This version of the form is not currently in use and is provided for reference only. Download this version of

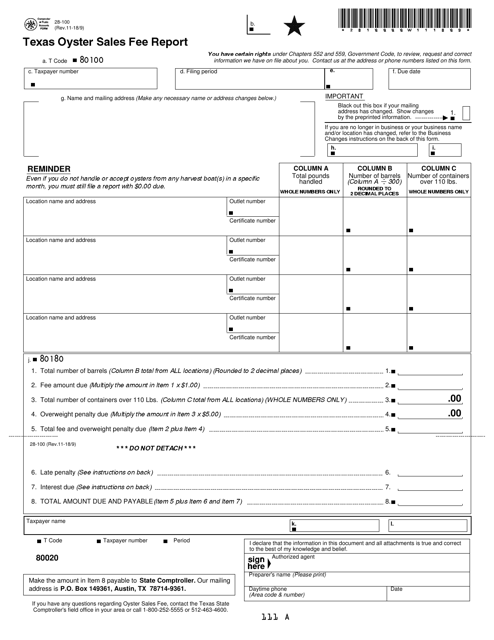

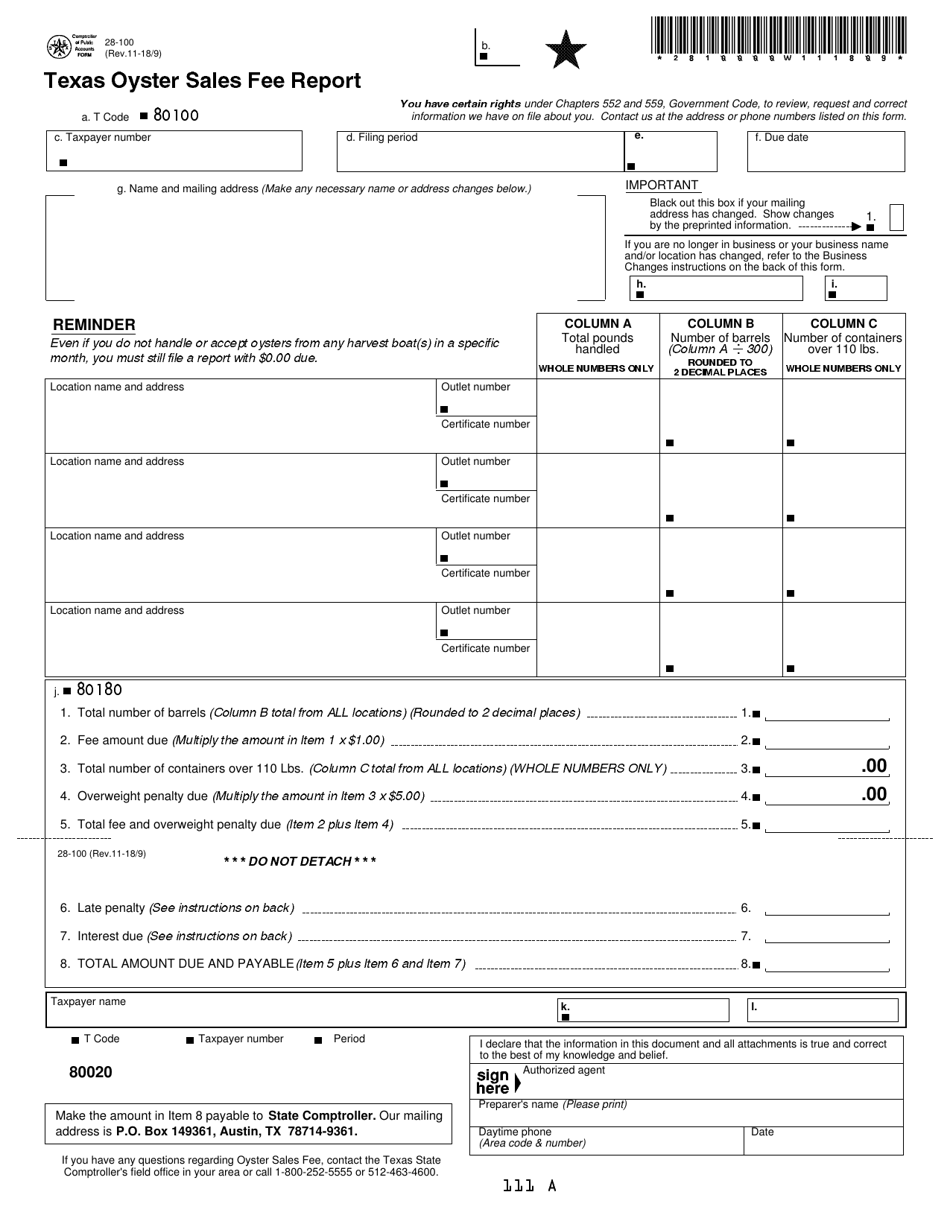

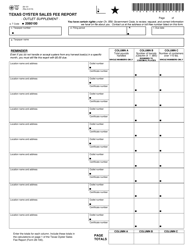

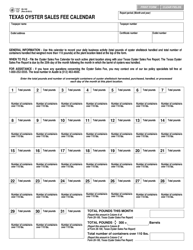

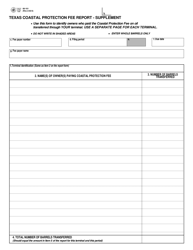

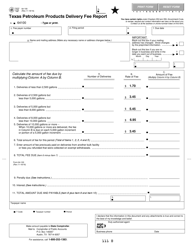

Form 28-100

for the current year.

