This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-223

for the current year.

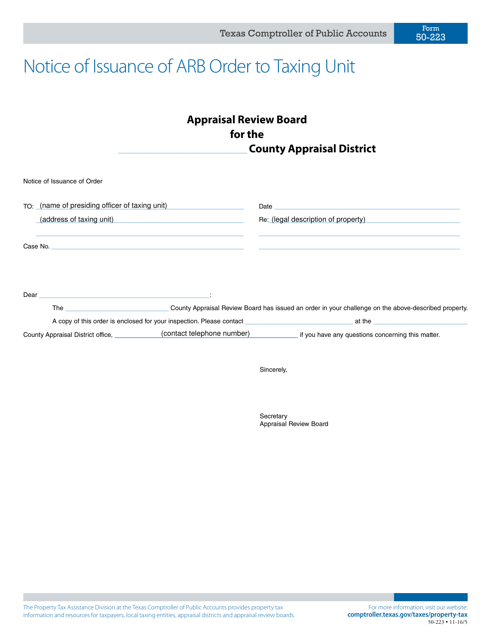

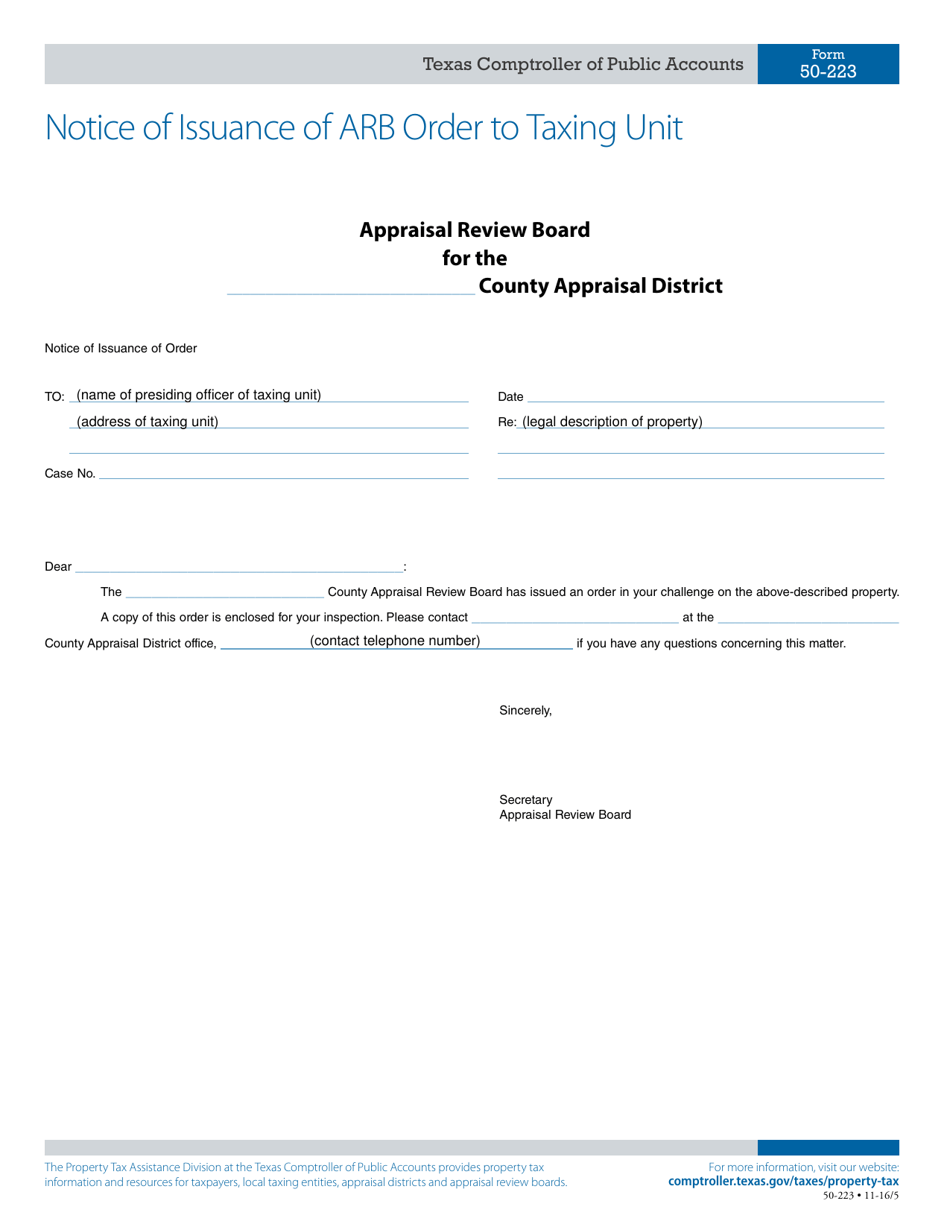

Form 50-223 Notice of Issuance of Arb Order to Taxing Unit - Texas

What Is Form 50-223?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-223?

A: Form 50-223 is the Notice of Issuance of Arbitration Order to Taxing Unit in Texas.

Q: What is the purpose of Form 50-223?

A: The purpose of Form 50-223 is to notify a taxing unit that an arbitration order has been issued.

Q: Who uses Form 50-223?

A: Form 50-223 is used by the entity that issued the arbitration order to notify the taxing unit.

Q: What information is required on Form 50-223?

A: Form 50-223 requires information such as the name and contact details of the taxing unit, the arbitration order number, and the date of issuance.

Q: Is there a deadline for submitting Form 50-223?

A: Yes, Form 50-223 must be submitted to the taxing unit within a specified time frame.

Q: What happens after Form 50-223 is submitted?

A: After Form 50-223 is submitted, the taxing unit will take appropriate action based on the arbitration order.

Q: Are there any fees associated with filing Form 50-223?

A: There are no fees associated with filing Form 50-223.

Q: Can Form 50-223 be filed electronically?

A: Yes, Form 50-223 can be filed electronically.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-223 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.