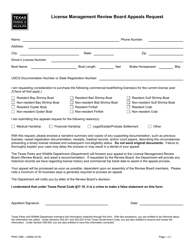

Form 50-775 Notice of Appeal of Appraisal Review Board Order - Texas

What Is Form 50-775?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-775?

A: Form 50-775 is a Notice of Appeal of Appraisal Review Board Order in Texas.

Q: What is the purpose of Form 50-775?

A: The purpose of Form 50-775 is to appeal the decision of the Appraisal Review Board in Texas.

Q: Who can file Form 50-775?

A: Any property owner who disagrees with the decision of the Appraisal Review Board can file Form 50-775.

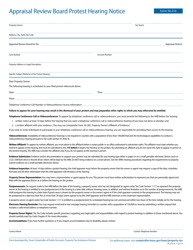

Q: What information is required in Form 50-775?

A: Form 50-775 requires information such as the property owner's name, property address, and reasons for the appeal.

Q: What is the deadline for filing Form 50-775?

A: The deadline for filing Form 50-775 is generally May 31st following the year the Appraisal Review Board order is received.

Q: What happens after filing Form 50-775?

A: After filing Form 50-775, the case will be scheduled for a hearing before the Appraisal Review Board or a district court.

Q: Can I get assistance in filling out Form 50-775?

A: Yes, you can seek assistance from the local Appraisal District or a qualified attorney in filling out Form 50-775.

Q: Is there a fee for filing Form 50-775?

A: There may be filing fees associated with filing Form 50-775, depending on the local Appraisal District's policies.

Q: Can I submit additional evidence with Form 50-775?

A: Yes, you can submit additional evidence to support your appeal along with Form 50-775.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-775 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.