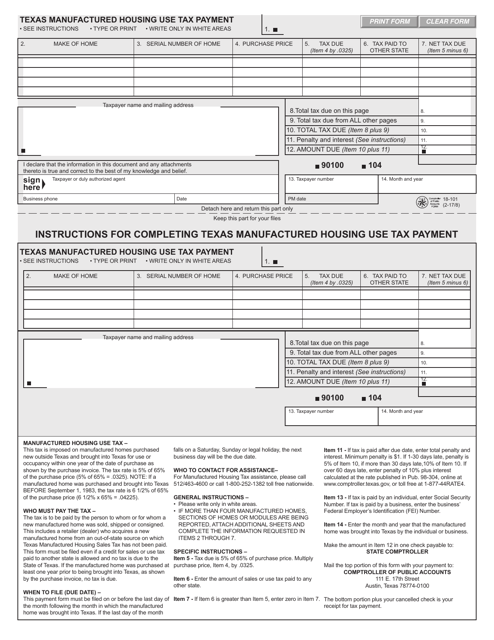

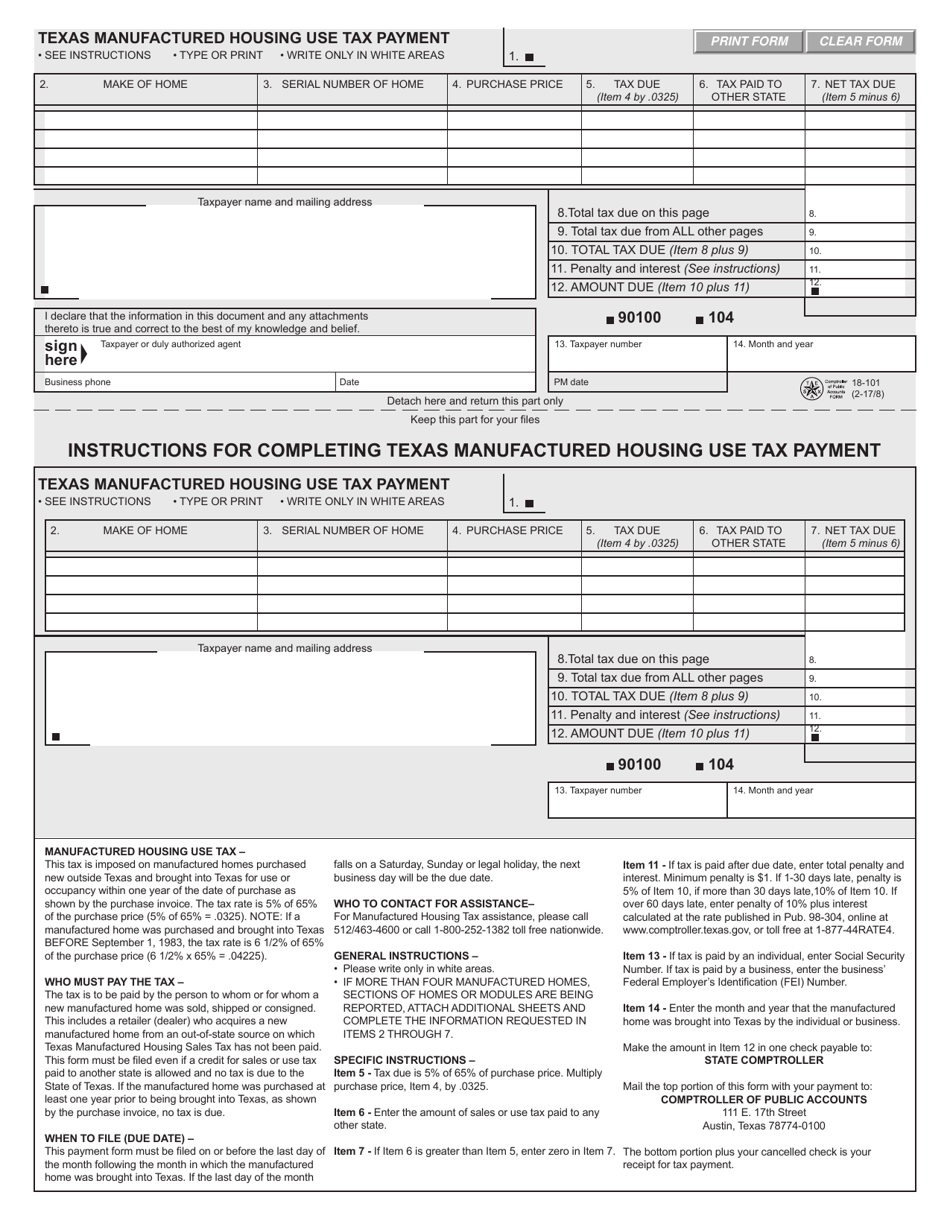

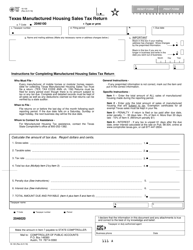

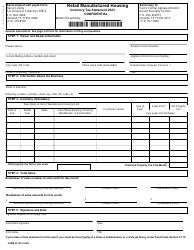

Form 18-101 Texas Manufactured Housing Use Tax Payment - Texas

What Is Form 18-101?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 18-101?

A: Form 18-101 is the Texas Manufactured Housing Use Tax Payment form.

Q: What is the purpose of Form 18-101?

A: The purpose of Form 18-101 is to make a payment of the Texas Manufactured Housing Use Tax.

Q: Who needs to file Form 18-101?

A: Individuals or businesses who owe Texas Manufactured Housing Use Tax need to file Form 18-101.

Q: What is the Texas Manufactured Housing Use Tax?

A: The Texas Manufactured Housing Use Tax is a tax imposed on the sale, lease, or transfer of manufactured homes in Texas.

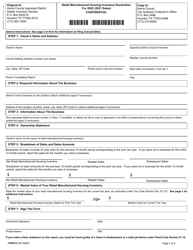

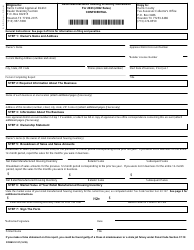

Q: How do I fill out Form 18-101?

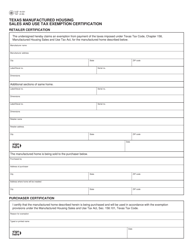

A: To fill out Form 18-101, you will need to provide information about the manufacturer, retailer, and purchaser of the manufactured home, as well as the amount of tax owed.

Q: When is Form 18-101 due?

A: Form 18-101 is generally due on the 20th day of the month following the month in which the sale, lease, or transfer of the manufactured home occurred.

Q: Are there any penalties for late filing of Form 18-101?

A: Yes, there may be penalties for late filing of Form 18-101, including interest charges and potentially additional fees.

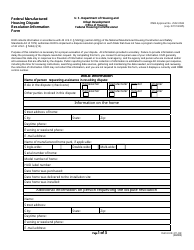

Form Details:

- Released on February 8, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 18-101 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.