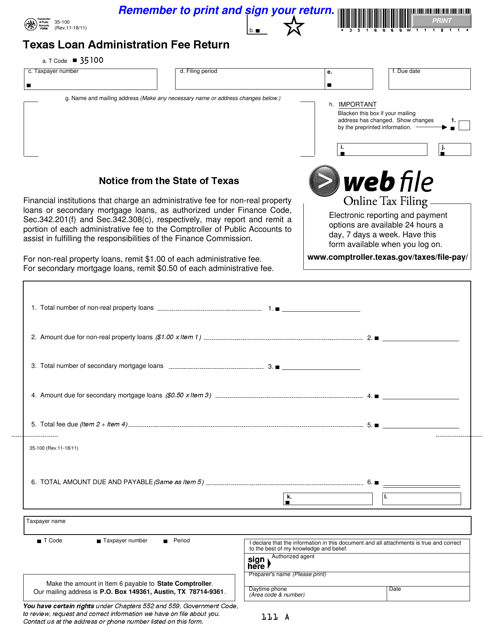

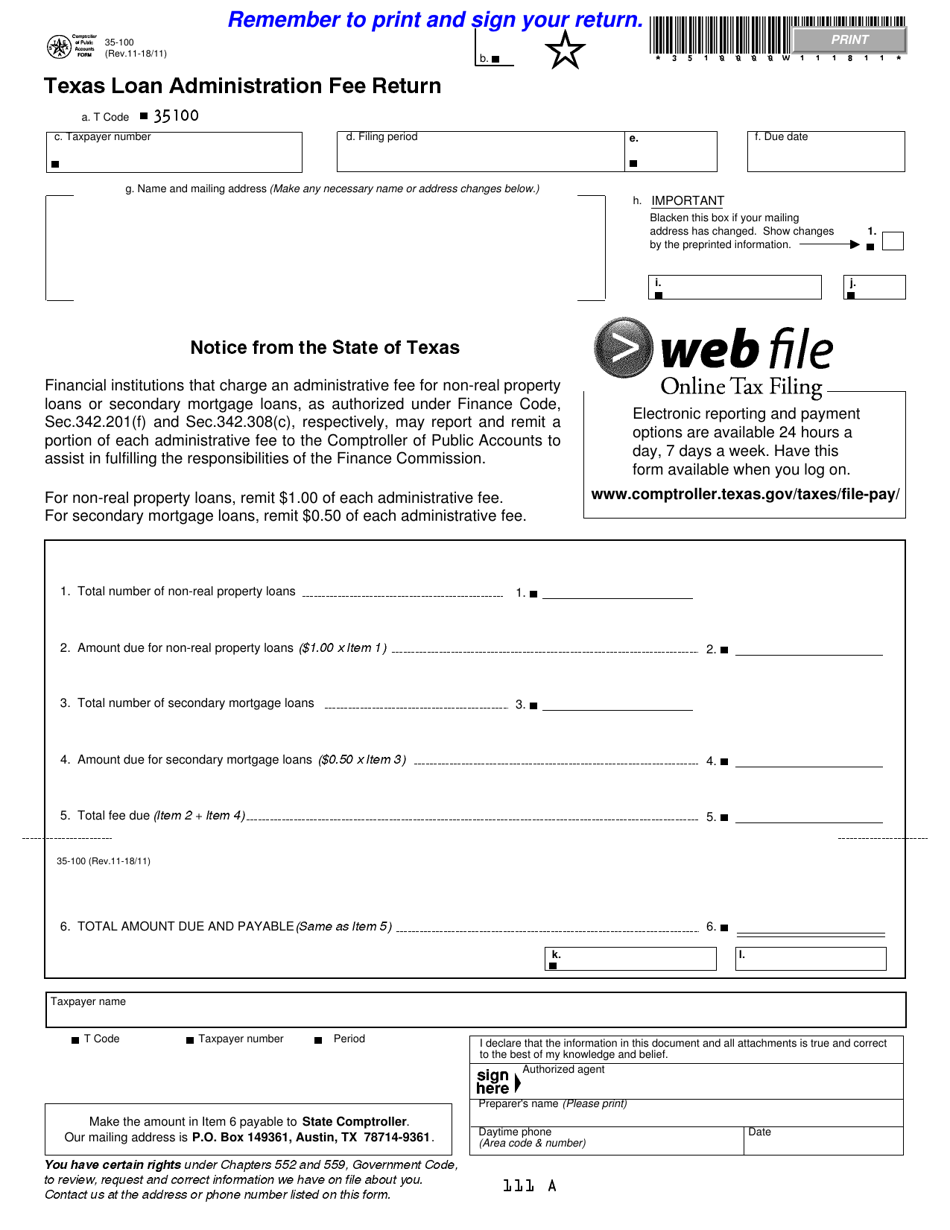

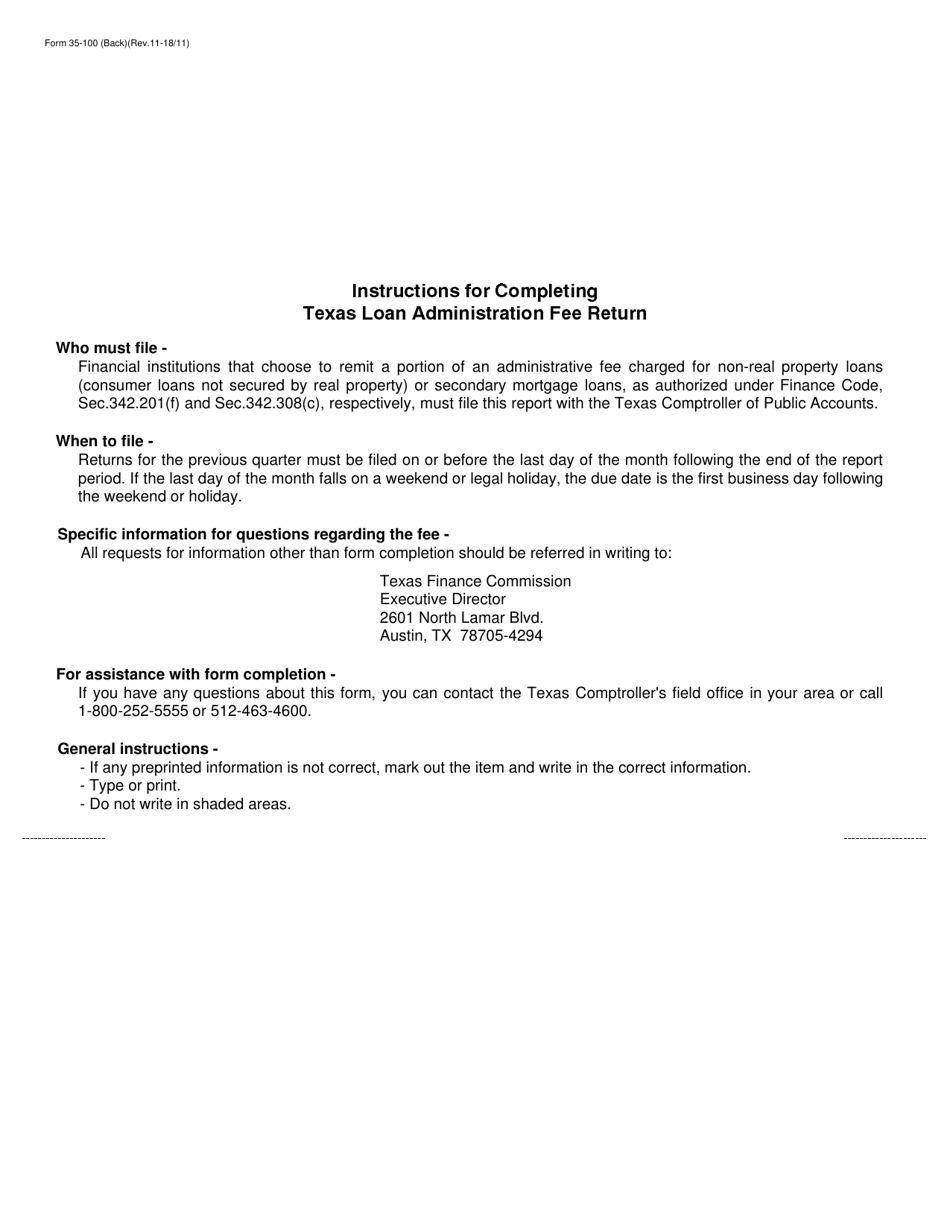

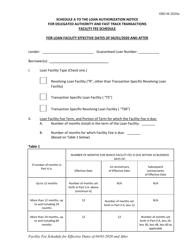

Form 35-100 Texas Loan Administration Fee Return - Texas

What Is Form 35-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 35-100?

A: Form 35-100 is the Texas Loan Administration Fee Return form.

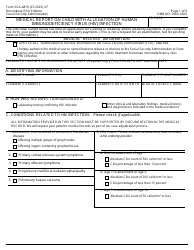

Q: What is the purpose of Form 35-100?

A: The purpose of Form 35-100 is to report and remit the loan administration fee owed to the state of Texas.

Q: Who needs to file Form 35-100?

A: Any entity or individual that collected a loan administration fee in Texas is required to file Form 35-100.

Q: How often should Form 35-100 be filed?

A: Form 35-100 should be filed quarterly, by the 30th day after the end of each calendar quarter.

Q: Are there any penalties for late filing of Form 35-100?

A: Yes, there are penalties for late filing of Form 35-100, including interest and additional fees.

Q: Do I need to pay the loan administration fee before filing Form 35-100?

A: Yes, the loan administration fee must be paid in full before filing Form 35-100.

Q: What if I have multiple locations in Texas, do I need to file separate forms?

A: If you have multiple locations in Texas, you may need to file separate forms for each location.

Q: What should I do if I made an error on Form 35-100?

A: If you made an error on Form 35-100, you should file an amended return to correct the error.

Form Details:

- Released on November 11, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 35-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.