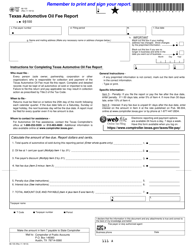

Form 28-100 Texas Oyster Sales Fee Report - Texas

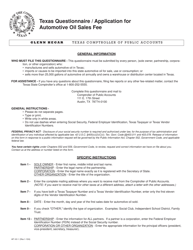

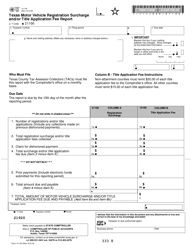

What Is Form 28-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 28-100?

A: Form 28-100 is a Texas Oyster Sales Fee Report.

Q: What is the purpose of Form 28-100?

A: The purpose of Form 28-100 is to report oyster sales fees in Texas.

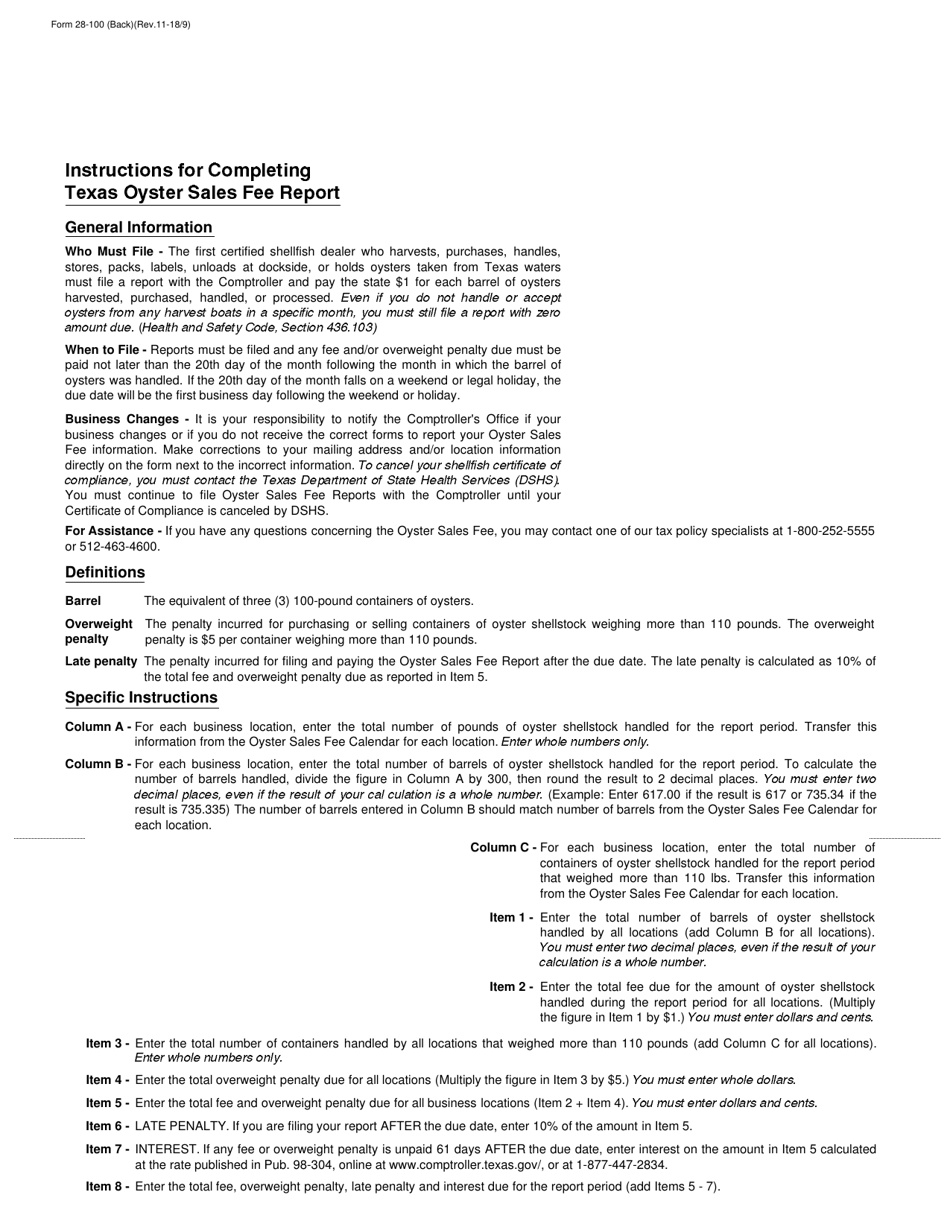

Q: Who needs to file Form 28-100?

A: Any business or individual engaged in oyster sales in Texas needs to file Form 28-100.

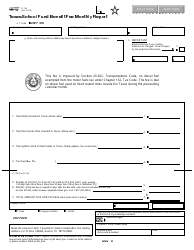

Q: How often is Form 28-100 filed?

A: Form 28-100 is filed monthly, on or before the 20th day of the month following the reporting month.

Q: What information is required on Form 28-100?

A: Form 28-100 requires information including sales volume, selling price, and fees owed.

Q: What are the consequences of not filing Form 28-100?

A: Failure to file Form 28-100 can result in penalties and interest charges.

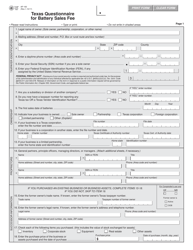

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 28-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.