This version of the form is not currently in use and is provided for reference only. Download this version of

Form 20-103

for the current year.

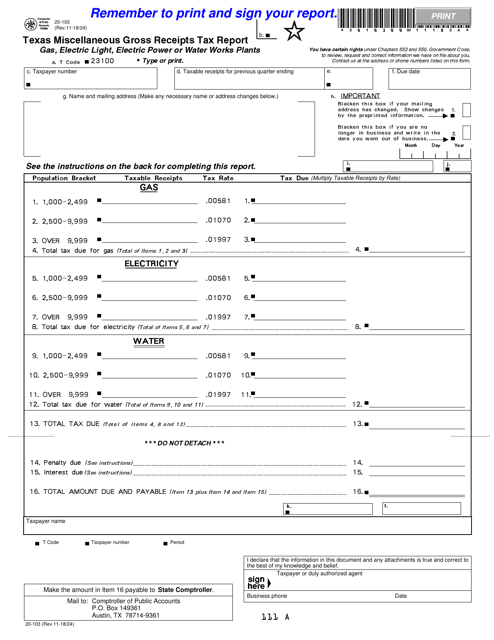

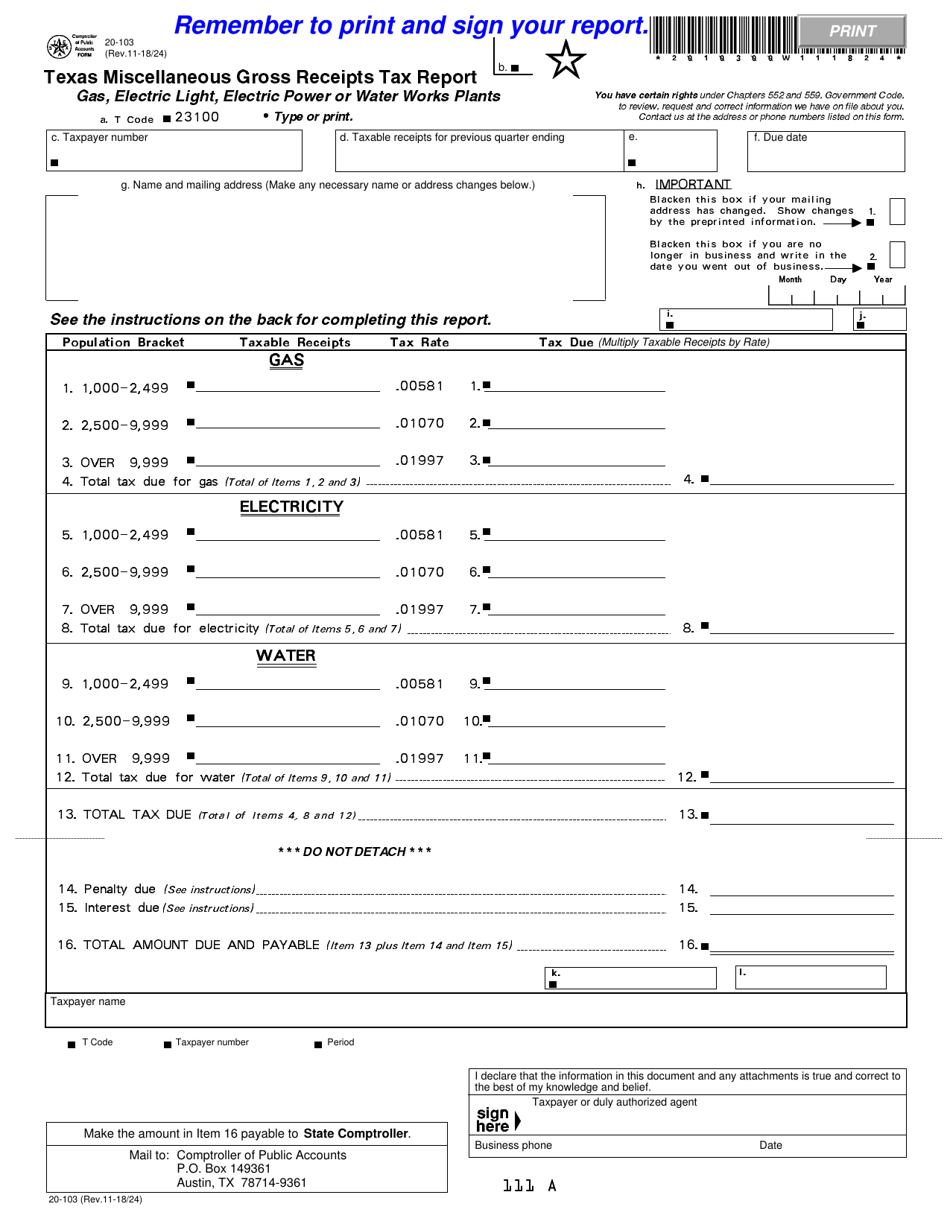

Form 20-103 Miscellaneous Gross Receipts Tax Report - Gas, Electric Light, Electric Power or Water Works Plants - Texas

What Is Form 20-103?

