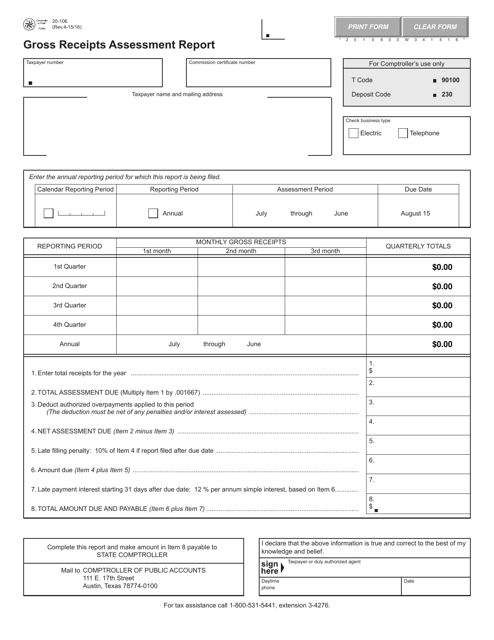

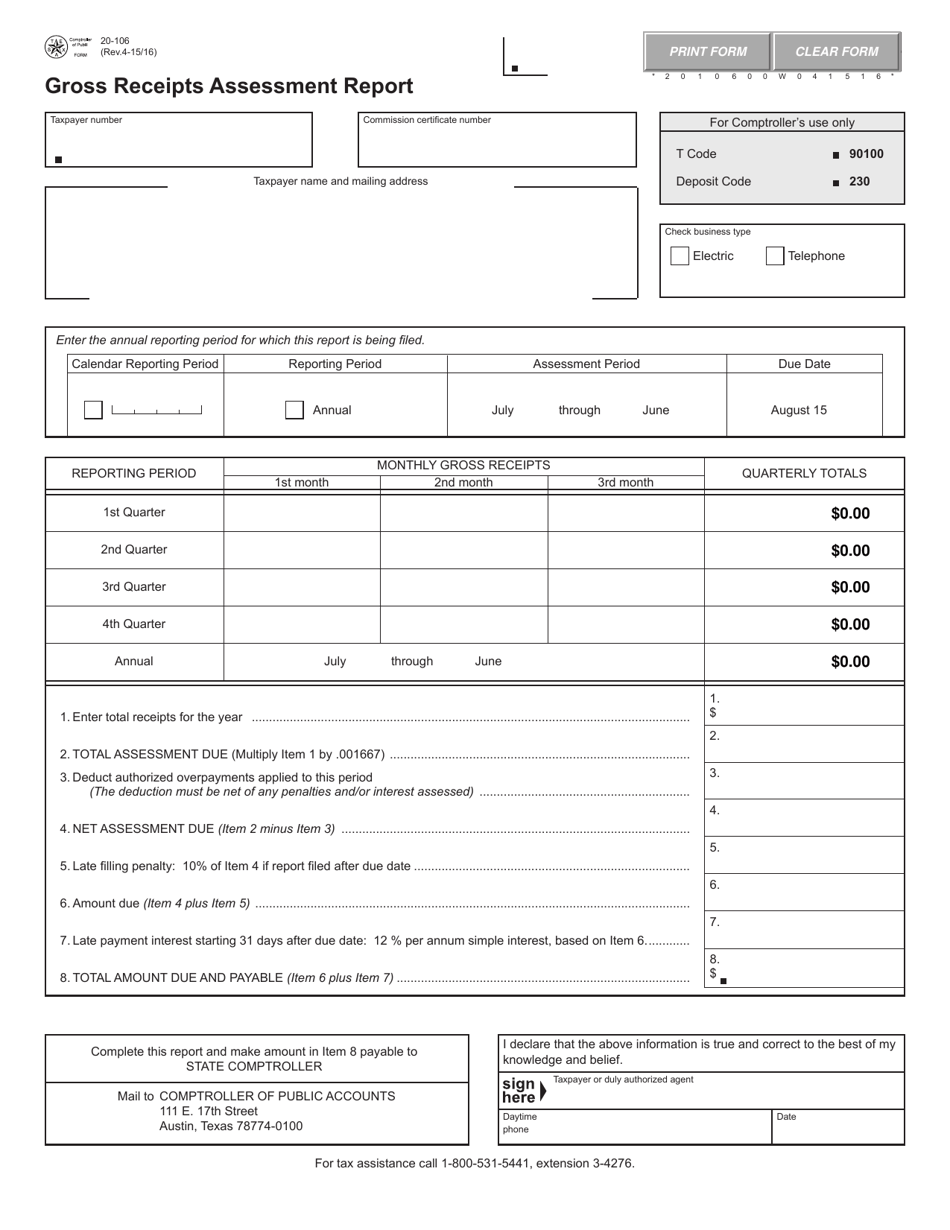

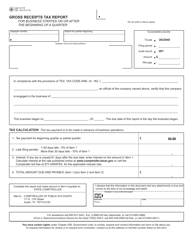

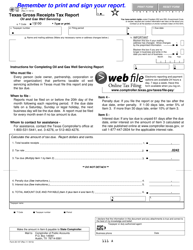

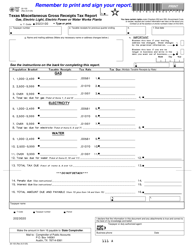

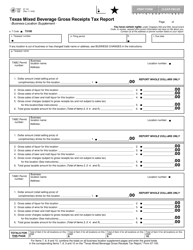

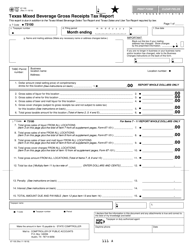

Form 20-106 Gross Receipts Assessment Report - Texas

What Is Form 20-106?

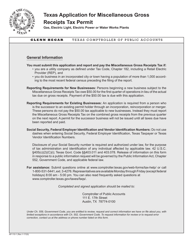

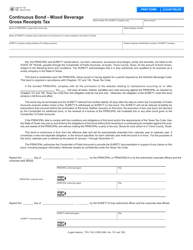

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20-106?

A: Form 20-106 is the Gross Receipts Assessment Report in Texas.

Q: What is the purpose of Form 20-106?

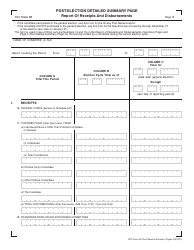

A: The purpose of Form 20-106 is to report and assess gross receipts in Texas.

Q: Who needs to file Form 20-106?

A: Businesses operating in Texas may need to file Form 20-106.

Q: What are gross receipts?

A: Gross receipts refer to the total amount of money or value received by a business from its activities.

Q: What information is required on Form 20-106?

A: Form 20-106 requires information such as business details, sales information, and gross receipts.

Q: When is Form 20-106 due?

A: Form 20-106 is generally due annually by May 1st.

Q: Are there any penalties for not filing Form 20-106?

A: Yes, there may be penalties for not filing Form 20-106 or for filing it late.

Q: Are there any exemptions or deductions available on Form 20-106?

A: Yes, there may be exemptions or deductions available on Form 20-106. It is important to review the instructions and guidelines provided by the Texas Comptroller.

Form Details:

- Released on April 16, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20-106 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.