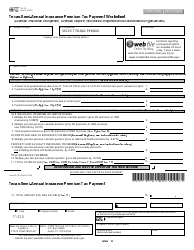

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 25-200

for the current year.

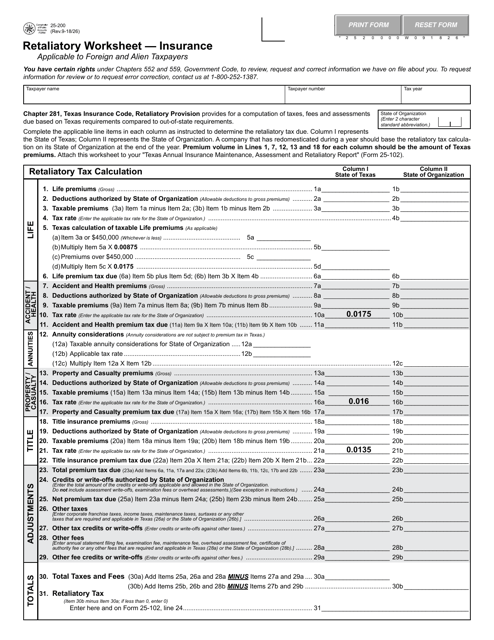

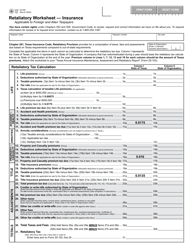

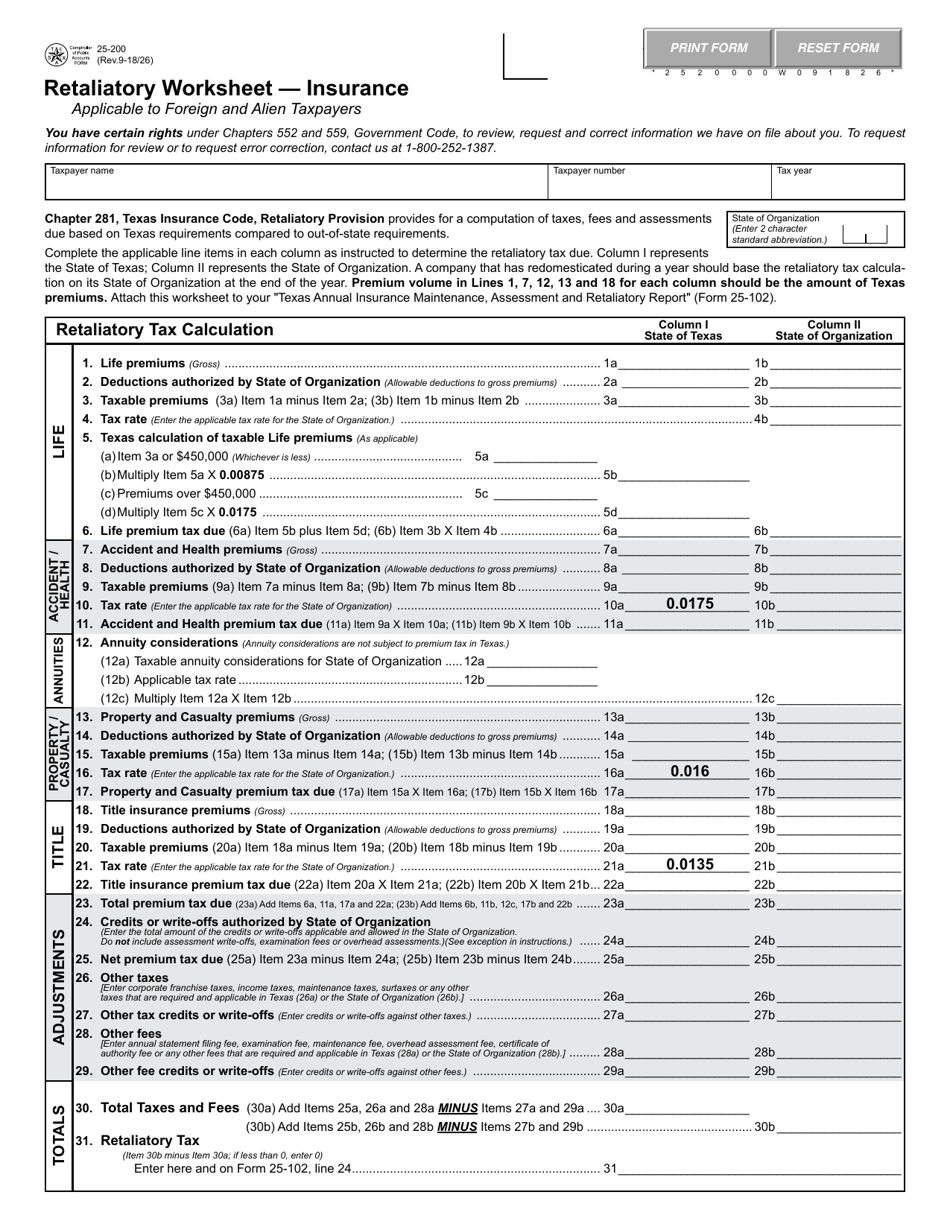

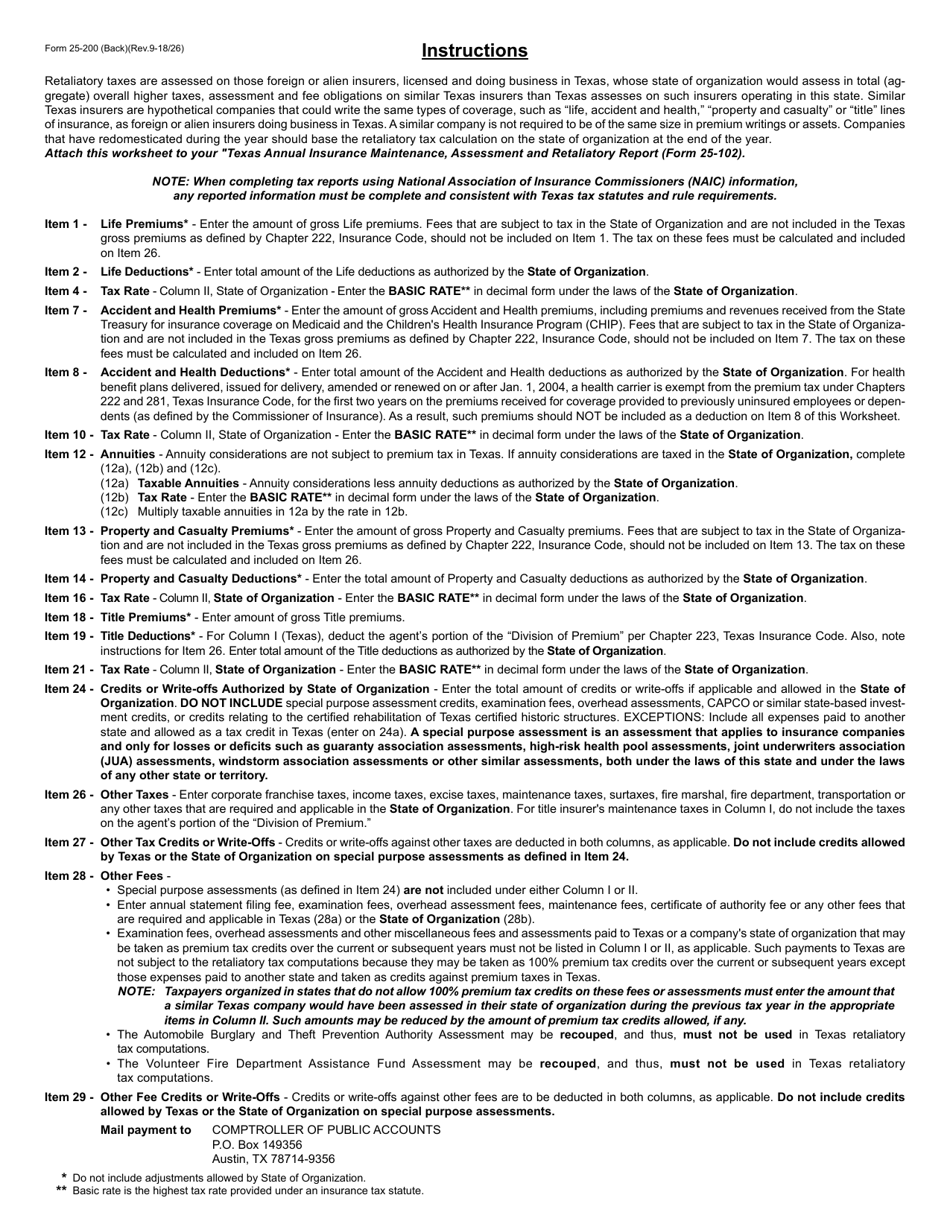

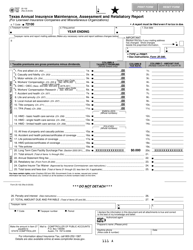

Form 25-200 Retaliatory Worksheet - Insurance (Applicable to Foreign and Alien Taxpayers) - Texas

What Is Form 25-200?

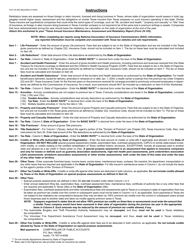

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25-200?

A: Form 25-200 is the Retaliatory Worksheet for Insurance, applicable to foreign and alien taxpayers in Texas.

Q: Who needs to fill out Form 25-200?

A: Foreign and alien taxpayers in the insurance industry who are operating in Texas need to fill out Form 25-200.

Q: What is the purpose of Form 25-200?

A: The purpose of Form 25-200 is to calculate the retaliatory tax owed by foreign and alien insurers in Texas.

Q: When is Form 25-200 due?

A: Form 25-200 is generally due on the 15th day of the third month following the end of the taxpayer's fiscal year.

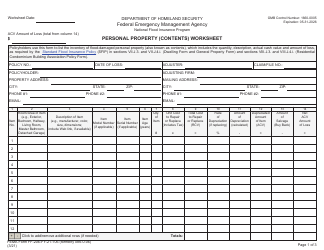

Q: What information do I need to fill out Form 25-200?

A: You will need to provide information about your company's premiums, taxes, and fees paid in your home state or country, as well as any exemptions or credits applied.

Q: Are there any penalties for late filing of Form 25-200?

A: Yes, there are penalties for late filing of Form 25-200. It is important to file the form on time to avoid any penalties or interest charges.

Q: Who can I contact for assistance with Form 25-200?

A: If you need assistance with Form 25-200, you can contact the Texas Department of Insurance directly for guidance and support.

Form Details:

- Released on September 26, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-200 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.