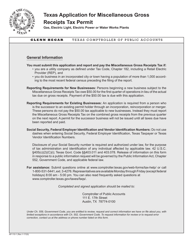

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20-103?

A: Form 20-103 is the Miscellaneous Gross ReceiptsTax Report for gas, electric light, electric power, or water works plants in Texas.

Q: Who needs to file Form 20-103?

A: Gas, electric light, electric power, or water works plants in Texas need to file Form 20-103.

Q: What is the purpose of Form 20-103?

A: The purpose of Form 20-103 is to report and remit the gross receipts tax for gas, electric light, electric power, or water works plants in Texas.

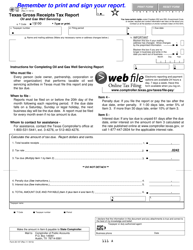

Q: What information is required on Form 20-103?

A: Form 20-103 requires information about gross receipts, tax due, and other relevant financial details.

Q: When is Form 20-103 due?

A: Form 20-103 is due on or before the 20th day of the month following the end of the reporting period.

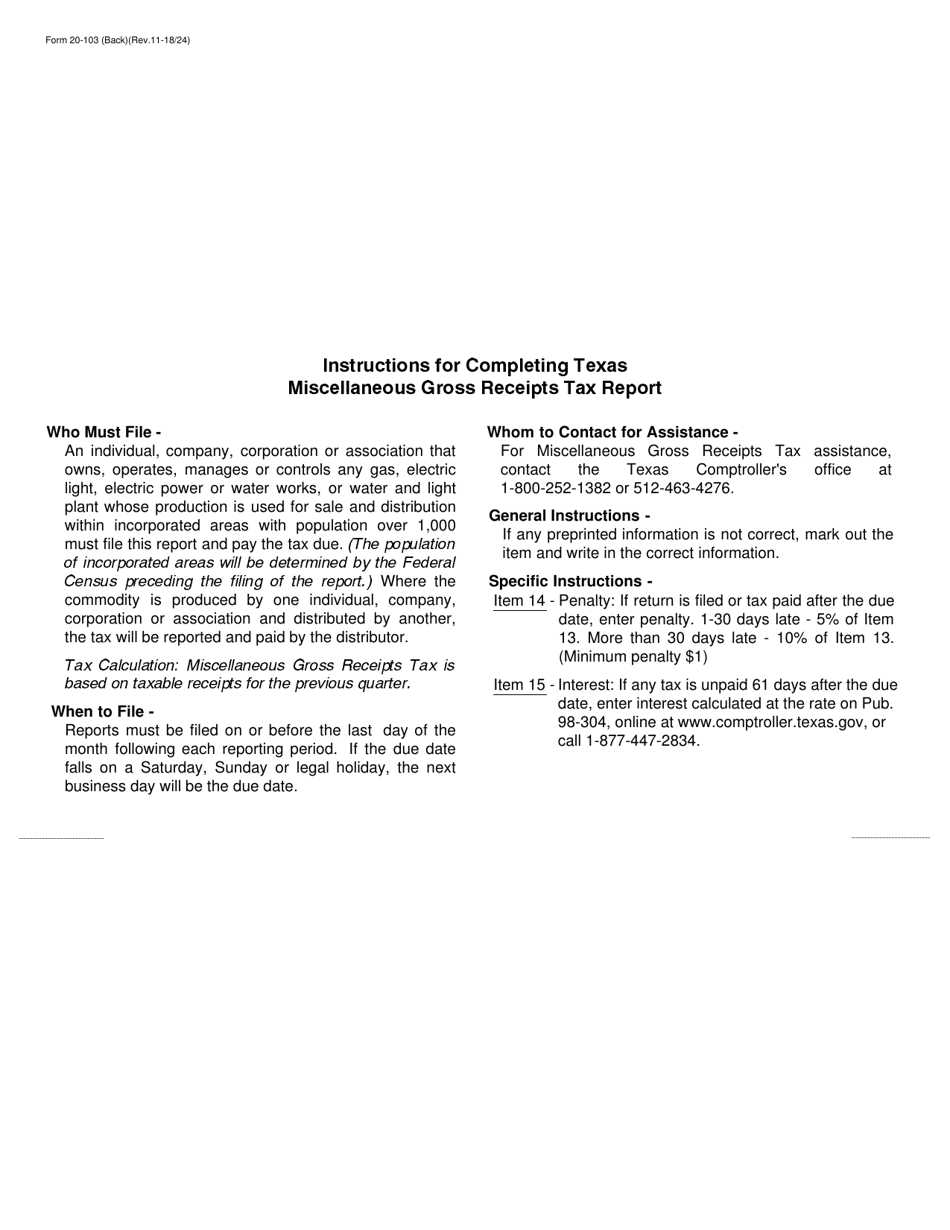

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the requirements of Form 20-103.

Form Details:

- Released on November 24, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20-103 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.