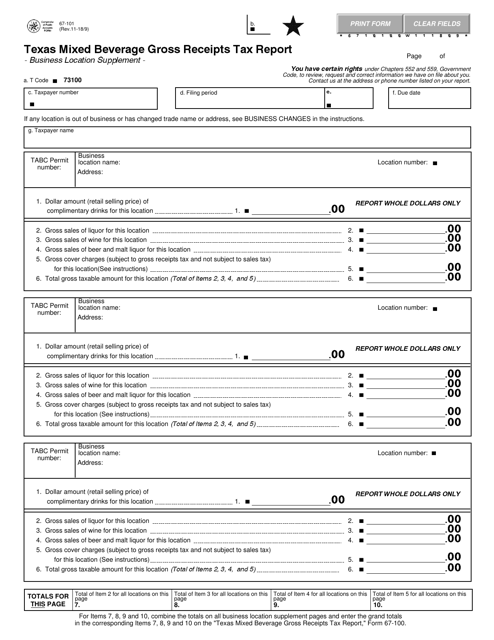

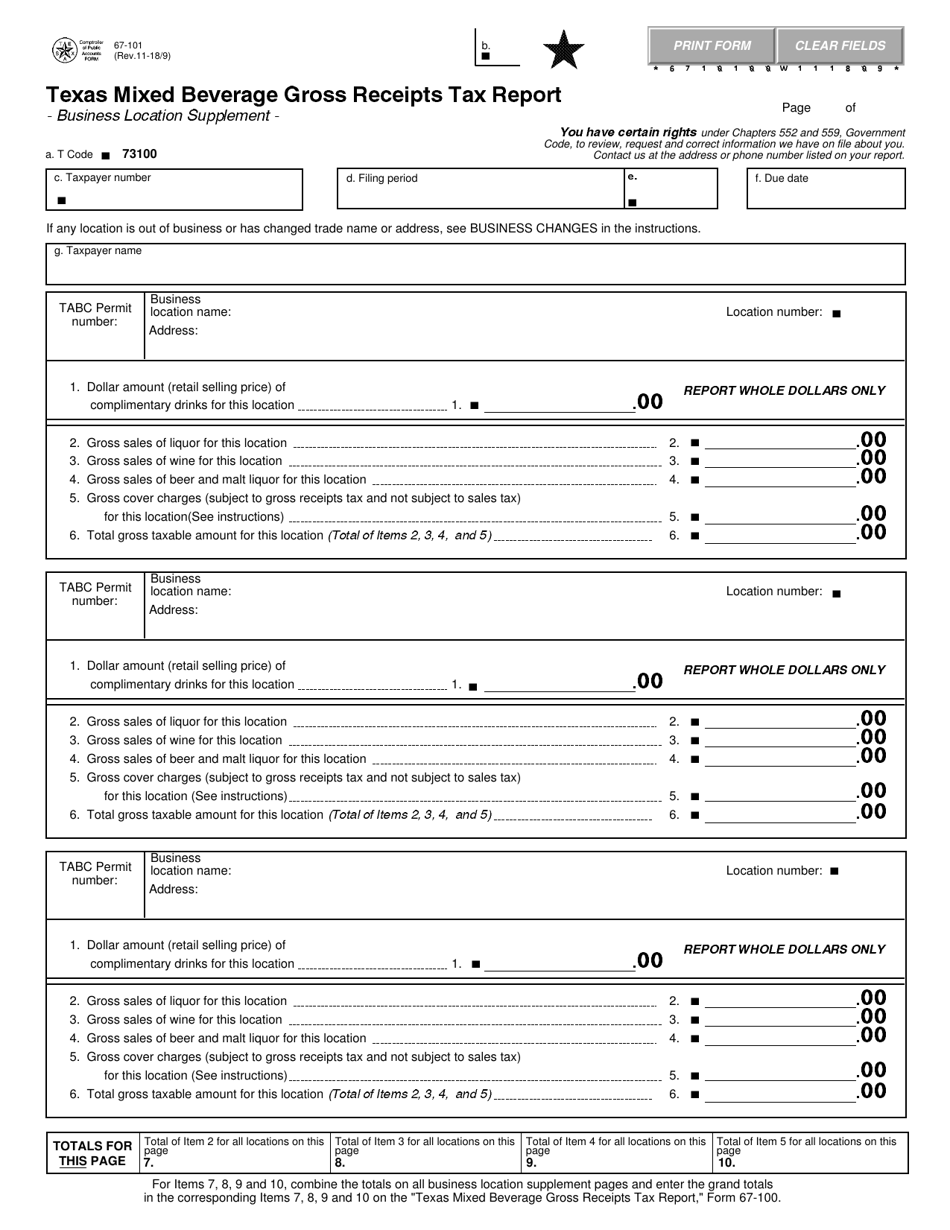

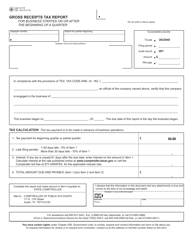

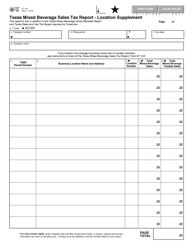

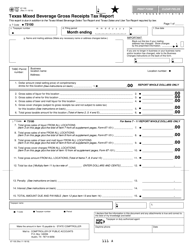

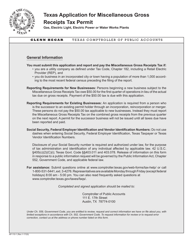

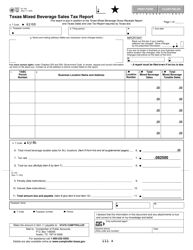

Form 67-101 Texas Mixed Beverage Gross Receipts Tax Report - Business Location Supplement - Texas

What Is Form 67-101?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 67-101?

A: Form 67-101 is the Texas Mixed BeverageGross ReceiptsTax Report - Business Location Supplement form.

Q: What is the purpose of Form 67-101?

A: The purpose of Form 67-101 is to report the gross receipts of a mixed beverage business in Texas.

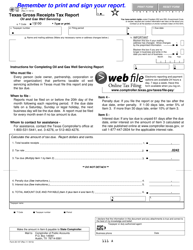

Q: Who needs to file Form 67-101?

A: Businesses in Texas that sell mixed beverages need to file Form 67-101.

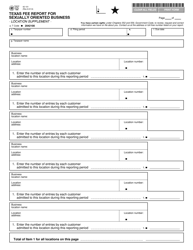

Q: What information is required on Form 67-101?

A: Form 67-101 requires information about the business location and gross receipts of the mixed beverage sales.

Q: When is the deadline to file Form 67-101?

A: The deadline to file Form 67-101 varies, so it is recommended to check with the Texas Comptroller's office for the specific due date.

Q: Is there any penalty for late filing of Form 67-101?

A: Yes, there may be penalties for late filing or failure to file Form 67-101, so it is important to submit the form on time.

Q: What should I do if I have questions or need assistance with Form 67-101?

A: If you have questions or need assistance with Form 67-101, you can contact the Texas Comptroller's office for guidance.

Form Details:

- Released on November 9, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 67-101 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.