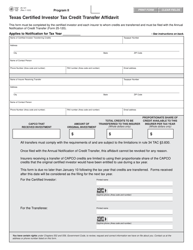

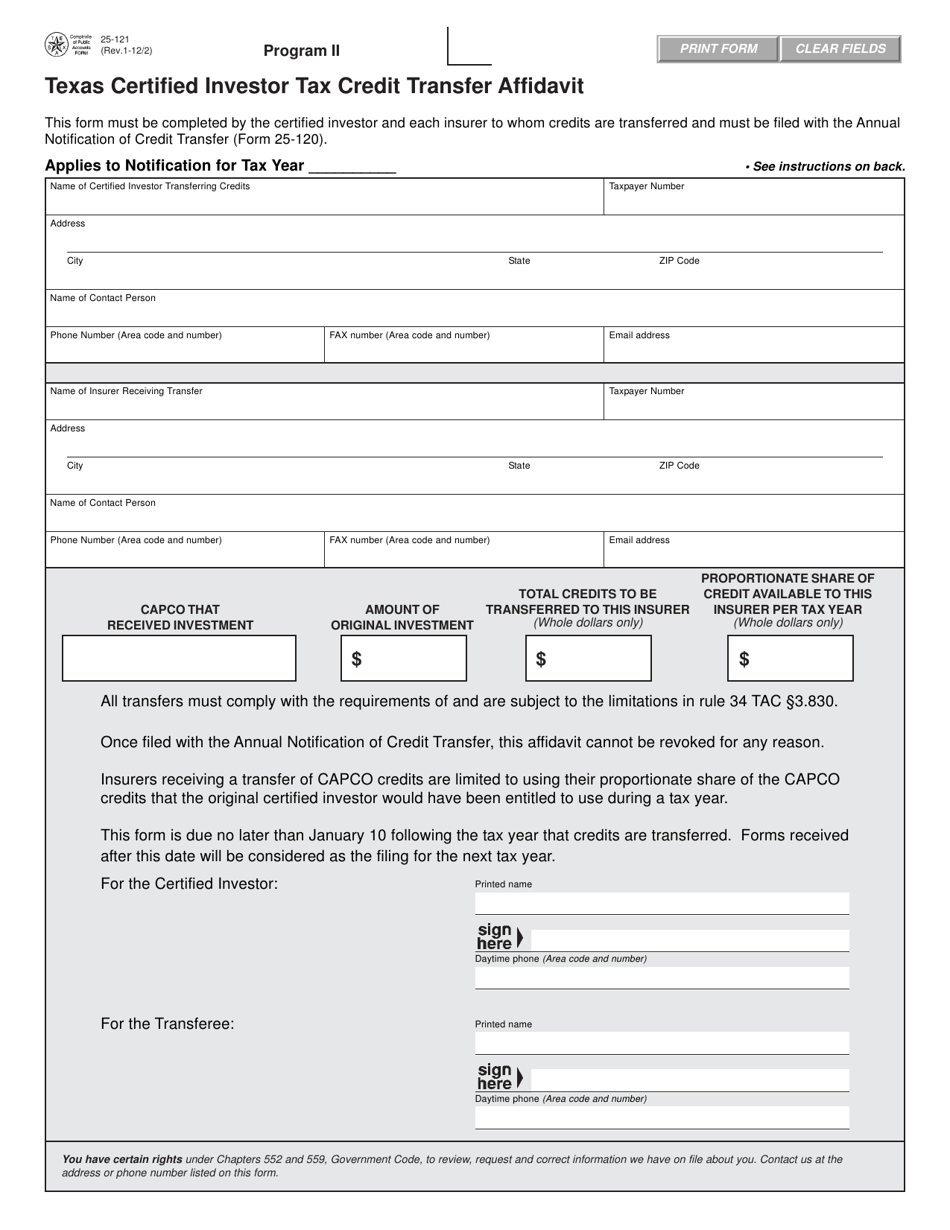

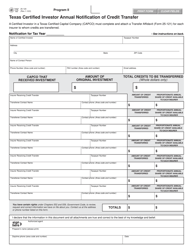

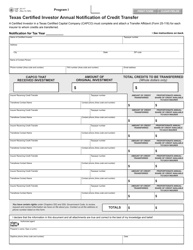

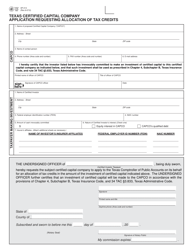

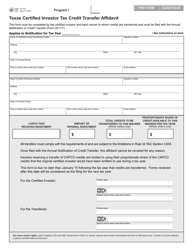

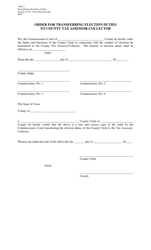

Form 25-121 Texas Certified Investor Tax Credit Transfer Affidavit - Program Ii - Texas

What Is Form 25-121?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25-121?

A: Form 25-121 is the Texas Certified Investor Tax CreditTransfer Affidavit for Program II in Texas.

