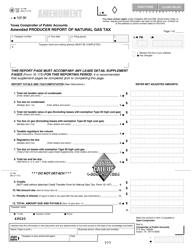

This version of the form is not currently in use and is provided for reference only. Download this version of

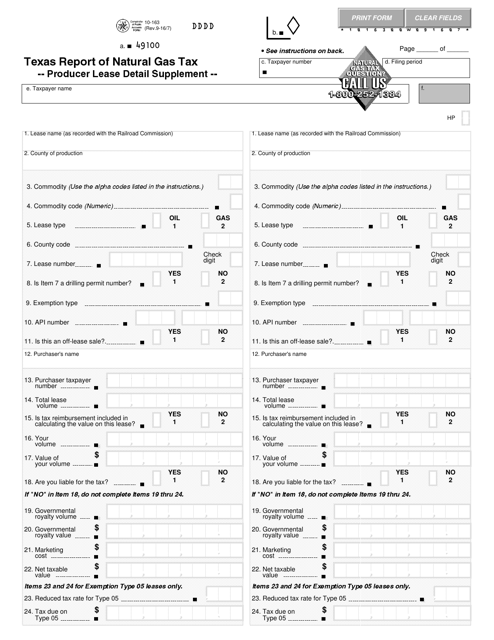

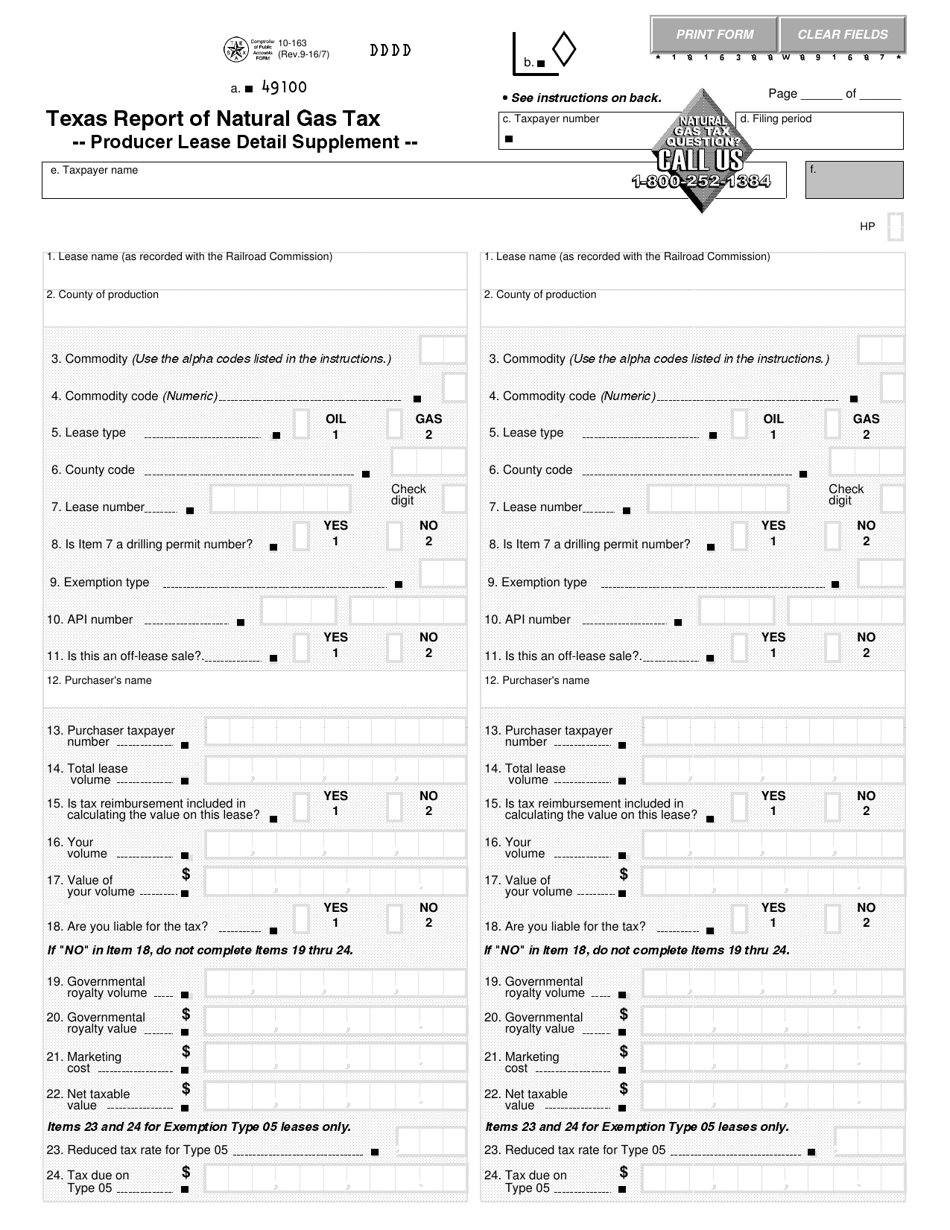

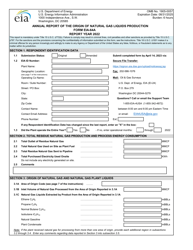

Form 10-163

for the current year.

