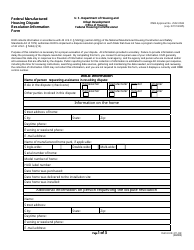

This version of the form is not currently in use and is provided for reference only. Download this version of

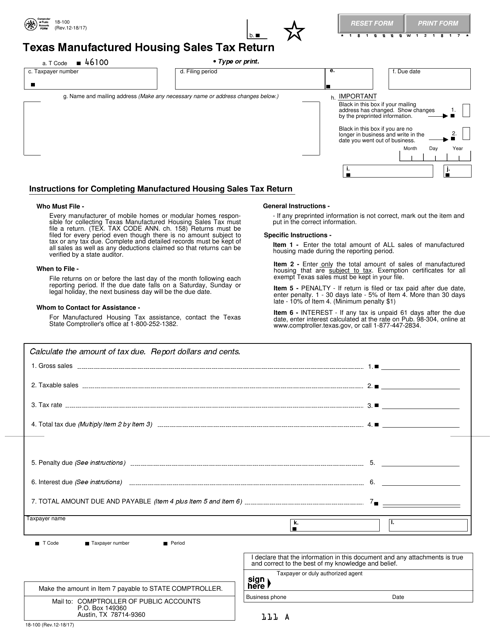

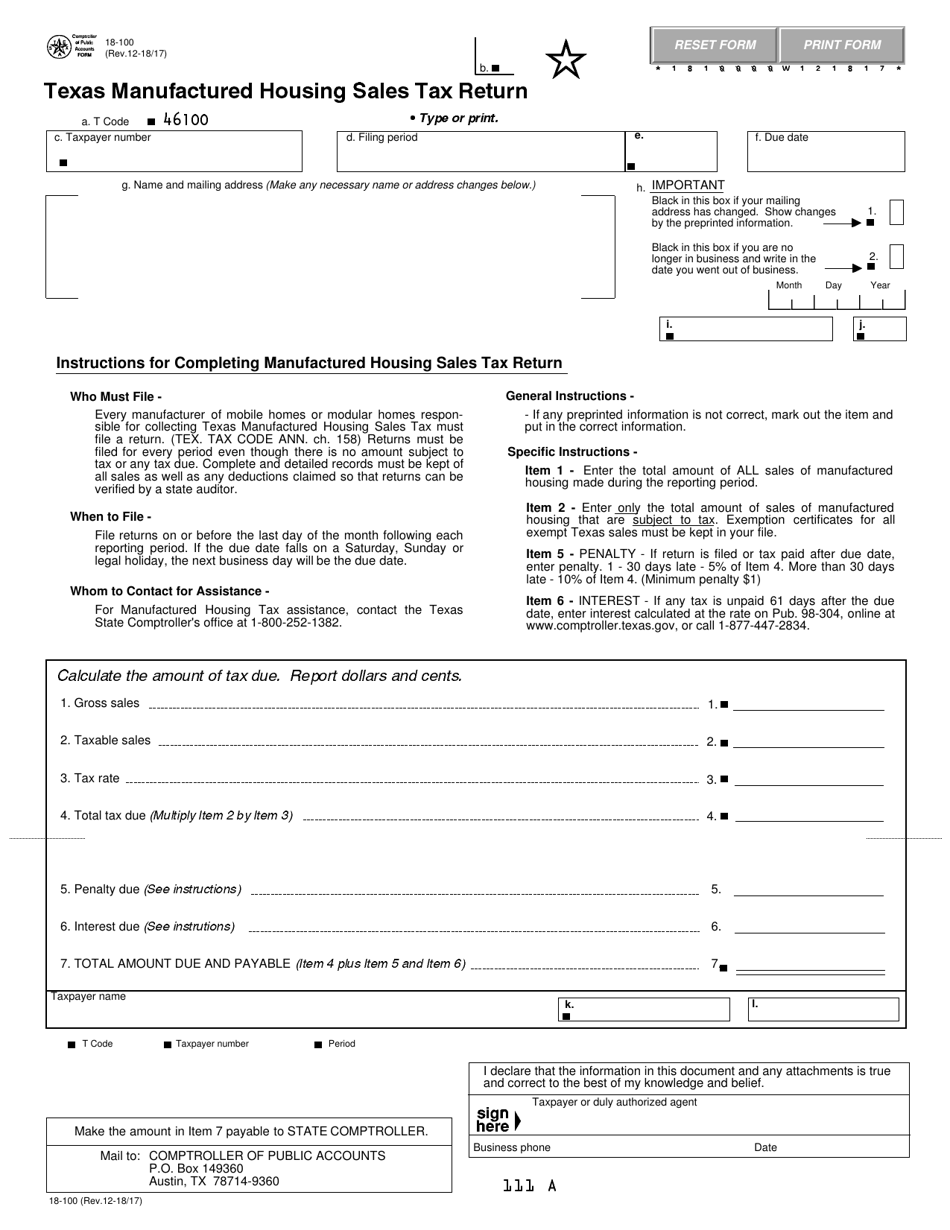

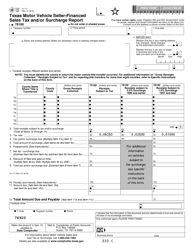

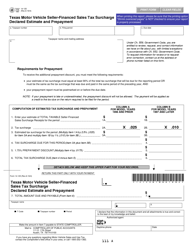

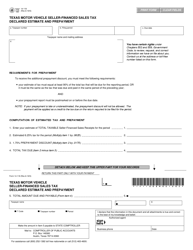

Form 18-100

for the current year.

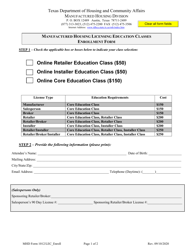

Form 18-100 Texas Manufactured Housing Sales Tax Return - Texas

What Is Form 18-100?

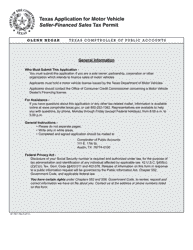

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 18-100?

A: Form 18-100 is the Texas Manufactured Housing Sales Tax Return.

Q: What is the purpose of Form 18-100?

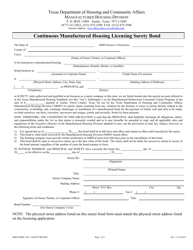

A: Form 18-100 is used to report and pay sales tax on the sale of manufactured housing units in Texas.

Q: Who needs to file Form 18-100?

A: Any person or business engaged in the sale of manufactured housing units in Texas needs to file Form 18-100.

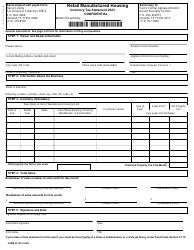

Q: When is Form 18-100 due?

A: Form 18-100 is due on or before the 20th day of the month following the reporting period.

