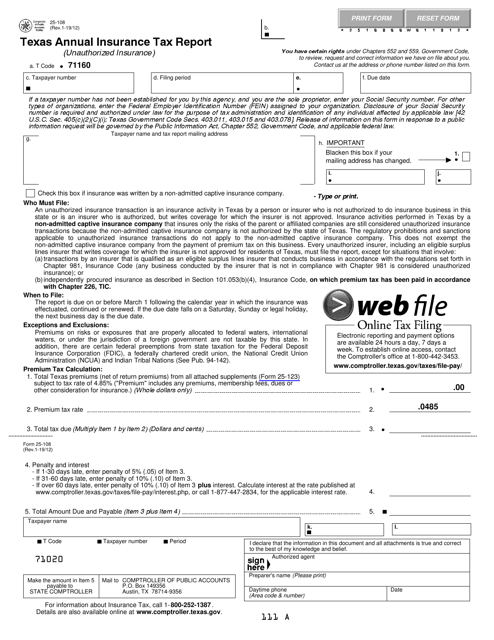

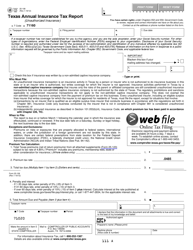

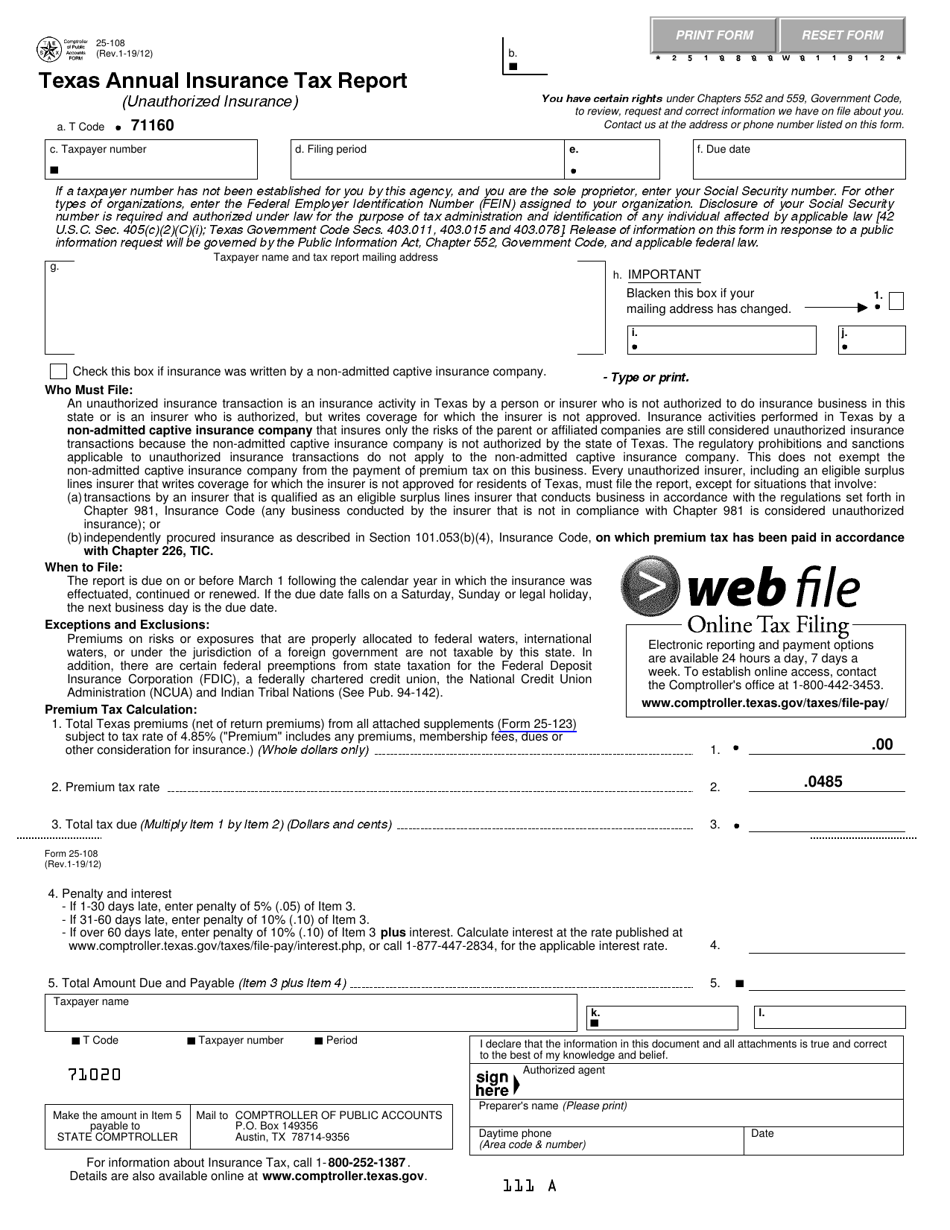

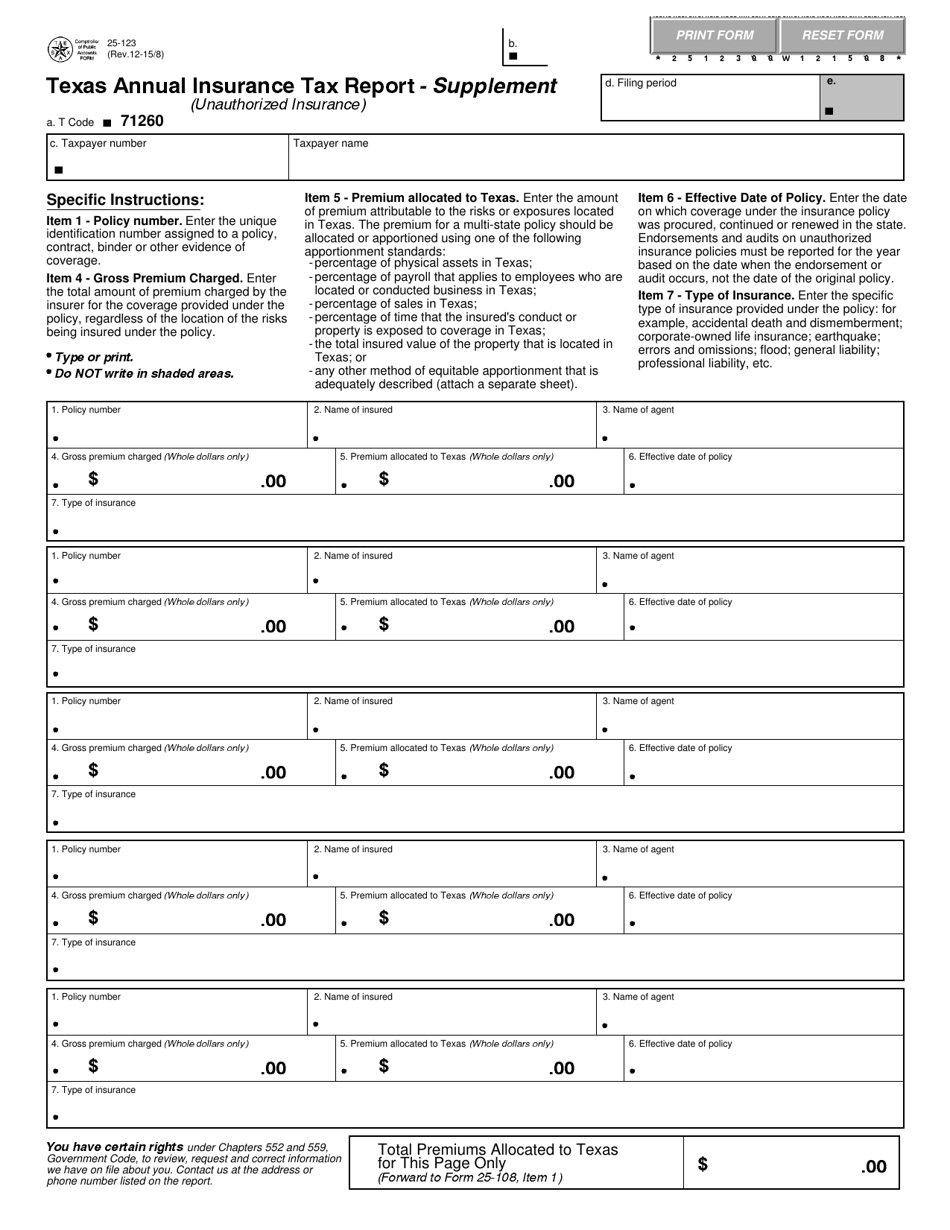

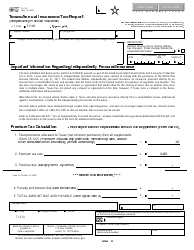

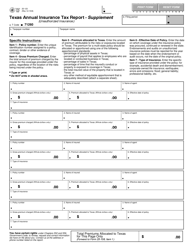

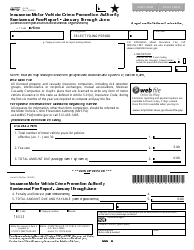

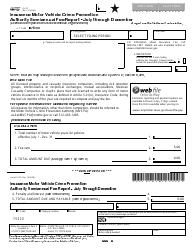

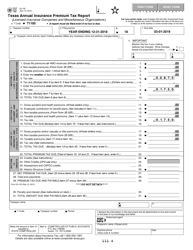

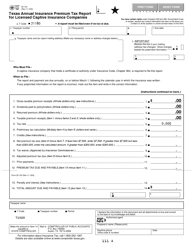

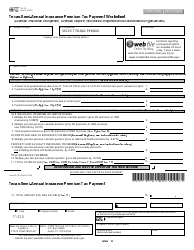

Form 25-108 Texas Annual Insurance Tax Report (Unauthorized Insurance) - Texas

What Is Form 25-108?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 25-108?