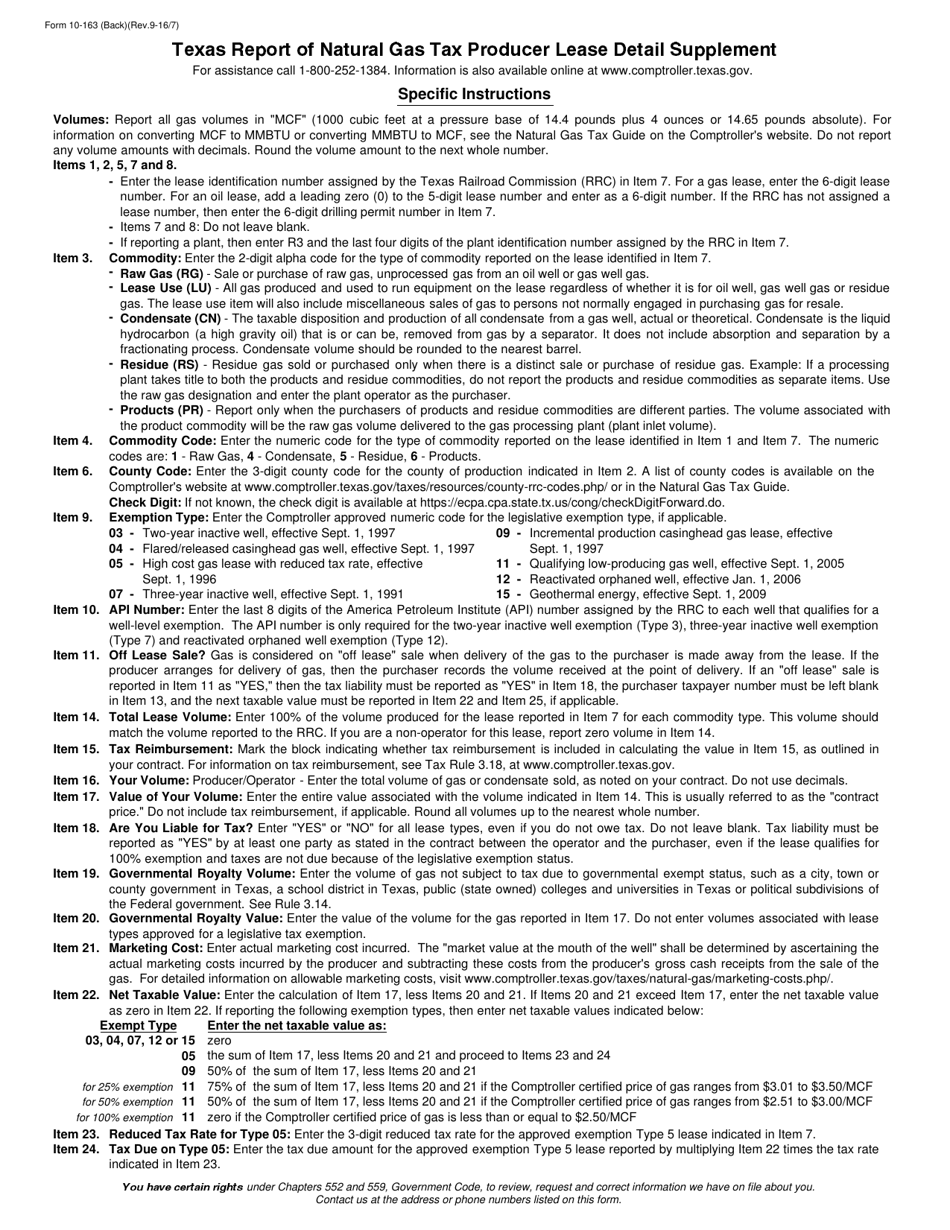

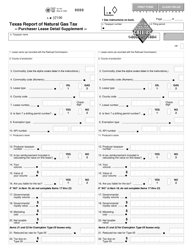

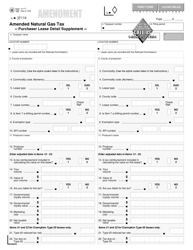

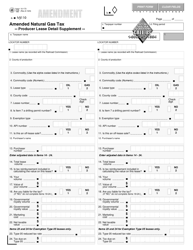

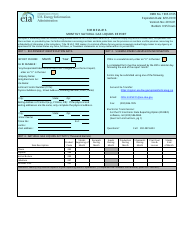

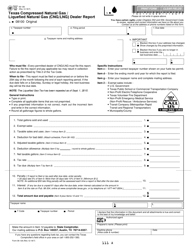

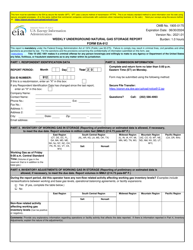

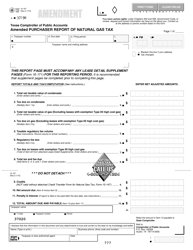

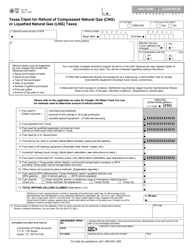

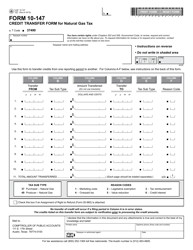

Form 10-163 Texas Report of Natural Gas Tax Producer Lease Detail Supplement - Texas

What Is Form 10-163?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-163?

A: Form 10-163 is the Texas Report of Natural Gas Tax Producer Lease Detail Supplement.

Q: What is the purpose of Form 10-163?

A: The purpose of Form 10-163 is to report detailed information about natural gas production on leases in Texas.

Q: Who needs to file Form 10-163?

A: Producers of natural gas on leases in Texas are required to file Form 10-163.

Q: What information is required on Form 10-163?

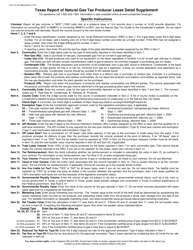

A: Form 10-163 requires detailed information about each lease, including lease number, county, operator name, and production data.

Q: When is the deadline to file Form 10-163?

A: The deadline to file Form 10-163 is typically the 25th day of the month following the month in which the production occurred.

Q: Are there any penalties for not filing Form 10-163?

A: Yes, there are penalties for failing to file Form 10-163, including fines and interest on unpaid taxes.

Q: Is Form 10-163 specific to Texas only?

A: Yes, Form 10-163 is specific to natural gas production on leases in Texas.

Q: Is Form 10-163 related to the payment of natural gas taxes?

A: Yes, Form 10-163 is used to report natural gas production for the purpose of calculating and paying taxes.

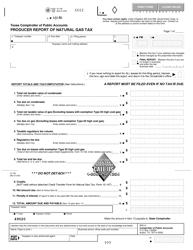

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-163 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.