Q: What is the purpose of Form 25-121?

A: The purpose of Form 25-121 is to transfer the certified investor tax credits in Program II in Texas.

Q: Who needs to fill out Form 25-121?

A: Investors who wish to transfer their tax credits in Program II in Texas need to fill out Form 25-121.

Q: What is Program II in Texas?

A: Program II in Texas is a tax credit program for certified investors.

Q: What is a certified investor?

A: A certified investor is an individual or entity that has been certified by the Comptroller as eligible to receive tax credits.

Q: How do I transfer my tax credits in Program II?

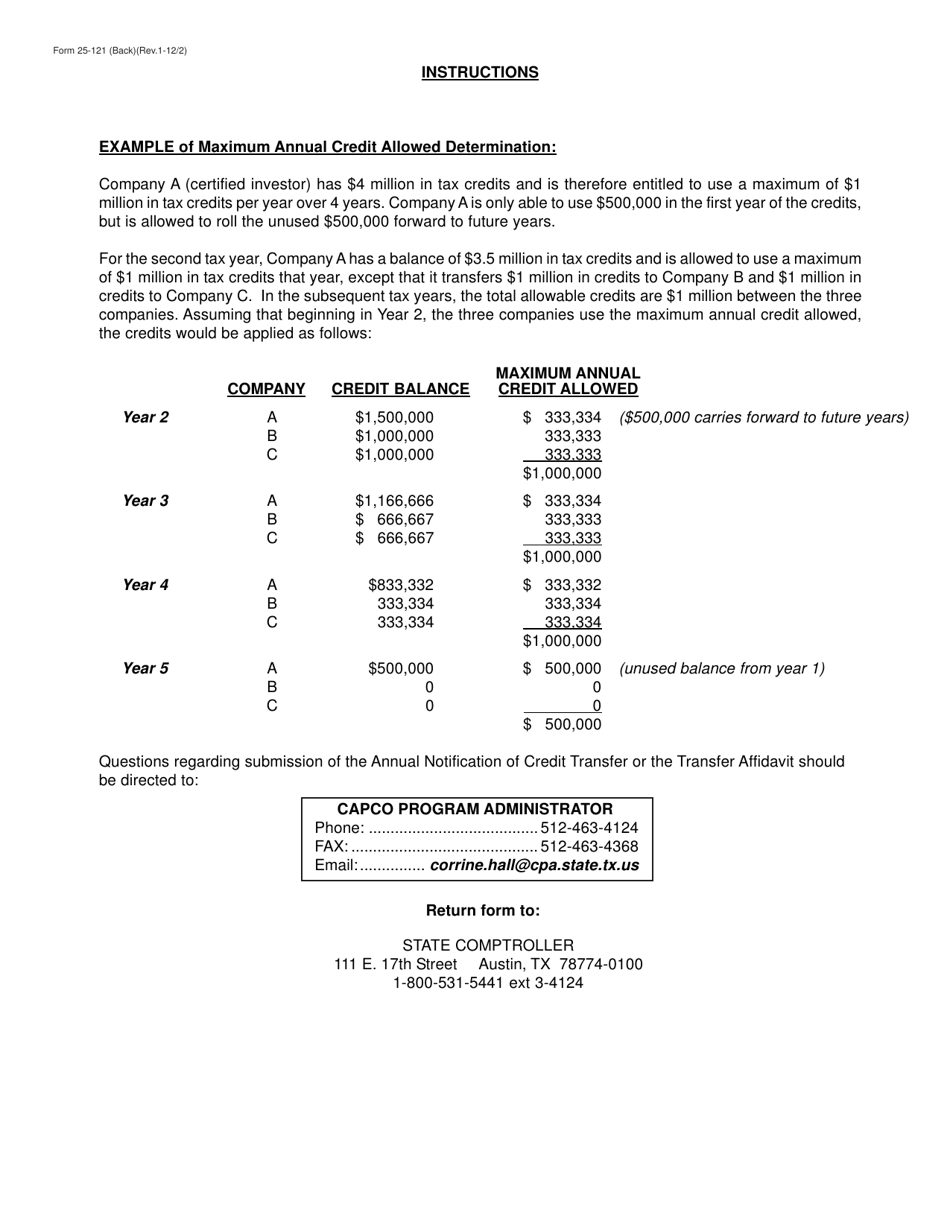

A: To transfer tax credits in Program II, you need to fill out Form 25-121 and follow the instructions provided.

Q: Are there any fees for transferring tax credits?

A: There may be fees associated with transferring tax credits in Program II. Please refer to the instructions on Form 25-121 for more information.

Q: Can I transfer my tax credits to another individual or entity?

A: Yes, you can transfer your tax credits to another individual or entity as long as they are eligible to receive the credits.

Q: What should I do if I have more questions?

A: If you have more questions regarding Form 25-121 or the tax credit program in Texas, you should contact the Comptroller of Public Accounts for assistance.

Form Details:

- Released on January 2, 2012;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-121 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.