This version of the form is not currently in use and is provided for reference only. Download this version of

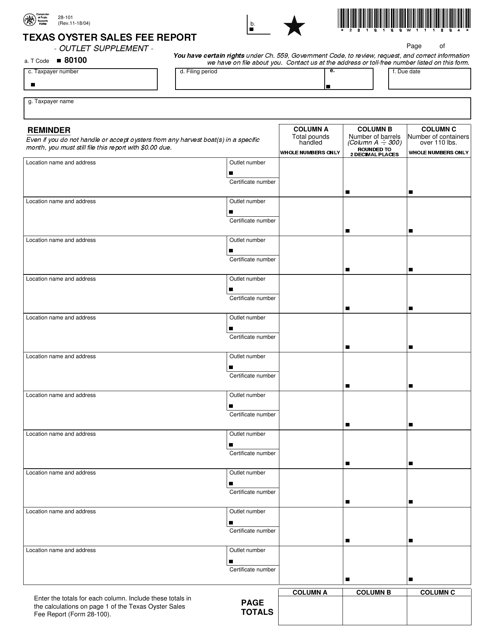

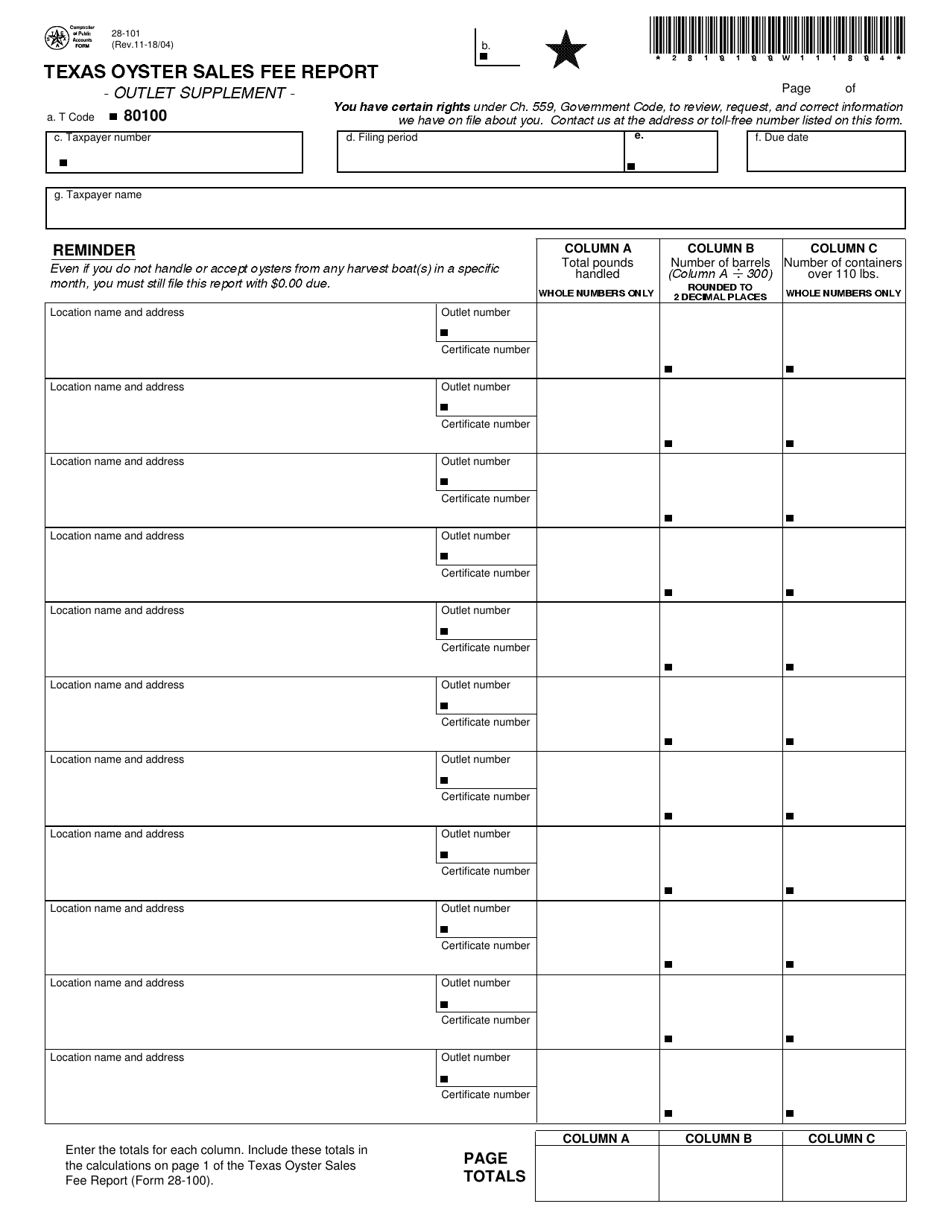

Form 28-101

for the current year.

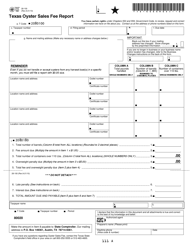

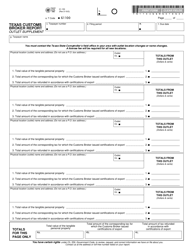

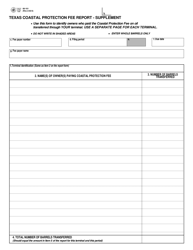

Form 28-101 Texas Oyster Sales Fee Report- Outlet Supplement - Texas

What Is Form 28-101?

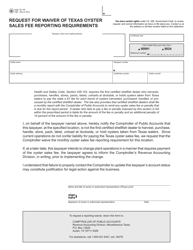

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 28-101?

A: Form 28-101 is the Texas Oyster Sales Fee Report- Outlet Supplement - Texas.

Q: What is the purpose of Form 28-101?

A: The purpose of Form 28-101 is to report the sales of oysters in Texas.

Q: Who needs to fill out Form 28-101?

A: Businesses and individuals involved in the sale of oysters in Texas need to fill out Form 28-101.

Q: What information is required in Form 28-101?

A: Form 28-101 requires information such as the name and address of the outlet, sales and purchases data, and payment information.

Q: Is there a deadline for submitting Form 28-101?

A: Yes, Form 28-101 must be submitted on a monthly basis, and the deadline for submission is typically the 20th day of the following month.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 28-101 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.