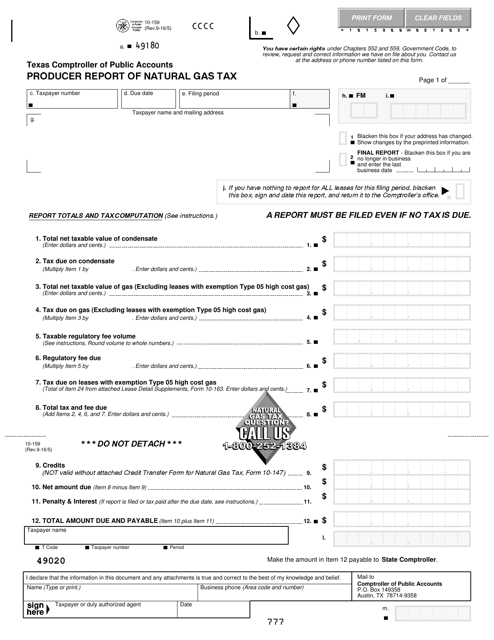

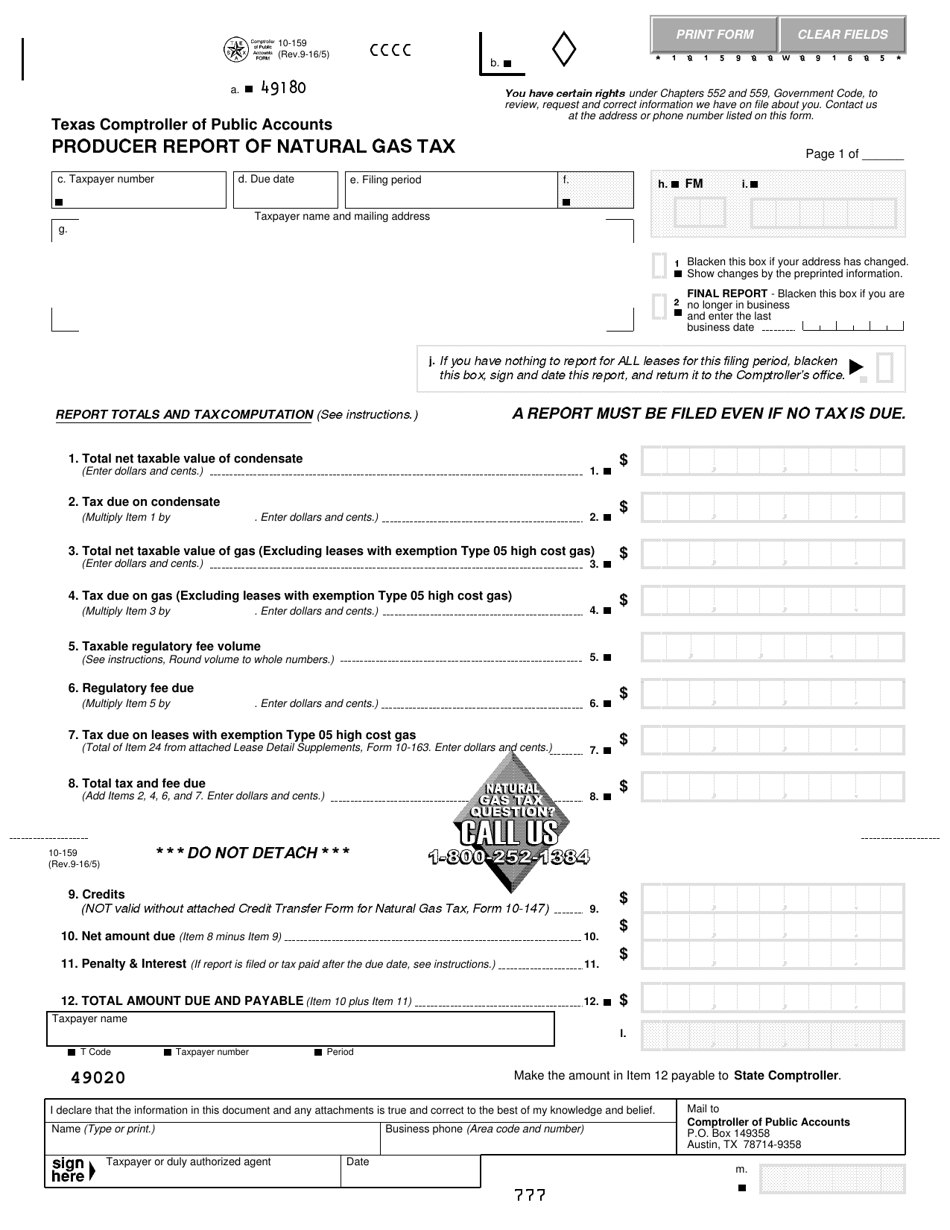

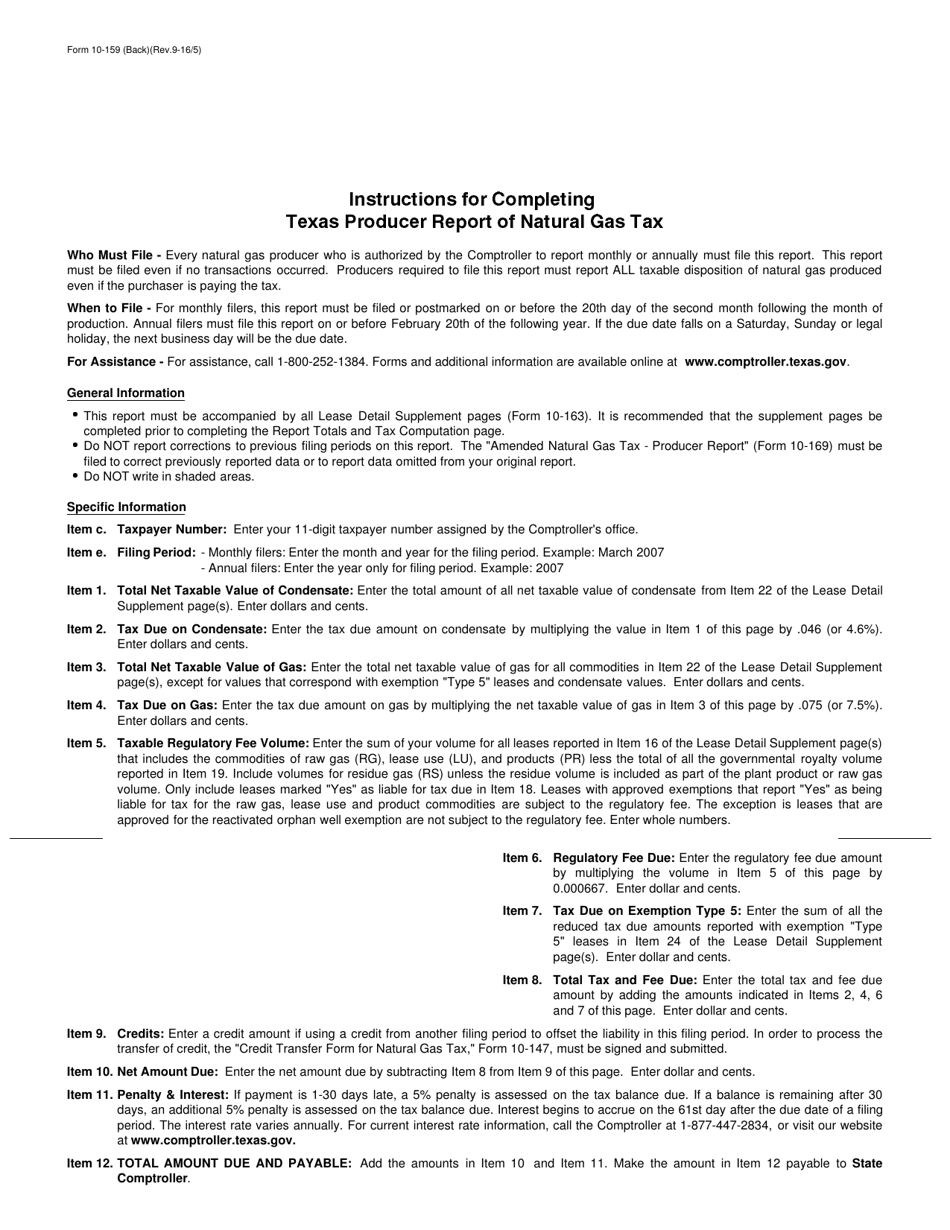

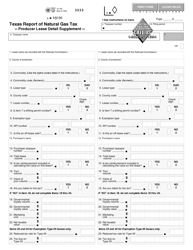

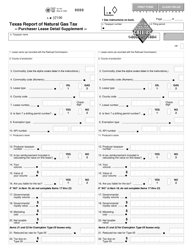

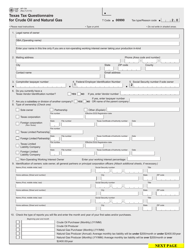

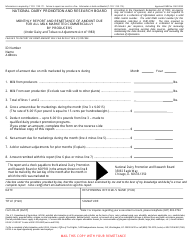

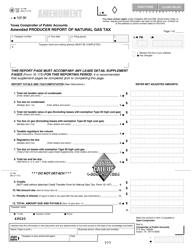

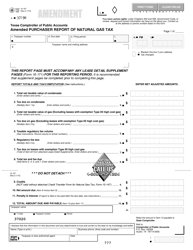

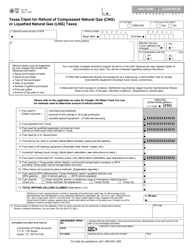

Form 10-159 Producer Report of Natural Gas Tax - Texas

What Is Form 10-159?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-159?

A: Form 10-159 is the Producer Report of Natural Gas Tax for the state of Texas.

Q: Who needs to file Form 10-159?

A: Producers of natural gas in Texas need to file Form 10-159.

Q: What is the purpose of Form 10-159?

A: Form 10-159 is used to report and pay the natural gas tax in Texas.

Q: How often does Form 10-159 need to be filed?

A: Form 10-159 needs to be filed on a monthly basis.

Q: Is there a deadline for filing Form 10-159?

A: Yes, Form 10-159 must be filed by the 25th day of the month following the production period.

Q: Are there any penalties for late filing of Form 10-159?

A: Yes, late filing of Form 10-159 may result in penalties and interest charges.

Q: Do I need to include payment with Form 10-159?

A: Yes, payment for the natural gas tax must be included with the filed form.

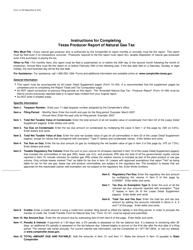

Q: Are there any exemptions or deductions available for the natural gas tax?

A: Yes, there are certain exemptions and deductions available, which are outlined in the instructions for Form 10-159.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-159 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.