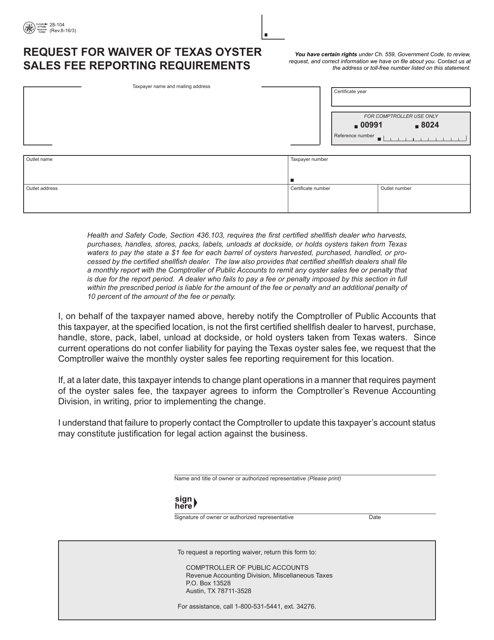

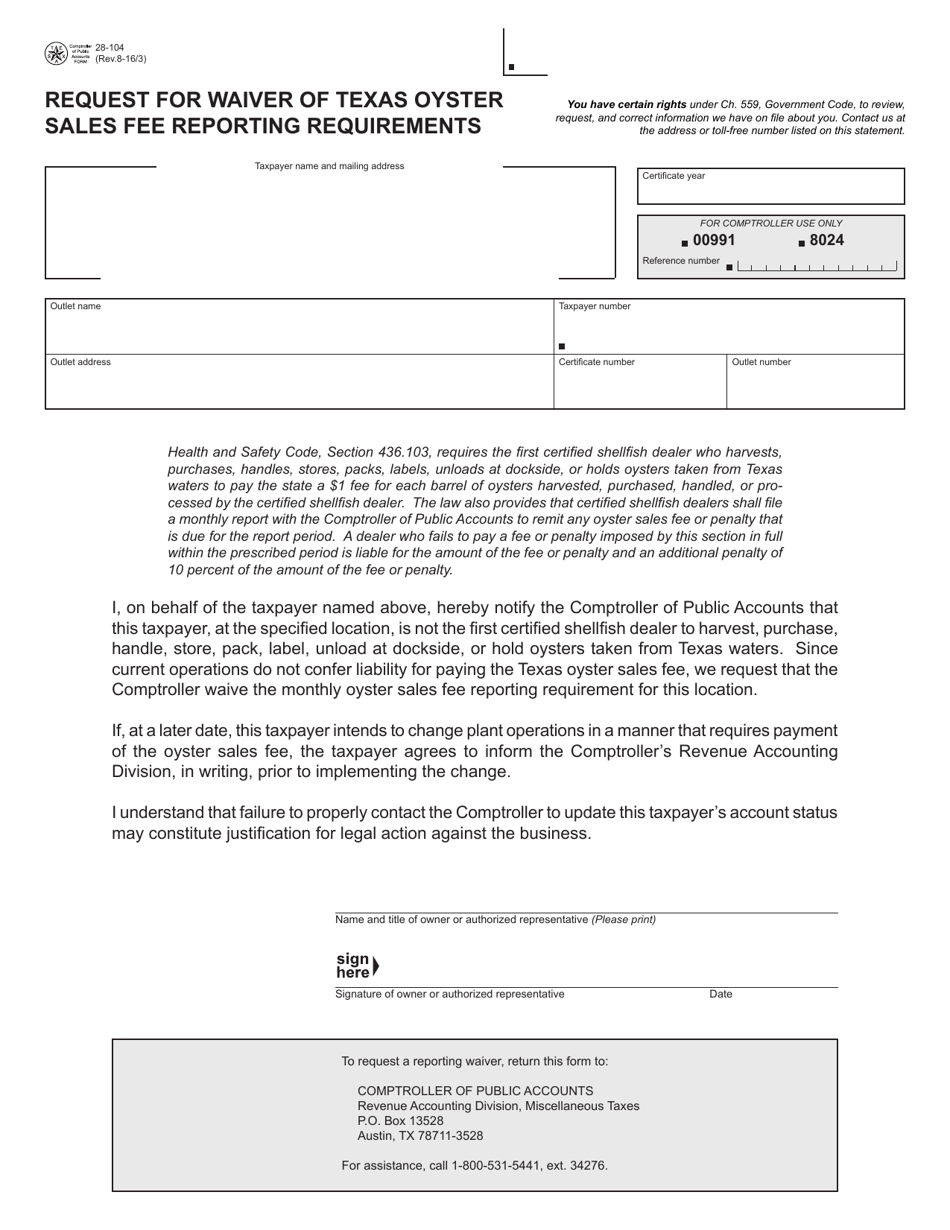

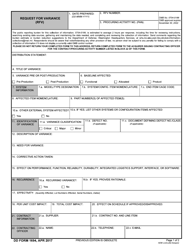

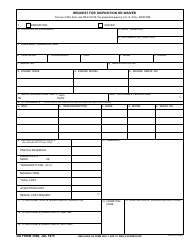

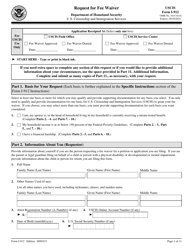

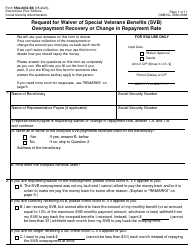

Form 28-104 Request for Waiver of Texas Oyster Sales Fee Reporting Requirements - Texas

What Is Form 28-104?

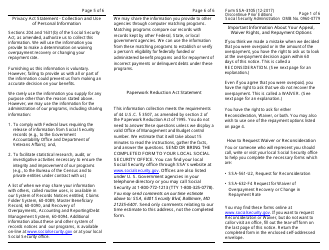

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 28-104?

A: Form 28-104 is a request form for waiving the reporting requirements for Texas Oyster Sales Fee.

Q: What is the purpose of Form 28-104?

A: The purpose of Form 28-104 is to request a waiver of the reporting requirements for Texas Oyster Sales Fee.

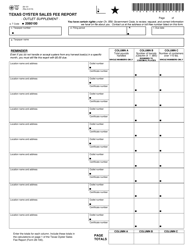

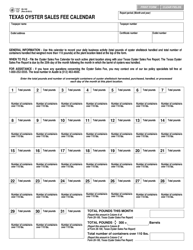

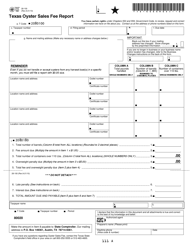

Q: What are the reporting requirements for Texas Oyster Sales Fee?

A: The reporting requirements for Texas Oyster Sales Fee include providing sales and invoice information.

Q: Who needs to fill out Form 28-104?

A: Anyone who wants to be exempt from the reporting requirements for Texas Oyster Sales Fee needs to fill out Form 28-104.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 28-104 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.