A: The Form 25-108 is the Texas Annual Insurance Tax Report specifically for unauthorized insurance.

Q: Who needs to file the Form 25-108?

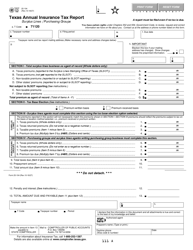

A: Insurance companies or organizations engaged in unauthorized insurance in Texas need to file the Form 25-108.

Q: What is unauthorized insurance?

A: Unauthorized insurance refers to insurance activities that are not licensed or approved by the state.

Q: What information is required on the Form 25-108?

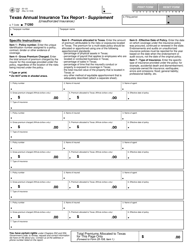

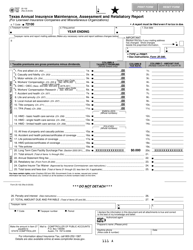

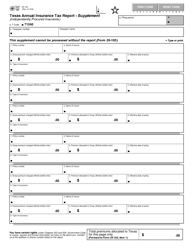

A: The Form 25-108 requires information about the insurance company or organization, details of authorized business and premiums, and other financial information.

Q: When is the deadline to file the Form 25-108?

A: The Form 25-108 must be filed no later than March 1st of each year.

Q: Are there any penalties for late or non-filing of the Form 25-108?

A: Yes, penalties may apply for late or non-filing of the Form 25-108, including fines and potential suspension of business activities in Texas.

Form Details:

- Released on January 12, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-108 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.