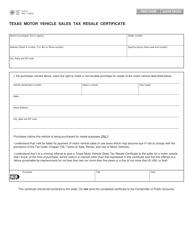

Q: Are there any penalties for not filing Form 18-100?

A: Yes, there are penalties for late or non-filing of Form 18-100. The penalties vary depending on the amount of tax due and the period of non-compliance.

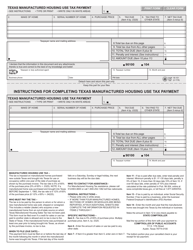

Q: What should I include when filing Form 18-100?

A: When filing Form 18-100, you should include details of all sales of manufactured housing units during the reporting period, along with the applicable sales tax due.

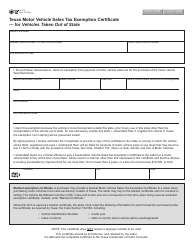

Q: Can I file Form 18-100 electronically?

A: Yes, you can file Form 18-100 electronically through the Comptroller's Electronic Reporting System.

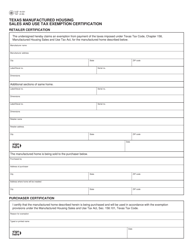

Q: Can I claim any exemptions on Form 18-100?

A: Yes, there are certain exemptions available on Form 18-100. You should review the instructions provided with the form to determine if you qualify for any exemptions.

Form Details:

- Released on December 17, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 18-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.